Balance Transfer Credit Cards

Plan Before You Switch

Use our Balance Transfer Calculator to find the right card for you.

If you’re carrying credit card debt, a balance transfer credit card can help you pay it down faster by moving your balance to a new card with 0% interest for a set period. Using a balance transfer calculator helps you understand how much interest you could potentially save by transferring debt from your existing cards to a balance transfer card.

Best Balance Transfer Credit Cards – February 2026

The Mintalists have compiled a transparent list of top scoring UK balance transfer credit cards so you can compare key features side by side – including 0% interest periods, transfer fees, and ongoing APRs. Each card is also rated using our independent proprietary credit card rating system, designed to help you understand how different options stack up against one another.

Representative APR

24.9% APR (variable)

Purchases

24.90% (variable) p.a.

Balance Transfers

0% for up to 35 months, then 24.90% (variable) p.a. (3.45% fee).

Account Fees

£0

Representative Example: At an assumed credit limit of £1,200, at a purchase rate of 24.90% (variable) p.a., most accepted customers get a rate of 24.9% APR (variable).

Representative APR

24.9% APR (variable)

Purchases

24.90% (variable) p.a.

Balance Transfers

0% for 20 months (transfer made within 90 days), then 24.90% (variable) p.a. (2.99% fee)

Account Fees

£0

Representative Example: At an assumed credit limit of £1,200, with a purchase rate of 24.90% (variable) p.a., most accepted customers get a rate of 24.9% APR (variable).

Representative APR

24.9% APR (variable)

Purchases

0% for up to 6 months, then 24.94% (variable) p.a.

Balance Transfers

0% for 29 months, then 24.94% (variable) p.a. (3.49% for 3 months)

Account Fees

£0

Representative Example: At an assumed credit limit of £1,200, with a purchase rate of 24.94% (variable) p.a., most accepted customers get a rate of 24.9% APR (variable).

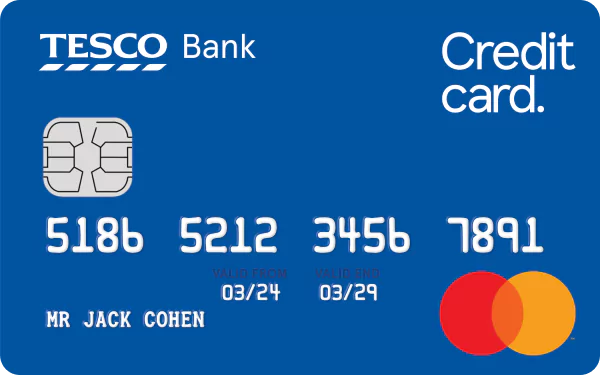

Representative APR

24.9% APR (variable)

Purchases

0% for up to 3 months, then 24.90% (variable) p.a.

Balance Transfers

0% for 35 months, then 24.90% (variable) p.a. (3.19% transfer fee)

Account Fees

£0

Representative Example: At an assumed credit limit of £1,200, with a purchase rate of 24.90% (variable) p.a., most accepted customers get a rate of 24.9% APR (variable).

Representative APR

24.9% APR (variable)

Purchases

0% for up to 6 months, then 24.94% (variable) p.a.

Balance Transfers

0% for 31 months, then 24.94% (variable) p.a. (3.2% fee for 3 months)

Account Fees

£0

Representative Example: At an assumed credit limit of £1,200, with a purchase rate of 24.94% (variable) p.a., most accepted customers get a rate of 24.9% APR (variable).

Representative APR

24.9% APR (variable)

Purchases

0% for up to 3 months, then 24.90% (variable) p.a.

Balance Transfers

0% for 30 months, then 24.90% (variable) p.a. (3.49% fee)

Account Fees

£0

Representative Example: At an assumed credit limit of £1,200, with a purchase rate of 24.9% (variable) p.a., most accepted customers get a rate of 24.9% APR (variable).

Representative APR

24.9% APR (variable)

Purchases

24.94% (variable) p.a.

Balance Transfers

0% for 34 months, then 24.94% (variable) p.a. (3.49% fee)

Account Fees

£0

Representative Example: At an assumed credit limit of £1,200, with a purchase rate of 24.94% (variable) p.a., most accepted customers get a rate of 24.9% APR (variable).

Representative APR

24.9% APR (variable)

Purchases

0% for up to 3 months, then 24.90% (variable) p.a.

Balance Transfers

0% 34 months, then 24.90% (variable) p.a. (3.15% fee)

Account Fees

£0

Representative Example: At an assumed credit limit of £1,200, with a purchase rate of 24.90% (variable) p.a., most accepted customers get a rate of 24.9% APR (variable).

Representative APR

24.9% APR (variable)

Purchases

24.9% (variable) p.a.

Balance Transfers

0% for 36 months, then 24.94% (variable) p.a. (3.45% fee)

Account Fees

£0

Representative Example: At an assumed credit limit of £1,200, with a purchase rate of 24.9% (variable) p.a., most accepted customers get a rate of 24.9% APR (variable).

Representative APR

29.9% APR (variable)

Purchases

0% for up to 3 months, then 29.90% (variable) p.a.

Balance Transfers

0% for 14 months, then 29.90% (variable) p.a. (2.5% fee for 2 months)

Account Fees

£0

Representative Example: At an assumed credit limit of £1,200, with a purchase rate of 29.90% (variable) p.a., most accepted customers get a rate of 29.9% APR (variable).

Showing all 10 Balance Transfer credit cards

Find the right Credit Card for you

Does not impact your credit score

Find out which credit cards you’re eligible for

34.9% Representative APR (variable)

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

What is a balance transfer credit card?

A balance transfer credit card allows you to move existing credit card debt to a new card that offers a lower interest rate, often 0% for an introductory period. This helps reduce the amount of interest you pay, so more of your payments go toward the balance. Some cards also offer a 0% purchase introductory period too. Take a free eligibility check to see which cards and offers you could be eligible for without any impact on your credit score.

Should I use a balance transfer calculator?

If you’re thinking about moving a balance, comparing your current situation with a potential new one can help you make the decision as to whether a balance transfer credit card is the right option for you. A balance transfer calculator shows you in seconds whether the switch actually saves you money. You’ll see how much of your debt you can clear during the 0% period, what could still be left, and how fees affect the total.

Rather than guessing or reading general advice, try Mintify’s free Balance Transfer Calculator now. Enter your existing balance, 0% promo length, transfer fee and monthly payment to get a personalised repayment plan you can download.

Who are balance transfer cards for?

You may benefit from a balance transfer card if you:

- Have existing credit card debt and want to reduce interest

- Are paying high interest on your current card

- Can repay debt within a set promotional period

- Have a good enough credit score to qualify for top offers

Mintip: See our Top 10 Balance Transfer Credit Cards to compare the best 0% deals side by side.

Am I eligible for a balance transfer card?

You may qualify if you:

- Are 18+ and live in the UK

- Have existing card debt to transfer

- Meet the provider’s credit and affordability criteria

Mintip: Use an eligibility checker to see which cards you’re likely to be approved for with no impact on your credit score.

Straight from the Mintalists

What should you watch out for when using a balance transfer credit card? A balance transfer can potentially save you interest, but only if you avoid the common traps:

- Transfer fees add up. A “no fee” card might work out cheaper than a longer 0% offer with a 3% charge.

- Time restrictions. If you don’t clear the balance within the promotional period, your remaining balance will be hit with the card’s standard APR.

- Transfer window. Most cards require you to move your balance within 60–90 days of opening the account. Miss it, and you could lose the promotional 0% offer.

- Minimum payments don’t clear much. Sticking to the minimum keeps the account open, but you’ll still carry debt past the promo.

- Same bank restrictions. You usually can’t transfer between cards from the same provider or banking group.

- New spending isn’t free. Purchases or cash withdrawals often attract interest straight away.

- APR after the promo. When the 0% period ends, any remaining balance starts accruing interest at the card’s standard APR immediately. Check the rate and set a reminder for the end date.

Frequently asked questions

Can I transfer more than one balance?

Yes, many cards allow consolidating multiple balances but always check the terms offered to you.

Will a balance transfer affect my credit score?

When you apply for a balance transfer credit card, the lender will usually run a hard credit check. This may cause a small, temporary drop in your credit score. Over time, how your score changes will depend on how you manage the account – for example, making payments on time, staying within your limit, and reducing overall debt may have a positive effect, while missed payments or taking on more borrowing could harm it. Everyone’s situation is different, so outcomes will vary.

What happens after the 0% period ends?

When the promotional 0% balance transfer period ends, any remaining balance will usually start to accrue interest at the card’s standard APR. This rate can vary between cards and applicants, so make sure you check the terms you’ve been offered and don’t just focus on the introductory rate.

Are there balance transfer cards for bad credit?

Some credit building cards may include a balance transfer option. These offers are often shorter than mainstream 0% deals and may come with higher interest rates once the introductory period ends. Availability will depend on the card provider and your individual circumstances.

Can I transfer a balance from the same provider?

Most card providers do not allow you to transfer a balance between two of their own credit cards, or between cards within the same banking group. Always check your provider’s terms and conditions to confirm what’s possible before applying.

Find the right Credit Card for you

Does not impact your credit score

Find out which credit cards you’re eligible for

34.9% Representative APR (variable)

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.