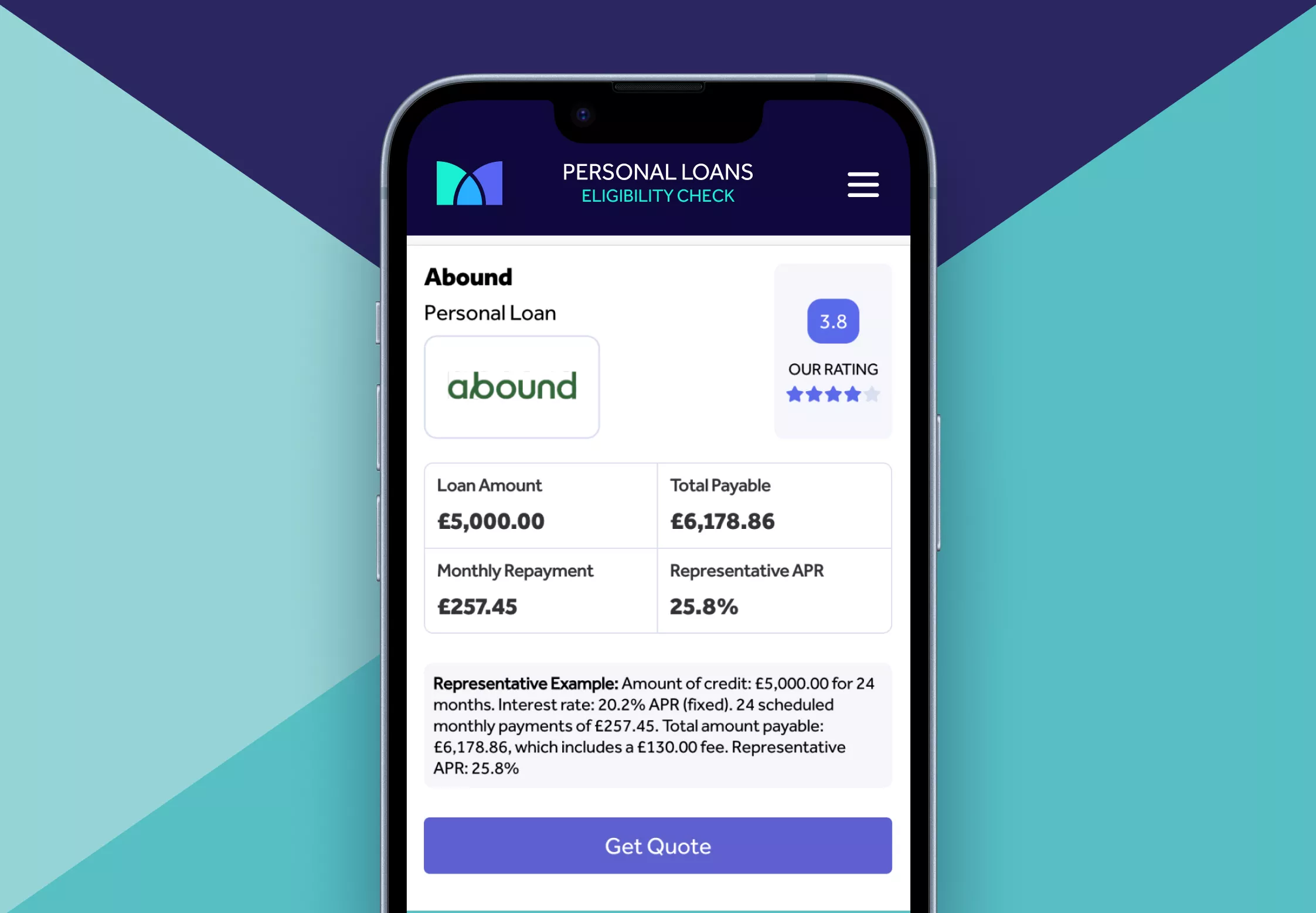

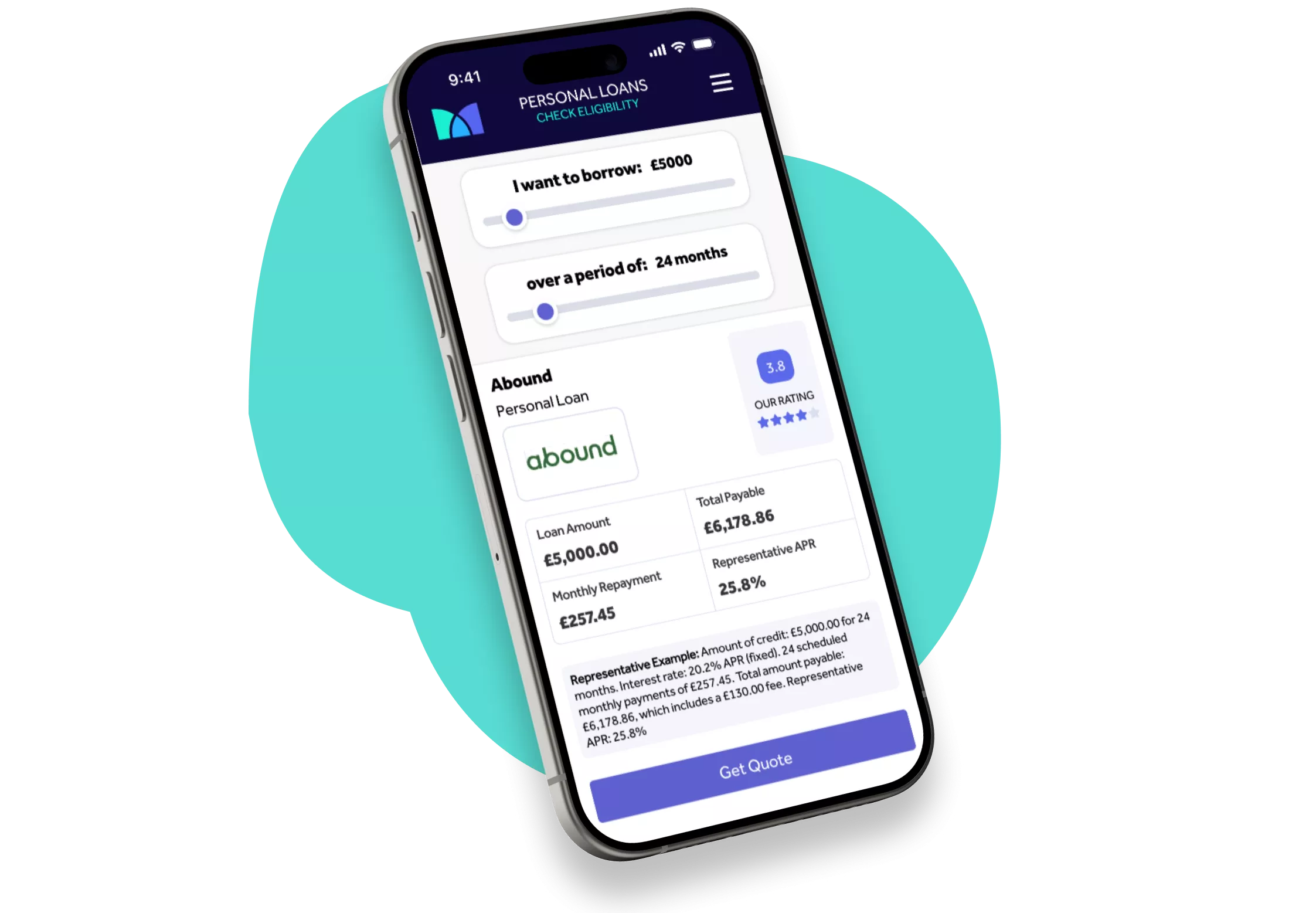

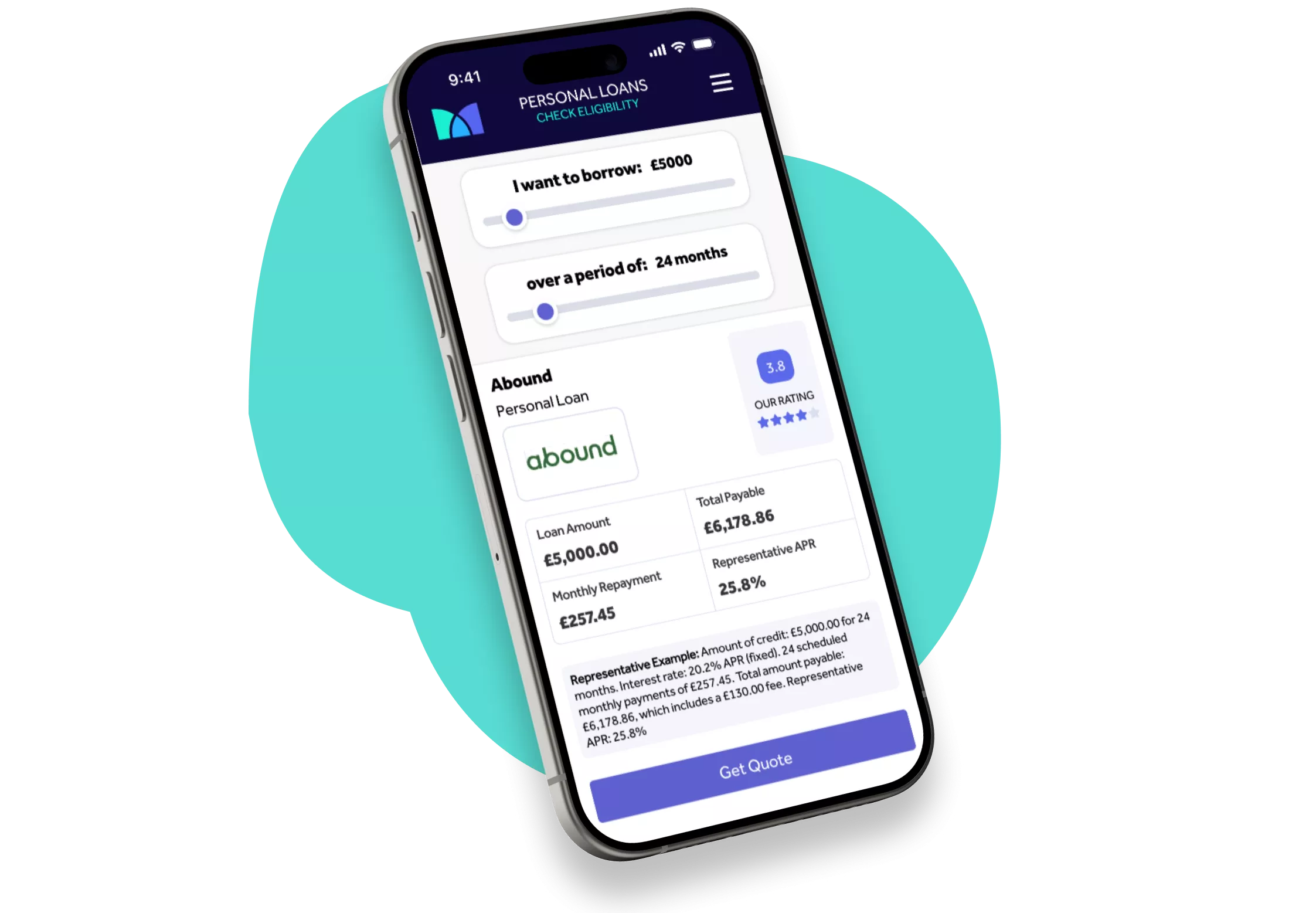

Abound loans review: rates, eligibility and how it works

Editor, Credit Cards: Michelle Blackmore

Last Updated: February 5, 2026

In This Article

Abound is a UK lender offering unsecured personal loans and assessing applications using both credit data and recent bank transactions through Open Banking.

What is Abound?

Abound is a UK lender offering unsecured personal loans between £2,000 and £12,000, typically repayable over 12 to 60 months. Their loan agreements include an arrangement fee, which is added to your loan balance and repaid through your monthly instalments.

Unlike lenders that rely mainly on credit scores, Abound reviews your recent bank transactions through Open Banking to understand your income, regular spending and financial commitments. Loan rates and terms are personalised and depend on your financial situation and the outcome of Abound’s affordability checks.

