Who Is Eligible for a Personal Loan in the UK?

Editor, Consumer Finance: Michelle Blackmore

Last Updated: February 12, 2026

In This Article

Quick Answer: To qualify for a personal loan in the UK, you’ll usually need to be aged 18 or over, live in the UK, have a regular income, and pass basic credit and affordability checks. Lenders may also review your credit history and existing borrowing before approving you.

Are you thinking about applying for a personal loan?

Most UK lenders follow clear eligibility rules, but the details behind them matter. It’s not only about age or income; lenders also assess affordability and overall financial stability to decide whether a loan is suitable for you.

However, eligibility isn’t just about ticking boxes on paper. Lenders will assess how affordable the loan is for you and how much of a credit risk you may represent based on your financial history.

This guide explains in plain English what lenders look for, how eligibility is assessed, and what you can do to improve your chances of approval before applying.

Personal loan eligibility criteria UK: the basics

Most UK lenders set similar baseline criteria for personal loans. These checks help ensure you can afford repayments and that lending is responsible under Financial Conduct Authority (FCA) rules.

- Age: You’ll need to be at least 18 years old and in some cases, even 21. Some lenders also set an upper age limit, often between 70 and 75, by the end of the loan term.

- Residency: You must live permanently in the UK and have a valid UK address and bank account in your name.

- Income: Lenders expect a regular income, whether from employment, self-employment, pension, or certain benefits.

- Credit history: Your credit report is checked to see how you’ve managed previous borrowing and whether any missed payments or defaults appear.

- Affordability: Each lender assesses whether the loan fits comfortably within your disposable income after regular outgoings.

What lenders check before approving a loan

When you apply for a personal loan, lenders assess more than just your credit score. Their goal is to confirm that the loan is affordable and suitable for your financial situation under FCA rules. Each lender’s assessment may vary slightly, but most focus on similar key areas.

- Credit score and history: Your credit report shows how you’ve managed borrowing in the past, including any missed payments, defaults or County Court Judgments (CCJs). A strong record can increase approval chances, while recent issues may limit the amount or rate offered.

- Employment and stability: Lenders check that you have a steady income source and that your employment or self-employment history is consistent.

- Debt-to-income ratio: This compares your monthly repayments against your income. A lower ratio indicates that you have room in your budget for another loan.

- Existing borrowing: If you already hold several active credit accounts, lenders may view this as greater exposure to credit and a potential affordability risk.

- Bank account and ID verification: Proof of address and identity are required to meet anti-money-laundering and fraud-prevention checks before funds are released.

Each of these checks helps lenders decide whether the loan is affordable and sustainable for you. A strong overall profile across income, stability and credit management usually results in better interest rate offers.

Some lenders might even use terms like “loans for bad credit”, but this doesn’t mean affordability is ignored. It usually means that if you pass their checks despite a lower credit score or previous declines, you’ll still be considered; often at a higher APR to reflect the added risk.

Mintip: Before applying anywhere, use a soft-search eligibility checker. It shows your likelihood of approval without affecting your credit score and helps you compare realistic loan options safely.

LOAN APPROVAL CHECKER

See your chances of getting a loan approved

Applying for loans isn’t always straightforward, and rejections are frustrating. We give you access to a lender panel that runs a personalised pre-approval check, showing the loans you’re more likely to be accepted for. Pre-approval does not guarantee acceptance and is subject to further lender checks.

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender. UK residents only. Terms of Use apply.

Minimum income and employment requirements

There’s no fixed income threshold that applies to all lenders. Each provider sets its own criteria depending on the loan amount, term and target customer profile. The key factor is consistency; lenders want to see a stable and verifiable income stream that supports regular repayments.

- Typical income levels: Many mainstream lenders consider annual incomes of around £12,000 to £15,000 or higher, though some lenders may accept less if affordability checks are passed.

- Employment status: Full-time, part-time and self-employed applicants may qualify if they can show a reliable income. If you’re self-employed, expect to provide several months of bank statements or recent tax returns.

- Benefits and pensions: Some lenders accept income from government benefits or pensions, provided it is regular and paid into your own account.

- Affordability over absolute income: Lenders place more emphasis on how much of your income remains after essential expenses than on the total amount you earn.

For example, if you earn £2,000 per month and already repay £700 on existing credit commitments, the lender will assess whether an additional loan appears affordable within your disposable income.

