How We Score Credit Cards

Mintify has developed a data-informed, proprietary credit card rating system that allows us to score cards based on how well they serve the needs of different types of UK consumers. This system is designed to evaluate value through the lens of various consumer priorities, whether it be transferring balances to minimise the cost of borrowing, extending the duration for purchase payments, accruing rewards from expenditures, or seeking greater financial flexibility. This rating system does not include credit cards for business use which is covered separately.

Data over opinion

While we value opinions, expertise and intuition, we value the data above all else. We commit to publishing only research backed, data-rich content, free from inherent bias or conflict of interest. This approach allows us to operate with complete transparency.

On that basis, this article provides a detailed breakdown of our credit card rating methodology. This includes an in-depth look at the specific criteria used and an explanation of how various features are quantitatively weighted. This ensures that Mintify’s readers and members are provided information based on reliable, data-informed assessment criteria to support impartial product comparison, not personal financial advice.

Research & database design

To score cards based on their position relative to others in their category, we first built a UK credit card database containing over 13,000 datapoints for over 130 credit cards available in the UK. We obtained this data from credit card issuers’ websites and the financial institutions directly. This data was then cleaned and preprocessed to remove duplicates, handle missing values, and normalised. Each credit card record was then assigned a primary category based on our assessment of its most common use case.

Where certain data points (e.g. income thresholds, transfer fees, or credit limits) are not disclosed by card issuers, we apply a consistent fallback rule of assigning a neutral score of 3 stars. This ensures the scoring remains balanced and comparable across products with varying levels of available information.

Dynamic data

We invest equally in building technology solutions that allow us to easily and regularly update this database, providing our readers and members with a tool that delivers dynamic product data rather than a static view of a single point in time. Data is updated daily.

Our ratings are based on publicly available information at the time of review. While we strive to keep our data accurate and up-to-date, terms and offers may change. This scoring system is for general informational purposes only and does not constitute financial advice or a personal recommendation. We encourage all readers and members to review the full details of any product and consider their own financial circumstances before making a decision.

Handling missing or unavailable data

While we aim to maintain a complete and up-to-date product dataset, some providers do not disclose certain details. In such cases, we assign a neutral 3-star rating unless there is a strong justification to apply an alternative value. This prevents penalising products unfairly due to a lack of transparency from the provider, while still allowing the product to be compared meaningfully.

Your interests come first.

Mintify is a mission driven, consumer first company. Our company culture is oriented towards being responsible and socially conscious and we do not allow affiliate relationships, revenue arrangements, or promotional incentives to influence product ratings. In fact, we regularly make decisions that do not maximize revenue when those decisions are demonstrably in the long term interest of our audience, society more broadly, or our values. Products are scored using a fixed methodology based on product features that typically offer value to consumers. Our comparisons are transparent, impartial, and independent of any partner or advertiser influence. Scoring is not intended to indicate product suitability for individual borrowers.

Categories & weightings

Our analysis of the primary use cases of all cards in the database produced six primary card categories:

- Balance Transfer

- Cashback

- Credit Building

- Low Interest

- Purchases

- Rewards

While a card may include features across multiple categories, such as both a 0% introductory APR on purchases and on balance transfers, we assign it to the category that reflects its primary marketed purpose. This is determined by how the card is positioned by the issuer in its official marketing materials. For instance, a card marketed primarily for balance transfers will be classified as a Balance Transfer card, even if it also includes a promotional purchase rate. This approach ensures consistent categorisation based on intended use, while still capturing the value of secondary features within the scoring process.

Key factors that influence the quality and appeal of a credit card were captured by consulting with experts in this field. These factors can, and do, vary based on user needs and card category, but commonly include:

| Factor | Description |

|---|---|

| Interest Rates | Lower interest rates are generally more favourable, particularly for borrowing or carrying a balance. |

| Annual Fees | Cards with no or low annual fees tend to be more attractive to cost-conscious customers. |

| Rewards and Benefits | Includes cashback, points, travel perks, and other incentives that add value to spending. |

| Credit Limit | Higher credit limits offer more flexibility, especially for larger purchases or improving credit utilisation. |

| Introductory Offers | Offers such as 0% interest periods or welcome bonuses can significantly increase a card’s appeal. |

| Customer Service | The quality and reliability of customer support can impact long-term satisfaction. |

| Fees & Charges | Lower fees, such as foreign transaction fees and balance transfer fees. |

These factors were weighted by level of importance and scored based on a representative model of the average UK credit card holder and their spending behaviour. This model was based on publicly available data obtained from the Office of National Statistics.

