Shawbrook Personal Loans: Rates, Eligibility and Review

Editor, Consumer Finance: Michelle Blackmore

Last Updated: December 7, 2025

In This Article

If you’re looking for a reliable fixed-rate personal loan in the UK, Shawbrook Bank is a transparent option. This review covers everything from how much you can borrow, repayment costs, eligibility, pros & cons, and alternative lenders so you can decide if it’s right for you.

Features of a Shawbrook loan

| Feature | Details |

|---|---|

| Loan Amount | £1,000 up to £50,000 |

| Loan Term | 1 to 7 years (12-84 months) |

| Rate type | Fixed rate; monthly repayments stay fixed |

| Representative APR | From 14.1%; can go up to 34.9% depending on risk & credit score. Always check the contract terms you have been offered personally. |

| Eligibility | Aged 21-75; UK resident; minimum 3 years; minimum income £15,000; UK bank account; good credit with no active County Court Judgements (CCJs) |

| Application and Funding | Online application; soft credit check; funds usually within 3 working days once approved. |

How does Shawbrook decide my loan rate?

Shawbrook doesn’t publish a single fixed rate for all borrowers. Instead, the rate you’re offered depends on your personal circumstances, such as your credit history, income, and the loan amount and term you choose.

Shawbrook offers personal loans from £1,000 to £50,000 over 1 to 7 years. The maximum APR you could be offered is 34.9%.

Because the rate is tailored to you, Shawbrook does not provide a general loan calculator. Instead, you can request a personalised quote with a soft credit check (which won’t affect your credit score) to see what rate you may qualify for.

Example costs of a Shawbrook loan

Here are a few illustrative examples so you can see what you might end up paying, depending on amount & term. These are hypothetical but based on recent published representative rates.

Example 1: Borrow £5,000 over 3 years

- Representative APR: ~14.1% fixed

- Monthly payments: approx £169.10

- Total to repay: ~ £6,087.76 (so ~£1,087 interest over 3 years)

Example 2: Borrow £10,000 over 5 years

- Representative example from Shawbrook: APR 14.1% fixed; monthly payments ~ £228.88

- Total repayable: ~ £13,732.84 (so ~£3,732 over 5 years)

