Credit Cards With No Foreign Transaction Fees

Editor, Consumer Finance: Michelle Blackmore

Last Updated: February 5, 2026

In This Article

Spending abroad shouldn’t come with a surprise bill

If you’ve ever checked your statement after a trip or ordered something from an overseas website and wondered why the total is a bit higher, it’s usually down to a foreign transaction fee. Most cards add a charge of around 2.75% – 3% when you spend in another currency, even online. You’ll find this fee explained in the terms and conditions from your card provider.

Cards that offer 0% foreign transaction fees remove that extra cost. So a £100 hotel stay remains £100. A €60 online purchase costs the equivalent amount in pounds, without the added fee.

And this applies whether you’re travelling or simply shopping in euros, dollars or another currency online. The right card helps you avoid unnecessary charges.

What is a foreign transaction fee?

Every time you pay in another currency, your bank converts it into pounds at the Visa or Mastercard rate, and then, most issuers add a percentage on top.

A €200 meal could show up as £176 instead of £171 and that £5 isn’t the exchange rate shifting, it’s the bank’s foreign fee.

It can happen on holiday, at an overseas ATM, or even from your sofa when you order from a non-UK website.

Who needs a card with no foreign transaction fees?

You don’t have to be a frequent flyer to save money here.

- The holiday planner:

You’re booking flights, hotels and meals abroad. A 0% foreign transaction card means every pound you spend goes on experiences, not conversion charges.- The online shopper:

Buying from EU clothing sites or US electronics stores? Most add the fee automatically in checkout currency conversions.- The digital nomad or freelancer:

You pay for software or subscriptions in dollars every month and that 3% fee is eating into your income.

Even modest spending adds up. £100 a month in foreign currency = around £36 a year lost in fees.

Mintip: Always pay in the local currency. If a shop or ATM offers to charge you in pounds, that’s called dynamic currency conversion and it’s almost always worse value.

Foreign Fee Savings Calculator

Use Mintify’s free Foreign Transaction Fee Savings Calculator to estimate how much you could save when spending abroad or shopping online in another currency.

Enter your total annual spend and the foreign transaction fee charged by your card. This calculator will show the estimated amount you pay in fees each year and how much you could save with a credit card that charges no foreign transaction fees.

Foreign Transaction Fee Calculator

See how much you could save with a no foreign fee credit card.

What to look for before you apply

A “no foreign transaction fee” label doesn’t tell the whole story. Here’s what to check first:

- The foreign transaction fee itself

Confirm that the card genuinely charges 0% on overseas and online non-sterling purchases. Some cards advertise “reduced” fees (like 1.99%) rather than none at all.- Cash withdrawals abroad

Many cards waive fees on purchases but still charge interest on cash withdrawals from the day you take them. If you use ATMs abroad, check the small print to avoid racking up a hefty bill.- Interest-free period on purchases

Most cards still offer the usual up-to-56-day interest-free window if you clear your balance in full. If you miss that, and interest applies whether you spent in pounds or euros.- Rewards, cashback or perks

Some fee-free cards skip rewards entirely, while others still pay cashback. Decide if perks matter more to you.- Eligibility and soft-search tools

Travel cards often favour stronger credit profiles, but there are near-prime options too. Always check your eligibility first. A free credit card eligibility check will show your chances of approval with no impact on your credit score.

