Zuto car finance review – is Zuto legit?

Editor, Consumer Finance: Michelle Blackmore

Last Updated: February 7, 2026

In This Article

Zuto is a UK car finance broker that helps customers find vehicle finance through its panel of approved lenders. When you check your eligibility for car finance, a soft credit check takes place, which does not affect your credit score, and an attempt is made to match you with a suitable finance provider.

If you’re approved in principle, Zuto works with lenders that may be able to support applicants across different credit profiles, depending on affordability and individual circumstances. The final offer, including your APR, loan term and monthly payments, depends on your personal circumstances and the lender’s criteria.

We have partnered with Creditec Limited, a credit broker authorised and regulated by the Financial Conduct Authority under reference number 971164, to give Mintify users access to Creditec’s panel of lenders. This panel includes Zuto alongside a range of other UK lenders. When you check your eligibility through Creditec, they will carry out a soft search that will not affect your credit score. If you are eligible, Zuto may appear in your personalised results.

This guide explains how Zuto works, is Zuto legit, what to expect if you are matched with them, and how our partnership with Creditec allows you to check your eligibility with Zuto and similar lenders without affecting your credit score.

Mintip: If you are “approved in principle” or receive a provisional offer, remember this is not a final decision. The lender will still need to complete full credit and affordability checks before any finance can be confirmed.

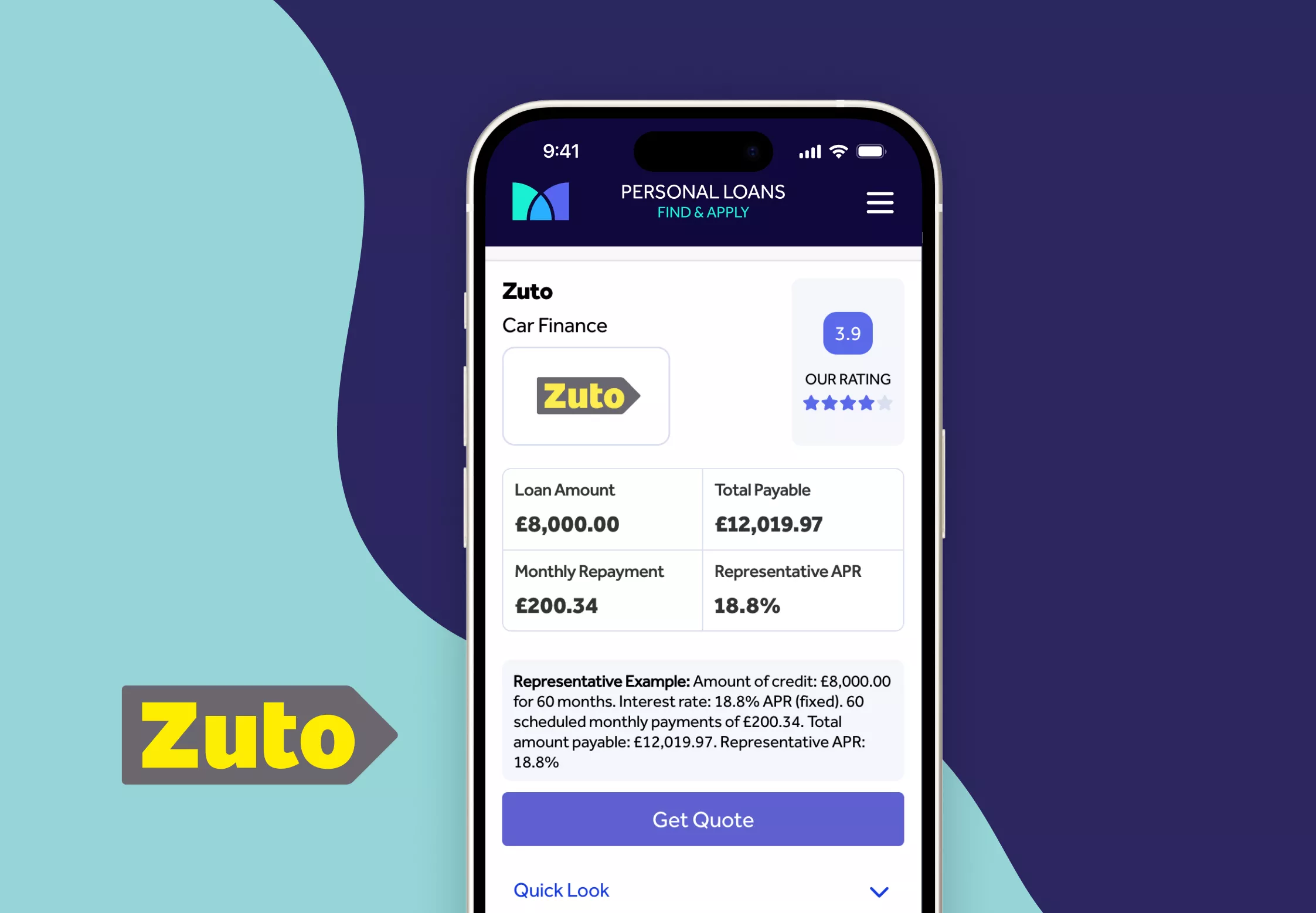

Zuto Car Loan Calculator

This Zuto car loan calculator shows example monthly repayments based on a sample loan amount, term, and representative APR.

