Quick car finance: A practical guide to fast approval

Editor, Consumer Finance: Michelle Blackmore

Last Updated: February 5, 2026

In This Article

Getting car finance quickly is possible, but it’s rarely as instant as adverts or social posts make it sound. Lenders and brokers still need to run affordability checks, verify documents and make sure the car itself meets their criteria. This guide explains how fast car finance decisions usually happen in the UK, what affects the timeline, and what you can do to make the process smoother. The information is practical and based on how the approval process actually works, not assumptions or unrealistic promises.

What “quick” car finance really means

When people talk about “quick” car finance, they often imagine an almost instant decision. In reality, speed depends on a few moving parts. Lenders still need to check affordability, verify your details and make sure the car you want fits their criteria. Some applications can be decided on the same day, but it’s reasonable to expect the process to take between 24 and 48 hours once all the information is provided.

A fast decision doesn’t mean skipping important checks. It simply means the lender or broker has enough clear information to assess your application promptly. Things like accurate personal details, a clean credit file and having your documents ready can make the process feel much smoother. The aim of this guide isn’t to promise instant approval, but to help you understand what affects the timeline so you can prepare and avoid delays.

What speeds up a car finance application (and what slows it down)

The time it takes to get car finance approved usually comes down to how clear and complete your information is. Most delays happen when lenders need to double check details, request missing documents or verify the car you want to buy.

- Clear and accurate personal details make affordability checks easier.

- Having proof of income and proof of address ready prevents back-and-forth.

- A stable credit file with no recent changes speeds up the process.

- Choosing a car from a recognised dealer can reduce verification delays.

- Applying on weekdays usually leads to quicker responses than weekends.

Across the car finance market, many regulated brokers use soft-search checks as part of their process. If you are matched with a broker through a panel, you may see names such as Autolend or Zuto. This is a normal part of how broker panels work and does not guarantee approval, but it allows them to explore potential options without adding unnecessary hard searches to your credit file.

Mintip: Eligibility checks are free, leave no mark on your credit score, and help you see which lenders may consider you before you decide to apply.

A simple step-by-step path to a quick car finance approval

A straightforward approach can make the application process feel much quicker. Preparing your documents and understanding what lenders look for can help you avoid unnecessary delays.

- Gather proof of income, proof of address and your driving licence before applying.

- Use a use a soft search eligibility check to understand your chances without harming your credit file.

- Decide on your budget and repayment expectations in advance.

- Choose the car you want early, as lenders often need its details to progress your application.

- Respond quickly to any follow-up requests from the lender or broker.

These steps don’t guarantee faster approval, but they remove the most common causes of delay and make it easier for lenders to assess your application accurately.

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Quick car finance for bad credit, here’s what to expect

Having a weaker credit history doesn’t prevent you from getting car finance, but it can influence how quickly lenders are able to make a decision. Applications may take slightly longer because lenders often need to look more closely at income, recent payment behaviour and overall affordability.

- Lenders may request extra documents, such as recent bank statements or additional proof of income.

- Soft search tools can still give you an idea of your eligibility without affecting your credit score.

- Recent missed payments or new credit accounts can slow down decision-making.

- A clear and accurate application helps avoid follow-up questions and delays.

- Borrowing within a realistic budget improves your chances of approval and keeps repayments manageable.

Nothing in the process is guaranteed, and timelines vary based on your personal circumstances. The most important thing is ensuring the repayments are affordable and that you understand the terms before committing to any agreement.

Why “quick” isn’t always the right priority

Getting finance approved quickly can be helpful, especially if your current car has broken down or you need to be on the road for work. But speed shouldn’t replace careful decision-making. A finance agreement is a long-term commitment, and rushing the process can make it harder to compare your options properly.

- A lower rate might be available if you take more time to compare lenders.

- Fast decisions can still come with higher borrowing costs.

- Choosing a car in a hurry may limit your ability to check its condition or value.

- Agreeing to repayments too quickly can create affordability pressure later on.

- Taking an extra day to review the terms often leads to a more comfortable decision.

Quick finance has its place, but only when you are confident that the repayments fit your budget and the agreement suits your needs. A short pause to review everything can make a significant difference in the long run.

When getting car finance quickly makes sense (and when it doesn’t)

There are situations where getting finance quickly is genuinely useful. If your car has failed unexpectedly, your job relies on travel or you have already found a suitable vehicle, a prompt decision can help you move forward without major disruption. In these cases, quick finance offers practical support rather than being a shortcut.