As with any credit product, whether this type of loan is suitable will depend on your personal circumstances and whether the repayments are affordable for the full term.

How do Abound loans work?

Abound assesses applications by looking at both your credit history and your recent bank transactions through Open Banking. This helps them understand your income, regular spending and whether the monthly repayments would be manageable alongside your other commitments.

At the start of the process, a soft credit search is carried out. This allows you to see whether you may be eligible without affecting your credit score. If you choose to continue with an Abound application, you will be asked to share your bank data securely through Open Banking so they can complete their affordability checks.

After reviewing the information, Abound may present a personalised loan offer. This will outline the loan amount, term, interest rate and monthly repayment. Funds are only released once all checks and verification steps are completed and you confirm that you want to proceed.

Here is a simple summary of the typical steps:

- A soft search is completed at the start (no impact on your credit score)

- Open Banking information is used to confirm income and spending

- The application is assessed for affordability and suitability

- A personalised offer may be provided if you meet the criteria

- Funds are released after final checks and your confirmation

The exact steps and timeframes can vary depending on your financial situation and whether additional checks are required.

Does Abound charge any fees?

Abound includes several fees within its loan agreements. These are outlined clearly in the Pre-Contract Credit Information and the credit agreement you receive before making a decision.

- Arrangement fee: Abound adds a loan fee to the amount you borrow. It is included in your monthly repayments and accrues interest. The fee is non-refundable if you repay early, unless you withdraw from the agreement within 14 days.

- Late payment fee: A £12 charge applies if a scheduled repayment is missed. This is refunded automatically if the payment is made within seven days of the due date.

