Autolend: apply for quick car finance

Editor, Consumer Finance: Michelle Blackmore

Last Updated: February 5, 2026

In This Article

Autolend is a UK car finance lender that works exclusively through approved credit brokers. You cannot apply to Autolend directly – instead, you need to go through a broker that has Autolend on their panel. If you meet Autolend’s eligibility criteria, you may be offered pre-approval to help finance your vehicle purchase.

We have partnered with Creditec Limited, a credit broker authorised and regulated by the Financial Conduct Authority under reference number 971164, to give Mintify users access to Creditec’s panel of lenders. This panel includes Autolend alongside a range of other UK lenders. When you check your eligibility through Creditec, they will carry out a soft search that will not affect your credit score. If you are eligible, Autolend may appear in your personalised results.

This guide explains how Autolend works, what to expect if you are matched with them, and how our partnership with Creditec allows you to check your eligibility with Autolend and similar lenders without affecting your credit score.

Mintify is an Introducer Appointed Representative of Creditec Limited and is not itself a lender or broker. Any finance you take out will be subject to the lender’s own terms, conditions and approval process.

Autolend Car Loan Calculator

This Autolend car loan calculator shows example monthly repayments based on a sample loan amount, term, and representative APR.

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender. Examples are for illustration purposes only. The rate and term you are offered are subject to status and affordability and are dependent on your individual circumstances. Find out how this calculator works or how this site works.

Loan Amount

Total Payable

Monthly Repayment

Representative APR

Representative example will update based on your input.

What is Autolend?

Autolend is a trading name of Lendable Ltd, a UK-based online lending platform established in 2014. Lendable is authorised and regulated by the Financial Conduct Authority (FCA reference number: 720719) and registered in England and Wales (Company number: 08828186). Autolend is a direct lender that offers car finance through approved intermediaries, also known as brokers. Customers cannot apply directly to Autolend. If you are matched with Autolend via a broker, the loan funds are paid directly to the vehicle retailer once your agreement is completed.

How Autolend works: Key things to know

- Apply through a broker that includes Autolend in its lender panel.

- The broker runs a soft credit check that does not affect your credit score.

- If eligible, you receive a conditional offer from Autolend.

- Once signed, Autolend sends the funds directly to the car dealer.

- Repayments are made monthly, with the option to settle early without penalty.

Compare Autolend alongside a panel of UK lenders

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

How Autolend car finance works: step-by-step guide

Autolend is a direct lender that works exclusively through approved brokers. If you take a free eligibility check and meet their criteria, your broker may match you with Autolend for your car finance.

Here is what happens from start to finish:

- Take a free eligibility check: See if you qualify for a loan with Autolend and compare offers from other lenders. If your chosen broker does not work with Autolend, their offers will not be shown.

- Submit your details: provide employment, income, and any other requested information.

- Soft credit check: a soft search is done to assess your eligibility. This does not affect your credit score.

- Loan match: if you fit Autolend’s profile, you may receive a conditional offer.

- Review your offer: check the interest rate, term length, total repayable, and any fees, such as loan or option to purchase fees.

- Sign and verify: complete ID checks and provide any required deposit. Usually a minimum of 5% of the vehicle price, with part exchange counting towards this.

- Funds sent to dealer: Autolend transfers the money directly to the retailer, typically within two hours of approval. It can take longer at weekends, evenings, or bank holidays.

- First repayment: usually due 30 days after the dealer is paid, with the option to choose a different payment date.

Mintip:You can repay early at any time without penalty. This may reduce the total interest you pay.

Autolend reviews

Autolend reviews on Trustpilot show over 1,400 verified reviews, with an average score of 4.7 out of 5 at the time of writing. Trustpilot is a recognised and independent platform for customer feedback. The majority of reviews describe a positive experience, highlighting quick application processes, clear communication, and competitive rates for eligible borrowers. Some reviews reflect less favourable experiences, often linked to individual circumstances or eligibility outcomes. As with any financial product, results will vary depending on the applicant’s profile.

Autolend loan eligibility criteria

To be considered for an Autolend car finance agreement through a broker, you will generally need to meet the following minimum requirements:

- be a UK resident for at least the past three years

- receive a regular income of at least £800 per month

- be aged 18 or over

- pass any affordability and credit checks

Autolend reviews hundreds of data points from your credit file to assess affordability and risk. At the quote stage, they only carry out a soft credit search, so checking your eligibility will not affect your credit score.

You can check your eligibility for Autolend by taking a free eligibility check. You may be matched with Autolend or other lenders that better suit your personal circumstances.

Does autolend charge any fees?

Autolend applies certain fees as part of its car finance agreements. These are included in your monthly repayments and will be shown in your personalised quote before you sign.

