Zilch Classic Card Review

Editor, Consumer Finance: Michelle Blackmore

Last Updated: February 7, 2026

In This Article

The Zilch Classic card is a flexible, app-based credit card that lets you either pay in full to earn rewards or split purchases into installments with no interest although some transactions may include a small upfront fee which will always be shown before you confirm payment.

There’s no annual fee for the digital card itself, and all charges or fees are displayed clearly in the Zilch app before you confirm a transaction, helping you understand the total cost before committing.

But how does the Zilch Classic card actually work? Who is it designed for, and what are the key things to watch out for before applying?

Here’s everything you need to know.

What is the Zilch card?

The Zilch Classic card is a digital card that combines elements of traditional credit and Buy Now, Pay Later (BNPL). It’s designed to give you flexibility at checkout, letting you either pay in full and earn rewards, or split the cost of eligible purchases into instalments.

You can use the card for everyday spending online or in-store through your mobile wallet, and manage everything within the Zilch app; from available balance to upcoming payments and transaction history.

How BNPL regulation is changing in the UK

Most BNPL products in the UK have operated outside full Financial Conduct Authority (FCA) regulation, meaning they haven’t had to carry out affordability checks or provide the same level of consumer protection as credit cards. This is now changing. The UK Government confirmed plans to bring BNPL agreements under FCA oversight, following a review by the Financial Conduct Authority and HM Treasury.

Once these rules take effect, BNPL providers will need to meet stricter standards, including clear pre-contract information, transparent costs, creditworthiness assessments, and access to the Financial Ombudsman Service for customer complaints. The aim is to ensure that short-term instalment products are fair, affordable, and clearly understood by consumers.

Zilch is already operating within this regulated framework. Its credit card and instalment options are provided under a fully authorised consumer credit licence, meaning your borrowing is covered by the Consumer Credit Act and supervised by the FCA. This gives you the same key protections as other regulated credit products – including clear disclosure of terms, fair treatment obligations, and recourse if something goes wrong.

How does the Zilch card work?

Once your account is approved (subject to status and affordability checks), you’ll receive a virtual Zilch Classic card that can be used online or through your mobile wallet in-store. Each time you make a purchase, you can choose between two options:

- Pay in full: You pay the entire amount upfront and earn cashback or rewards on eligible transactions (subject to Zilch’s reward scheme terms and availability).

- Pay later: You split the cost into installments. These payments are automatically scheduled and collected from your linked account. No interest is charged, but some purchases may include a small upfront fee.

This flexibility is similar to buy now, pay later, but with the added benefit of credit card protections such as Section 75 coverage and clear regulatory oversight. All repayment dates, instalment amounts, and any fees are displayed in the app before you confirm a purchase, ensuring transparency and control.

Mintip: Zilch may not charge interest, but it’s still credit and fees are still involved. Only spend what you can repay in full and on time to protect your credit score.