- Changing repayment amounts: A £30 fee applies if you ask to reduce your monthly repayment amount. There is no charge for increasing your instalments.

Always check your credit agreement for the most up-to-date fees, as these may change over time

Who owns Abound?

Abound is operated by Fintern Ltd, a UK-based financial services company. Fintern Ltd is authorised and regulated by the Financial Conduct Authority for lending and credit broking activities.

The company states that its aim is to offer a clearer and more detailed approach to affordability by looking at real financial behaviour rather than relying solely on credit scores. This forms the basis of how Abound reviews applications and prices its loans.

As with any lender, being regulated does not mean a loan will be suitable for everyone. Any offer you may receive will depend on your own financial circumstances and Abound’s assessment at the time you apply.

- Loans provided by Fintern Ltd

- Authorised and regulated by the Financial Conduct Authority

- Focus on assessing how applicants manage their day-to-day finances

What do Abound say about their loans?

“Consumer lending is broken. Our mission is to fix it”

”Over 15 million people in the UK struggle to borrow for unexpected costs. Abound was founded to offer low-cost, fair and flexible lending solutions which serves borrowers interests and their long-term financial health.”

Abound

This statement reflects Abound’s description of its own product. Consumers should always compare APRs, fees and eligibility across providers before applying.

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Who can apply for an Abound loan?

Abound has its own criteria for deciding who may be eligible for a personal loan. Like all lenders, they review your income, spending, credit history and overall financial stability. You will also be asked to share your recent bank transactions through Open Banking so they can assess whether the monthly repayments would be affordable for you.

Meeting the basic requirements does not guarantee approval. Every application is assessed individually, and the final decision will depend on your circumstances at the time you apply.

Typical requirements include:

- Being at least 18 years old and living in the UK

- Having a regular and reliable income

- Holding a UK bank account with online banking

- Consenting to share bank transaction data through Open Banking

- A credit file that supports the likelihood of repaying the loan

Abound may look more positively on applications where income is steady, essential bills are paid on time and existing levels of borrowing are manageable. However, certain patterns can reduce the chances of approval, such as frequent overdraft use, recent missed payments, high-cost short-term borrowing or signs of financial strain.

- Stable income and predictable spending may support eligibility

- Lower existing debt can help with affordability

- Recent missed payments may reduce eligibility

- Heavy overdraft use or high-cost credit may signal financial pressure

If you are considering a loan, it can help to review your budget and make sure you understand the full cost of credit, not just the monthly repayment.

How do you apply for an Abound loan?

The process for applying for an Abound loan takes place online. It usually begins with a soft search eligibility checker so you can see whether you may be eligible without affecting your credit score. This step helps you understand whether continuing with an application is likely to be worthwhile.

If you choose to proceed with Abound, you will be asked to give secure Open Banking access to your recent bank transactions. This allows Abound to review your income, spending and financial commitments to check whether the repayments would be affordable for you.

Self-employed applicants may still be eligible for an Abound loan, although lenders may ask for extra documents to confirm income. You can read our guide on loans for self-employed to understand what to expect.

Once Abound has assessed the information, you may be given a personalised offer. This will show the proposed loan amount, interest rate, repayment term and monthly cost. You can then decide whether you want to go ahead. Funds are only released after all verification steps are completed.

Here is a general outline of the steps involved:

- A soft credit search is completed at the start (no impact on your credit score)

- Open Banking access is requested to confirm income and spending

- Your application is assessed for affordability and suitability

- A personalised offer may be provided if you meet Abound’s criteria

- Funds are released after final checks and your confirmation

It is important to only continue with an application if you are comfortable sharing your bank data and confident that you can maintain the repayments for the full loan term. Always review the Summary Box and key information before agreeing to any credit.

Mintip: If you’re thinking about taking out a loan to pay off other debt, make sure it genuinely helps you move forward and not just delay repayments. If you’re unsure, speak to a free and impartial service like StepChange or MoneyHelper before committing.

Abound loans are completed online. Using a soft search eligibility checker gives an early indication of eligibility, and the full decision is made once Open Banking checks and verification steps are completed. Funding times vary depending on your circumstances.

How long do Abound loans take?

Abound loans are completed fully online, so you do not need to visit a branch. The initial soft search gives you an early indication of whether you may be eligible, but the final decision is only made once Abound has reviewed your Open Banking information and completed their affordability checks.

For some applicants, this process can be completed relatively quickly, while for others it may take longer. The timing depends on how easily your income and spending can be verified and whether Abound needs any additional information.