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender. Examples are for illustration purposes only. The rate and term you are offered are subject to status and affordability and are dependent on your individual circumstances. Find out how this calculator works or how this site works.

Loan Amount

Total Payable

Monthly Repayment

Representative APR

Representative example will update based on your input.

What is Zuto car finance?

Zuto car finance is a broker-led service that helps UK consumers arrange vehicle finance through a panel of approved UK lenders. Zuto is not a lender itself. Instead, they act as an intermediary, using your application details to try and match you with a finance provider based on your credit profile and affordability.

The process starts with an online eligibility check and a soft credit search. This means you can check your potential suitability without impacting your credit score. If a suitable lender match is found, you may receive a provisional offer. If you proceed, a full affordability assessment and hard credit search will follow.

Zuto can help arrange finance for vehicles sold by dealers it works with, and can provide history and valuation checks on the vehicle as part of the process. These do not replace a full mechanical inspection. In some cases, Zuto may also be able to help with finance for private car sales, depending on the lender’s criteria.

Key things to remember:

- Zuto is a broker, not a lender

- Check your eligibility using a soft search application

- If eligible, you may be matched with a lender

- Finance is usually for cars from verified dealers, but private sales may be possible

- Supports a wide range of credit profiles

Final loan terms, including the APR, loan duration, and deposit requirement, depend on your individual circumstances and the lender’s decision. Zuto’s panel includes lenders with varying criteria, so outcomes may differ from one customer to another. Approval is not guaranteed.

Is Zuto legit?

Zuto is a legitimate and FCA-regulated, credit broker, not a direct lender, with registration number 452589. By being a credit broker it means they do not provide the finance themselves but work with a panel of lenders across different credit profiles. Being authorised and regulated by the Financial Conduct Authority requires firms to meet standards on transparency, customer treatment and complaint handling. It also gives consumers access to defined protections, including the right to escalate complaints to the Financial Ombudsman Service if issues cannot be resolved directly.

Using a broker can be a convenient way to compare different car finance options in one place, and some customers may find this helpful if they are unsure which type of finance suits them. However, approval, rates and terms will depend on the lender you are matched with, your credit profile, affordability checks and the information provided during the application.

As with any credit decision, it is important to review the proposed terms carefully before signing an agreement and make sure the repayments fit comfortably within your budget. If you are unsure, seeking independent financial advice or comparing alternatives may help you decide the right path for your circumstances.

How Zuto car finance works: step-by-step guide

Zuto is a car finance broker that works with a panel of approved lenders. If you take an eligibility check and meet a lender’s criteria, Zuto may match you with a suitable option for your vehicle purchase.

Here is what happens from start to finish:

- Take a free eligibility check: See if you qualify for car finance with Zuto’s panel of lenders. A soft credit search is used, so this will not affect your credit score.

- Submit your details: Provide information about your employment, income, and the type of car you’re looking to finance.

- Soft credit check: A soft search is carried out to assess your eligibility across lenders. This does not leave a visible mark on your credit file.

- Loan match: If you meet a lender’s criteria, you may receive a conditional offer through Zuto.

- Pick your car: Choose a vehicle from Zuto’s network of verified dealers or use one you’ve already found. Zuto will run a free history and valuation check on the car to ensure it meets the lender’s requirements. Part exchange may also be accepted.

- Review your offer: Check the interest rate, term, deposit, and total repayable amount, along with any fees.

- Sign and verify: Complete ID checks and provide any documents or deposit required by the lender.

- Funds sent to dealer: Once approved, the lender transfers funds directly to the car dealer. Timing depends on the lender’s process.

- First repayment: Typically due around 30 days after payout. The lender may allow you to choose a payment date.

All finance is subject to status and affordability checks. Terms vary by lender. Zuto acts as a broker and is authorised and regulated by the Financial Conduct Authority (FRN: 452589).

Mintip: While Zuto runs both a vehicle history and valuation check, we still recommend having the car inspected by a qualified mechanic before purchase. This can help you avoid unexpected issues later on.

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Can I get car finance for a private car sale?

Yes, some lenders on Zuto’s panel may offer car finance for private sales, although it’s less common than dealer finance. If you’re looking to buy a car from a private seller, Zuto may be able to help by matching you with a lender that supports this type of purchase.