Does your credit score affects eligibility?

Your credit score is one of the main indicators lenders use when assessing a personal loan application. It reflects how you’ve managed borrowing in the past and helps lenders estimate the level of risk in offering you credit. However, a high score is not the only way to be approved, and a lower score does not automatically mean rejection.

- Good credit history: Applicants with a strong record of on-time payments and low credit utilisation are generally offered lower interest rates and higher borrowing limits.

- Fair or low scores: Many lenders, particularly near-prime or specialist providers, consider applicants with lower scores if affordability checks are passed. The trade-off is usually a higher APR to offset the additional risk.

- Recent applications: Submitting multiple full applications in a short time can reduce your score temporarily, as each hard credit check is recorded on your file.

- Credit file accuracy: Mistakes such as incorrect addresses, outdated accounts or duplicated debts can affect your score. It’s worth reviewing your report before applying.

You can check your credit file for free with the UK’s main credit reference agencies such as Experian, Equifax and TransUnion. If you find any inaccuracies, raise a dispute directly with the agency to have them corrected before you apply for new credit.

How to check your eligibility safely

Checking your personal loan eligibility before you apply helps you understand which lenders are most likely to approve you and what rates you could be offered. The safest way to do this is by using a soft-search tool, which gives you an indicative result without affecting your credit score.

- Use a soft-search eligibility checker: These tools run a ‘soft’ credit search, which is only visible to you. It shows your likelihood of approval based on information from one or more credit reference agencies.

- Compare representative APRs: Review the typical rates lenders advertise. Your own offer may differ depending on your credit profile, income and borrowing history.

- Read the loan terms carefully: Check the total cost, repayment schedule and any early repayment conditions before accepting an offer.

- Avoid multiple full applications: Submitting several hard credit applications in a short time can temporarily reduce your score and make future approvals harder.

If you use an eligibility checker, your results will show lenders that match your profile and perform soft searches only. This allows you to explore options safely before deciding whether to proceed with a full application.

Get Personalised Loan Rates

Find lenders that can approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

What if you don’t meet the criteria?

If you’re declined for a personal loan or find that you don’t meet a lender’s requirements, it doesn’t necessarily mean you can’t borrow in the future. Each lender has its own assessment process, and being turned down by one doesn’t automatically mean rejection elsewhere.

- Consider a smaller amount: Borrowing less can improve your affordability ratio and make approval more likely.

- Check near-prime or specialist lenders: Some providers focus on borrowers with limited or less-than-perfect credit histories. They still run full affordability checks, but may be more flexible on past credit issues. Interest rates are often higher to reflect the additional risk.

- Work on improving your credit profile: Making existing repayments on time, lowering credit utilisation and checking your report for errors can all help strengthen future applications.

- Explore community or credit-union loans: These can be alternatives if you have difficulty accessing mainstream lending.

- Seek free financial guidance: Independent services like MoneyHelper or StepChange can provide confidential advice if you’re struggling with repayments or managing debt.

If you’ve recently moved to the UK or don’t yet have a long credit history, see our guide on getting a loan as a foreigner in the UK for more details on how lenders assess non-UK residents.

Borrow responsibly before you apply

Before taking out a personal loan, it’s worth asking yourself whether borrowing is the right choice for your situation. A loan can be useful for consolidating debt, managing a large planned purchase, or covering essential costs but it should fit comfortably within your budget and not add further financial pressure.

- Review your reasons for borrowing: If you’re using credit to cover everyday spending or other debts, it may be better to pause and review your budget before applying for new credit.

- Focus on saving where possible: Building a small emergency fund can reduce the need to borrow later and make repayments more manageable if your circumstances change.

- Use free budgeting tools: Apps and online calculators can help you track spending, set limits and identify areas to cut back before taking on new credit.

Responsible lending means borrowing only what you can afford to repay and understanding how it fits into your overall financial goals. Taking time to review your situation before applying can help you avoid unnecessary costs and protect your credit score in the long term.

Mintip: Forget spreadsheets or manual tracking. Mintify is an intelligent budgeting app and financial control centre for your money. It helps you budget, track spending, set achievable goals, and plan your financial future, all in one place. Get early access and we’ll let you know as soon as it launches.