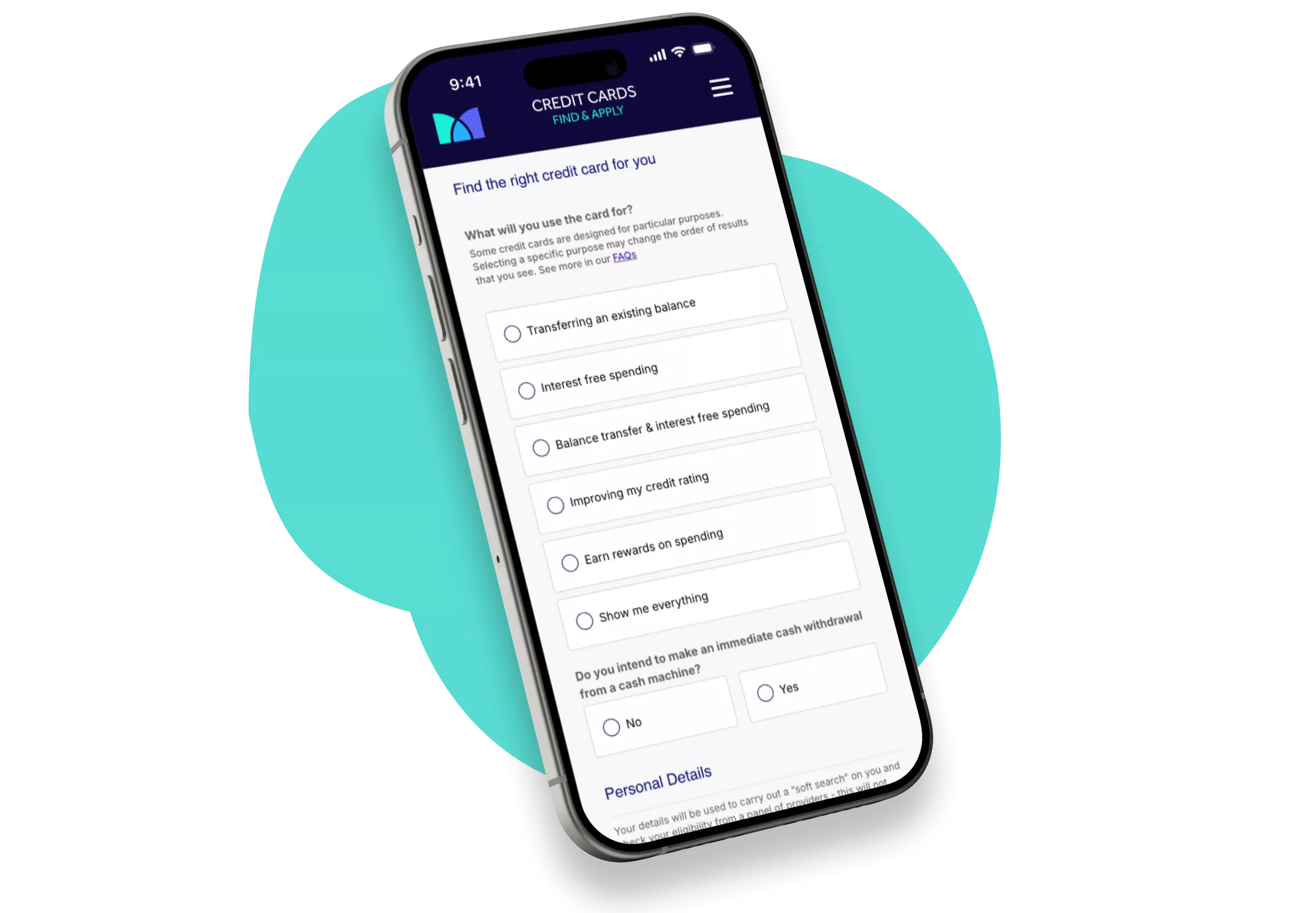

Find the right Credit Card for you

Does not impact your credit score

Find out which credit cards you’re eligible for

34.9% Representative APR (variable)

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Compare travel rewards credit cards with no foreign transaction fees

NatWest Bank Travel Rewards Credit Card | Barclaycard Rewards Credit Card | |

|---|---|---|

| Account Fee | £0 | £0 |

| Representative APR | 27.90% | 28.90% |

| Purchases Description | 27.90% (variable) p.a. | 28.90% (variable) p.a. |

| Purchases Interest Free | 56 days | 56 days |

| Balance Transfers | 27.90% (variable) p.a. | 28.90% (variable) p.a. (fee is stipulated in the offer) |

| Incentive on Opening | Enjoy fee-free spending abroad and earn cashback on every applicable trip with this travel rewards credit card. | Get 0.25% cashback on all your everyday spending, plus no transaction fees when you’re abroad. |

| Cashback/Rewards (if applicable) | You can earn 1% back on eligible travel spending such as flights, hotels, car hire and transport, 1–15% back with selected partner retailers, or 0.1% back on everyday purchases instead. Check the full terms for qualifying spend and exclusions. | 0.25% after £1 of yearly spend. Cashback paid into card account annually or on request. |

| Minimum Credit Limit | £250.00 | £50.00 |

| Intro Balance Transfers Fee | 0.00% | 0.00% |

| Balance Transfers Fee | 0.00% | 0.00% |

| Foreign Usage (EU) | 0% | 0.00% |

| Foreign Usage World | 0% | 0.00% |

Credit builder cards with no foreign fees

Zopa Visa |  Lendable Ltd thimbl Credit Builder Credit Card | |

|---|---|---|

| Account Fee | £0 | £0 |

| Representative APR | 34.90% | 48.90% |

| Purchases Description | 34.90% (variable) p.a. | 48.9% (variable) p.a. |

| Purchases Interest Free | 56 days | 35 days |

| Balance Transfers | Not Available | Not Available |

| Incentive on Opening | The Zopa credit card has no annual fee and is a great option for travel, with no charges on spending abroad. | This card has no foreign transaction fees and can be managed via the Zable app. Zable periodically reviews your thimbl account and will inform you if you are eligible for a credit limit increase. |