Timeline:

- Start with loan eligibility checker. (no impact on your credit score)

- Provide Open Banking access so Abound can review your income and spending

- Abound completes affordability and verification checks

- Once everything is confirmed, check your offer details carefully before proceeding

Funding is released after all checks are complete and you confirm you want to go ahead. Timing varies between applicants, so it is best not to rely on receiving funds for any urgent or time-sensitive costs.

Is an Abound loan secured or unsecured?

Abound only offers unsecured personal loans. This means you do not need to use your home, car or any other asset as security when applying. Instead, your eligibility is assessed using your credit file and your recent bank transactions through Open Banking.

Unsecured borrowing can be straightforward in the sense that no collateral is required, but it also means Abound will look closely at whether the repayments are affordable based on your income, spending and existing commitments.

Here is a simple summary of what this means in practice:

- No collateral is required to apply

- Affordability and credit history are central to the assessment

- Repayments are fixed for the full loan term

- Missing or late payments can affect your credit score and may lead to collection action

If you are unsure whether an unsecured loan is appropriate for your situation, it can help to review your budget and consider whether the repayments fit comfortably alongside your other financial commitments.

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Abound is a legitimate UK lender regulated by the Financial Conduct Authority. Their loans are provided by Fintern Ltd, and the company must follow rules on affordability, responsible lending and the secure handling of customer data.

Is Abound legitimate and safe?

Yes. Abound (trading name of Fintern Ltd) is a UK lender authorised and regulated by the Financial Conduct Authority under Firm Reference Number 929244. Fintern Ltd is registered in England and Wales (Company No. 12472034) and has its registered office at 3rd Floor, 86-90 Paul Street, London EC2A 4NE.

The company is required to comply with the Consumer Credit Act and the rules set out in the FCA’s Consumer Credit Sourcebook and Consumer Duty. Abound is also a member of CIFAS (the UK’s leading anti-fraud association) and is registered with the Information Commissioner’s Office under registration number ZA747930, meaning it must meet UK data protection standards under the UK GDPR.

Being authorised and regulated means Abound must follow rules on responsible lending, affordability checks and how it handles your data. It does not guarantee you will be approved for a loan or that a loan will be suitable for you and any offer depends on your individual circumstances and the assessment made at the time of your application.

- Authorised and regulated by the FCA (FRN 929244)

- Registered company: Fintern Ltd, England & Wales No. 12472034

- Member of CIFAS and registered with the ICO (ZA747930)

What do customers say about Abound?

According to recent Trustpilot data, Abound holds a TrustScore of 4.9 out of 5 based on more than 16,000 reviews. Most customers rate the service as excellent and highlight the clear communication, simple application process and fast decisions.

- Application process described as straightforward and easy to complete

- Clear updates and helpful customer support throughout the process

- Many reviewers report fast approval and quick release of funds

There are also some less positive reviews, which generally relate to affordability checks or unexpected declines after Open Banking data was reviewed. These experiences are in the minority but worth being aware of.

- Some applicants were declined after Open Banking checks showed affordability concerns

- A few users felt the review of their bank transactions was more detailed than expected

- Not all customers received same-day funding, especially where extra verification was needed

Customer reviews can provide helpful insight into how a lender operates, but they cannot predict your own outcome. Your experience will depend on your financial circumstances and Abound’s assessment at the time you apply.

Is Abound a good option?

Abound can be a suitable option for people who want a more detailed view of their financial position rather than a decision based mainly on credit score. Their use of Open Banking allows them to look at real income, regular spending and essential bills, which some borrowers may find more reflective of their day-to-day circumstances.

However, Abound’s approach also comes with trade-offs. Abound also includes an arrangement fee within the loan, and late-payment charges apply, so the product may be more appropriate for people who are confident their repayments will be made on time.

As with any credit product, the right choice depends on your own circumstances and what you can comfortably afford to repay.

Abound loans:

- may suit borrowers who prefer decisions based on current financial behaviour.

- uses Open Banking to conduct a detailed affordability review.

- includes an arrangement fee added to the loan balance.

- applies fees for late repayments, which is refunded if paid within seven days.

- is always subject to status, verification and affordability checks.

Mintip: Be aware of the total cost of credit, not just the interest rate. Always check how much you’ll repay in total, including arrangement fees and interest, before signing a credit agreement. Make sure the loan fits comfortably within your budget and avoid borrowing more than you need.

How does Abound compare to other options?

Abound takes a different approach from many traditional loan providers by placing more weight on your recent bank transactions and overall financial behaviour. This means they focus less on your credit score alone and more on whether the repayments appear affordable based on your day-to-day spending and income.

This can work well for people whose credit file does not fully reflect their current situation, but it also means Abound may decline applications where spending patterns show signs of financial pressure, even if the credit score is reasonable. Their use of Open Banking will be a positive for some applicants and a drawback for others.