In most cases, you’ll need to provide extra details about the vehicle and the seller. Zuto will guide you through what’s required and speak to the lender on your behalf. Final approval will depend on the lender’s checks and whether the car meets their criteria.

Types of car finance available and alternatives to consider

Zuto supports multiple types of car finance through its panel of lenders. If you are not matched with Zuto as a broker, or choose not to proceed, there are other options to consider. Each type of finance works differently, and the right one will depend on your credit profile, preferences, and whether you want to own the car at the end of the agreement.

Below are some of the most common ways to finance or purchase a car.

- Hire Purchase (HP): You pay for the car in fixed monthly instalments over an agreed term. The lender owns the vehicle during the agreement. Once you’ve made the final payment, the car becomes yours.

- Personal Contract Purchase (PCP): Monthly payments cover the car’s depreciation rather than its full value. At the end, you can return the car, trade it in, or pay a final balloon payment to keep it.

- Personal Loan: You borrow money from a lender and use it to buy the car outright. You own the car from day one and repay the loan in monthly instalments. This can also be a useful option for buying from a private seller.

If you’re considering a personal loan to buy your next car, you can compare rates and lenders using our guide to the best car loans in the UK.

Zuto car finance eligibility

Zuto works with a panel of UK lenders, each with their own criteria. Below are the common eligibility requirements you will normally need to meet before a lender can consider your application through Zuto.

- You must be at least 18 years old.

- You need at least three years of UK address history.

- You do not need to be a homeowner.

- Full-time, part-time and self‑employed applicants can be considered.

- Some lenders may accept applicants with irregular income or no traditional proof of income, provided affordability can be verified.

- Provisional driving licences are accepted by some lenders.

- International licence holders may be accepted if they meet residency and affordability criteria.

- Bad credit applicants may be considered depending on the lender’s policies.

- Joint applications are available, although criteria can vary between lenders.

All applications start with a soft credit search so you can see your potential eligibility without affecting your credit score. If you choose to proceed with a lender, a full affordability assessment and hard credit check will take place. Final decisions, loan terms and any deposit requirements depend on your personal circumstances and the lender selected.

Mintip: Car finance is often one of the largest loans people take outside of a mortgage. Make sure the monthly repayments are comfortably affordable before you commit. Always consider total cost, not just the monthly repayments.

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

About Zuto

Zuto was founded in 2006 with the aim of simplifying how people finance a car. Rather than applying to lenders one by one, Zuto helps you find and apply for car finance through a single application. They act as a broker, working with a panel of lenders offering a wide range of finance products.

According to Zuto, they have access to over 275 finance options through their panel. Their technology and support team aim to match applicants with a lender and vehicle that suits their needs and budget. Zuto says more than 450,000 customers have used their service to help finance a car.

Whether you’re applying for car finance for the first time or already have experience, Zuto positions itself as a guided route to securing car finance with less hassle. You choose the car, Zuto helps with the checks, and if you’re approved, the lender pays the dealer directly.

- Founded in 2006

- Broker model, not a lender

- Over 275 lender products available

- More than 450,000 customers supported

- Regulated by the Financial Conduct Authority (FRN: 452589)

Zuto Limited is authorised and regulated by the Financial Conduct Authority. All finance is subject to status, credit checks, and affordability assessments by the lender. Zuto does not provide financial advice.

Does Zuto charge any fees?

Zuto does not charge customers any fees for using its broker service. Instead, Zuto receives a commission from the lender if you go ahead with a finance agreement. This commission is paid by the lender, not the customer.

The amount of commission may vary depending on the lender, product type, loan amount, or your credit profile. Zuto does not provide financial advice, and any recommendation is based on the lenders available from its panel at the time of your application.

In some cases, the lender or dealer may apply an administration fee. If this applies, it should be disclosed in the terms before you proceed. Zuto also offers a free vehicle history and valuation check for cars sourced through approved dealers.

Do I need to pay a deposit or upfront payment?

Some lenders on Zuto’s panel may offer car finance with no deposit required. However, putting down a deposit can reduce the amount you need to borrow and lower your monthly repayments.

In some cases, a car dealer may ask for a holding payment to reserve the vehicle. This is separate from any finance agreement and is arranged directly with the dealer. If you’re asked to pay a holding fee, always check whether it is refundable.

- Ask the dealer to confirm whether the holding fee is refundable if you change your mind.

- If possible, avoid paying by cheque if a refund is expected, repayment can take longer.

- If you plan to finance the full value of the car, check with the dealer how any upfront payment would be handled.

- If possible, negotiate a lower holding fee unless it forms part of your final deposit.

Any deposit requirements or holding fees are set by the dealer, not Zuto. The lender’s requirements will depend on the vehicle, your credit profile, and their own affordability checks.