- Fast approval can help if a reliable car is essential for work or family commitments.

- It may be helpful when a vehicle you want is likely to sell quickly.

- Quick timelines make sense when you have already checked the car’s condition and history.

- An eligibility check can speed things up by giving you early clarity on your likely options.

- Speed is appropriate when the repayments clearly fit within your budget.

However, getting finance quickly is less suitable if you’re still comparing cars, unsure about your budget or feel pressured to make a quick decision. Slowing down in those moments can help you stay in control and avoid taking on a commitment that may become difficult to manage later on.

How car finance brokers work

Many car finance applications in the UK are handled through brokers rather than directly with a lender. A broker acts as an intermediary, helping you compare a range of finance options without needing to contact multiple lenders yourself. They do not make lending decisions, but they can help you understand what you may be eligible for before you complete a full application.

- Brokers work with a panel of lenders and use your details to check which options may suit your circumstances.

- Most brokers use soft search tools that checks your eligibility without affecting your credit file.

- Brokers are regulated and must follow rules on clear information, responsible lending and fair treatment of customers.

- Some brokers receive a commission from the lender if you take out finance through them; this does not automatically mean you will pay more.

- Upfront fees are uncommon, but if a broker charges a fee it must be disclosed clearly before you agree to proceed.

Using a broker can save time and provide more visibility on your options, especially if you prefer a single point of contact. However, it is still important to read the terms carefully, compare the total cost and make sure the repayments fit within your budget before committing to any agreement.

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Alternatives to car finance

Car finance is a common way to fund a vehicle, but it is not the only option. Depending on your budget and circumstances, looking at alternatives can give you more flexibility or help reduce the total cost of getting on the road.

- Using savings or combining savings with a smaller borrowing amount can reduce monthly repayments.

- A personal loan offers a simple repayment structure and allows you to own the car from day one.

- Choosing a lower-cost vehicle can make approval easier and keep borrowing to a minimum.

- Taking a short pause to improve your eligibility may lead to better rates or faster approvals later on.

- A joint personal loan may increase the total income considered in your application, which can sometimes help with affordability, but only if both people are confident the repayments fit within their budgets.

- Employer schemes or workplace loans may be available as an alternative in some roles.

Exploring these options alongside traditional car finance can help you make a more confident and balanced choice, especially if you are aiming to keep costs manageable over the long term. If you want to different car loans and finance options in more detail, our guide to the best car loans in the UK explains how they work in more detail.

Mintip: If you’re confident the repayments would fit your budget, an eligibility check can help you explore potential options safely before making any commitments. If, however, you feel unsure about taking on more debt, free impartial support is available through organisations like StepChange and MoneyHelper.

Frequently asked questions

How long does car finance approval usually take?

Most car finance applications are decided within 24 to 48 hours once all documents are provided. Some lenders can respond on the same day, but timelines vary depending on your circumstances, the car you want to buy and the lender’s internal checks.

Can I get car finance on the same day?

Same-day decisions are possible but not guaranteed. They usually happen only when your documents are ready, your details are straightforward and the lender’s checks can be completed without delays.

Do eligibility checks affect my credit score?

No. Eligibility checks use a soft search, which does not leave a visible mark on your credit file and does not impact your score. A hard search only happens if you proceed with a full application.

What documents do I need for quick car finance?

You will typically need proof of income, proof of address and a valid driving licence. Some lenders may also request recent bank statements or additional documents depending on your situation.

Can I get car finance quickly with bad credit?

It is possible, but decisions may take longer because lenders need to verify your affordability more closely. Having documents ready and borrowing an amount that fits comfortably within your budget can help reduce delays.

Is car finance faster through a broker or a lender?

Both can be quick, but brokers may give you a broader view of your potential options because they work with multiple lenders. However, neither route guarantees fast approval, as timelines depend on your personal circumstances and the checks involved.

What slows down a car finance application?

Common delays include missing documents, recent changes on your credit file, incomplete information, manual underwriting checks and additional verification needed for the car you want to buy.

Is a personal loan quicker than car finance?

Personal loans can sometimes be quicker because they do not require checks on the vehicle itself. However, timelines still depend on affordability checks and the lender’s assessment process.

Does a joint application make car finance easier to get?

A joint application may help if it increases the total income and both applicants can comfortably afford the repayments. Both people are equally responsible for the loan, so it is important to be sure the commitment is manageable.