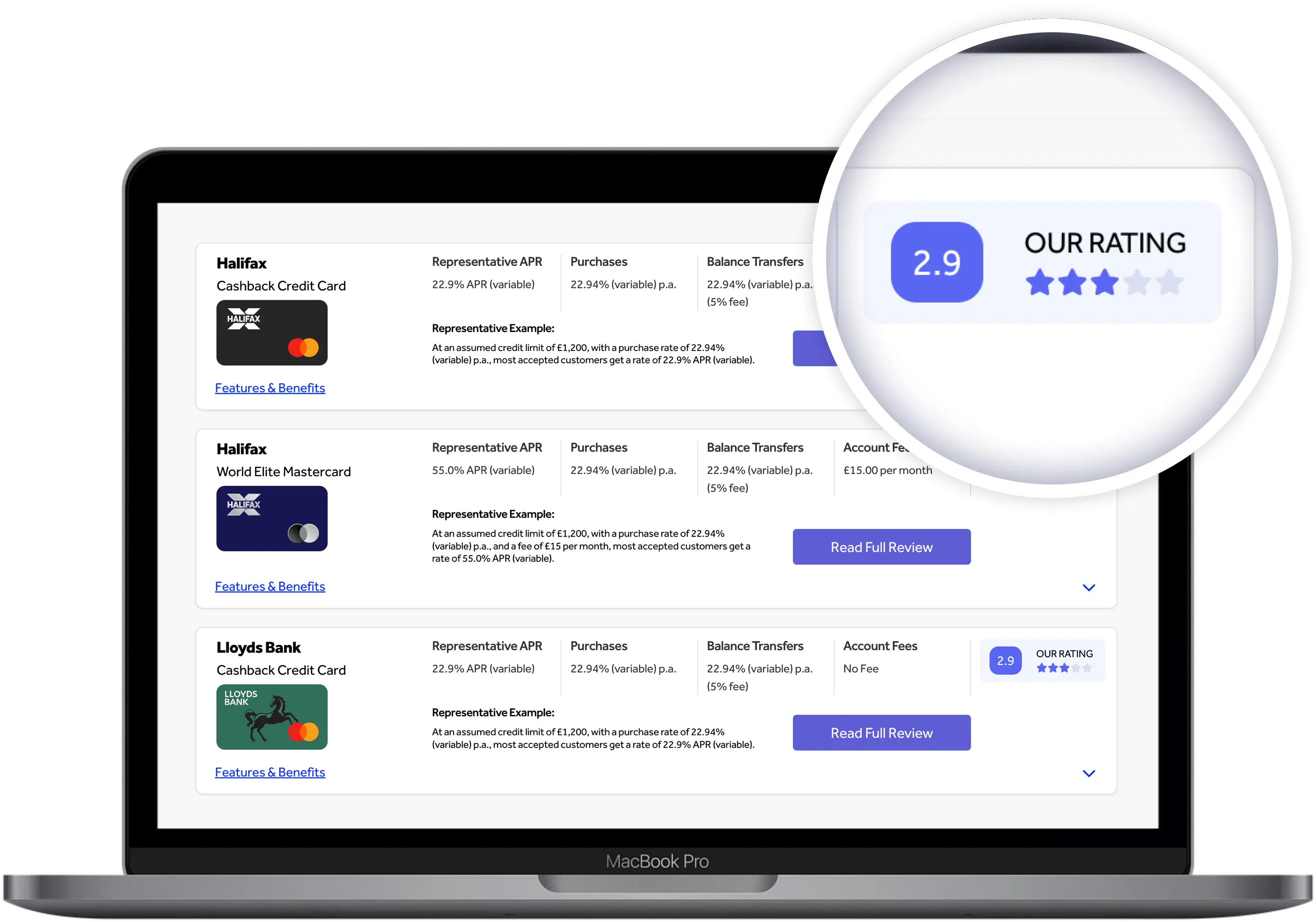

The 5-Star Rating

Each product is assessed across multiple factors, with scores assigned on a scale from 1 to 5 for each. These individual scores are then averaged to produce an overall rating. To reflect meaningful differences between products, we include one decimal place in the final result, for example, 4.2 out of 5 stars. This rating is intended to help users compare general product features and should not be interpreted as a personal recommendation.

