Marbles credit card review – is it a good option to consider?

Editor, Consumer Finance: Michelle Blackmore

Last Updated: February 15, 2026

In This Article

The marbles credit card is a credit-builder card issued by NewDay. It is aimed at borrowers who have a limited or developing credit history and want access to a manageable line of revolving credit.

This review outlines how the card operates, the types of users it may be suitable for, and the factors you should assess before applying. It also explains how we evaluate products through our proprietary credit card rating system that allows us to score cards based on how well they serve the needs of different types of UK consumers. The information here is impartial and factual. It is intended to help you understand the product and should not be regarded as financial advice.

What is the marbles credit card?

The marbles credit card is a credit building card issued by NewDay Ltd. It may be considered by people who are looking for their first credit card or want to re-establish their credit profile through regular, well-managed use. It reports to major UK credit reference agencies each month, which can help demonstrate your repayment behaviour over time if payments are made on time.

Depending on your individual profile, marbles may also offer introductory 0% periods on purchases or balance transfers. These offers are not guaranteed and vary by applicant, so it’s important to check the specific terms provided to you before applying.

- Issued by NewDay Ltd (FCA regulated)

- Designed for people building or rebuilding their credit

- Reports monthly to major UK credit reference agencies

- Potential 0% periods on purchases or balance transfers, depending on eligibility

Mintip: Because starting credit limits tend to be lower and the APR is higher than mainstream cards, the marbles credit card works best for small, manageable spending and full monthly repayments. Used this way, it can help strengthen your credit record over time.

Find the right Credit Card for you

No impact to your credit score

Find out which cards you’re eligible for

34.9% Representative APR (variable)

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Product features & benefits of the marbles credit card

Some applicants may be offered introductory 0% periods on purchases or balance transfers. These offers are not guaranteed and depend on your individual eligibility. It is important to review the personalised terms shown to you before applying.

As with most credit building cards, the marbles credit card works best when used for manageable spending and repaid in full each month. This approach can help demonstrate steady repayment behaviour without incurring interest charges.

| Account Fee | £0 |

|---|---|

| Representative APR | 34.90% |

| Purchases | 0% for 7 months then 34.9% (variable) p.a. |

| Purchases Interest Free | 56 days |

| Balance Transfers | 0% for 7 months then 34.9% (variable) p.a. (3% fee) |

| Incentive on Opening | The marbles credit card offers up to 7 months of 0% interest on purchases and balance transfers. Your account will be reviewed after 3 months, and you may be considered for a credit limit increase with responsible use. |

| Cashback/Rewards (if applicable) | No cashback scheme |

| Minimum Credit Limit | £250.00 |

What is the maximum credit limit on a marbles credit card?

Maximum credit limits are subject to status, but up to £1,500 may be offered over time depending on how the account is managed, your credit history and the lender’s affordability checks.

You may be considered for a credit limit review after around three months, depending on how your account is managed and your overall circumstances. Any review is at the discretion of the lender and is not guaranteed.

Fees and charges of the marbles credit card

The APR on the marbles credit card is broadly in line with what is usually seen across other credit building cards. As with most cards aimed at people with limited or developing credit histories, rates tend to be higher than those offered on mainstream credit cards.

The figures displayed below are for guidance only and may differ from the terms you are offered. Always check the specific rates and fees provided by the lender and make sure you understand how they apply to your account.

| Introductory Balance Transfers Fee | 3.00% |

|---|---|

| Balance Transfers Fee | 3.00% |

| Late Payment | £12 |

| Cash Withdrawal Fee | 5% |

| Cash Withdrawal Minimum Charge | £4 |

| Foreign Usage (EU) | 2.95% |

| Foreign Usage World | 2.95% |

Which bank owns marbles credit cards?

The marbles credit card is not issued by a bank. It is provided by NewDay Ltd, a UK consumer credit firm that also operates other credit-building brands such as Aqua and Opus. NewDay Ltd and NewDay Cards Ltd are registered in England and Wales under company numbers 7297722 and 4134880, and form part of the wider NewDay group of companies.

