Monthly instalment loans – no credit check – what’s possible in the UK?

Editor, Personal Loans: Michelle Blackmore

Last Updated: February 5, 2026

In This Article

If you are searching for a monthly instalment loan, you are not alone. Many people in the UK look for ways to borrow money without affecting their credit score or facing rejection. This guide explains how monthly instalment loans work, whether no credit check loans exist, and how to check your eligibility safely without harming your credit file.

What is a monthly instalment loan?

A monthly instalment loan is a type of personal loan that is usually repaid in fixed monthly payments over a set period. The total amount you borrow, the interest rate, and the term of the loan all determine what your monthly payment will be. Repayment terms usually range from a year to ten years but some loans can go up to 25 years and beyond, depending on the applicant and the agreement. Instalment loans are typically unsecured loans, meaning they do not require a guarantor or collateral. Borrowers often take out amounts from £1,000 to £10,000, with £5,000 being one of the most common. If you’re comparing offers to find, for example, the cheapest £5,000 loan, make sure to look at interest rates, total repayment costs and any fees charged by the lender.

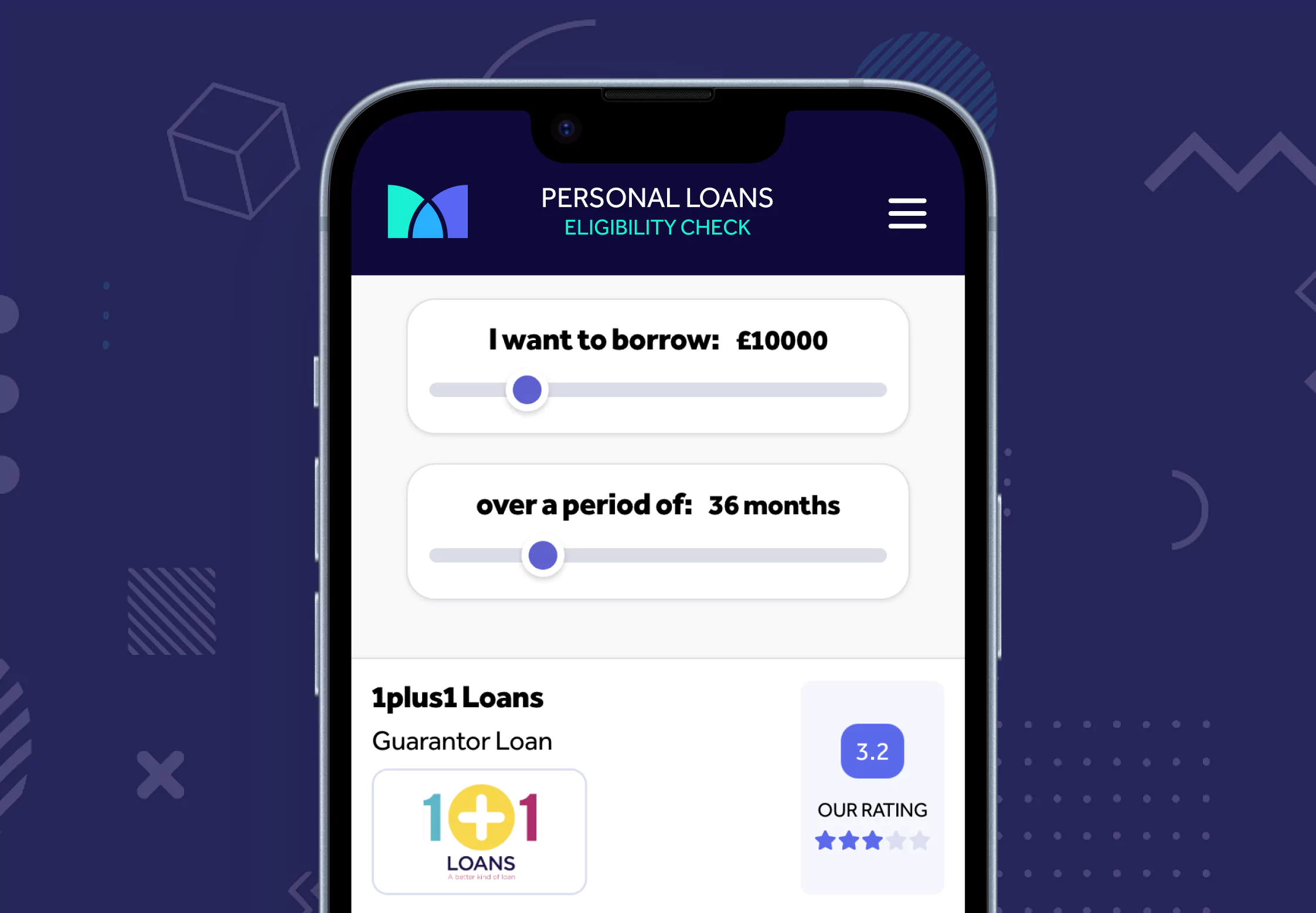

Get Personalised Loan Rates

Find lenders that can approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Why people search for “no credit check” loans

People often search for “no credit check” loans because they are worried about being rejected. This can be due to missed payments, past defaults, or simply not having much of a credit history. Some people may be new to the UK and have no credit profile at all. Others may have been declined before and want to avoid another rejection, which could lower their credit score. Unfortunately, some websites advertise no credit check loans without explaining that these are not available from FCA-authorised lenders in the UK.

