Jaja Purchase Credit Card Review

Editor, Consumer Finance: Michelle Blackmore

Last Updated: December 6, 2025

In This Article

The Jaja credit card is a straightforward, app-based purchase credit card designed for people who want simple, transparent borrowing without unnecessary extras.

Jaja states that one of the core reasons to choose the card is to “build your credit” by making regular payments on time. It’s aimed at those with fair or limited credit history and offers a clean digital experience through the Jaja app, where you can track spending, make payments, and manage your account in real time. There’s no annual fee, no foreign transaction charges, and regular credit limit reviews that can help you build confidence and credit over time. It’s a card positioned to support financial progress rather than complicate it.

But is Jaja legit? How does the card actually work in practice? And is it genuinely worth considering if you’re trying to improve your credit score or rebuild your credit history after a few bumps along the way? We’ll look at who Jaja are, what makes their credit card different, and what to consider before applying.

Here’s everything you need to know.

What is the Jaja credit card?

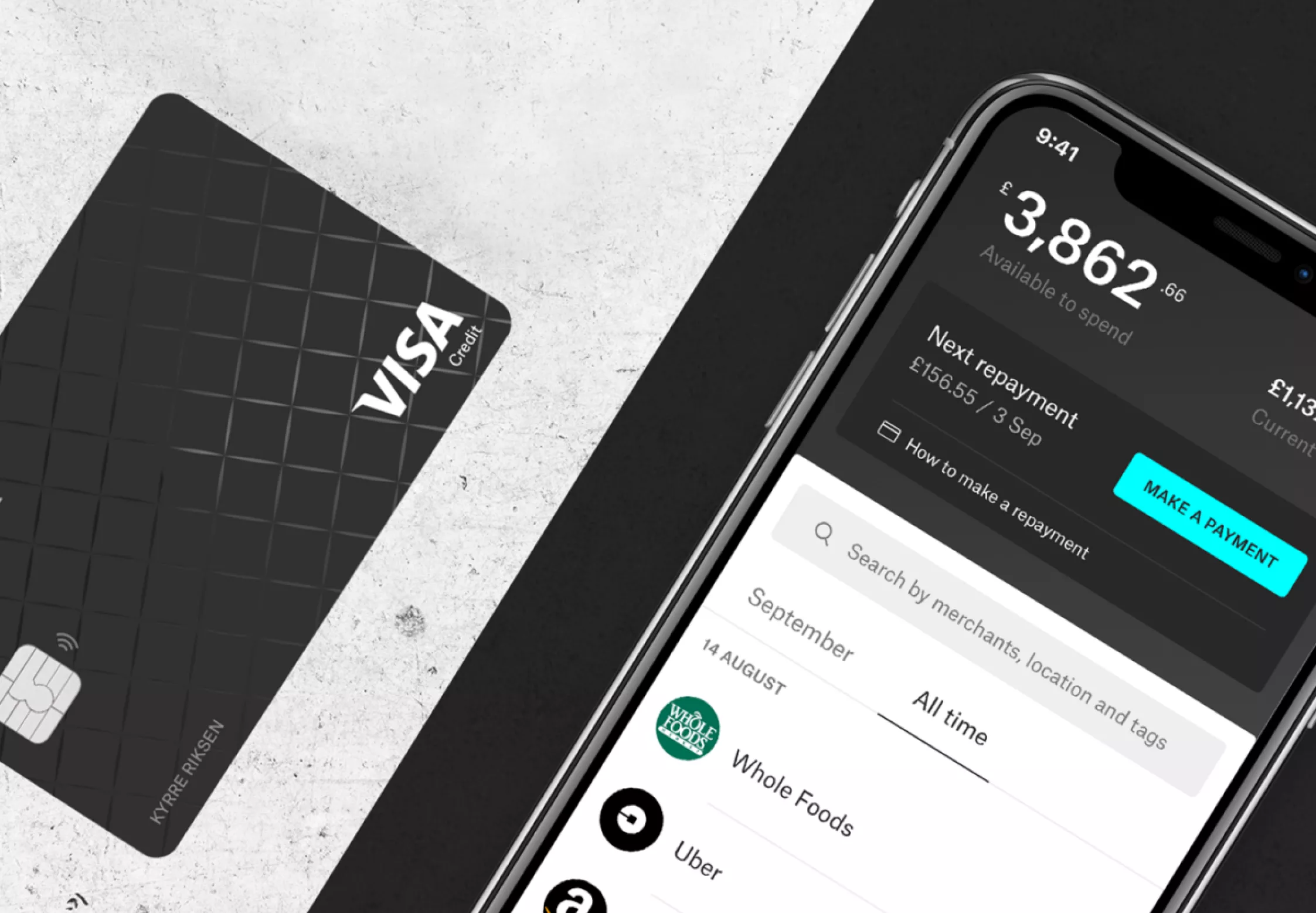

The Jaja purchase credit card is a mobile-first product. It offers simple everyday spending with full app-based control of your account, transactions, and repayments. The representative APR is 34.9% variable.

Everything is managed online, and applying takes just a few minutes. You can check your eligibility with a soft credit check, meaning there’s no impact on your credit score unless you go ahead and get approved.

Which bank owns the Jaja Credit Card?

Jaja credit cards are issued by Jaja Finance Ltd, a UK fintech. Jaja is not owned by a high street bank. It is an independent credit card provider regulated by the Financial Conduct Authority (FCA).

How does the Jaja credit card work?

Jaja keeps things simple. You get a Visa card you can use both online and in stores, including abroad, with no foreign transaction fees which makes it useful if you need a credit card with some travel credit card benefits.

Key features of the Jaja credit card:

- No annual fee

- Tap to pay (up to £100)

- App-based account tracking and reminders

- Interest-free period of up to 56 days if you pay your balance in full

The representative APR is higher than other purchase cards and more in line with credit builder cards. If you regularly pay off your balance during the interest free period, you can avoid charges and may help improve your credit profile over time.

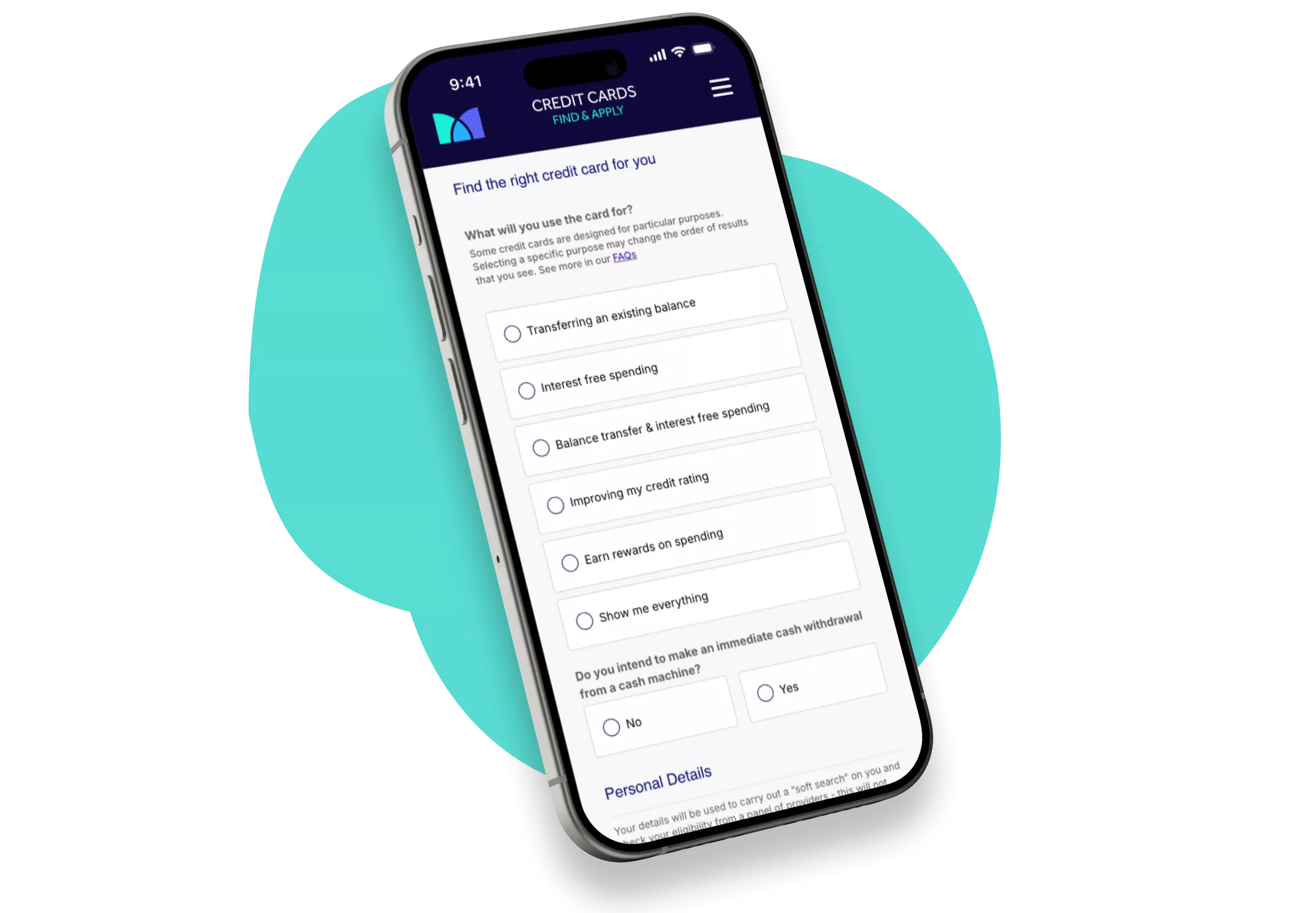

Find the right Credit Card for you

Does not impact your credit score

Find out which credit cards you’re eligible for

34.4% Representative APR (variable)

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Who can apply for the Jaja credit card?

To apply for a Jaja purchase credit card, you must meet the following criteria:

- Be at least 18 years old

- Not already have a Jaja card

- Not be bankrupt or have an active IVA

How do I apply for a Jaja credit card?

To apply for a Jaja credit card, start by checking your eligibility online using a credit card eligibility checker. This won’t affect your credit score.

If you’re eligible, you’ll be asked to provide basic personal details and may be invited to link your bank account using Open Banking to improve your chances of approval.

Before taking out any credit, always check the most recent terms offered to you from the provider issuing you the credit card. Make sure you’re clear on what’s being offered and any important conditions that apply.

You can check your eligibility through a soft search that won’t affect your credit score. If you’re approved and decide to go ahead, Jaja will then carry out a hard credit check as part of the final step.

What do Jaja say about the Jaja purchase credit card?

“The Jaja Vanta Purchase Credit Card was built with near prime borrowers in mind, aiming to provide simple credit alongside strong digital service.”

Lucas Dalglish, Chief Commercial Officer, Jaja Finance

This statement reflects Jaja’s description of its own product. Consumers should always compare APRs, fees and eligibility across providers before applying.

What is the maximum credit limit on a Jaja credit card?

Customers will be offered limits depending on individual credit history, affordability checks, and Jaja’s lending criteria. The exact limit is personalised and subject to status.

Jaja will also review your account to see whether you qualify for a higher credit limit. You don’t need to request this yourself.These credit limit reviews are usually based on how you manage your card including making payments on time, staying within your limit, and how much of your credit you use. A higher limit, when used responsibly, can help improve your credit utilisation ratio, which is an important part of your credit score.

Is the Jaja credit card a good credit card?

If you’re looking for a purchase card with long 0% introductory periods or perks such as rewards, rewards, Jaja probably isn’t for you. But if your goal is to build credit without paying annual fees, it could be one to consider.

Jaja may be especially useful if:

- You’re applying for your first credit card or rebuilding after a rough patch

- You want a credit card with no annual fees

- You travel or shop in other currencies and want to avoid foreign fees

Used responsibly, it can help strengthen your credit profile and potentially open the door to better credit cards in the future.

Product Features & Benefits

| Account Fee | £0 |

|---|---|

| Representative APR | 34.90% |

| Purchases | 34.9% (variable) p.a. |

| Purchases Interest Free | 56 days |

| Balance Transfers | 34.9% (variable) p.a. |

| Incentive on Opening | The Jaja Credit Card can be managed entirely through its mobile app, with features such as instant spend alerts and contactless payments up to £100. |

| Cashback/Rewards (if applicable) | No cashback scheme |

| Minimum Credit Limit | £250.00 |

Fees & Charges

| Introductory Balance Transfers Fee | 0.00% |

|---|---|

| Balance Transfers Fee | 3.00% |

| Late Payment | £12 |

| Cash Withdrawal Fee | 3% |

| Cash Withdrawal Minimum Charge | £3 |

| Foreign Usage (EU) | 0% |

| Foreign Usage World | 0% |

Jaja credit card vs Capital one

Jaja and Capital One are two recognised providers in the UK near-prime credit card space. Both are commonly used by customers who are building or rebuilding their credit history.

- Jaja provides a digital-first experience, with its mobile app offering flexible controls such as card freeze, push notifications and real-time spending alerts.

- Capital One is a long-established UK lender, known for starter cards and credit-building products that have supported a wide customer base over many years.

This section is designed to help you see how Jaja’s app-led approach compares with Capital One’s wider range. Always review representative APRs, fees and eligibility requirements before applying, as offers depend on your personal circumstances and are subject to status.

Jaja Finance Jaja Credit Card |  Capital One Classic Mastercard | |

|---|---|---|

| Account Fee | £0 | £0 |

| Representative APR | 34.90% | 34.90% |

| Purchases Description | 34.9% (variable) p.a. | 34.94% (variable) p.a. |

| Purchases Interest Free | 56 days | 56 days |

| Balance Transfers | 34.9% (variable) p.a. | 34.94% (variable) p.a. (3% fee) |

| Incentive on Opening | The Jaja Credit Card can be managed entirely through its mobile app, with features such as instant spend alerts and contactless payments up to £100. | The Capital One Classic Credit Card has no annual fee and offers flexible credit limits that you can request to increase (subject to approval) or lower to stay in control. You can easily manage your account, payments, and spending through the Capital One app. |

| Cashback/Rewards (if applicable) | No cashback scheme | No cashback scheme |

| Minimum Credit Limit | £250.00 | £200.00 |

| Intro Balance Transfers Fee | 0.00% | 0.00% |

| Balance Transfers Fee | 3.00% | 3.00% |

| Foreign Usage (EU) | 0% | 2.75% |

| Foreign Usage World | 0% | 2.75% |

Is Jaja legit and safe?

Yes. Jaja Finance Ltd is FCA-regulated and has operated in the UK credit card market for several years. The app uses strong security features, including biometric login and card-freeze controls.

All transactions are processed through Visa, and your account is managed through the secure Jaja app.

What do customers say about Jaja?

Reviews on TrustPilot highlight the simplicity and ease of use of the Jaja app, noting its intuitive interface for managing accounts, checking transactions and staying on top of payments. Many also find the application process straightforward with clear communication throughout.

Consumers often comment on:

- The absence of foreign fees

- Clear communication through the app

- Quick setup and management of direct debits

Some reviews also note mixed experiences with payment processes, app compatibility and customer service responsiveness. As with all credit products, feedback varies by personal circumstances.

Find the right Credit Card for you

Does not impact your credit score

Find out which credit cards you’re eligible for

34.4% Representative APR (variable)

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Frequently asked questions about the Jaja credit card

What is the Jaja credit card?

Jaja is a purchase credit Visa card issued by Jaja Finance. It’s designed to help people with limited or fair credit improve their score over time.

Which bank is Jaja?

Jaja is not a bank. It is a UK-based fintech (Jaja Finance Ltd) specialising in credit cards.

Which credit cards use Jaja Finance?

Jaja issues its own cards and has powered credit card portfolios for other companies in the UK.

Will applying for a Jaja credit card affect my credit score?

Using an eligibility checker will not impact your credit score. A full application may result in a hard search, which could temporarily affect your score.

How often do Jaja increase credit limits?

Jaja may review your account from time to time and could notify you if you become eligible for a higher credit limit. You do not need to apply manually, but any increase is subject to Jaja’s assessment and lending criteria.

Is the Jaja credit card good for travel?

It can be. There are no foreign transaction fees, which makes it a rare travel friendly option among credit builder cards.

Is the Jaja credit card safe?

Yes. You manage your account via a secure app with payment alerts, card freezing, and strong data protection measures.

What is the representative APR?

34.9% variable, though your rate may differ.

Where can I find reviews of Jaja?

Reviews for Jaja are available on independent platforms such as TrustPilot. These reflect customer experiences across Jaja products. Just remember, contract terms can vary based on your credit history, so checking your eligibility first without affecting your credit score is a practical step.

Can I use Jaja with Apple Pay or Google Pay?

Yes, you can add your card to mobile wallets and start using it before the physical card arrives.

Is the Jaja credit card right for you?

The Jaja Vanta is a strong option if you want an app-led card with simple controls and don’t mind a higher representative APR. It is best suited for those looking to build or rebuild credit, and who plan to repay in full each month. For rewards or low interest borrowing, other cards may be more competitive.

Ready to see which credit card could be right for you?

Take an eligibility check; it’s free, fast, and doesn’t affect your credit score.

Find the right Credit Card for you

Does not impact your credit score

Find out which credit cards you’re eligible for

34.4% Representative APR (variable)

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Related Articles

Balance transfer cards for credit builders

How much can you balance transfer?

What is a balance transfer fee?

How to do a balance transfer on a credit card

Marbles credit card review – is it a good option to consider?

When to do a balance transfer (and how to plan ahead)

The content presented here has been impartially gathered by the Mintify team and is offered on a non-advised basis for informational purposes only. We adhere to strict editorial integrity