Are brokers like Autolend or Zuto lenders?

No. Brokers such as Autolend or Zuto act as intermediaries and do not lend money themselves. Their role is to connect applicants with lenders on their panel based on the information provided. Any lending decision is made by the lender, not the broker.

Can I improve my chances of a fast approval?

Yes. Keeping your documents ready, ensuring your personal details are accurate, using a soft-search eligibility check and choosing a car from a recognised dealer can all help reduce delays.

Check your car finance options

Every application is different, and there is no single “best” way to finance a car. The most important step is understanding what you may be eligible for, comparing the total cost and making sure the repayments are affordable for you.

A soft-search eligibility check can help you see which lenders may consider your application without affecting your credit file. It takes only a couple of minutes and gives you clearer insight before you move on to a full application.

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Related Articles

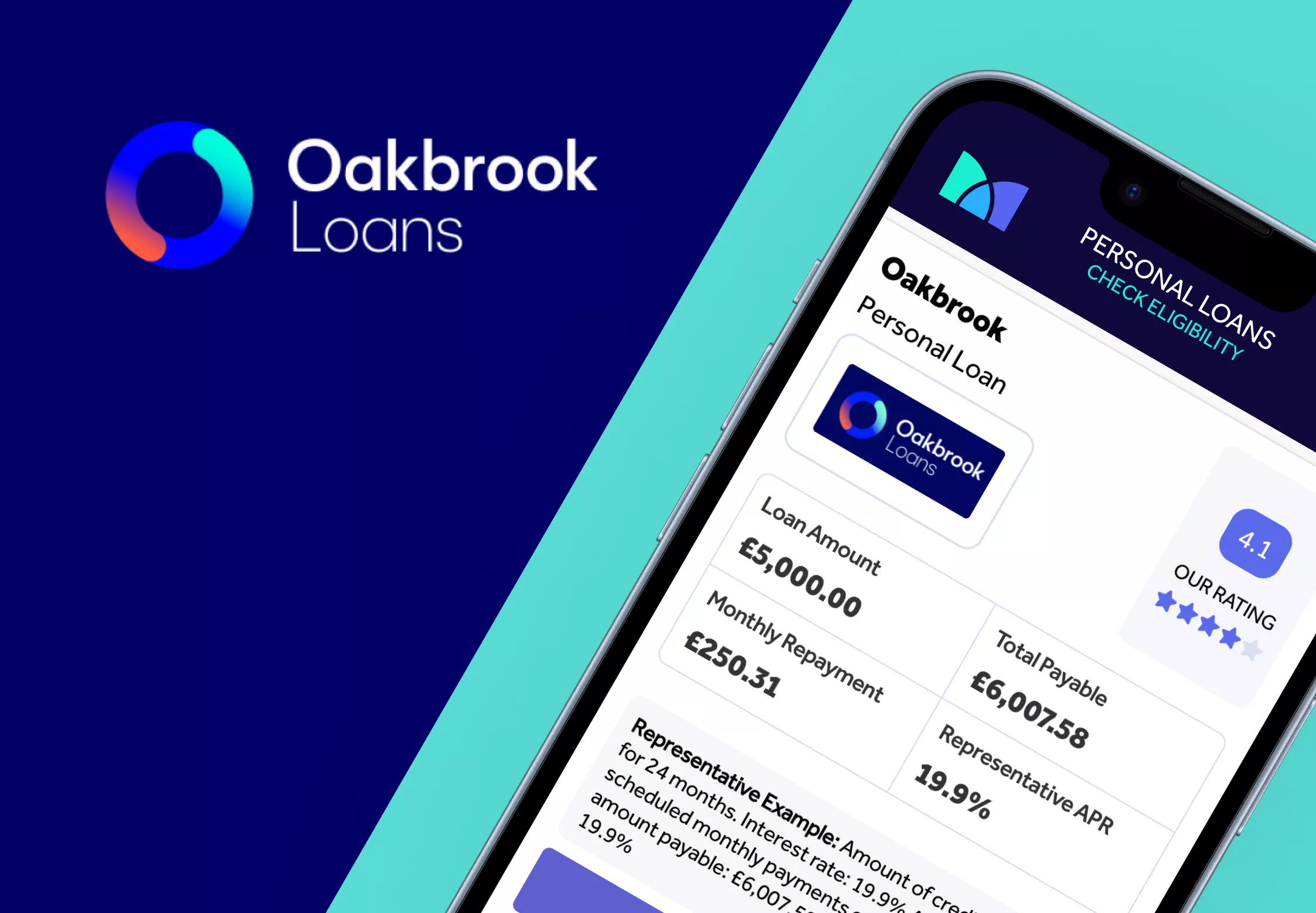

Oakbrook Loans Review

Lendable Loans Review

How to Apply for a Car Loan in the UK

My Community Finance

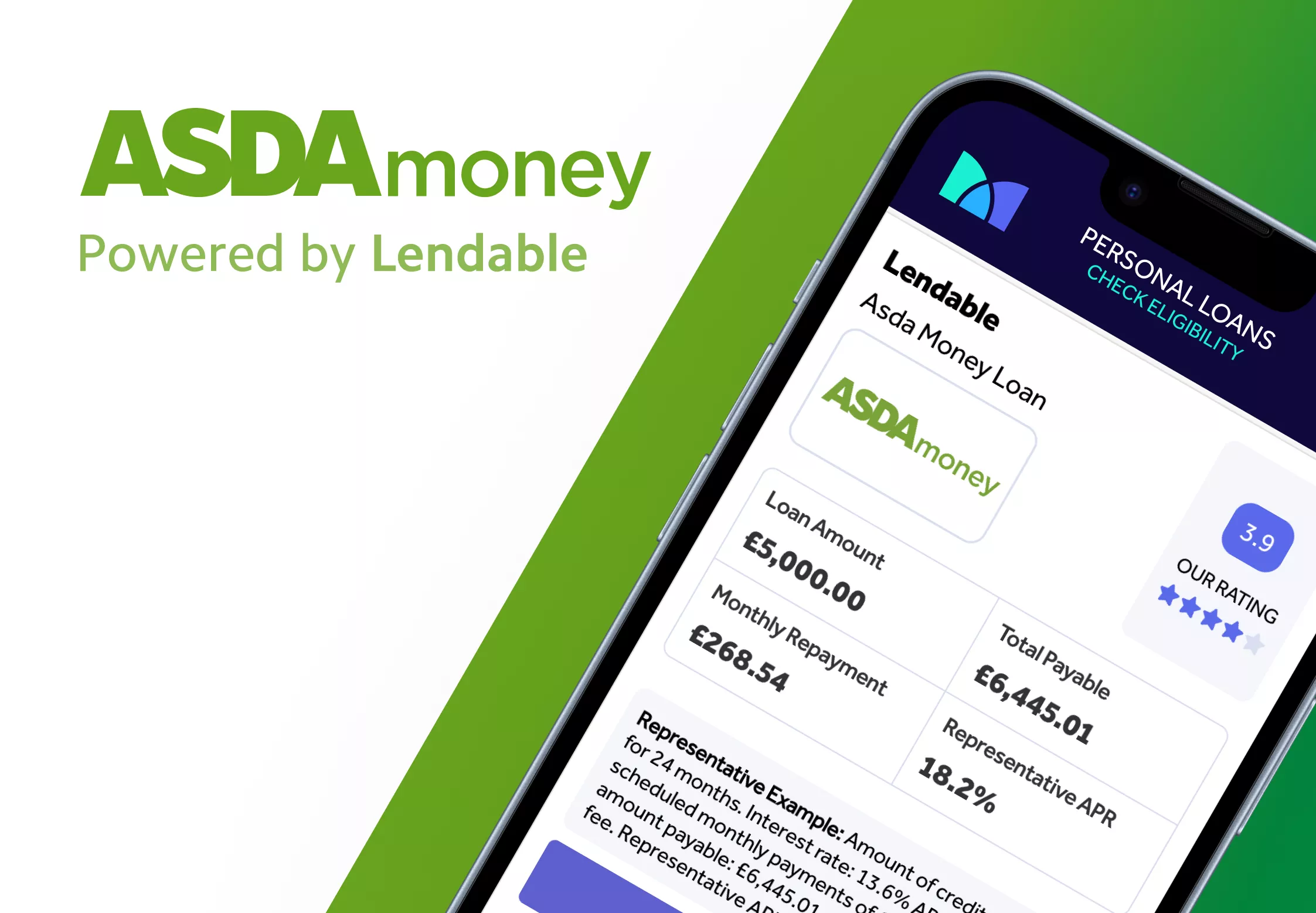

Asda Loans Review

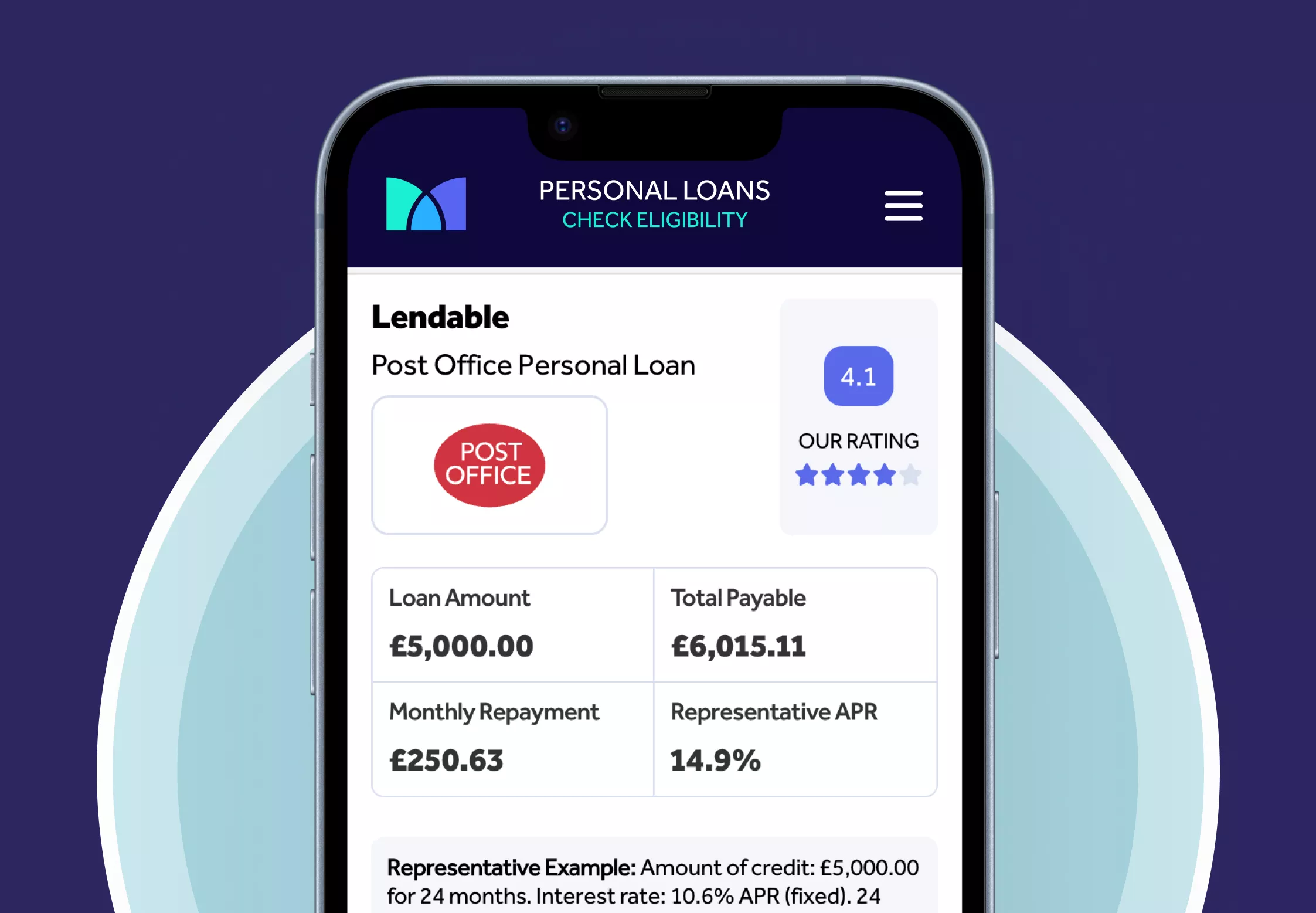

Post Office Loans Review

The content presented here has been impartially gathered by the Mintify team and is offered on a non-advised basis for informational purposes only. We adhere to strict editorial integrity. Mintify is an Introducer Appointed Representative of Creditec Limited. We provide editorial reviews of the whole market, but we only provide links to apply for products available through Creditec’s panel of lenders. We may earn a commission if you click these links. This does not affect our editorial independence, but it limits the products you can apply for directly on this site.

Editor, Credit Cards: Michelle Blackmore

Last Updated: February 5, 2026