Plan Before You Take Out a Loan

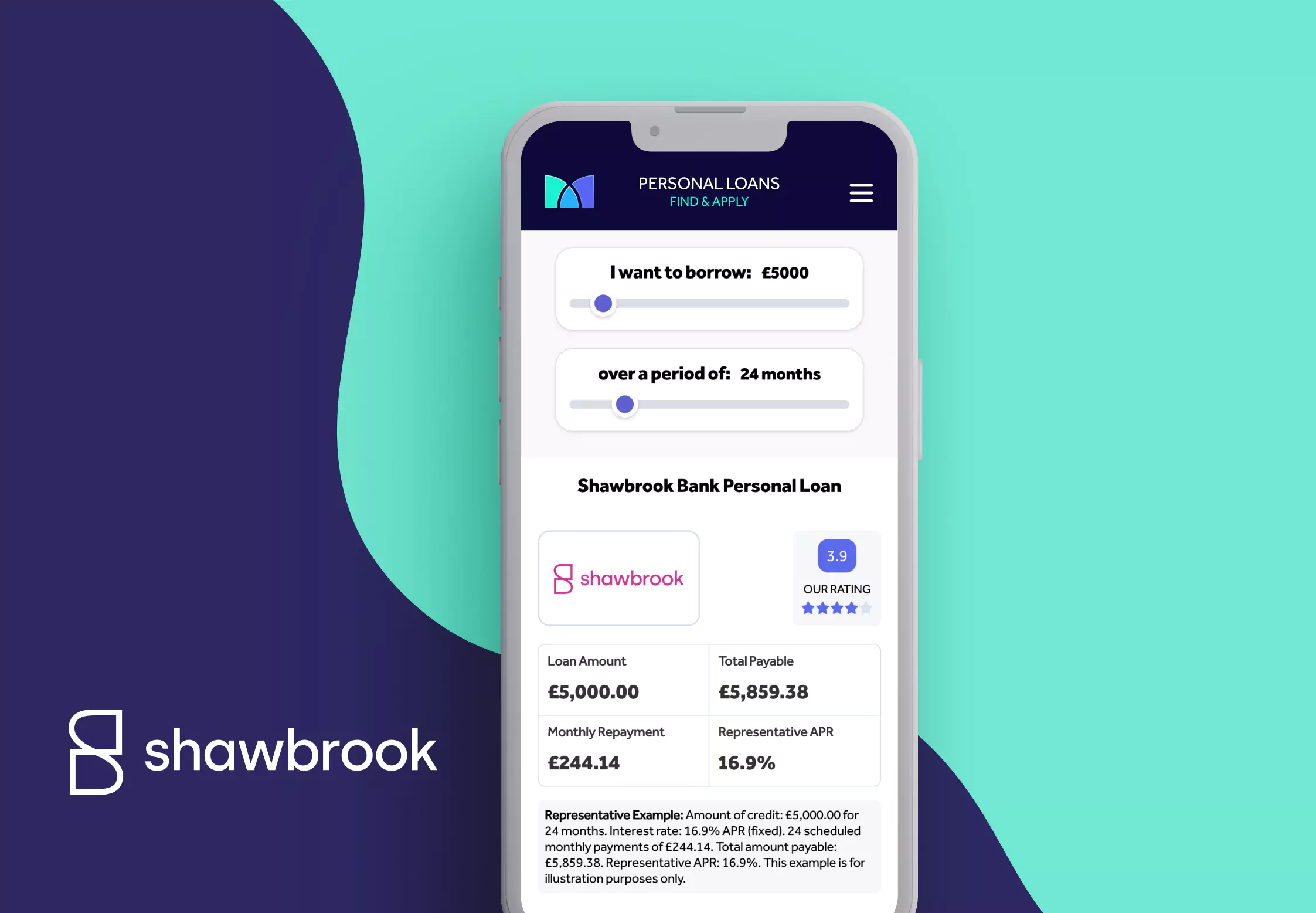

Use our Loan Calculator to find the right loan for you.

If you’re thinking about taking out a a personal loan with Shawbrook, use our calculator to see illustrative rates. After that, you check your eligibility to get a more customised rate.

Should I take out a Shawbrook loan?

Best suited for:

Situations to be wary of or check alternatives:

- Borrowers with decent credit who want predictable repayments.

- People needing a mid-range loan amount (say £5,000–£30,000) rather than very small micro-loans.

- Those who want transparency and fixed rates without hidden arrangement fees.

- If your credit score or history isn’t strong it may mean you’re offered a much higher APR (towards the max).

- If you need funds urgently “same day funding” isn’t provided; three working days wait after approval/paperwork.

- If you might need to pay the loan off very early; check the early repayment charges so you don’t overpay.

Mintip: Only borrow if the repayments are affordable for you both now and in the future. Compare offers across lenders and check your eligibility with a soft search before applying. If you are unsure or struggling with debt, free and impartial support is available from StepChange and MoneyHelper.

Pros & Cons of Shawbrook personal loans

| Pros | Cons |

|---|---|

| Very clear and upfront about fees & what you’ll pay; fixed rate gives payment certainty. | Potentially high APR for those with poorer credit; early repayment costs may apply. |

| Decent loan amounts and terms (flexible 1-7 years). | Waiting time of up to 3 days for funds even after approval. |

| Soft credit check for initial quote means your credit score isn’t impacted just by enquiring. | Not ideal for urgent funding; maximum age / income criteria may disqualify some. |

| Good user reviews; relatively smooth and transparent process. | No guarantor / secured loan option in this type (for people who need lower risk). |

Overall, Shawbrook’s personal loans offer clarity and predictable repayments, but applicants may face higher rates depending on their profile and funds are not released instantly. It is important to compare options from multiple lenders before deciding if this product is suitable for you.

