NewDay Limited Credit Cards

7 CARDS

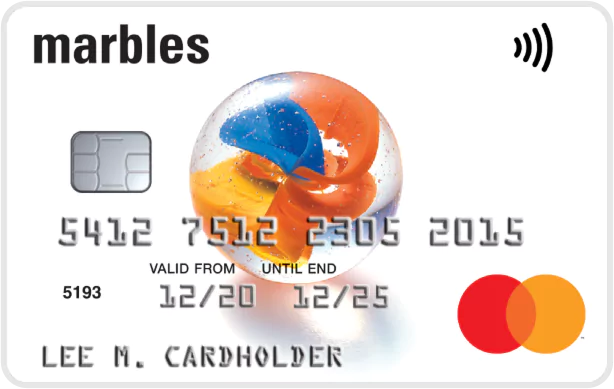

NewDay Limited, a UK-based credit card issuer, specialises in credit services through retail and own-brand cards. Offering options like the NewDay John Lewis, Aqua, Marbles, and Bip cards, they focus on helping individuals with limited credit histories or those working to build or rebuild their credit scores.

Representative APR

29.9% APR (variable)

Purchases

29.95% (variable) p.a.

Balance Transfers

29.95% (variable) p.a. (5% fee)

Account Fees

£0

Representative Example: At an assumed credit limit of £1,200, with a purchase rate of 29.94% (variable) p.a., most accepted customers get a rate of 29.9% APR (variable).

Representative APR

34.9% APR (variable)

Purchases

0% for 7 months then 34.9% (variable) p.a.

Balance Transfers

0% for 7 months then 34.9% (variable) p.a. (3% fee)

Account Fees

£0

Representative Example: At an assumed credit limit of £1,200, with a purchase rate of 34.95% (variable) p.a., most accepted customers get a rate of 34.9% APR (variable).

Representative APR

34.9% APR (variable)

Purchases

34.95% (variable) p.a.

Balance Transfers

34.95% (variable) p.a. (3% fee)

Account Fees

£0

Representative Example: At an assumed credit limit of £1,200, with a purchase rate of 34.95% (variable) p.a., most accepted customers get a rate of 34.9% APR (variable).

Representative APR

29.9% APR (variable)

Purchases

34.95% (variable) p.a.

Balance Transfers

34.95% (variable) p.a.

Account Fees

£0

Representative Example: At an assumed credit limit of £1,200, with a purchase rate of 34.9% (variable) p.a., most accepted customers get a rate of 34.9% APR (variable).

Representative APR

34.9% APR (variable)

Purchases

34.94% (variable) p.a.

Balance Transfers

0% for 9 months, then 34.94% (variable) p.a. (3% fee for 60 days)

Account Fees

£0

Representative Example: At an assumed credit limit of £1,200, with a purchase rate of 34.94% (variable) p.a., most accepted customers get a rate of 34.9% APR (variable).

Representative APR

34.9% APR (variable)

Purchases

39.95% (variable) p.a.

Balance Transfers

39.95% (variable) p.a. (3% fee)

Account Fees

£0

Representative Example: At an assumed credit limit of £1,200, with a purchase rate of 39.95% (variable) p.a., most accepted customers get a rate of 34.9% APR (variable).

Representative APR

34.9% APR (variable)

Purchases

34.95% (variable) p.a.

Balance Transfers

0% for 5 months then 34.95% (variable) p.a. (3% fee). Balance transfers must be made within the first 60 days

Account Fees

£0

Representative Example: At an assumed credit limit of £1,200, with a purchase rate of 34.95% (variable) p.a., most accepted customers get a rate of 34.9% APR (variable).

Showing all 7 credit cards

Didn’t find what you’re looking for? We also provide a full and complete view of the current UK credit card market with a dynamic database of over 120 alternative credit cards here.