| Cashback/Rewards (if applicable) | No cashback scheme | No cashback scheme |

| Minimum Credit Limit | £250.00 | £200.00 |

| Intro Balance Transfers Fee | 0.00% | 0.00% |

| Balance Transfers Fee | 0.00% | 0.00% |

| Foreign Usage (EU) | 0% | 0% |

| Foreign Usage World | 0% | 0% |

Alternative rewards cards with no foreign fees

Monzo Flex Credit Card | Yonder Free Membership Credit Card | |

|---|---|---|

| Account Fee | £0 | £0 |

| Representative APR | 29.00% | 32.00% |

| Purchases Description | 29.0% (variable) p.a. | 31.93% (variable) p.a. |

| Purchases Interest Free | 90 days | 0 days |

| Balance Transfers | Not Available | Not available |

| Incentive on Opening | You can benefit from interest-free purchases when you pay in full on your next payment date or spread purchases over £100 across three monthly payments. You can also spend abroad with no fees. | Get £10 off your first purchase and earn up to 1,000 points when you spend £1,000 within 30 days. Check the full terms and conditions for details on how rewards are applied. |

| Cashback/Rewards (if applicable) | You can earn unlimited cashback on eligible card purchases you make on your Flex Credit Card. You’ll also earn cashback if you checkout using Apple Pay and Google Pay. You need to be a personal current account customer. | 1 Points per £1 spent on all purchases. Up to 5 points at selected places. |

| Minimum Credit Limit | £0.00 | £0.00 |

| Intro Balance Transfers Fee | 0.00% | 0.00% |

| Balance Transfers Fee | — | 0.00% |

| Foreign Usage (EU) | 0.00% | 0% |

| Foreign Usage World | 0.00% | 0% |

Hidden costs still worth watching

Even fee-free cards can have additional fees you need to watch out for:

- ATM interest: starts from withdrawal date unless repaid in full.

- Dynamic currency conversion: merchants “helpfully” charge in GBP which can be worse value.

- Late payments: attract fees and may impact your credit profile.

- Foreign ATM provider fees: charged by local banks, not your card issuer.

Mintip: Watch out for surprise ATM fees abroad; they’re added by the local bank, not your card provider. The screen will usually warn you, but only if you stop and read it before pressing “OK”.

Can’t get approved for a 0% foreign fee card?

If you’re building credit or rebuilding credit, there are still ways to cut costs:

- Some cards charge a lower foreign transaction fee (1–2%) instead of the full 3%.

- Use a soft search eligibility tool to see realistic options without affecting your credit score.

Remember: applying for multiple cards in quick succession can harm your credit record. Compare credit cards carefully and apply once you’re confident.

Do no fee credit cards mean fee-free abroad?

It’s easy to confuse “no annual fee” with “no foreign transaction fee” but they’re not the same thing.

A no fee credit card usually means the card has no annual or monthly account charge. You won’t pay to keep it open, but you might still be charged up to 3% on every overseas or non-GBP transaction.

By contrast, a no foreign fee credit card removes that surcharge on foreign spending but some of these cards do have annual or monthly fees.

In short:

- “No annual fee” should mean no cost to hold the card.

- “No foreign fee” should mean no extra cost when spending abroad or online in another currency.

Remember: When comparing credit cards, check both columns “annual fee” and “foreign transaction fee.” A card can have no fees in one but not the other.

Find the right Credit Card for you

Does not impact your credit score

Find out which credit cards you’re eligible for

34.9% Representative APR (variable)

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Frequently Asked Questions

Which UK credit cards don’t charge foreign transaction fees?

Several major UK brands offer cards with no foreign transaction fees. Always confirm current terms and conditions before you apply, as these features can change over time.

Are these cards completely free to use abroad?

They remove the typical three per cent foreign transaction fee, but other charges such as interest or ATM fees can still apply depending on how you use the card.

Do I pay interest on foreign purchases?

Overseas purchases follow the same rules as UK transactions. You will not pay interest if you repay your balance in full by the due date.

Can I withdraw cash abroad without paying extra?

Some brands allow fee-free cash withdrawals if you clear the balance promptly. Others may charge interest from the day of withdrawal, so check the specific conditions before using an ATM overseas.

Do I need to tell my bank before travelling?

Not usually. However, make sure your contact details are up to date so your provider can reach you if they need to confirm or verify any transactions.

Key takeaway: Is a credit card with no foreign transaction fees worth it?

A 0% foreign transaction fee credit card isn’t just for travellers. It’s for anyone who spends in another currency be it online, abroad, or somewhere in between.

These credit cards can save around 3% on every non-GBP purchase, give you Section 75 protection, and often include extra rewards.

Choosing one comes down to what matters most: fee-free spending, rewards, or credit building.

You can check your credit card eligibility through a free eligibility checker. It’s quick, free and no impact on your credit score.

Related Articles

Check your credit card eligibility in the UK

Balance transfer cards for credit builders

How much can you balance transfer?

What is a balance transfer fee?

How to do a balance transfer on a credit card

Marbles credit card review – is it a good option to consider?

The content presented here has been impartially gathered by the Mintify team and is offered on a non-advised basis for informational purposes only. We adhere to strict editorial integrity

Find the right Credit Card for you

Does not impact your credit score

Find out which credit cards you’re eligible for

34.9% Representative APR (variable)

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.