Here is a simple summary of how Abound’s approach may feel different from what some borrowers expect:

- Open Banking plays a major role in the assessment, which gives a detailed view of your financial behaviour

- Affordability checks are thorough and can be stricter than some applicants anticipate

- Decisions can be quick when income and spending are stable and easy to verify

Ultimately, whether Abound feels like the right fit depends on how comfortable you are with sharing your bank data and how predictable your income and monthly spending are. Checking your eligibility with a free eligibility checker first can help you understand how their assessment method applies to your own circumstances.

Frequently asked questions

What is Open Banking?

Open Banking is a regulated system that allows you to share your recent bank transaction data securely with approved companies. It helps lenders understand your income, spending and financial commitments, and you can remove access at any time.

How long does it take to get an Abound loan?

Timelines vary. A decision is made once Abound has completed its affordability and verification checks, and funds are released only after final approval. Some applications may require further information, which can affect the timing.

Can an application be declined after initial checks?

Yes. Early checks do not guarantee approval. The final decision depends on Abound’s full affordability assessment and your circumstances at the time you apply.

Does Abound offer unsecured loans?

Yes. Abound offers unsecured personal loans, which means no asset is used as security. Repayments must still be affordable and manageable for the full loan term.

Can I repay my loan early?

Yes. You have the right to repay your loan with Abound early. You may still be charged interest for the period the money was borrowed, but no separate fee is charged solely for repaying early.

What fees does Abound charge?

Abound charges an arrangement fee that is added to your loan balance, a £12 late payment fee if a scheduled repayment is missed and a £30 fee if you ask to reduce your monthly repayment. Exact fees and amounts are set out in your credit agreement and may change over time.Abound charges an arrangement fee that is added to your loan balance, a £12 late payment fee if a scheduled repayment is missed, and a £30 fee if you ask to reduce your monthly repayment. Exact fees and amounts are set out in your credit agreement and may change over time.

