Best Car Loans and Finance Deals in the UK: Your 2025 Guide

Editor, Consumer Finance: Michelle Blackmore

Last Updated: February 6, 2026

In This Article

Finding the right way to fund a car can feel confusing, especially when interest rates, deposits, and eligibility rules vary widely between lenders. This guide explains how personal car loans and broker-arranged car finance work, how to compare deals fairly, and what to consider before making a decision. The aim is to help you understand your options clearly and make an informed choice based on your budget, needs, and individual circumstances. Affordability checks apply to all regulated credit products, and the options available to you will depend on your credit profile, income and outgoings.

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Compare car loans and finance options in the UK

Below is a comparison of selected car loan and finance providers, based on our independent scoring criteria. These providers have verified customer reviews on third-party platforms such as Trustpilot. We’ve highlighted key product features including representative APRs, loan amounts, and repayment terms to help you assess suitability. Where available, you can carry out a soft search eligibility check, which shows your likelihood of approval without affecting your credit score.

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender. Examples are for illustration purposes only. The rate and term you are offered are subject to status and affordability and are dependent on your individual circumstances. Find out how this calculator works or how this site works.

Loan Amount

Total Payable

Monthly Repayment

Representative APR

Representative example will update based on your input.

Loan Amount

Total Payable

Monthly Repayment

Representative APR

Representative example will update based on your input.

What is a car loan and how does car finance work?

A car loan is usually an unsecured personal loan that provides a fixed lump sum to purchase a vehicle outright. Once the funds are paid to you, you become the legal owner of the car immediately and repay the loan in set monthly instalments over an agreed term. Rates and amounts vary by lender and depend on factors such as your credit history, income, and overall affordability.

Car finance works differently. Options such as hire purchase (HP), personal contract purchase (PCP), and conditional sale link the finance agreement to the vehicle itself. You typically pay an initial deposit, followed by monthly payments over the term. With HP, you become the owner once the final payment is made. With PCP, a large optional final payment (often called a balloon payment) is required if you want to own the car at the end; otherwise, you can return or part-exchange it. Conditional sale agreements work similarly to HP but transfer ownership automatically at the end of the term.

Both personal loans and structured car finance agreements involve credit checks, affordability assessments, and terms that vary by lender or broker. Understanding how each option works can help you decide which structure best suits your budget and how you plan to use the vehicle.

Mintip: Be aware of balloon payments. If you’re considering PCP, the final balloon payment can be several thousand pounds. You won’t own the car unless you make this payment, so it’s important to check whether this cost fits into your future budget.

How to find a low-cost car loan or finance deal

The cost of a car loan or car finance agreement depends on more than the advertised APR. Lenders assess your credit history, income, and outgoings to set the rate they offer you, and the structure of the agreement can also affect the total amount repayable. Focusing on the full cost of borrowing, not just the monthly payment, helps you compare offers more accurately.

- The representative APR gives an indication of typical pricing, but your actual rate may differ based on your circumstances.

- Some lenders charge additional fees, such as arrangement or early settlement fees, which can affect the overall cost.

- Deposits can reduce the amount you need to borrow, but this may not always result in a lower total cost.

- Longer terms can reduce monthly payments but often increase the total amount repayable.

- Comparing multiple lenders or brokers can help you understand the range of rates and terms you may qualify for.

- Soft search tools let you check your eligibility without affecting your credit score.

Taking time to review the full terms of each offer, including total repayable amounts and any conditions attached to the finance, can help you identify the most affordable and

What makes a car loan or finance deal best for you?

The right option depends on how you plan to use the car, your monthly budget, and whether owning the vehicle outright is important to you. Each product has its own structure, and understanding these differences can help you decide which approach fits your circumstances.

- If you want immediate ownership and flexibility to buy from any seller, a personal car loan may be more suitable.

- If lower monthly payments are a priority, a structured finance product such as PCP may offer a more manageable cost, though the total amount repayable can be higher.

- If you prefer a clear path to ownership without a large final payment, hire purchase may be more straightforward.