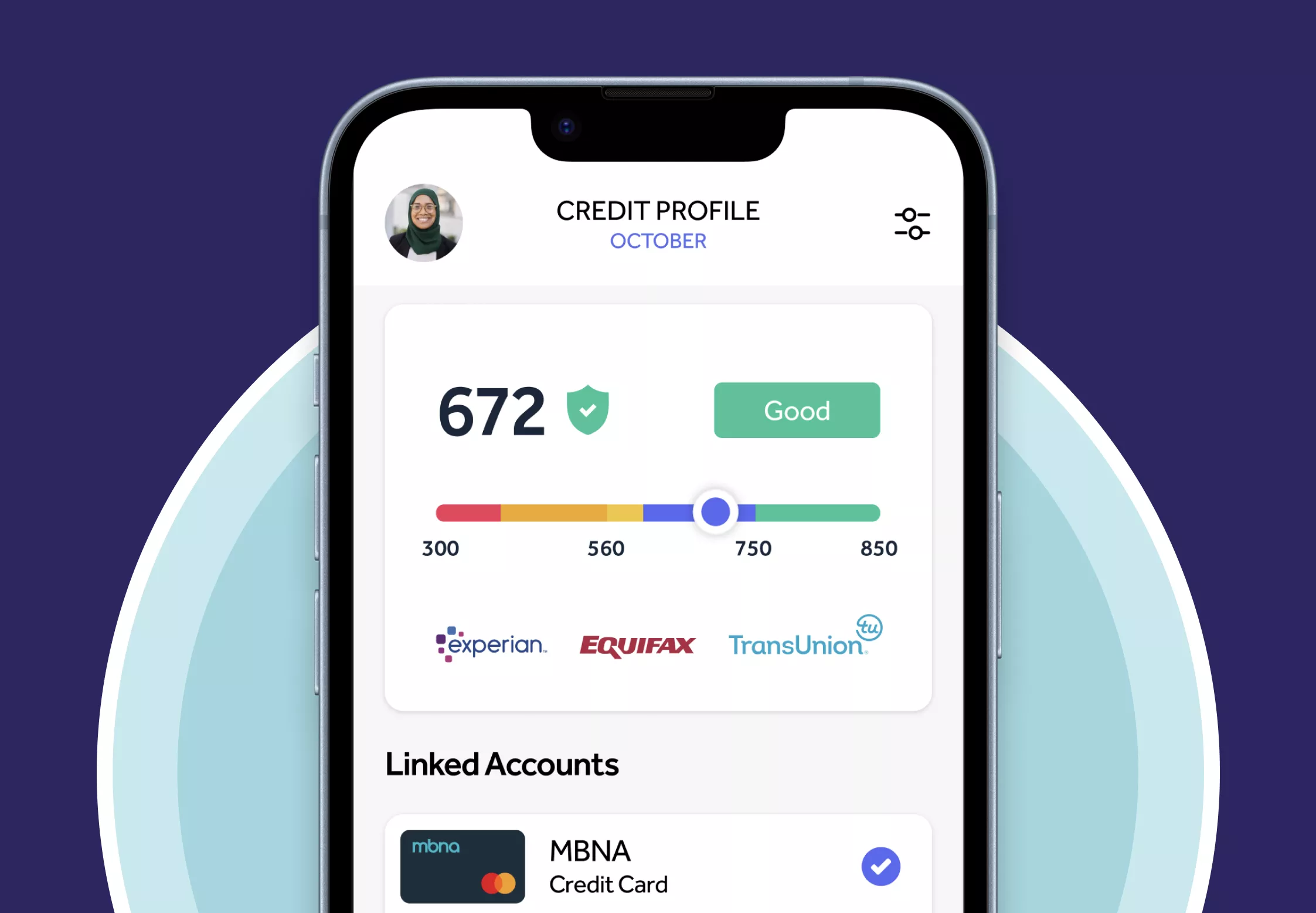

Using a loan eligibility checker helps you compare offers that you could be eligible for without any impact on your credit score.