Loan fee

When you take out a loan with Autolend, a non-refundable loan fee is added to the loan amount. This fee is refundable only if you use your 14 day right to cancel. You do not pay this fee upfront, it is included in your monthly repayments. The loan fee, and the interest due on it, are factored into the annual percentage rate (APR). Your quote will confirm the exact amount.

Option to purchase fee

If you keep the vehicle at the end of your agreement, a £25 option to purchase fee is added to your final payment. Ownership usually transfers to you once all amounts due under the agreement, including the £25 fee, have been paid. Always check the terms and conditions in your contract.

There are no hidden charges, and no money is requested upfront before you receive your loan.

Compare Autolend offers alongside other UK lenders

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Autolend refinance

Autolend offers a vehicle refinance option that allows you to replace your current car finance with a new agreement. This can be used to move from one lender to another, or to change the terms of your existing finance. The process involves taking out a new loan to pay off your current car finance in full.

How autolend refinance works

The Autolend refinance product is a hire purchase (HP) agreement. When you refinance using this product, Lendable Ltd, trading as Autolend, will take legal ownership of the vehicle until the full outstanding balance, including the £25 option to purchase fee, is paid.

You can use Autolend refinance to replace both hire purchase (HP) and personal contract purchase (PCP) agreements. The terms of the new finance may be different from your existing agreement, so it is important to review all the details before deciding.

Is refinance right for you?

Whether refinancing is suitable will depend on your personal circumstances. A new offer could result in higher monthly payments or an increase in the total cost of borrowing. Always compare the terms of the new agreement with your current one and consider seeking independent financial advice if you are unsure.

Alternatives to Autolend

If you’re not eligible with Autolend, there are other car finance options to consider.

- Hire purchase (HP). You make fixed monthly repayments and you own the car after the final payment, plus any option to purchase fee.

- Personal contract purchase (PCP). Monthly repayments are usually lower. At the end you can return the car, trade it in, or buy it by paying the optional final payment.

- Unsecured personal loan. You borrow a set amount to buy the car outright and repay it in fixed monthly instalments.

When you check your car finance eligibility on Mintify, we introduce you to Creditec Limited, our regulated partner. Creditec’s lender panel includes Autolend and other UK finance providers. This means you can see a range of options you may be eligible for based on your circumstances.

You can also review our best car loans UK guide to understand these options better.

Frequently asked questions about Autolend

Is Autolend a lender or a broker?

Autolend is a direct lender, but only accepts applications via car finance brokers.

My quote is pre-approved. What does that mean?

This means Autolend has performed a soft credit search and provided a conditional quote. If you decide to proceed, the loan will be issued once all required checks are complete and the information provided is verified. All quotes are subject to manual review, and a soft search will not affect your credit score.

How did Autolend decide on my rate?

When you request a quote, Autolend assesses a range of factors, including information from your credit file, to provide a personalised APR. These rates are not negotiable.

Why have I been declined?

Autolend assesses many data points when reviewing applications, so there is often no single reason for a decline. They work with Experian to perform a soft credit search. There is a free service that allows you to view your Experian file. If you have been declined, you may be able to reapply in the future if your circumstances change.

How much can I borrow through Autolend?

Autolend offers loans between £1,000 and £35,000 with terms ranging from 1 to 5 years. You can repay early at any time without penalty, which may reduce the amount of interest you pay.

Do I need to pay a deposit?

Autolend requires a deposit of at least 5% of the vehicle’s purchase price. Any part-exchange you have will count towards this amount.

Do Autolend loans have fees?

Yes, Autolend has a £375 fee. This fee and interest will be detailed in your loan agreement before you sign. These are included in your monthly repayments.

How quickly will the dealer receive the funds?

Once your agreement is signed and all checks are complete, Autolend sends the funds directly to the vehicle retailer. This is usually within two hours, but may take longer during evenings, weekends, or bank holidays.

Can I settle my loan early?

Yes. You can request an early settlement at any time.

Is Autolend part of Lendable Ltd?

Yes. Autolend is a trading name of Lendable Ltd, authorised and regulated by the Financial Conduct Authority (FCA reference number: 720719).

Does Autolend accept bad credit?

Autolend considers applications from a range of credit profiles. Their basic criteria is:

- You regularly get paid at least £800.00 per month

- You have been living in the UK for at least 3 years

When you are checking your eligibility for a quote, only a soft credit search is performed, so requesting a loan quote for Autolend will not affect your credit score.

Key points to remember:

Autolend is one of several UK lenders you may be matched with when you check your eligibility. While their process is designed to be quick and transparent, approval always depends on your individual circumstances.