- If you regularly change your car, agreements that allow part-exchange at the end of the term can provide more flexibility.

- Your credit profile, deposit amount, and the age or value of the car can influence which types of products you may be eligible for.

Ultimately, the best deal is one that fits comfortably within your budget, aligns with your plans for the vehicle, and is offered on terms you fully understand and can afford throughout the agreement.

Mintip: A car loan covers the finance, but owning a car comes with ongoing costs too. Insurance, servicing, tyres, MOTs, fuel and unexpected repairs can add up. Building these into your budget helps you get a clearer view of what you can comfortably afford over the full term of the agreement.

Should you use a personal loan or car finance?

Choosing between a personal car loan and a car finance agreement depends on how you prefer to pay for the vehicle and how much flexibility you want over the term. Both options can be suitable when used responsibly, but they work in different ways and come with different commitments.

A personal loan provides the full amount upfront, and you own the car immediately. This gives you freedom to buy from any seller, including private sellers, and there are no mileage or vehicle condition rules. Monthly payments are fixed, and there is no optional final payment.

Car finance products such as hire purchase and PCP link the agreement to the vehicle. Monthly payments can be lower, particularly with PCP, but you usually need a deposit and ownership is only transferred once the contract ends. Mileage limits, condition requirements, and balloon payments can also apply.

The right choice depends on your budget, how long you plan to keep the car, and whether you prefer immediate ownership or lower monthly costs with more structure. Reviewing both types of products and checking your eligibility through soft searches can help you understand which option aligns better with your circumstances.

How to check your eligibility

Most lenders and brokers offer soft search tools that let you see your likelihood of approval before making a full application. A soft search does not affect your credit score and can help you compare real rates and terms based on your circumstances.

- Soft searches show which lenders are more likely to approve you without leaving a hard credit footprint.

- They help you compare personalised offers rather than relying on headline APRs.

- You can review loan amounts, monthly repayments, and potential terms before deciding whether to proceed.

- Using soft searches reduces the risk of unnecessary applications and protects your credit profile.

If you decide to continue with an application, the lender or broker will carry out a full credit check and review your income and outgoings to assess affordability.

Documents you may need

Whether you apply for a personal car loan or a structured finance agreement, lenders will usually ask for documents that confirm your identity, address, income, and overall affordability. Having these ready can help prevent delays and make the application process smoother.

- Proof of identity such as a valid passport or UK driving licence.

- Proof of address, typically a recent utility bill, council tax letter, or bank statement dated within the last three months.

- Proof of income, including payslips, bank statements, or tax returns if you are self‑employed.

- Employment details such as your job title, employer name, and length of employment.

- Vehicle details if the finance is linked to the car being purchased, including make, model, mileage, and registration.

Some lenders may use Open Banking (with your consent) to review your income and spending patterns more accurately. You will usually see exactly what is required once you complete an eligibility check and move to the full application stage.

Mintip: Always check your eligibility before applying. It helps you see which lenders are more likely to approve you without damaging your credit score. This reduces the risk of rejection and protects your credit profile while you compare real offers.

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

How much can I borrow for a car loan?

The amount you can borrow for a car loan or finance agreement depends on your credit history, income, regular expenses, and the lender’s own criteria. Most lenders offer car loans starting from around £1,000, with higher limits available for applicants who meet stronger affordability and credit requirements.

- Lenders assess your income and existing commitments to determine what you can reasonably afford to repay each month.

- Your credit history helps lenders understand how reliably you have managed borrowing in the past.

- Loan amounts may be higher if the finance is secured against the vehicle, as with hire purchase or conditional sale agreements.

- The age, mileage, and value of the car can also influence the maximum amount offered for some types of finance.

If you are unsure how much you may qualify for, completing a a soft search eligibility check can give you an indication without affecting your credit score.

Estimate repayments with a car loan calculator

A personal loan calculator can help you understand what your monthly repayments might look like based on the amount you want to borrow, the interest rate, and the length of the term. It is a useful way to check whether the repayments fit comfortably within your budget before you apply.