Can you get a no credit check loan in the UK?

In the UK, all FCA-regulated lenders must run a credit check before approving a personal loan. This means there are no true no credit check loans available from authorised providers. Some lenders advertise loans without a credit check, but these are usually either unregulated or based overseas, and they may carry very high interest rates or hidden fees. What you can do, however, is complete a soft search. This lets you see your eligibility and which loans you could be eligible for without leaving a mark on your credit file.

What is a soft search and why does it matter?

A soft search is a way for a lender to review your credit profile without leaving a mark that other lenders can see. It gives both you and the lender a clearer view of your eligibility before you apply. If you decide to go ahead, the lender will carry out a full (hard) credit check as part of the approval process. Using an eligibility checker, also known as a loan approval checker, helps protect your credit score and reduces the chance of being declined unnecessarily.

Who offers soft search loans with monthly repayments?

Many UK lenders and brokers now offer soft search tools that let you check your eligibility for unsecured loans without affecting your credit score. These tools show which loan offers you’re likely to be approved for based on your credit profile, income and borrowing history.

Some lenders may show you as pre-approved, which means you’re highly likely to be accepted if you go ahead and apply. Whether you’re looking to borrow £1,000, £5,000 or more, using a soft search can help you find the cheapest £5,000 loan or any other loan amount available to you based on your circumstances.

What do lenders look at if they do not run a hard credit check upfront?

Even when a soft search is used, lenders still assess your financial situation. This includes your income, employment status, regular expenses, and any existing credit commitments. Some may also ask to view your bank statements or use Open Banking to better understand your affordability. The goal is to ensure you can afford the repayments without placing you at financial risk.

Are monthly instalment loans available for bad credit borrowers?

Yes, but you may be offered a higher interest rate or a shorter term. Several lenders specialise in helping people with bad credit, missed payments, or defaults. Using a soft search helps avoid unnecessary rejections and can give you a more realistic idea of your options. Make sure you focus on the total cost, not just the monthly amount, when comparing loan offers.

You can use the loan approval checker to see which lenders will offer loans for bad credit.

Get Personalised Loan Rates

Find lenders that can approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

How to compare instalment loans

Not all loans are equal. Some lenders may charge arrangement fees or early repayment charges. Others might advertise low monthly payments but stretch the term out, leading to a higher total cost. If you are comparing options and hoping to find the cheapest loan, make sure you look at the total repayment figure and not just the headline APR. Also check for hidden costs or penalties in the terms and conditions.

Alternatives if you are struggling to get approved

- Credit builder credit cards

- Community lenders or credit unions

- Guarantor loans

- Secured loans if you own a car or property

Always make sure the lender is FCA authorised and that you understand the full terms before proceeding.

How to check your eligibility without damaging your credit

Most reputable lenders and comparison services offer soft search tools. These let you check which loans you may be eligible for with one or more lenders in a matter of minutes. You will not see a drop in your credit score, and you can compare loans based on your financial profile. This is a helpful way to reduce the risk of rejection and view competitive loan options tailored to your circumstances.

Keep in mind that these comparisons do not guarantee a loan approval and you must go through the full application process to receive a formal loan offer.

Mintip: Checking your eligibility with a soft search helps you compare multiple lenders without risk. You see your chances before applying, avoid unnecessary rejections, and stay in control of your credit file.

Get Personalised Loan Rates

Find lenders that can approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Frequently asked questions about monthly instalment loans and credit checks

Can I get a loan without any credit check?

All FCA authorised lenders are required to assess creditworthiness, which typically includes at least a soft credit check at the eligibility stage of the application process. While some lenders advertise “no credit check” loans, this usually means there’s no hard credit check during the initial eligibility check. However, a full credit assessment is still required before approval. Be cautious of any lender claiming to offer loans with no checks at all, as they may not be regulated.

Do soft searches affect my credit score?

No. They are not visible to other lenders and do not harm your credit score.

What credit score do I need to get approved?

There is no fixed score. Lenders assess your overall financial situation, including income and affordability.

How quickly can I get a loan?

Some lenders can approve and pay out funds on the same day, especially if you meet their soft search and affordability criteria. Taking a free eligibility check can show you which loans you may be eligible for, helping to speed up the process. However, it’s important to remember that taking on a loan should never be a rushed decision.

Are there monthly instalment loans for bad credit?

Installment loans are an increasingly common option for individuals with bad credit, offering a way to manage one-off or urgent expenses. They can be used for a range of needs, including car repairs, medical treatments, or dental costs.

However, as with any form of borrowing, it’s important to consider whether taking on new credit is affordable for you in the long term. Missing repayments can negatively impact your credit score and make future borrowing more difficult.

What to remember before applying for a loan

There is no such thing as a guaranteed or no credit check loan in the UK if you are borrowing from a regulated lender. The safest way to borrow is to check your eligibility using a soft search, compare loan offers based on total cost, and avoid any lender that promises approval without questions. If you want to spread the cost with fixed monthly payments and protect your credit score, start by taking a free personal loan eligibility checkto compare loans you could be eligible for.

Related Articles

Check your credit card eligibility in the UK

Balance transfer cards for credit builders

How much can you balance transfer?

The content presented here has been impartially gathered by the Mintify team and is offered on a non-advised basis for informational purposes only. We adhere to strict editorial integrity

Editor, Credit Cards: Michelle Blackmore

Last Updated: February 5, 2026