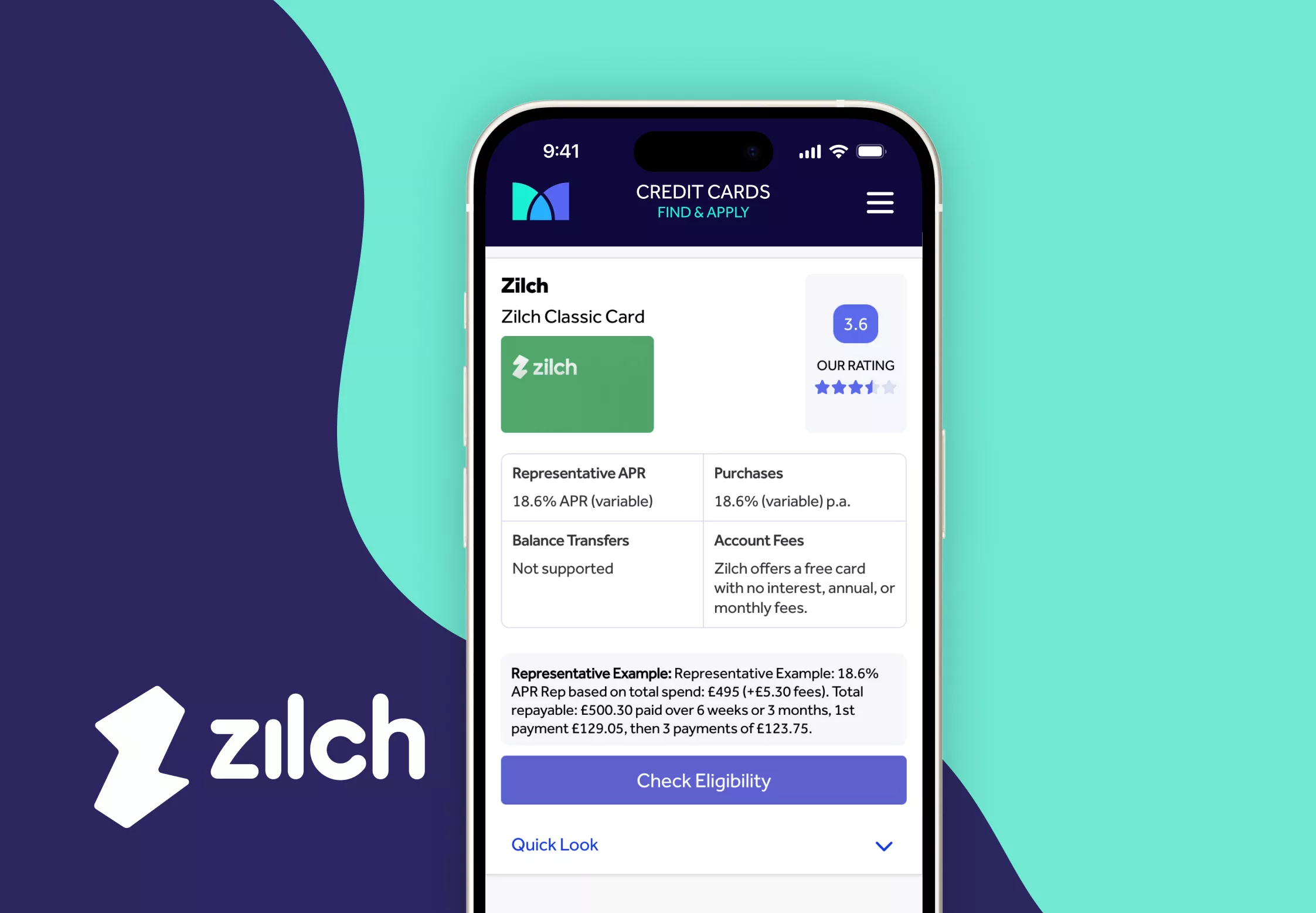

Find the right Credit Card for you

Does not impact your credit score

Find out which credit cards you’re eligible for

34.9% Representative APR (variable)

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Product Features & Benefits of the Zilch Classic card

| Account Fee | £0 |

|---|---|

| Representative APR | 18.60% |

| Purchases | 18.6% (variable) p.a. |

| Purchases Interest Free | 0 days |

| Balance Transfers | Not supported |

| Incentive on Opening | The Zilch Classic card can be used to pay in full and earn rewards, or through a Buy Now Pay Later plan where rewards don’t apply and fees may be charged. Always check your agreement carefully so you understand when and how any fees apply. |

| Cashback/Rewards (if applicable) | You can earn up to 5% in rewards when you shop online and enable your card. You can get 0.5% back in Rewards when you Tap and Pay in-store or use Zilch Anywhere. Payment must be made in full. |

| Minimum Credit Limit | £0.00 |

Repayments, fees and charges of the Zilch Classic card

Whilst Zilch does not charge interest on installment purchases, some transactions may include an upfront fee, which will always be shown clearly in the app before you confirm your purchase. The exact amount depends on the retailer and type of transaction.

There are no annual or monthly fees for holding the digital Zilch Classic card, and no foreign transaction fees when you use the card abroad. If you choose to request a physical card, a monthly fee may apply; the details are provided in the app before you order.

How do repayments work?

If you choose to “pay later,” Zilch automatically schedules your repayments and collects them from your linked bank account. You’ll see the exact repayment dates and amounts in the app before confirming your purchase.

Repayments are usually taken every two weeks, though schedules can vary by purchase. You can repay early at any time through the app without penalty. Make sure you have enough funds in your linked account to avoid missed payments, which could affect your credit record.

Does Zilch have late payment fees?

Zilch does not charge late fees or add interest on missed payments. However, if several payments are missed, Zilch may temporarily block your account. During this time, you won’t be able to make new purchases until any outstanding instalments have been repaid.

Is there interest or hidden costs?

Zilch does not charge interest on any purchases made using the buy now pay later option. However, potential fees are shown before you spend so always check the total cost carefully to make sure it’s affordable for you. There are no hidden interest charges, but missed or late payments could result in additional fees or impact your credit score.

Are repayments managed in the app?

All repayment information, including upcoming installments, due dates, and your remaining balance is displayed in the Zilch app. You can also make manual payments or clear your balance early at any time. Zilch sends reminders before payments are due to help you manage your account and avoid missing repayments.

Mintip: Always review the fee shown in the Zilch app before confirming a purchase. Some transactions include an upfront charge, so checking first helps you stay in control of costs.

Who can apply for the Zilch Classic card?

To apply for a Zilch card, you must meet the following criteria:

- Be at least 18 years old

- Not already have a Zilch card

- Not be bankrupt or have an active IVA

Zilch may consider customers with a limited or developing credit history, but approval is subject to status, credit checks and affordability assessment.

Like any regulated credit product, eligibility depends on your individual circumstances, including your credit record and affordability assessment.

Check your credit card eligibility through a soft search, which does not impact your credit score.

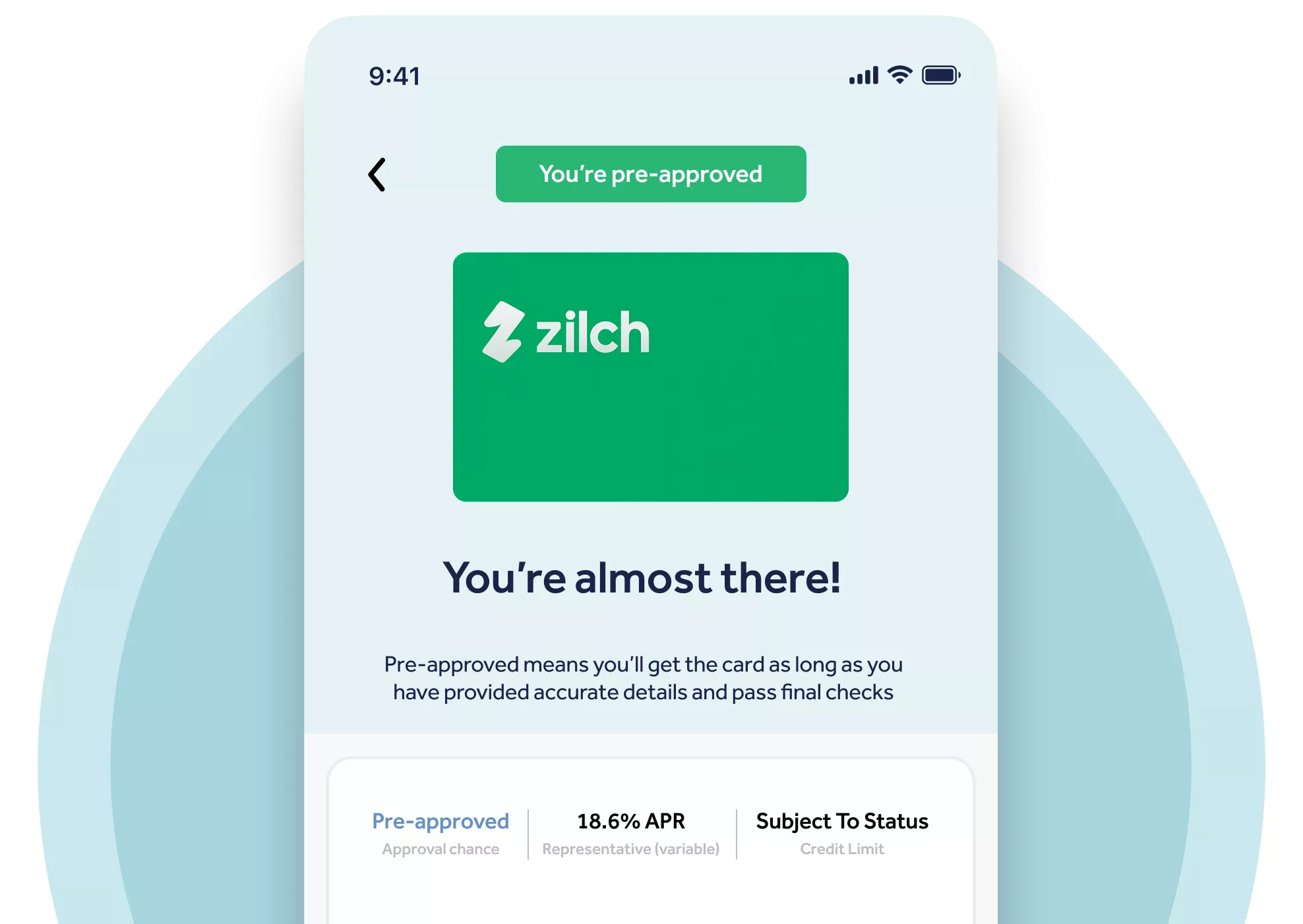

How do I apply for a Zilch card?

To see if you could be eligible for a Zilch card, start by using a credit card eligibility checker. This uses a soft search, so it won’t affect your credit score. You’ll also be able to compare results and see if other cards might better match your circumstances before deciding which to apply for.

If you choose to continue with Zilch, you’ll be taken through the lender’s own application process, which includes further checks before any approval is confirmed. This could include:

- Creating a Zilch account: providing your personal details and verifying your identity.

- Credit and affordability checks: Zilch runs the necessary checks to confirm eligibility and assess your ability to manage repayments.

- Account setup: if approved, you’ll receive a virtual Zilch Classic Credit Card, which can be added to your mobile wallet for use online or in-store.

Zilch will confirm your credit limit, repayment terms and any applicable fees before activation. You’ll also be able to view all payment schedules and rewards within the app so you can make an informed decision before spending.

Credit is provided under a regulated agreement and is subject to the lender’s terms and approval.

Is Zilch a bank?

No, Zilch is not a bank. It’s a UK financial technology company authorised and regulated by the Financial Conduct Authority (FCA) to provide consumer credit.

Unlike a bank, Zilch doesn’t hold current accounts or savings deposits. Instead, it offers regulated credit products such as the Zilch Classic card which allow customers to pay in full or spread purchases into instalments.

Zilch partners with authorised financial institutions to handle card issuing and payment processing, while the credit agreement itself is provided and managed by Zilch.

What is the maximum credit limit on the Zilch Classic card?

Credit limits on the Zilch Classic card are set individually based on Zilch’s credit and affordability checks. The amount available to you depends on factors such as your income, spending behaviour, and credit history.

Zilch does not publicly advertise a fixed maximum limit, as it may vary between customers and can change over time. Limit increases are reviewed periodically and may be offered to customers who demonstrate responsible account management, but this is never guaranteed.

Can I withdraw money from the Zilch Classic card?

No the Zilch Classic card is designed for making purchases, not for cash withdrawals. You can use it to pay online or in-store, but it cannot be used to withdraw cash from an ATM or transfer money to a bank account.

This restriction helps customers avoid additional fees or interest that often apply to cash advances with other credit cards, and ensures the card is used only for eligible spending.

Always check the card’s terms for permitted use and applicable fees before making a purchase.

Mintip: If you’re finding it hard to keep up with payments, free and confidential help is available from StepChange or MoneyHelper before taking on more credit.

Is it safe to connect my bank to Zilch?

Yes connecting your bank account to Zilch is considered secure when done through official channels, as the process uses secure, regulated technology to verify your identity and assess affordability. Zilch uses Open Banking, which is regulated by the Financial Conduct Authority (FCA) in the UK.

When you give permission, Zilch can view certain financial data (such as income and spending patterns) through your bank, but it cannot move money or make payments on your behalf. This data is encrypted and shared securely via authorised Open Banking providers.

As with any financial service, always make sure you connect through Zilch’s official website or mobile app and avoid third-party links or unofficial offers.

You can always check Zilch’s privacy policy and Open Banking provider details before granting access, so you understand exactly what information is shared and why.

Who might the Zilch Classic card suit?

The Zilch Classic card may suit people who want flexibility when paying for everyday purchases and prefer managing their account through a mobile app. It can appeal to customers who like the convenience of choosing between paying in full or spreading the cost of a purchase over time, provided they understand the repayment schedule and potential fees involved.

It may be most suitable for those who:

- Have a regular income and can comfortably manage scheduled repayments.

- Want to earn rewards when paying in full but still have the option to defer certain costs.

- Prefer an app-based experience with clear visibility of upcoming payments.

Zilch may not be suitable for customers who:

- Need the use of a 0% purchase card or make balance transfers.

- Depend on credit to meet essential living costs or are already managing multiple debts.

- Prefer a credit card with traditional interest charges.

Mintip: Understanding that Zilch combines regulated credit with Buy Now, Pay Later style instalments is important. It’s still a credit commitment and missed payments can affect your credit score and lead to additional charges.

Zilch Reviews: Customer feedback from Trustpilot

Zilch currently holds a TrustScore of 4.5 out of 5 on Trustpilot, as of the latest update. Many users praise the app’s simplicity, quick setup, and the ability to choose between paying in full or splitting purchases into installments. Several reviews also highlight responsive customer service, especially when resolving payment or account issues.

However, not all feedback is positive. Some customers mention frustration over credit limits not increasing as expected, or occasional confusion about fees and transaction updates in the app.

Overall, most reviewers describe Zilch as an easy and convenient way to manage short-term spending but individual experiences vary and depend on using the product responsibly and keeping up with repayments.

Customer review information is taken from a third-party source (Trustpilot) and may change over time. Mintify does not verify or endorse individual customer statements.

Understanding what Zilch is and what it isn’t can help manage expectations and avoid confusion about charges or repayment terms. It’s a regulated consumer credit product, not a budgeting or savings tool, so always check the fee details and repayment schedule in the app before you spend.

Find the right Credit Card for you

Does not impact your credit score

Find out which credit cards you’re eligible for

34.9% Representative APR (variable)

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Frequently asked questions about the Zilch Classic card

What is the Zilch Classic Card?

It’s a digital credit card that combines traditional credit with buy now, pay later-style flexibility. You can pay in full and earn rewards or spread eligible purchases into instalments with no interest, though some transactions may include a small upfront fee.

Is Zilch a bank?

No. Zilch is a UK-based fintech company authorised and regulated by the Financial Conduct Authority (FCA) to provide consumer credit. It is not a bank and does not hold customer deposits.

How does the Zilch Classic Card work?

When you make a purchase, you can choose to pay in full or split the cost into instalments. Repayments are collected automatically through your linked account, and all fees and payment dates are shown before you confirm the transaction.

Who can apply for the Zilch Classic Card?

You must be a UK resident aged 18 or over, have a regular income, and a valid UK bank account. Approval depends on credit and affordability checks, and acceptance is not guaranteed.

How do I apply for the Zilch Classic Card?

You can apply via the Zilch app or website by verifying your identity and completing a short credit and affordability assessment. If approved, you’ll receive a virtual card that can be added to your mobile wallet.

What is the maximum credit limit on Zilch?

Credit limits vary based on your individual circumstances. Zilch sets your limit following affordability and credit checks, and it may adjust over time depending on your usage and payment history.

Can I withdraw cash from my Zilch Classic Card?

No. The card is designed for purchases only and cannot be used for cash withdrawals or balance transfers.

Is it safe to connect my bank to Zilch?

Yes. Zilch uses secure, FCA-regulated Open Banking technology to verify income and assess affordability. It cannot move money from your account; It can only view relevant financial data you consent to share.

Does using Zilch affect my credit score?

Zilch reports activity to credit reference agencies. Making payments on time can help demonstrate responsible use, but missed payments may negatively affect your credit score.

Does Zilch charge interest or fees?

Zilch does not charge interest on installment payments, but some transactions include an upfront fee. Any applicable charges are displayed clearly before you confirm a purchase.

Is Zilch legit?

Yes. Zilch is authorised and regulated by the FCA under firm reference number 923137. It must meet strict standards for transparency and customer protection.

What protections do I have when using Zilch?

Eligible purchases made with the Zilch Classic Credit Card may be covered by Section 75 of the Consumer Credit Act, giving you additional protection if something goes wrong with a transaction.

Can I increase my Zilch credit limit?

Zilch may review your credit limit over time based on responsible usage and payment history, but increases are not guaranteed.

How do repayments work?

If you choose to pay later, your instalments are automatically collected from your linked bank account on pre-agreed dates shown in the app. You can also pay off balances early at any time.

What happens if I miss a payment?

Missing a payment could result in additional charges and may affect your credit score. It’s important to keep track of repayment dates and ensure funds are available before each collection.

Related Articles

Check your credit card eligibility in the UK

Balance transfer cards for credit builders

How much can you balance transfer?

What is a balance transfer fee?

How to do a balance transfer on a credit card

Marbles credit card review – is it a good option to consider?

The content presented here has been impartially gathered by the Mintify team and is offered on a non-advised basis for informational purposes only. We adhere to strict editorial integrity

Find the right Credit Card for you

Does not impact your credit score

Find out which credit cards you’re eligible for

34.9% Representative APR (variable)

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.