- Calculators give an estimate only and do not reflect the exact rate a lender may offer you.

- Your actual interest rate will depend on your credit profile, income, and the lender’s assessment of affordability.

- Using a calculator can help you compare different term lengths and see how they change the total amount payable.

- It can also highlight how even small changes in APR or loan amount can affect your monthly cost.

You can use a personal loan calculator to try different scenarios and better understand the potential repayments before completing an eligibility check.

Mintip: If you want help understanding the costs, terms or risks of borrowing, you can get free and impartial support from organisations such as MoneyHelper and StepChange. They can guide you through your options so you can make a decision that feels right for your situation.

Frequently asked questions about car loans and car finance

Can I get car finance with bad credit?

Yes, but you may face higher interest rates or stricter terms. Checking eligibility first is recommended.

Is it better to use a personal loan or dealer finance?

It depends on the rates offered. A personal loan gives you ownership from day one, while dealer finance may offer lower upfront costs.

Do I need a deposit for car finance?

Not always. Some lenders offer no deposit options, though these can lead to higher monthly payments.

How do I apply for a car loan?

Start with an eligibility check to see which lenders may approve you. Once you see your options, you can compare interest rates, loan terms, and fees. If you’re happy with an offer, you can proceed to a full application with the lender.

What credit score is needed for car finance?

There is no single score requirement. Lenders assess your entire financial situation, not just your number.

Are there fees with car loans or car finance?

Some lenders charge arrangement fees, early repayment fees, or late payment penalties. Not all do, so it’s important to check the terms before applying. The total cost of borrowing includes interest plus any additional charges, which should be clearly disclosed by the lender.

Finding the right car loan or finance deal

There is no single best way to fund a car, and the right choice depends on your budget, how you plan to use the vehicle, and whether you prefer ownership from day one or lower monthly payments with more structure. Comparing multiple lenders, reviewing the total amount repayable, and checking your eligibility through soft searches can help you make a clear and informed decision. Taking the time to understand the terms of any offer, including fees or final payments, will help you choose an option that fits comfortably within your finances both now and over the full term of the agreement.