Key takeaways

- Eligibility isn’t the same as approval: Meeting basic requirements such as age, income and UK residency gets you through the first stage, but lenders still assess your credit history and overall affordability.

- Affordability carries more weight than you think: A stable income and realistic repayment plan can outweigh a less-than-perfect credit score when lenders make decisions.

- Soft checks are your friend: Use eligibility tools to see your chances before applying. It protects your credit score and helps you compare real-world options safely.

- Rejection is feedback, not failure: If you’re declined, take it as a signal to review spending, reduce existing debt or improve your credit profile before reapplying.

- Borrowing should fit your bigger picture: A loan can help with planned goals, but if it’s to plug a budget gap, pause and look at ways to save or manage cash flow first; your future self will thank you.

Take note: All credit is subject to status and affordability checks. The information provided here is for general guidance only and not financial advice. Always review the representative APR, terms and eligibility criteria offered by each lender before applying.

Get Personalised Loan Rates

Find lenders that can approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Related Articles

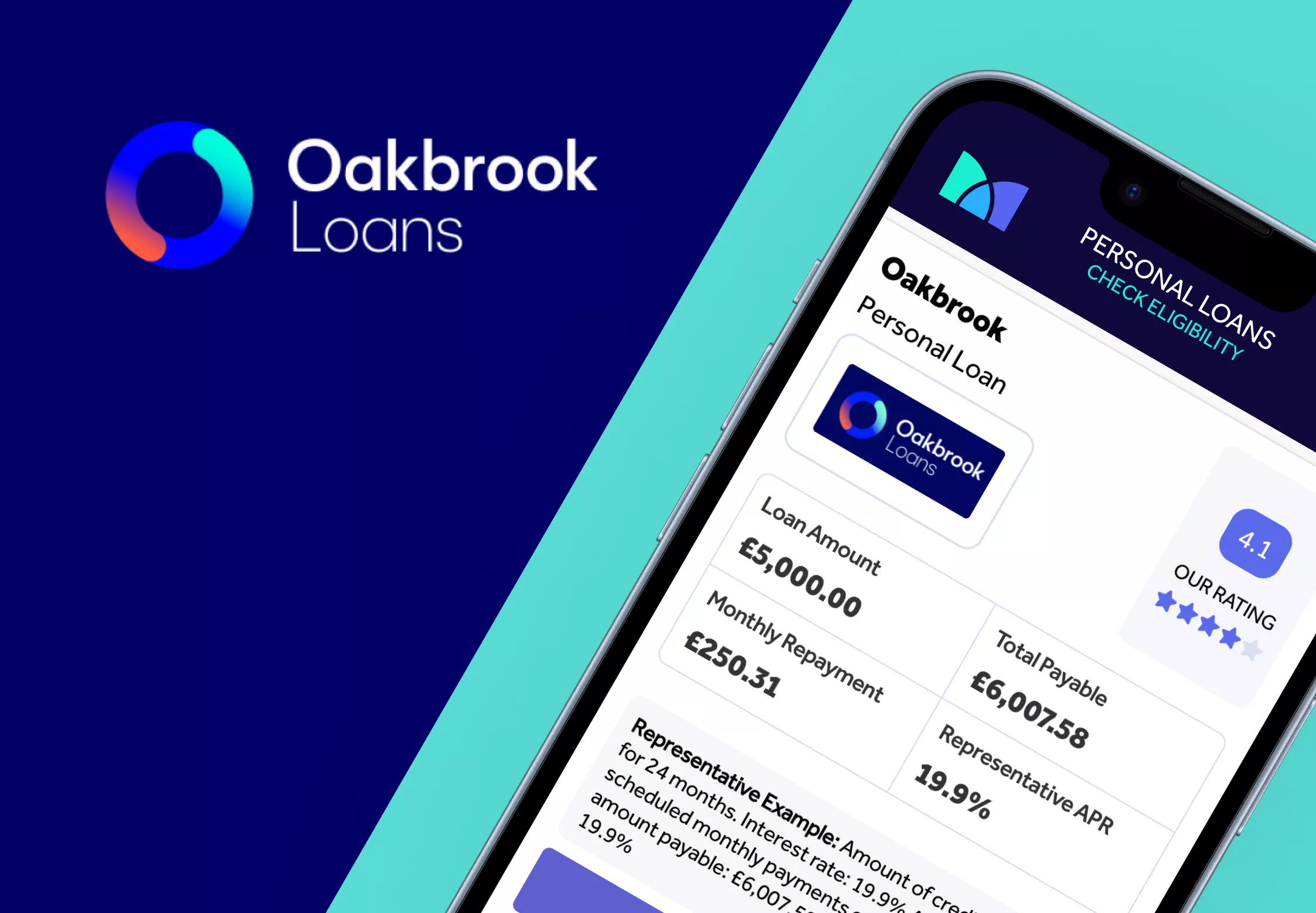

Oakbrook Loans Review

Lendable Loans Review

How to Apply for a Car Loan in the UK

My Community Finance

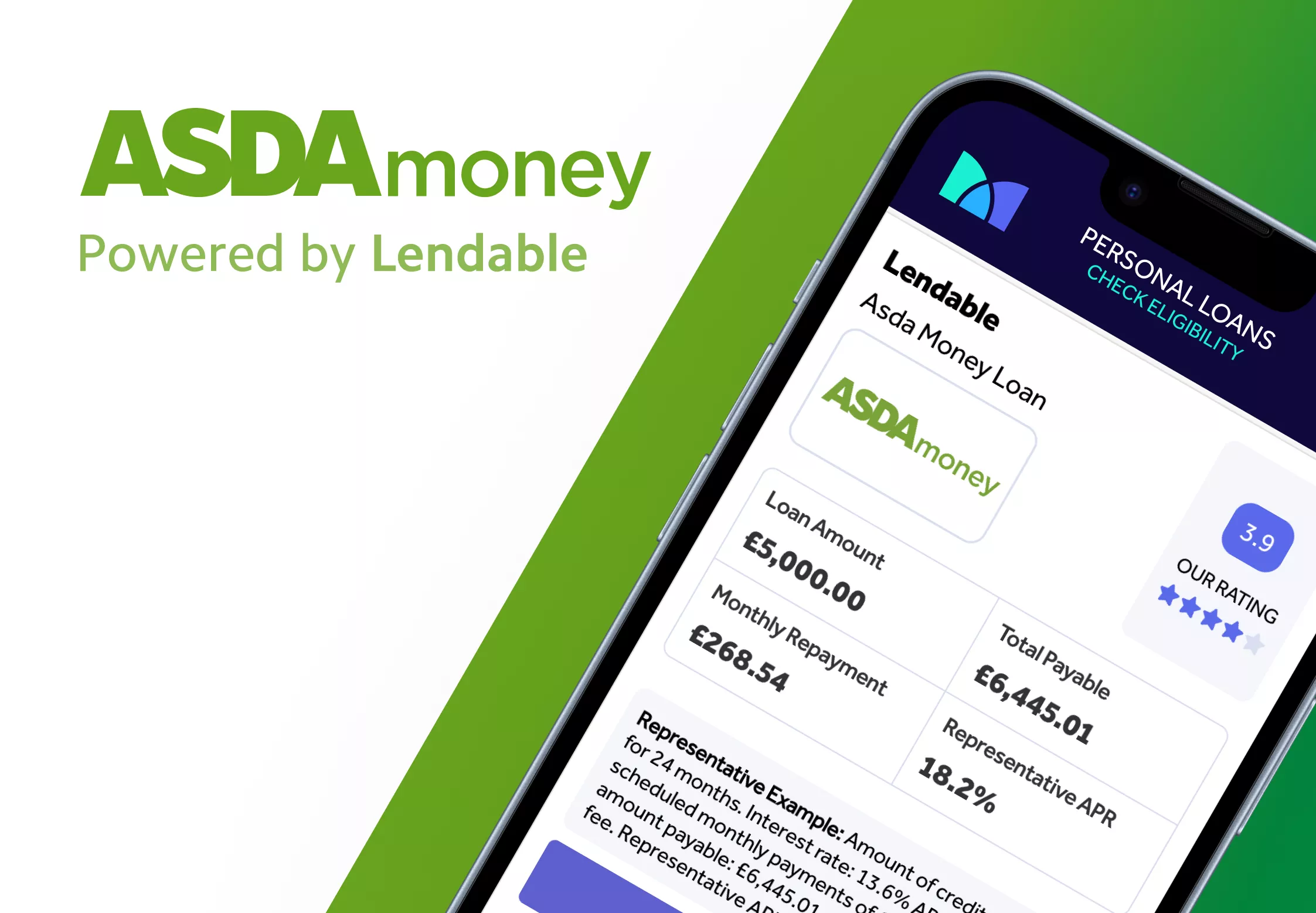

Asda Loans Review

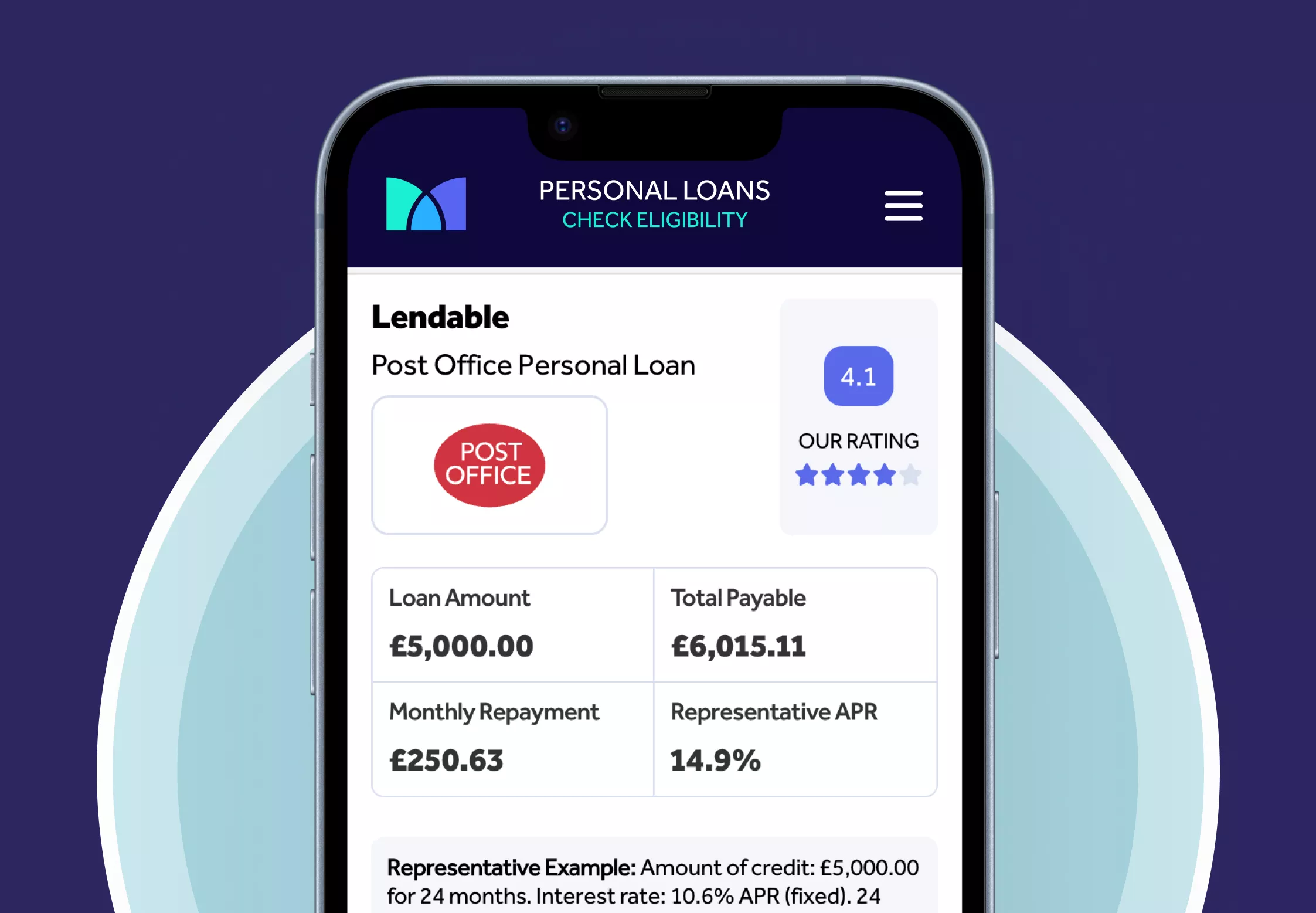

Post Office Loans Review

The content presented here has been impartially gathered by the Mintify team and is offered on a non-advised basis for informational purposes only. We adhere to strict editorial integrity