How can I apply for a Shawbrook loan (Step by Step guide)

- Check eligibility:

Confirm you meet age, income, residency, bank account, credit history requirements.

- Get a quote:

Use an online eligibility check; a soft credit search with no impact to your credit score.

- Select loan amount & term:

Think carefully about how much you need vs how long you want to pay it back. Shorter term = higher monthly, but less interest overall.

- Submit documentation:

Residential addresses for past 3 years, employment/income details.

- Review your offer:

You’ll see your fixed APR, monthly repayment, total repayable. Check early repayment charge details.

- Sign contract & receive funds: Once signed, funds typically arrive in your bank in ~3 working days.

Things to prepare before you apply for a Shawbrook loan

Being prepared can make the application process smoother and may help reduce delays. Before applying, it’s useful to have:

- Proof of ID:

Example: a valid passport or UK driver’s licence.

- Proof of address:

A recent utility bill, bank statement, tenancy agreement, or your driver’s licence if it shows your current address.

- Loan details:

Have a clear idea of how much you want to borrow and the repayment term that works for your budget.

Having these documents ready can make your application smoother and help Shawbrook process it more efficiently once submitted. You can start by using a free loan eligibility checker, which runs a soft credit search that will not affect your credit score.

Mintify is an Introducer Appointed Representative of Creditec Limited, who work with a panel of lenders. Shawbrook Bank is one of the lenders on this panel. That means when you check your eligibility, you’ll see results from Shawbrook alongside other lenders, allowing you to compare your options before deciding whether to apply.

How long does it take for a Shawbrook loan to be paid out?

The time it takes for a personal loan to arrive in your bank account varies depending on the lender. With Shawbrook, once you’ve been approved, signed your loan documents and returned them, you can usually expect to receive the money within three working days of Shawbrook receiving the signed paperwork.

Shawbrook vs other personal loans

| Feature | Shawbrook | Some other lenders |

|---|---|---|

| Fixed vs variable rate | Fixed throughout with clear terms | Some competitors have variable rates, or higher fees hidden in the fine print. |

| APR transparency | Representative APR clearly shown; soft search first | Others might advertise low APR but with conditions that many don’t meet. |

| Loan amounts / terms | Up to £50,000 and up to 7 years | Some lenders limit loan size or term more tightly. |

| Reputation / trust | FCA regulated; good reviews; transparency promise | Varies; always check FCA status, published reviews. |

The terms and conditions of Shawbrook loans and those of other lenders can change at any time. Always review the specific loan terms offered to you and make sure you understand both the total amount repayable and the interest charged before deciding to proceed.

You can start by taking a a free eligibility check to see which loans you may qualify for without affecting your credit score. This allows you to compare offers across lenders. Any loan you choose will always be subject to the lender’s final checks and approval.

Get Personalised Loan Rates

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Shawbrook reviews and customer feedback

Shawbrook has a strong reputation on Trustpilot, with an Excellent rating of 4.6 out of 5 from over 19,000 reviews. Around 83% of customers rate Shawbrook 5 stars, while just 6% leave 1-star reviews.

Critical themes:Positive themes:

- Competitive savings and loan rates: Many customers highlight good fixed ISA and loan offers, often saying Shawbrook is “among the top” rates available.

- Straightforward online process: Opening or transferring accounts is frequently described as simple, with recent website updates improving clarity and navigation.

- Responsive customer service: Phone agents and online support are praised for being polite, professional, and able to resolve issues quickly. Several reviewers valued being able to speak to a real person when needed.

- Long-term trust: Customers who’ve been with Shawbrook for years mention smooth renewals, easy bond rollovers, and confidence in the bank’s reliability.

Why it matters if you’re considering a Shawbrook loan:

- Website messaging: While many like the website, some reviewers found certain features (e.g. online messaging, accessing statements) less intuitive.

- Documentation gaps: A few customers wanted clearer annual statements or confirmation when renewing bonds.

- Product limitations: Some noted restrictions such as minimum withdrawal amounts or only being able to hold one type of ISA product at a time.

- If ease of use and clear service are priorities, reviews suggest Shawbrook delivers strongly.

- If you value flexibility, check the product terms carefully, a few reviewers were caught out by limits on account types or withdrawal rules.

- The overwhelming majority of reviews indicate Shawbrook is trusted, professional, and transparent, but you should still read your own agreement closely, especially around documentation and rate conditions.

Mintify editorial rating (3.9 / 5)

Summary: Shawbrook Bank personal loans has been scored for transparency and a broad range of loan amount and loan duration, but higher APRs depending on credit profile and slower funding mean they may not suit all borrowers.

Shawbrook Bank is a solid option in the UK personal loan market, particularly for borrowers with stable income and good credit who want predictable fixed monthly payments. Shawbrook’s emphasis on transparency and clear fee structures is a positive, and loans between £1,000 and £50,000 over one to seven years offer flexibility for different borrowing needs.

However, the APR offered could be higher which means that rates may be less competitive for some borrowers, and those with weaker credit may be offered significantly higher rates (up to 34.9% APR). Same day funding is not available, which makes Shawbrook less suitable if you need urgent access to money. Early repayment is possible, but check the agreement to see if it includes charges; it’s important to always check your specific terms.

Overall, Shawbrook earns a 3.9 out of 5. It stands out for transparency, service and stability, but may not be the cheapest or fastest lender compared to some alternatives.

This score is based on Mintify’s independent editorial guidelines, which assess personal loans across factors including loan amounts, terms, representative APR, fees, repayment flexibility, and transparency of information. Our ratings are designed to help consumers compare products objectively, but they are not financial advice. You can read more about how we score personal loans.

What does the Shawbrook loan agreement include?

If you are approved for a Shawbrook personal loan, you will likely sign a Fixed Sum Loan Agreement. This type of contract sets out the key details of your borrowing, including:

- The amount borrowed, the term, and the fixed interest rate applied.

- The monthly repayment amount and the total cost of credit over the life of the loan.

- Your rights and responsibilities, including what happens if you miss a payment.

- Information about your ability to make early repayments and any charges that may apply.

- A summary of important terms which usually highlights the main features of your loan and is designed to help you understand the agreement clearly before you sign.

Mintip: Always read your Shawbrook loan agreement carefully before signing. The terms set out your repayments, interest, and charges, and every agreement is unique to your loan. If you misplace your paperwork, you can request another copy directly from Shawbrook..

Frequently asked questions about Shawbrook Loans

Will applying for a Shawbrook loan affect my credit score?

Getting a quote uses a soft credit search, which does not affect your credit score. If you decide to proceed, a full credit check will be carried out, which may leave a mark on your credit file.

How quickly will I receive the money if approved?

Once your application is approved and Shawbrook receives your signed loan documents, the funds are normally released within three working days. Shawbrook does not currently offer same-day funding.

Can I pay off my Shawbrook loan early?

Yes, you can make overpayments or settle your loan early. Some agreements include an early repayment charge, usually based on a set number of days’ interest, so always check the terms of your individual loan.

What loan amounts and terms are available?

You can borrow from £1,000 up to £50,000, with repayment periods ranging from one to seven years (12 to 84 months).

What interest rate will I be offered?

The rate you receive depends on your personal circumstances, including your credit profile, income and chosen loan term. Shawbrook’s representative example is 14.1% APR for a £10,000 loan over five years, but rates can be higher or lower. The maximum APR is 34.9%.

Who is eligible for a Shawbrook loan?

You’ll generally need to be aged between 21 and 75, a UK resident for at least three years, have a UK bank account, and a regular income. Applications are subject to Shawbrook’s credit and affordability checks.

Related Articles

My Community Finance

Asda Loans Review

Post Office Loans Review

What credit score is needed for car finance in the UK?

Zuto car finance – reviews, how it works and eligibility checker

Car finance vs personal loan UK

The content presented here has been impartially gathered by the Mintify team and is offered on a non-advised basis for informational purposes only. We adhere to strict editorial integrity

Get Personalised Loan Rates

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.