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Related Articles

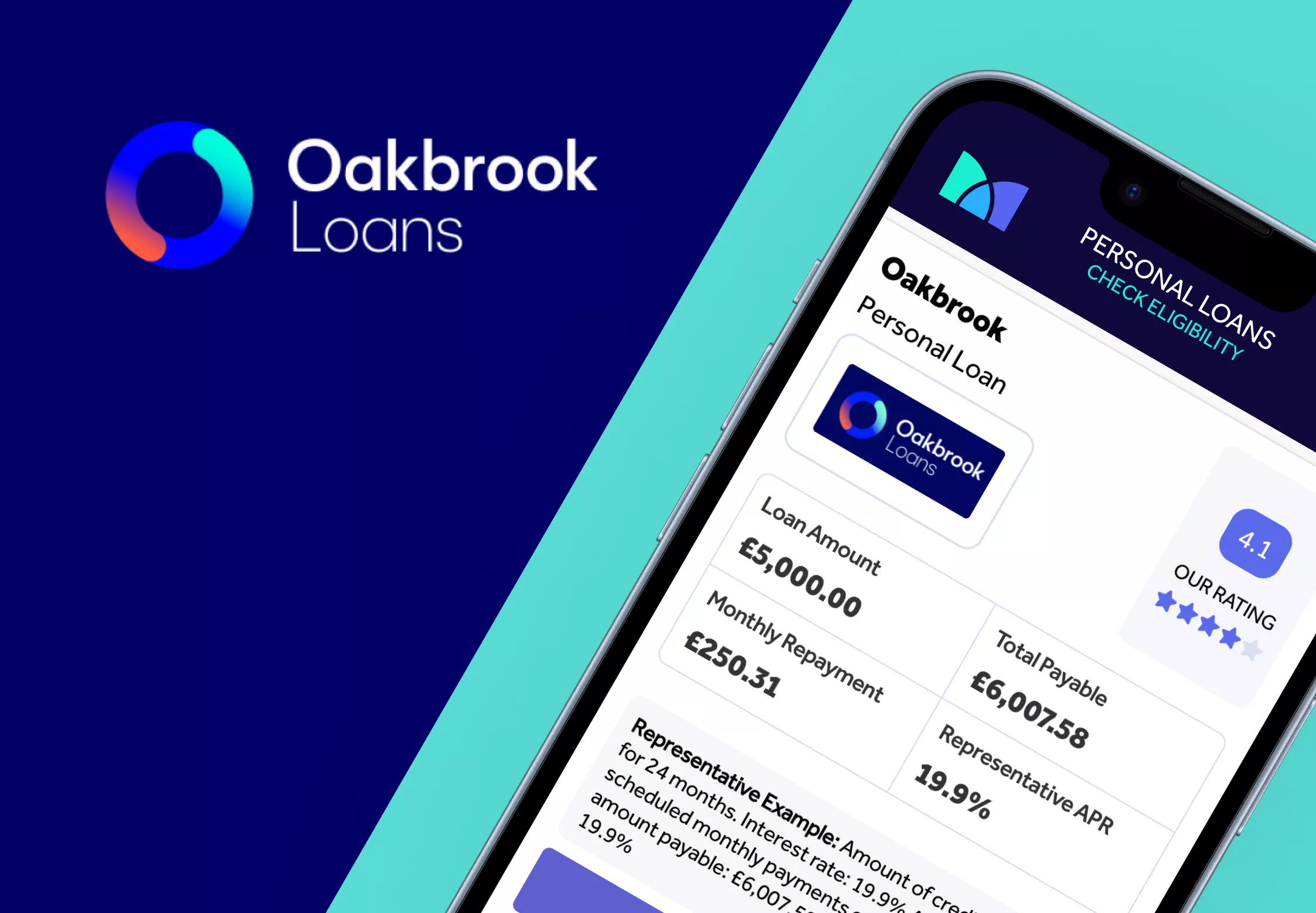

Oakbrook Loans Review

Lendable Loans Review

How to Apply for a Car Loan in the UK

My Community Finance

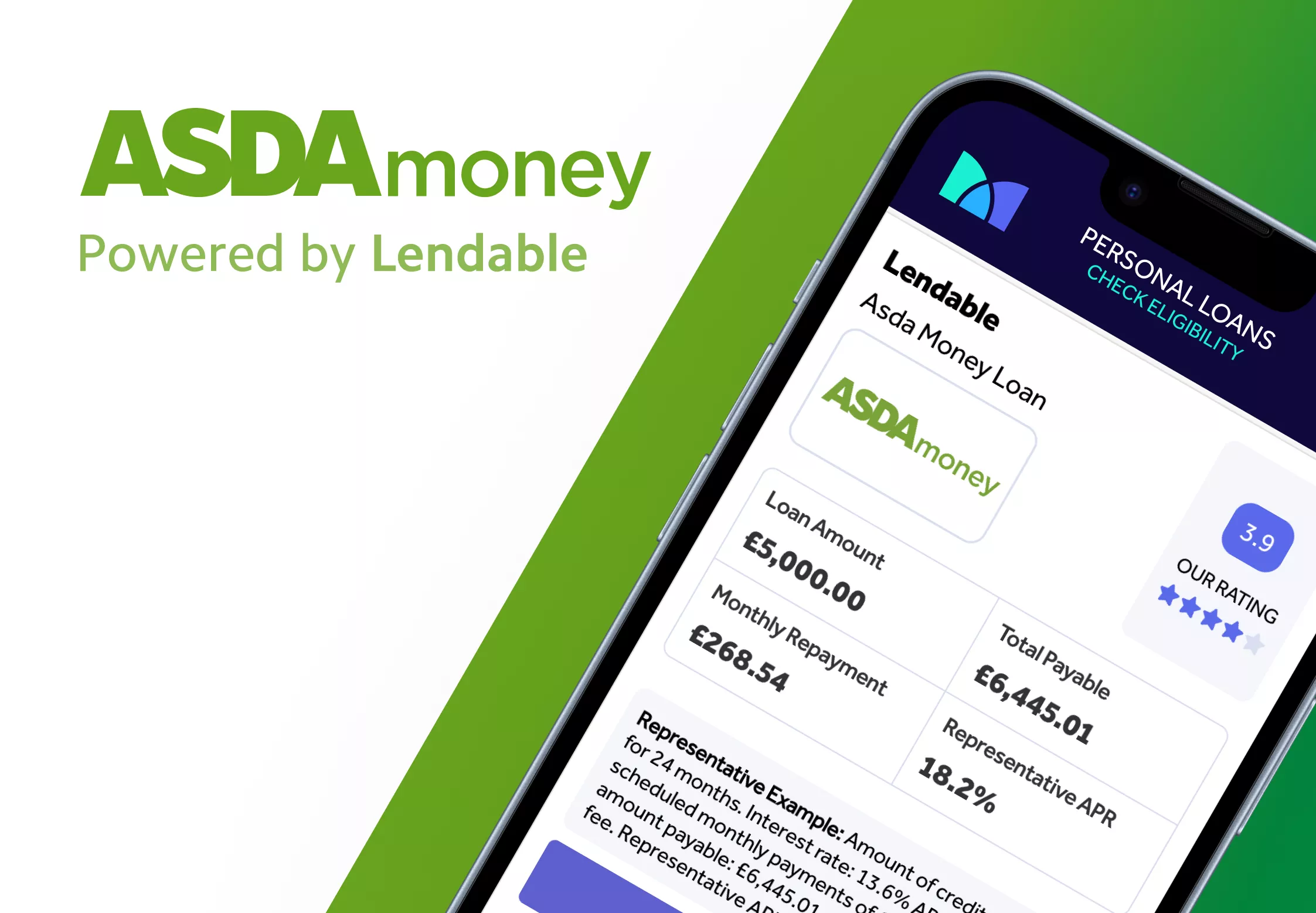

Asda Loans Review

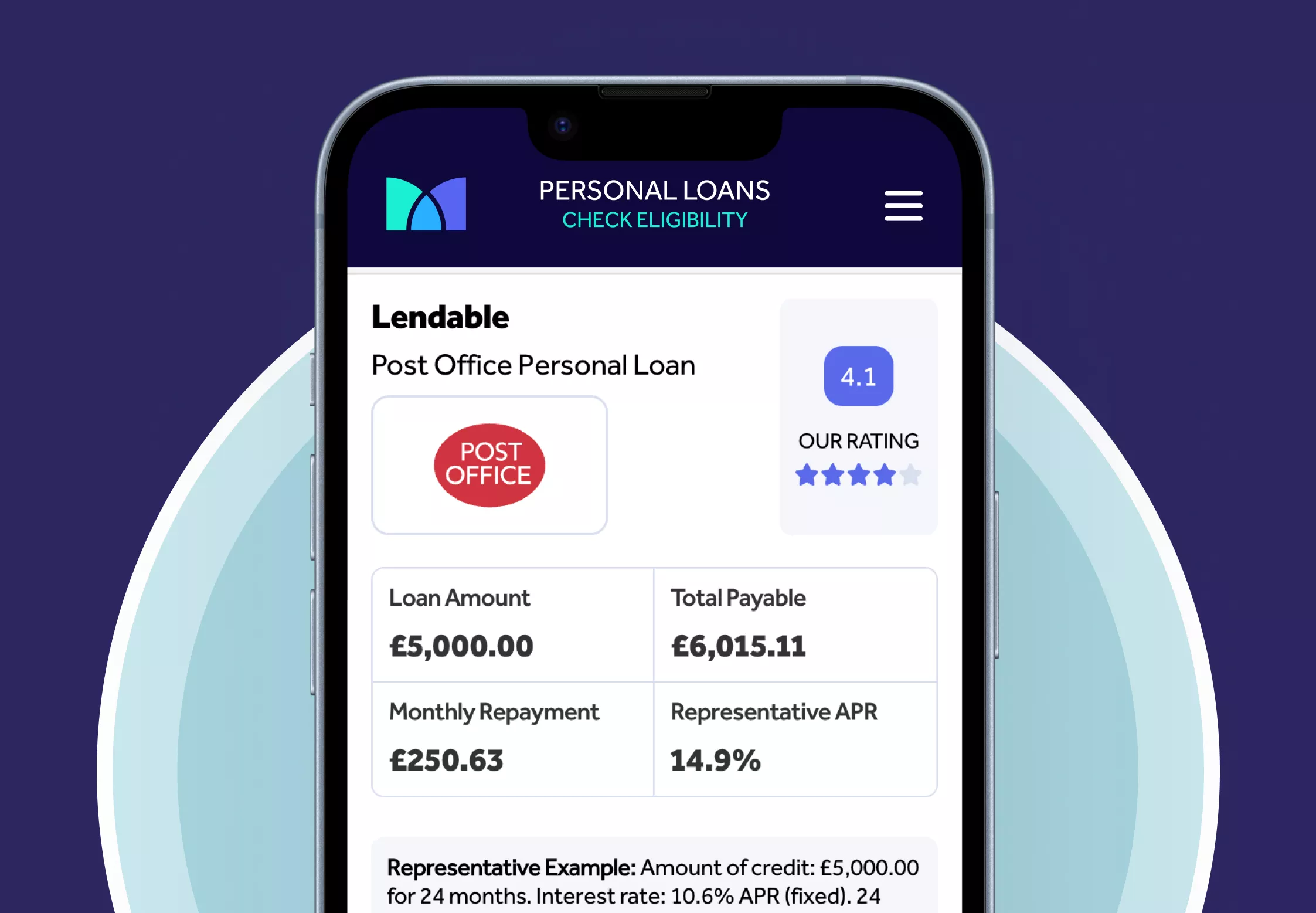

Post Office Loans Review

The content presented here has been impartially gathered by the Mintify team and is offered on a non-advised basis for informational purposes only. We adhere to strict editorial integrity. Mintify is an Introducer Appointed Representative of Creditec Limited. We provide editorial reviews of the whole market, but we only provide links to apply for products available through Creditec’s panel of lenders. We may earn a commission if you click these links. This does not affect our editorial independence, but it limits the products you can apply for directly on this site.

Editor, Credit Cards: Michelle Blackmore