Scoring methodology by card category

We’ve identified a core set of factors that typically matter most to customers when comparing credit cards such as interest rates, fees, rewards, and promotional offers. While these factors are broadly relevant, their importance can vary depending on how a card is intended to be used.

To reflect this, we’ve created tailored scoring models for each major credit card category including Balance Transfer, Purchases, Low Interest, Rewards, Cashback, and Credit Building. Within each category, the relevant factors are assigned specific weightings based on their typical importance to consumers using cards for that purpose.

Each credit card is then rated using a weighted average of its performance across those category-specific factors. This provides a star rating that helps users compare product features at a glance, without implying individual suitability or approval likelihood.

Rewards & Cashback

A rewards or cash back credit card’s overall rating is determined primarily by its ‘spend to value’ score. This calculation has been designed to provide an indicator of how much value the average cardholder is likely to receive via the cashback or rewards earned from regular spending and whether those earnings are enough to justify the card’s cost.

Scoring methodology & weightings:

There are four assessment calculations used to determine a Rewards or Cashback card’s overall rating. The value of each calculation carries a weighting according to their overall importance in determining customer value.

- Spend to Value (60% of total score)

- Interest Rates (20% of total score)

- Customer Service (10% of total score)

- Fees and Charges . Which cards offer more favourable fee structures. (10% of total score)

All scoring outputs are reviewed by at least two members of the Mintalist editorial team before publication, as part of our internal QA process.

Balance Transfer & Purchases

With responsible use, credit cards can be a cost-effective option for short-term borrowing, potentially reducing or completely bypassing interest costs. With that in mind, the most important consideration when choosing a balance transfer or purchases credit card is how much it can help you save on interest. Specifically, does the product’s introductory APR offer give you the time you need to pay off debt or finance new purchases while avoiding interest?

As such, we consider the potential value of a card’s introductory offers as primary in weighting their overall score, with an introductory balance transfer APR having a larger influence on a card score in the balance transfer category and an introductory purchase APR having a larger influence in the low-interest category. We also rate each card’s Representative APR since you may need to carry a balance long term or after your introductory APR period ends.

Our scoring system places the greatest weight on the introductory period, followed by the card’s ongoing APR. We also consider any fees charged for making the balance transfer, which can reduce the overall savings. While customer service has less weighting in this category, it still plays a role in shaping the overall consumer experience and is included where reliable data is available.

Here’s how we’ve weighted the card’s criteria:

Low Interest

Low-interest credit cards can offer value to consumers who expect to carry a balance over time, as they reduce the cost of borrowing through lower ongoing APRs. This can be particularly helpful for managing larger purchases or revolving balances in a more affordable way.

Our rating methodology places the greatest weight on the card’s representative APR, as it reflects the long-term cost of borrowing once any promotional period ends. Cards with consistently lower APRs receive higher scores in this category, helping consumers compare options based on likely usage patterns.

We also factor in any introductory low-interest offers on purchases or balance transfers, as these may reduce costs temporarily and enhance the product’s overall value.

In addition to APR, we consider other relevant features, including fees and charges (such as balance transfer fees and foreign usage fees), rewards, customer service, and any added benefits. These elements contribute to a well-rounded view of each card’s value and suitability for different user needs.

Here’s how we’ve weighted the low interest credit card criteria:

Credit Building

Credit builder cards are designed to help consumers establish or improve their credit profile when used responsibly. They also offer access to short term borrowing, often with lower eligibility thresholds than mainstream cards. The most significant factor in our scoring is the Representative APR, as these products typically carry higher interest rates due to their accessibility. Understanding the cost of borrowing is essential to building credit without creating financial strain.

We also take into account features that may support consumers on their credit journey, such as rewards or cashback programs. Additionally, we consider practical accessibility factors like starting credit limits, as these influence a consumer’s ability to manage their usage in a way that promotes healthy credit behaviour.

Customer service is excluded from this category’s scoring. While it remains important, reliable and consistent customer satisfaction data was not available across all lenders in this category.

Here’s how we’ve weighted the card’s criteria: