When to do a balance transfer (and how to plan ahead)

Editor, Consumer Finance: Michelle Blackmore

Last Updated: February 12, 2026

In This Article

Quick Answer: The best time to do a balance transfer is before your existing card starts charging interest or a 0% offer ends. Most new cards give you 60–90 days after activation to complete the transfer. Compare deals early, use a credit card eligibility checker, and include any transfer fees when calculating savings.

Many people only think about balance transfers once interest charges start adding up, often after Christmas or during other periods of higher spending. But the best time to act is before those charges appear. Missing payments or not clearing your balance before the 0% period ends can lead to interest being charged at your card’s standard rate.

Planning ahead means you can compare deals calmly, check your eligibility, and prepare your balances before applying, which may improve your likelihood of approval, depending on your credit profile, and help you secure a longer 0% window.

Even if your finances are under pressure, taking a few weeks to plan your move can make a big difference. You’ll have time to check fees, gather your existing card details, and decide which balance to move first. A well-timed transfer could reduce how much interest you pay and make repayment easier, depending on your balance and repayment pattern.

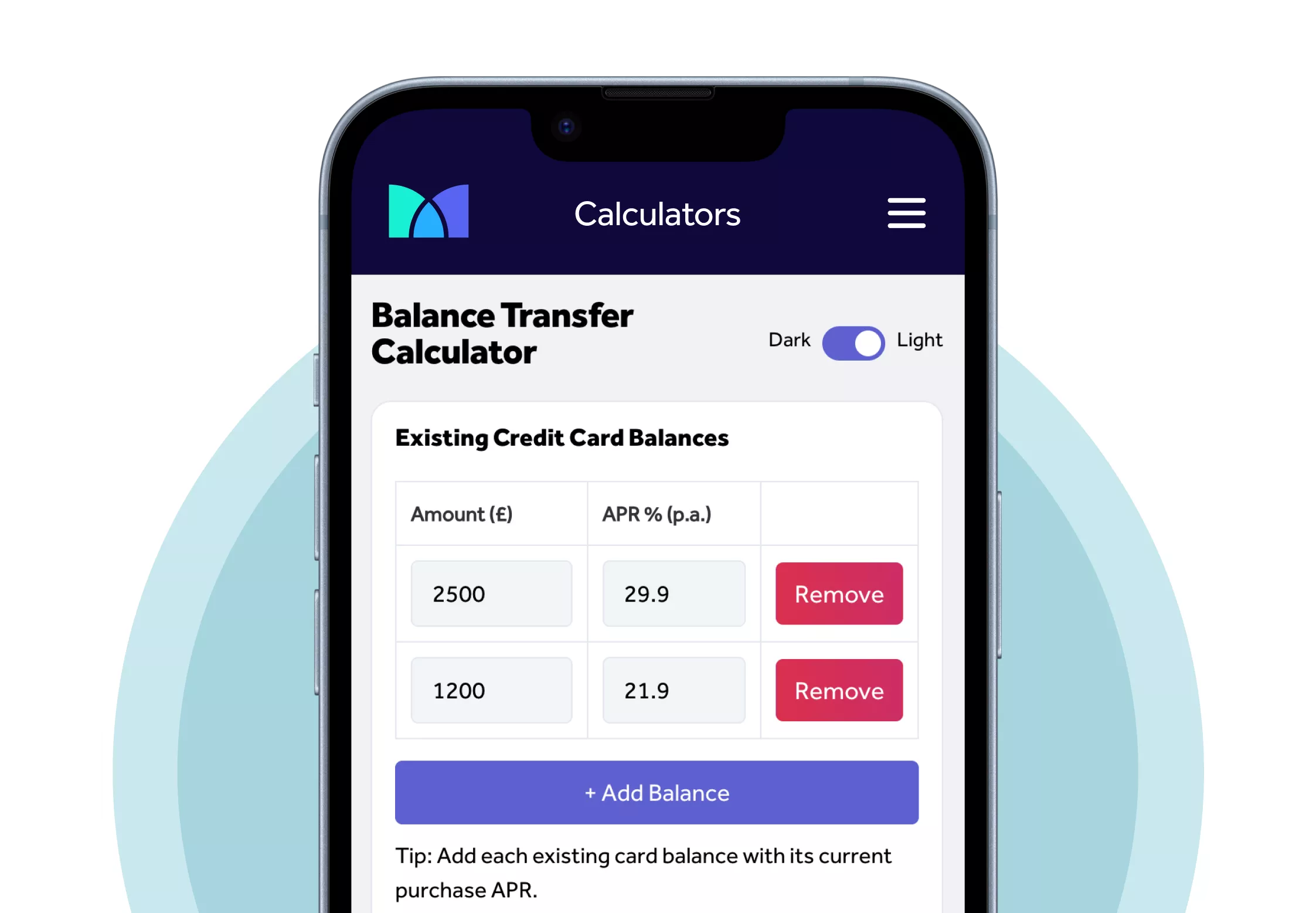

Use our free balance transfer calculator to estimate how much you could save before applying for a new card.

What is a balance transfer credit card?

A balance transfer credit card lets you move existing credit card debt onto a new card, often with a 0% interest period. Instead of paying interest on your old balance, you can focus on clearing what you owe during the promotional window.

Most balance transfer cards charge a one-off transfer fee, usually between 2% and 3% of the amount you move. For example, transferring £2,000 could cost around £40–£60. A few lenders offer no-fee balance transfer deals, but these usually come with shorter 0% periods.

- Purpose: Reduce or pause interest on existing credit card debt.

- Duration: Promotional 0% periods typically last 12–30 months.

- Fee: One-off charge based on the balance transferred, unless it’s a no-fee deal.

- Eligibility: Based on your credit profile, income and existing borrowing.

Using a balance transfer card can be a smart way to save money and simplify repayments, but only if you make regular payments and clear your balance before the 0% period ends.

Why planning ahead matters

Timing is crucial when it comes to balance transfers. Most new cards give you a set window, often around 60–90 days after activation, to complete your transfer though this may vary by lender. Missing that period means losing access to the 0% offer or paying standard interest on any balance you move later.

Planning ahead ensures you have your existing card details ready, your balances confirmed, and your transfer request submitted within the promotional window. It also gives you time to compare offers and avoid rushed decisions that could affect your credit file.

- 60–90 day window: This countdown starts when you activate your new card, not when you apply.

- Preparation: Knowing your balances in advance helps you request the correct transfer amount.

- Credit impact: Applying too late or too often can reduce your approval chances.

- Peace of mind: Early planning removes pressure when your current 0% deal or grace period ends.

By acting early, you can evaluate calmly the 0% terms and choice of lenders, while also ensuring your transfer is processed smoothly before any interest resumes.

Mint tip: If you’re worried about existing debt or repayments, free and impartial support is available from StepChange and MoneyHelper.

When should I start comparing balance transfer deals?

The best time to compare balance transfer offers is before your current promotional rate or introductory 0% period ends. This gives you enough time to review deals, check your eligibility, and submit an application without rushing or risking interest being added to your existing balance. Soft-search tools do not affect your credit score. Only a full application will appear on your credit file.

Starting your search a few weeks in advance allows you to track changing deals and find a card that fits your repayment plan. Many credit card lenders refresh offers monthly, and availability can vary depending on your credit score and financial circumstances.

- Before expiry: Begin comparing deals around six to eight weeks before your current offer ends.

- During quieter periods: Some of the most competitive 0% balance transfer promotions appear early in the year or after major spending seasons.

- If you’re new to balance transfers: Comparing early gives you time to understand fees, limits and eligibility requirements before applying.

- Monitor changes: Balance transfer deals can be withdrawn or replaced quickly, so it helps to shortlist a few options in advance.

By researching early, you’re more likely to find the right balance between 0% duration, transfer fees and credit limits and to complete your transfer within the available window once approved.

Mintip: Start comparing deals before your current card’s 0% offer ends, ideally while you’re still making interest-free payments. This gives you time to check your credit score, use a credit card eligibility checker, and line up the right balance transfer option before interest is added.

Find the right Credit Card for you

No impact to your credit score

Find out which cards you’re eligible for

34.9% Representative APR (variable)

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Types of balance transfer cards

Not all balance transfer cards are the same. Some will also include an introductory offer on purchases or are designed for people rebuilding their credit. Understanding the differences can help you choose the most suitable type for your situation.

- Long Balance transfer cards: These cards let you move existing debt to a new card with a 0% interest period for long periods of time, even over 30 months, usually for a one-off transfer fee.

- Low-fee balance transfer cards: These offer reduced fees, often 1%–2%, and can be useful if you’re transferring a large balance and want to minimise upfront costs. They may offer slightly shorter 0% periods than higher transfer fee cards.

- No-fee balance transfer cards: These charge no transfer fee but usually come with shorter 0% terms. They can be ideal if you plan to clear your balance quickly, or have a lower balance to pay off and want to avoid any one-off charges.

- Balance transfer and purchase cards: These combine 0% balance transfers and purchases offers, giving flexibility for managing old debt and short-term spending. The interest-free terms for each usually differ.

- Credit-builder balance transfer cards: Designed for people with limited or lower credit scores, credit builder cards offer shorter 0% periods and smaller limits but can help build a stronger credit profile if used responsibly.

Each card type has different trade-offs between 0% duration, transfer fees, and eligibility. The right choice depends on your repayment timeline and credit profile.

Plan Before You Switch

Calculate your potential savings: Use our balance transfer calculator, and you can plug in different transfer fees and 0% periods to see how they change your total cost and the monthly payment you’d need to clear the balance within the promotional window.

- Compare fees: Compare 0%, low-fee (1%–2%), and standard fees to see the upfront cost vs. savings.

- Adjust the 0% term: See how a longer or shorter promotional period affects monthly repayments.

- Set your transfer amount: Model one card or combine balances to match your new limit.

- Target a payoff date: Learn the monthly payment needed to clear the balance before the intro ends.

Results are for illustration only and do not represent any specific lender or offer. Always review your card’s summary box for the exact fee and terms.

Use our Balance Transfer Calculator to find the right card for you.

If you’re carrying credit card debt, a balance transfer credit card can help you pay it down faster by moving your balance to a new card with 0% interest for a set period. Using a balance transfer calculator helps you understand how much interest you could potentially save by transferring debt from your existing cards to a balance transfer card.

How to prepare before you apply for a balance transfer card

Before applying for a balance transfer card, it’s worth taking a few simple steps to check your finances and improve your chances of approval. Being organised helps you avoid unnecessary credit checks, delays, or rejected applications that can affect your score.

- Check your credit report: Review your report with the main credit reference agencies and correct any errors. Lenders use this information to assess your application.

- Calculate your existing balances: Make a note of how much you owe and on which cards. This helps you estimate how much to transfer and whether you’ll need one or more new cards.

- Use an eligibility checker: Soft-search tools show which cards you’re likely to be approved for without affecting your credit score. Use a free credit card eligibility checker to compare options safely. Soft-search tools do not affect your credit score. Only a full application will appear on your credit file.

- Limit other applications: Applying for several credit products in a short time can reduce your approval chances. Space out any applications by a few weeks.

- Understand fees and terms: Read the summary box for each card carefully to confirm the transfer fee, 0% period length and what happens when it ends.

The 60–90 day transfer window

Once your new balance transfer card is approved, most lenders give you a limited window, typically 60 to 90 days from activation, to complete your transfer. Missing this deadline means the transferred balance may not qualify for the 0% interest offer, leaving you paying the standard rate instead.

The countdown usually starts the day you activate your new card, not when your application is accepted. If you plan ahead, you can align activation with your next statement date or pay cycle so your balances are ready to move within that window.

- Card activation usually triggers the clock: The 60–90 day countdown begins when you activate your card, so timing matters.

- Gather details early: Have your existing card numbers and balances ready before activating.

- Request promptly: Some lenders take several working days to process transfers, so submit early.

- Check confirmation: Always confirm your transfer has been accepted and the 0% period applied correctly.

Getting your timing right ensures your balance qualifies for the promotional rate and that your repayment plan starts smoothly. It also prevents interest or fees being added due to missed deadlines.

What do I do before completing my balance transfer?

Once you’ve been approved for a balance transfer card, it helps to pause and double check the key details before you complete your balance transfer request. Acting too quickly without reviewing your new card’s terms can mean missing fees, limits, or expiry dates that affect the 0% offer.

- Confirm your transfer window: Review how long you have to complete the transfer; it can vary by lender.

- Check your available credit limit: Make sure it covers the amount you want to move, including any transfer fees. Some cards do not allow you to transfer 100% of your credit card limit.

- Decide which balance to move first: If you have more than one card, transfer the balance with the highest interest rate or shortest repayment period first.

- Review how payments will be applied: Some cards allocate repayments differently; check whether new spending or existing debt is cleared first.

These small checks only take a few minutes but can prevent confusion and extra charges later. Once you’re sure everything aligns, submit the transfer and wait for confirmation from both card providers.

Common balance transfer mistakes to avoid

Even with good planning, it’s easy to make small errors that reduce the benefit of a balance transfer. Avoiding these can help you get the full value of your 0% offer and stay on track to clear your debt within the promotional period.

- Waiting too long to apply: If your existing 0% offer or grace period ends, you may start paying interest before your new transfer completes.

- Missing the transfer deadline: Failing to move your balance within your new card’s 60–90 day window means losing access to the 0% rate.

- Spending on the new card: Purchases on a balance transfer card are rarely covered by the 0% offer and can start accruing interest immediately.

- Only paying the minimum: Minimum payments keep your account active but do little to reduce the balance. Aim to pay more each month if you can afford to.

- Forgetting the end date: Interest applies to any remaining balance once the 0% period ends, so note the expiry date and plan repayments accordingly.

Small details like payment timing and spending habits make a big difference. Treat your balance transfer card as a repayment tool rather than a new source of credit to make the most of the 0% period.

What happens after I transfer my balance?

Once your balance transfer has been approved and processed, there are a few simple steps that can help you manage your new card effectively and avoid unexpected interest or fees. These actions keep your repayment plan on track and ensure you get the full benefit of the 0% period.

- Set up a direct debit: Schedule at least the minimum payment each month to avoid late fees or losing your promotional rate.

- Pay more when you can: Making higher payments helps you clear the balance faster and reduces the risk of carrying debt once the 0% term ends.

- Avoid new spending: Treat the balance transfer card purely as a repayment tool. New purchases often attract standard interest unless a separate 0% purchase offer applies.

- Track your end date: Mark when your promotional period finishes and plan to repay or switch again before interest restarts.

- Keep your old account open (optional): Closing your previous card straight away can affect your credit utilisation. Wait until the transferred balance shows as cleared, then decide whether to close it or keep it open without using it.

Managing the new card carefully after your transfer keeps your credit profile steady and helps you stay in control of repayments. Once your balance is cleared, you can either close the account or keep it open responsibly to maintain a healthy credit utilisation ratio.

Mint tip: Always review your credit card agreement and key information before applying. If you’re struggling with debt, you can access free, impartial help from StepChange or MoneyHelper.

Make your balance transfer work for you

Planning ahead for a balance transfer puts you in control. By comparing deals early, understanding fees, and keeping track of deadlines, you can make the most of a 0% interest period and focus on reducing what you owe rather than paying extra in charges.

With Christmas approaching, everyday expenses can increase and many people reassess their borrowing in January. Planning ahead can help reduce the risk of taking on more debt than you can comfortably afford. You may find our guide on avoiding credit card debt over Christmas helpful if you want to start the new year with more control over your finances.

You can review our latest guide on the Top 10 Balance Transfer Credit Cards or use our Balance Transfer Calculator to compare potential savings and find a card that suits your goals.

Find the right Credit Card for you

No impact to your credit score

Find out which cards you’re eligible for

34.9% Representative APR (variable)

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Recommended Reading

If you want to explore more balance transfer and credit card topics, these guides may help:

Related Articles

Check your credit card eligibility in the UK

Balance transfer cards for credit builders

How much can you balance transfer?

What is a balance transfer fee?

How to do a balance transfer on a credit card

Marbles credit card review – is it a good option to consider?

The content presented here has been impartially gathered by the Mintify team and is offered on a non-advised basis for informational purposes only. We adhere to strict editorial integrity