Last Updated: February 6, 2026

How this calculator works

This tool provides an illustrative example of the costs of a personal loan based on the loan amount and term selected by the user. It is designed to reflect, as closely as possible, the actual calculation methods used by the lender.

What we show

For each loan product:

- We calculate monthly repayments, total amount repayable, and the representative APR.

- These calculations are based on publicly available product data and are representative, not personalised.

- We display the representative example required under FCA rules, which includes loan amount, duration, total repayable, interest rate, and representative APR.

How we calculate

The calculator uses the method aligned with how the lender presents its product:

- For lenders that use flat interest rates, we calculate using simple interest across the term.

- For those that use amortised or reducing balance interest, we apply appropriate formulas to reflect declining capital balances.

- Some lenders charge interest on a daily or monthly basis; we replicate those structures where applicable.

- If there are any fees (e.g. arrangement or completion fees), we incorporate these into the total amount repayable if the lender discloses them.

- We aim to reproduce the effective cost of credit as the lender would disclose it, using their advertised or representative data.

Important disclaimer

This calculator does not provide a personalised quote or credit offer. The figures shown are for illustrative purposes only and may differ from the rate or repayment terms you are offered. The actual cost of credit will depend on your personal circumstances and creditworthiness, and will be provided by the lender during the application process.

We regularly update our product data to ensure accuracy, but cannot guarantee that all lender changes are reflected in real time.