The marbles brand is owned by NewDay Cards Ltd and licensed to NewDay Ltd for issuing the credit. This is a common structure in the UK credit market, where brand ownership and lending activities sit within separate entities inside the same group.

Is the marbles credit card good for bad credit?

The marbles credit card may be appropriate for people with limited or developing credit histories who want to manage small amounts of credit and build a repayment record over time. Because the APR is higher than mainstream cards, it is not designed for long term borrowing or for carrying a balance month to month.

Whether it is suitable depends on your individual circumstances, including your ability to manage your spending and repay in full each month. If you want to explore other credit building options, our guide to the Best Credit Cards to Build Credit may be helpful.

Mintip: Used carefully, the card can support credit building efforts, but it may not be suitable for users who are already struggling with debt or who require a lower-cost form of credit. If you need help managing debt, free and impartial support is available from organisations such as StepChange and MoneyHelper.

Who can apply for the marbles credit card?

In general, applicants should be over 18, resident in the UK and able to demonstrate a stable source of income. The lender will also look at your recent credit behaviour, existing borrowing and overall affordability to determine whether the card is suitable for you. NewDay assesses each application individually, and meeting the basic criteria does not guarantee approval.

If you’re working on improving your eligibility for credit, you can read our guide on 9 habits that may help improve credit card eligibility.

| Availability | Available to new customers. You must not have taken out an Aqua, Marbles, Opus or Fluid card in the past 12 months. |

|---|---|

| Minimum Income | £0 |

| Minimum Age | 18 |

| Residency | Permanent resident in the UK. |

How do I apply for the marbles credit card?

The first step is to check your credit card eligibility through a free online soft eligibility checker to see if you are likely to be eligible for this or other cards. A soft search does not impact your credit score and helps you see your likelihood of being accepted without submitting a full application.

If you decide to move forward after checking your eligibility, you can continue with the online application with basic personal details, income information and your recent credit behaviour. If you proceed with the formal application, the lender will then run a hard credit check as part of their decision process.

Find the right Credit Card for you

No impact to your credit score

Find out which cards you’re eligible for

34.9% Representative APR (variable)

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Pros and cons of the marbles credit card

The marbles credit card has a number of strengths and limitations that are typical of credit building cards. The points below outline the key things to consider before deciding whether it fits your needs. These are general observations and may not reflect the specific terms you are offered.

Pros

- Reports monthly to major UK credit reference agencies

- Straightforward structure without complex features

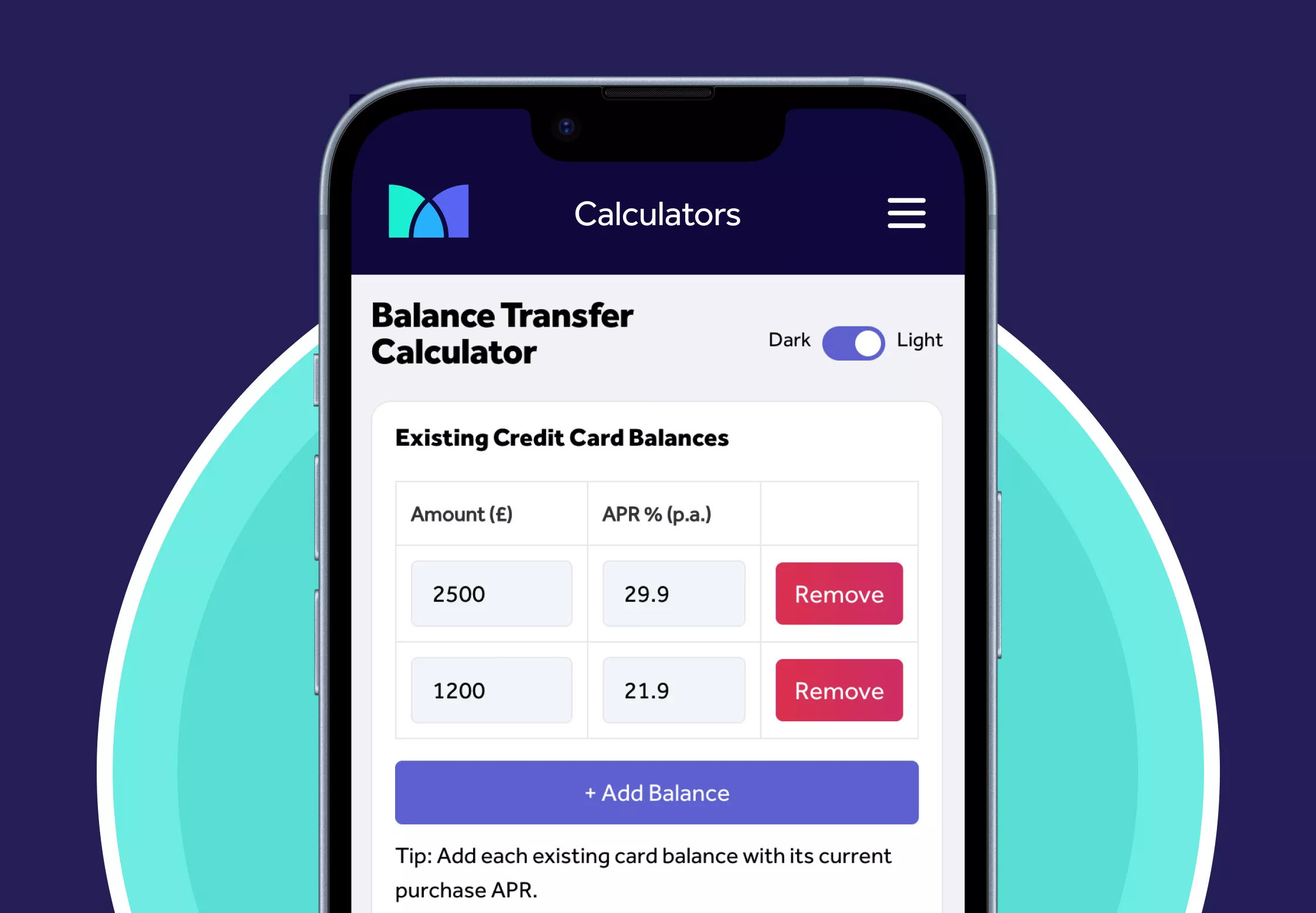

- App for managing payments, statements and limits

- Potential for credit limit reviews over time

- Some applicants may receive introductory 0% offers on purchases or balance transfers

Cons

- APR is higher than other credit cards

- Starting credit limits are usually lower

- No rewards or cashback incentives

- Carrying a balance can become expensive if not repaid in full

- Terms and introductory offers vary by applicant, so not everyone receives the same features

Additional benefits and tools offered by the marbles credit card

Marbles provides a range of account management tools that can help you keep track of your spending and stay organised. These features are designed to give you clearer visibility of your account and more control over how you manage repayments.

- Manage your account online through the app or web portal

- Choose a repayment date that fits your monthly budget

- Receive text alerts when you are approaching your credit limit

- Access a UK-based customer service helpline

These tools are optional and may support day-to-day account management, but they do not guarantee specific financial outcomes. How helpful they are will depend on your own circumstances and how you use the account.

Alternatives to the marbles credit card

There are several other credit building cards in the UK that may offer different features, starting limits or criteria. These alternatives will suit some users depending on their circumstances, credit profile and preference for app tools or account flexibility. The option below is one general example of a comparison between two cards issued by Newday.

Marbles vs Aqua classic

NewDay Limited marbles Mastercard |  NewDay Limited aqua Classic | |

|---|---|---|

| Account Fee | £0 | £0 |

| Representative APR | 34.90% | 34.90% |

| Purchases Description | 0% for 7 months then 34.9% (variable) p.a. | 34.95% (variable) p.a. |

| Purchases Interest Free | 56 days | 48 days |

| Balance Transfers | 0% for 7 months then 34.9% (variable) p.a. (3% fee) | 34.95% (variable) p.a. (3% fee) |

| Incentive on Opening | The marbles credit card offers up to 7 months of 0% interest on purchases and balance transfers. Your account will be reviewed after 3 months, and you may be considered for a credit limit increase with responsible use. | The Aqua Classic Credit Card has no annual fee and offers a personalised credit limit from £250 to £1,500, tailored to your profile and how you manage your account over time. |

| Cashback/Rewards (if applicable) | No cashback scheme | No cashback scheme |

| Minimum Credit Limit | £250.00 | £250.00 |

| Intro Balance Transfers Fee | 3.00% | 0.00% |

| Balance Transfers Fee | 3.00% | 3.00% |

| Foreign Usage (EU) | 2.95% | 2.95% |

| Foreign Usage World | 2.95% | 2.95% |

What do customers say about the marbles credit card?

Marbles has thousands of customer reviews on Trustpilot, where people often comment on how easy the app is to use, how clearly information is presented and how straightforward the application process feels. Many reviewers also mention using the card as part of rebuilding or establishing their credit history.

- Many users say the app makes it simple to view balances, payments and upcoming due dates.

- Some reviewers explain that marbles offered them an opportunity to begin improving their credit when other lenders were unable to approve them.

- Several customers note that initial limits were lower than expected, or that increases took longer than they hoped.

- Negative feedback sometimes relates to interest costs when balances are not cleared in full, or to credit limit reductions after changes in a user’s credit profile.

These points reflect common themes from customer feedback and may not match every user’s experience. Your own outcome will depend on your circumstances and how you manage the account.

Frequently asked questions

How do I check my eligibility for a marbles credit card?

You can check your eligibility by completing a free online eligibility check. This uses a soft search, so it will not affect your credit score, and shows your likelihood of being accepted before you decide whether to apply.

How often does marbles review credit limits?

You may be considered for a credit limit review after around three months, which could result in an increase from your fourth statement. Any review is subject to checks and is entirely at the discretion of marbles, so increases are not guaranteed.

Can I use the marbles credit card abroad?

You can use the card abroad wherever Mastercard is accepted. Foreign transaction fees and cash withdrawal charges may apply, and these will be shown in the terms of your personalised offer.

Does marbles charge for cash withdrawals?

Cash withdrawals usually come with a fee and start accruing interest immediately. These costs can be higher than standard purchases, so it is important to review the fees before using the card for cash.

Can I use the marbles credit card with Apple Pay or Google Pay?

Yes. Marbles credit cards can be added to supported digital wallets such as Apple Pay and Google Pay for contactless payments where these services are accepted.

Can I transfer a balance to the marbles credit card?

Yes. Some applicants may be offered balance transfer options, including introductory 0% periods. These offers depend on your individual circumstances and are not guaranteed. The exact rate, any promotional period and any fees will appear in your personalised terms.

Mintify’s verdict on the marbles credit card

The marbles credit card offers a simple structure and may suit people who want to build or re-establish their credit history using small, manageable spending. Its tools and app features can support day-to-day account management, and some applicants may receive introductory 0% offers depending on eligibility. However, the APR is higher than mainstream cards and starting limits are usually low, so it is not designed for long-term borrowing. Whether it is appropriate for you will depend on your personal circumstances, credit behaviour and ability to repay in full each month.

If you are considering marbles, checking your eligibility first can help you understand whether the card is a good fit for your situation with no impact on your credit score.

How we score credit cards

Mintify’s assessment of the marbles credit card is based on our independent proprietary scoring methodology. We evaluate factors such as interest rates, fees and charges and other features the card may offer in comparison to similar credit building cards.

This assessment is provided for information only and is not financial advice. Whether the marbles credit card is suitable for you will depend on your personal circumstances, eligibility and how you plan to use the account. Always review the personalised terms you are offered and consider using a free eligibility checker before applying.

If you want to understand the wider credit card landscape, you can also read our guide on how to choose a credit card, which explains the different types available and what to consider when deciding what may be appropriate for you.

Find the right Credit Card for you

No impact to your credit score

Find out which cards you’re eligible for

34.9% Representative APR (variable)

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Related Articles

Check your credit card eligibility in the UK

Balance transfer cards for credit builders

How much can you balance transfer?

What is a balance transfer fee?

How to do a balance transfer on a credit card

When to do a balance transfer (and how to plan ahead)

The content presented here has been impartially gathered by the Mintify team and is offered on a non-advised basis for informational purposes only. We adhere to strict editorial integrity