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Related Articles

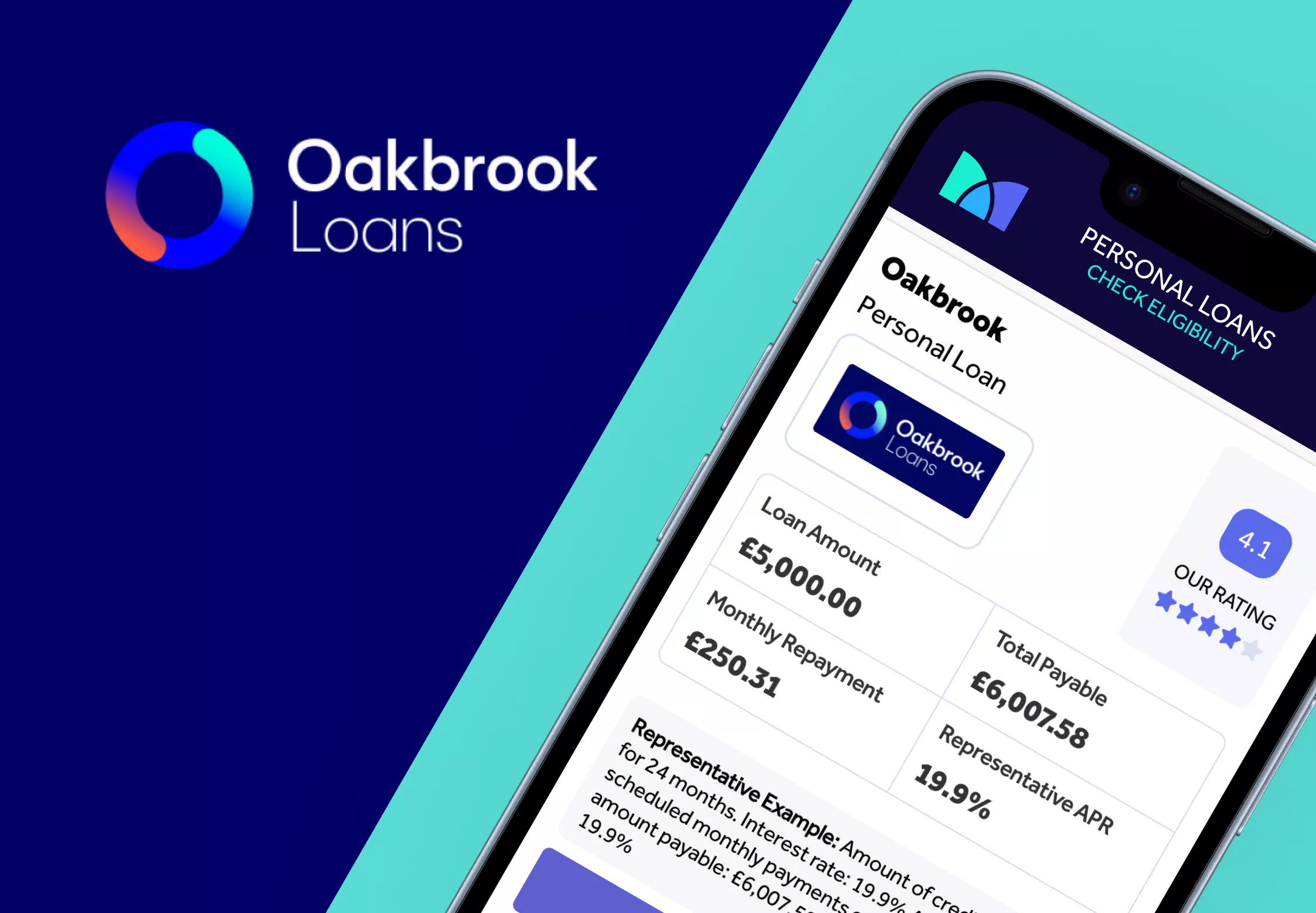

Oakbrook Loans Review

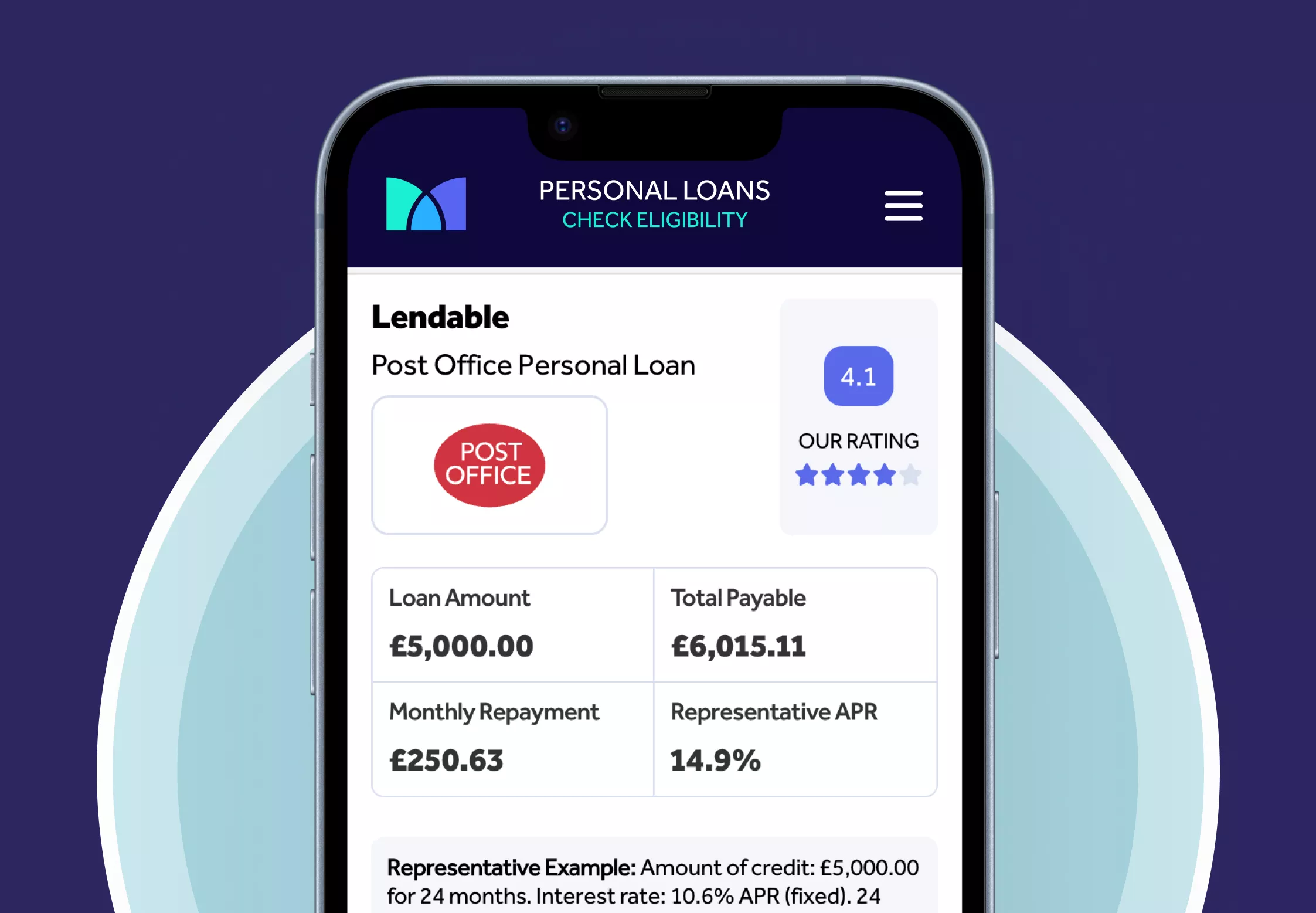

Lendable Loans Review

How to Apply for a Car Loan in the UK

My Community Finance

