9 Habits That Improve Your Credit Card Eligibility

Editor, Consumer Finance: Michelle Blackmore

Last Updated: February 16, 2026

In This Article

Applying for a credit card can sometimes feel like a guessing game. You are eligible for some, but not for others, especially the credit cards you really want, and it can be frustrating.

Even when you are eligible, the APR or credit limit offered might be different from what others get and it is rarely clear why.

Before you apply, it helps to understand what lenders look for and how small, consistent habits can make a real difference to your chances of approval.

This guide is for informational purposes only. These actions may help strengthen your application, but they don’t guarantee your eligibility. Each lender’s decision is unique.

Why eligibility matters

Credit card eligibility refers to how likely you are to be accepted for a card based on your financial profile. Lenders look at factors like your income, credit history and overall affordability before making a decision.

Checking your credit card eligibility first helps you apply with confidence and avoid unnecessary hard searches that can temporarily lower your credit score.

9 habits that could improve your credit card eligibility

Why 9 habits and not 5 or 7 or 12? There is no fixed number, but these are some of the practical habits that can help improve your credit card eligibility. You may have read about some of them before, but at Mintify we aim to explain the reasons behind them, not just the quick tips. Our goal is to make credit and lending easier to understand and more connected to real life.

- Pay all bills on time

Late payments are a warning sign for lenders. Even a single missed bill can affect your credit score. We are all human and forgetting to pay on time can happen, but if it happens often, it may suggest to lenders that you are struggling to manage your repayments. It is simply good housekeeping to make sure all bills are paid on time each month.

- Keep credit utilisation below 30%

Try not to use too much of your available credit limit. For example, if your limit is £3,000, aim to stay below £900 on average. This shows lenders that you can manage credit responsibly. Making a large purchase, such as booking a holiday, is fine if you plan to repay the balance quickly or reduce it back to around 30% of your total limit soon after.

- Register on the electoral roll

Being listed on the electoral roll helps lenders confirm your identity and address. It is a simple way to show stability.

- Check your credit report regularly

Small errors on your credit report can reduce your eligibility. Check your report with Experian, Equifax, or TransUnion and correct any mistakes you find. It is also good housekeeping to make sure the information held about you is accurate and up to date

- Avoid applying for multiple credit products at once

Unlike an eligibility check, once you officially decide to apply for a credit product, a hard credit check is carried out and it leaves a visible record on your credit file. Several applications made close together may suggest financial pressure to lenders. Using a credit card eligibility checker first can show you which products you are more likely to be approved for, so that when you do apply, the hard check is made with greater confidence.

- Reduce existing debts

Paying down balances improves your overall debt-to-income position. Even small, regular reductions can make a positive difference. If you currently have outstanding debts that you cannot repay in full, it may make sense to pause before applying for more credit and focus on reducing what you owe first.

- Keep older accounts open

A longer credit history helps lenders see consistent behaviour. If an older account is well managed and fee free, consider keeping it active.

- Show stable income or employment

Lenders look for a reliable income source when assessing applications. If you are self-employed, recent tax returns or bank statements can help verify your income. A stable income supports affordability checks and helps lenders see that repayments are likely to be manageable.

- Consider using a credit builder card responsibly

If you are new to credit or rebuilding your credit history, a lower limit credit builder card can help show positive repayment behaviour over time. Making payments on time and keeping within your limit can support this. These cards often have higher APRs, but if you clear the balance in full within the interest-free period, you should not be charged interest. You can read our guide on the best credit cards to build credit to learn more about how they work.

Check your eligibility safely and with no credit score impact

Before you apply, use a credit card eligibility checker that uses a soft search to see where you stand. It checks your credit information and matches you with potential lenders without affecting your score.

How it works:

- Enter your basic details.

- View your eligibility results.

- Compare the cards that best fit your profile.

Mintip: Take a moment to think about how you plan to use a credit card. If you already carry balances elsewhere, applying for another card could increase your total borrowing and interest costs.

Find the right Credit Card for you

Does not impact your credit score

Find out which credit cards you’re eligible for

34.9% Representative APR (variable)

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

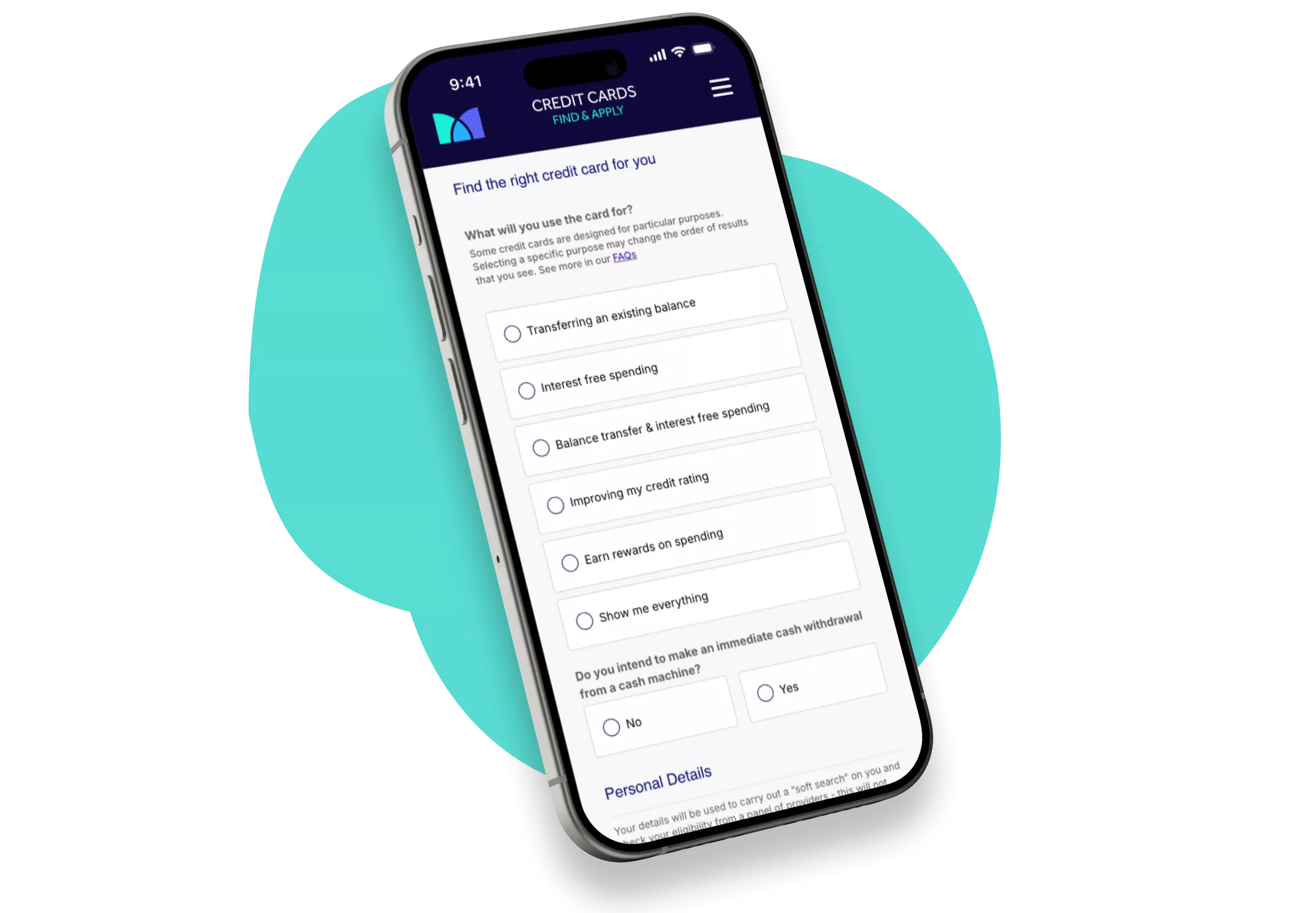

What a credit card eligibility check actually looks like

When you check your credit card eligibility, you will be asked for a few key details. These help lenders run a soft search that estimates your likelihood of approval without affecting your score.

You will usually provide:

- Age and residency status. Most lenders require you to be at least 18 and a UK resident with a fixed address.

- Employment status. Employed, self employed, retired, in education, or other. This gives a view of income stability.

- Annual income. Used to assess affordability and a suitable credit limit.

- Residential status. Owner, renter, council tenant, or living with family. Homeownership can indicate stability, but renters can still qualify if affordability is sound.

- Marital status. Used for demographic and address consistency. It does not determine creditworthiness on its own.

- Contact details and address history. Confirms identity and lets the soft search match your credit file with Experian, Equifax, or TransUnion.

After you submit, the soft search runs in the background. Your eligibility results may include:

- A pre-approval or description of how likely you are to be approved for each card.

- A list of cards that better match your profile, such as credit building or balance transfer products.

- An example of the APR and potential credit limit that relate to your credit profile.

If your credit file is in the fair or good band, you will usually see more products, but every lender scores differently.

What happens after the eligibility check?

After the eligibility check, if you decide to apply for one of the cards you were matched with, you will be redirected to the lender’s website to complete your application.

Depending on the lender, you may need to enter some (or even all) of your personal information again. This can feel repetitive, but it is a normal part of the process. In some cases, your details are not automatically transferred to the lender’s own application form, so you may need to re-enter some information. It only takes a few minutes and helps ensure your application is handled safely and accurately.

The good news is that you will already know which cards you are more likely to be approved for, so the application feels more confident and less of a guessing game.

How a soft search uses your credit data

During a soft search, the system usually checks a limited snapshot of your report to verify:

- Your credit score band, such as Excellent, Good, Fair, Poor, or Very Poor.

- Current credit limits and balances.

- Payment history and any missed payments or defaults.

- Recent applications.

This list is not final as it can differ from one eligibility check to another. More importantly, these checks do not affect your score when viewed as a soft search. They help rank products so the results are more relevant to your situation.

Why honesty matters

It might be tempting to overstate income or simplify details to improve your chances of approval. Do not do this. The eligibility check is only step one. If you go on to apply, the lender will verify your information. If details do not match, the application may be declined or moved to manual review.

Entering the accurate information helps you:

- See realistic results.

- Avoid failed applications and unnecessary hard searches.

- Match with products that suit your affordability.

Treat the eligibility check as a rehearsal. Accurate details now support a smoother application later.

Mintip: If you are struggling with debt or repayments, free and impartial support is available. StepChange and MoneyHelper offer confidential guidance to help you manage your finances and find the right solution for your situation.

Eligibility for balance transfer credit cards

Balance transfer credit cards are designed to help you move existing credit card debt onto a new card, often with a 0% interest period for a set time. Because they involve transferring an existing balance, lenders look closely at both your repayment history and how much credit you already use.

What lenders consider:

- Credit history and score: A good or excellent score improves the likelihood of qualifying for the longest 0% deals.

- Existing debt levels: Lenders may check that you are not close to your total credit limit and that you can manage repayments comfortably.

- Recent credit behaviour: Multiple recent applications can reduce your chances of approval.

- Income and affordability: The new credit line must be affordable alongside your current repayments.

- Balance transfer fees: Some cards charge a percentage fee when you move your balance; eligibility may depend on the amount you plan to transfer.

If you are eligible, a balance transfer card can help you manage debt more efficiently by saving on interest. However, it only works if you continue to make at least the minimum payment on time every month.

To estimate what you could save, try Mintify’s free balance transfer calculator. It shows how much interest you might avoid and how long your transfer could take to repay.

Balance Transfer Calculator

If you’re carrying balances on other credit cards, a balance transfer credit card can help you pay it down faster by moving your balance to a new card with 0% interest for a set period. Using a balance transfer calculator helps you understand how much interest you could potentially save by transferring debt from your existing cards to a balance transfer card.

Key takeaways

- Eligibility is about showing lenders that you can borrow responsibly and afford repayments.

- Paying on time, keeping balances low, and checking your credit file are high impact habits.

- Use soft search tools before you apply to avoid unnecessary hard searches.

- Honest and accurate information leads to better results and fewer surprises.

Good credit behaviour today can help build more options tomorrow.

Frequently asked questions

What improves credit card eligibility in the UK?

Paying bills on time, keeping credit utilisation low, registering on the electoral roll, maintaining stable income, and correcting errors on your credit report all help.

Does checking eligibility affect my credit score?

No. A soft search does not affect your score and is not visible to other lenders on your file.

Can I get a credit card with bad credit?

Some lenders offer credit builder or specialist cards for lower credit scores. Used responsibly, these can help improve your history over time. However, it’s important to note that these cards often have higher APRs; if you carry a balance you could pay significantly more interest than with a standard card.

What credit score do I need to get a credit card?

Each lender sets its own criteria. A score in the fair range or higher generally improves your chances, but decisions depend on the full profile and affordability.

How long does it take to improve eligibility?

There is no fixed time for when positive changes appear on your credit file as it depends on reporting cycles and your actions.

Related Articles

Check your credit card eligibility in the UK

Balance transfer cards for credit builders

How much can you balance transfer?

What is a balance transfer fee?

How to do a balance transfer on a credit card

Marbles credit card review – is it a good option to consider?

The content presented here has been impartially gathered by the Mintify team and is offered on a non-advised basis for informational purposes only. We adhere to strict editorial integrity

Find the right Credit Card for you

Does not impact your credit score

Find out which credit cards you’re eligible for

34.9% Representative APR (variable)

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.