Mintip: Your car finance payments are just one part of the cost. Don’t forget to factor in insurance, MOT, fuel, repairs, tyres and general wear and tear when budgeting.

What customers say about Zuto

Zuto has received thousands of reviews on Trustpilot from customers who have used its car finance broker service. The feedback highlights a range of experiences, including both positive comments and criticisms.

- Several reviewers commend the speed of the initial eligibility check and the ease of the online application process.

- Some users highlight helpful communication from Zuto while arranging vehicle checks and dealer payment once finance was approved.

- A number of customers mention being matched with a lender even after having limited or less-favourable credit history.

- Criticisms include variations in payout time, with a few users noting that funding took longer than expected when dealers or lenders had additional checks.

- There are comments about final interest rates or available vehicles being more than initially expected; this is consistent with the message that approval and terms depend on lender criteria.

As with any broker-led finance process, outcomes may vary depending on the lender’s criteria and each applicant’s personal circumstances.

Important: Missing payments can lead to extra charges and may affect your credit rating. Only take out credit if you’re confident you can keep up with the repayments. If your repayments ever become difficult to manage, free and impartial support is available from organisations such as StepChange, National Debtline and MoneyHelper.

Frequently asked questions about Zuto

1. Can I get car finance if I’m not currently employed?

You may still be able to get car finance if you are not employed, but lenders will need to see that you have a reliable source of income. This could include benefits, pensions, or support from a partner. Approval will depend on affordability checks and the individual lender’s criteria.

2. What documents do I need to apply for car finance through a broker?

You will usually need to provide your full name, date of birth, address history, employment details, and income. Some lenders may ask for proof of income, identification, or bank statements depending on the finance product and your credit profile.

3. Does applying for car finance affect my credit score?

The initial eligibility check is typically done using a soft credit search, which does not affect your credit score. If you choose to proceed with a lender, they will carry out a hard credit search, which is recorded on your credit file and may affect your score temporarily.

4. Can I apply for car finance if I’m self-employed or have variable income?

Yes, many lenders will consider self-employed applicants or those with variable income. You may be asked to provide recent tax returns or business accounts to show how much you earn and whether the repayments are affordable. Not all lenders accept self-employed applicants, so broker panels can help widen the options.

5. Will I need to pay anything upfront to the dealer or broker?

Zuto does not charge customers a fee for using its broker service. However, some car dealers may request a holding payment to reserve the vehicle. This is separate from the finance agreement. Always check whether the holding fee is refundable and get written confirmation from the dealer if you are unsure.

6. What happens if I want to change my car before the finance ends?

If you are still within a finance agreement, you will usually need to settle the outstanding balance before switching to another car. Some lenders may allow you to part-exchange the vehicle, but you should check the terms of your agreement before making changes. Early settlement may involve fees or affect your credit agreement.

7. What should I check before choosing a car to finance?

If you miss a payment or think you might fall behind, it is important to speak to your lender as soon as possible. Many lenders have support options or can help you agree a new payment plan. Missing payments can affect your credit file and lead to extra costs, so it is best to take action early. Free support is also available from organisations like StepChange and MoneyHelper.

9. Is Zuto the lender or just the broker?

Zuto is a credit broker, not a lender. That means it does not provide finance directly. Instead, it works with a panel of lenders and helps match you to a suitable option based on your application details. The finance agreement itself will be between you and the lender you choose to proceed with.

Zuto car finance: is it right for you?

Zuto is a broker, not a lender. It helps connect drivers with car finance offers from a wide panel of UK lenders. There are no fees for using the service, and eligibility checks use a soft credit search that does not impact your score.

Whether you are buying your first car or replacing an older one, it is important to check the full cost of borrowing and ensure the monthly repayments fit your budget. Always compare offers carefully and review the terms before proceeding.

- No fees charged by Zuto to the customer

- Soft search eligibility check with no impact to your credit score

- Hire purchase and PCP finance options available

- Support for a range of credit profiles

- Vehicle history and valuation checks included

Still exploring your options? You can also check our guide to the best car loans in the UK, which covers unsecured personal loans as an alternative way to finance your vehicle.

Related Articles

Check your credit card eligibility in the UK

Balance transfer cards for credit builders

How much can you balance transfer?

What is a balance transfer fee?

How to do a balance transfer on a credit card

Marbles credit card review – is it a good option to consider?

The content presented here has been impartially gathered by the Mintify team and is offered on a non-advised basis for informational purposes only. We adhere to strict editorial integrity. Mintify is an Introducer Appointed Representative of Creditec Limited. We provide editorial reviews of the whole market, but we only provide links to apply for products available through Creditec’s panel of lenders. We may earn a commission if you click these links. This does not affect our editorial independence, but it limits the products you can apply for directly on this site.