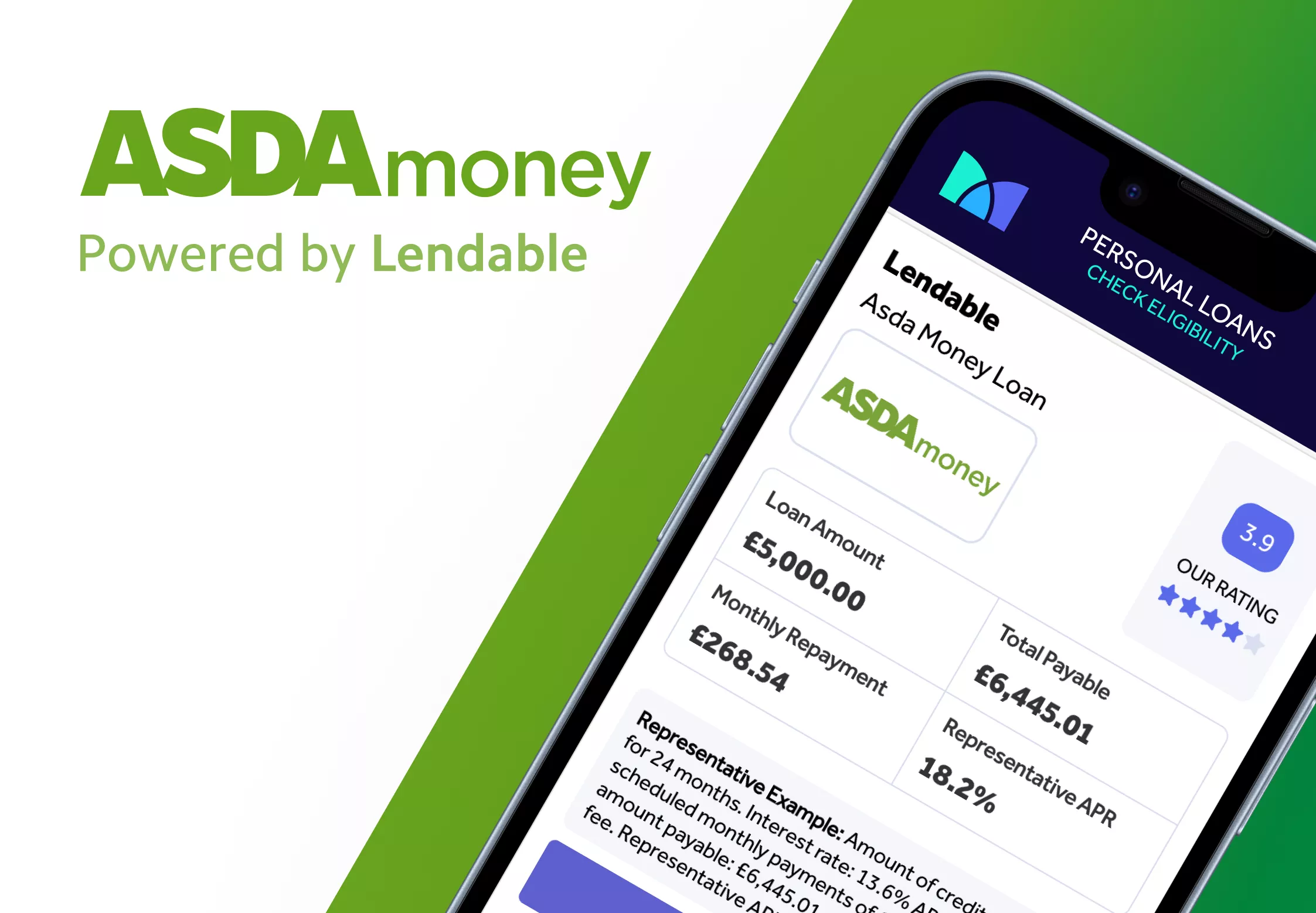

Asda Loans Review

Post Office Loans Review

The content presented here has been impartially gathered by the Mintify team and is offered on a non-advised basis for informational purposes only. We adhere to strict editorial integrity