- Applications via approved car finance brokers only: Autolend does not accept direct applications.

- Loan amounts from £1,000 to £35,000: Repayment terms range from 1 to 5 years.

- Basic eligibility criteria: You must earn at least £800 per month and have lived in the UK for at least 3 years.

- Soft credit search for quotes: This does not affect your credit score.

- Minimum 5% deposit typically required: Part-exchange can count towards this amount.

- Early repayment without penalty: This can reduce the total interest paid.

Ultimately, Autolend is a well reviewed lender with a straightforward application process, but no single finance option suits everyone. Using a free eligibility check lets you compare Autolend offers alongside other lenders and choose the car finance that works best for your needs.

Related Articles

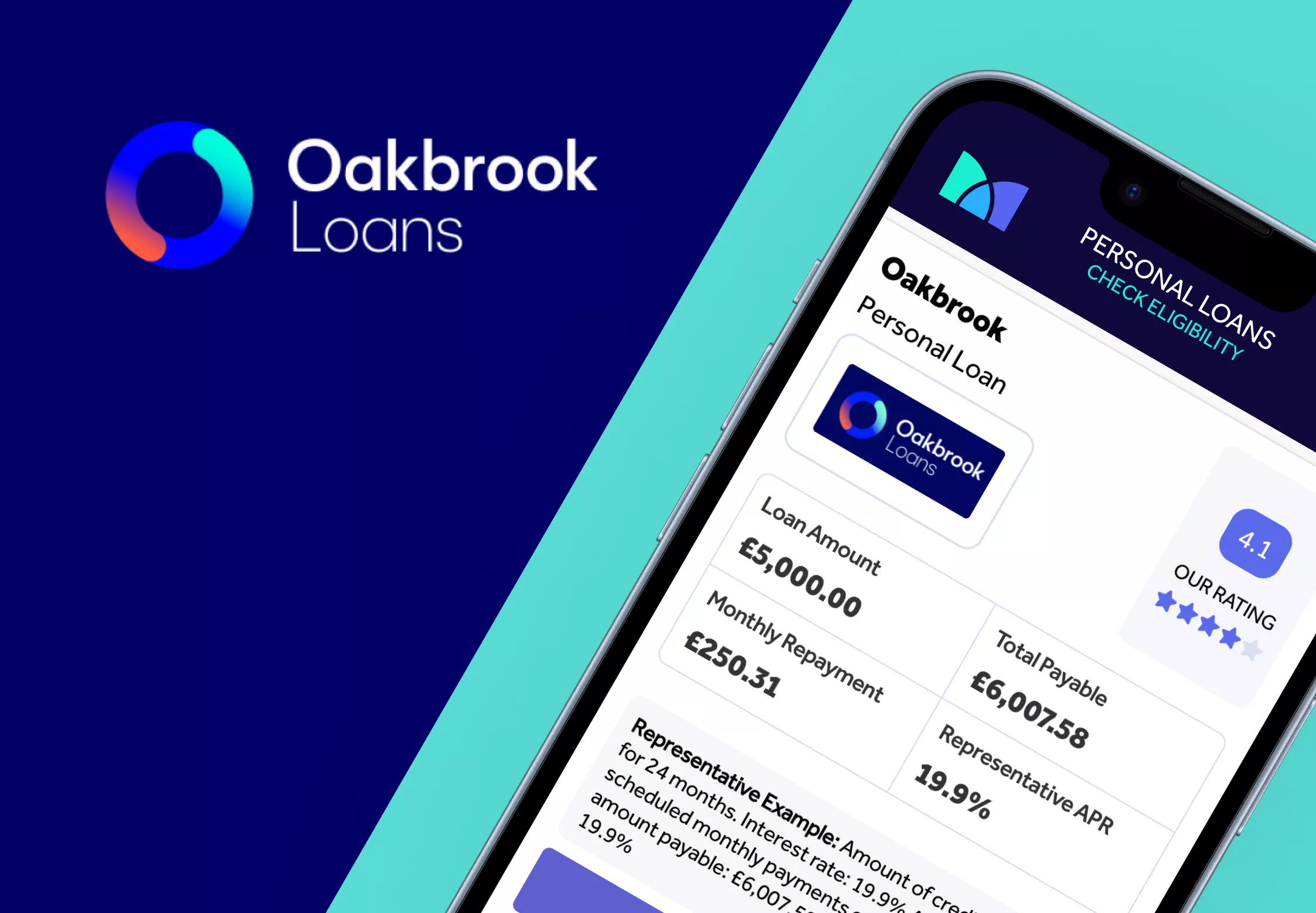

Oakbrook Loans Review

Lendable Loans Review

How to Apply for a Car Loan in the UK

My Community Finance

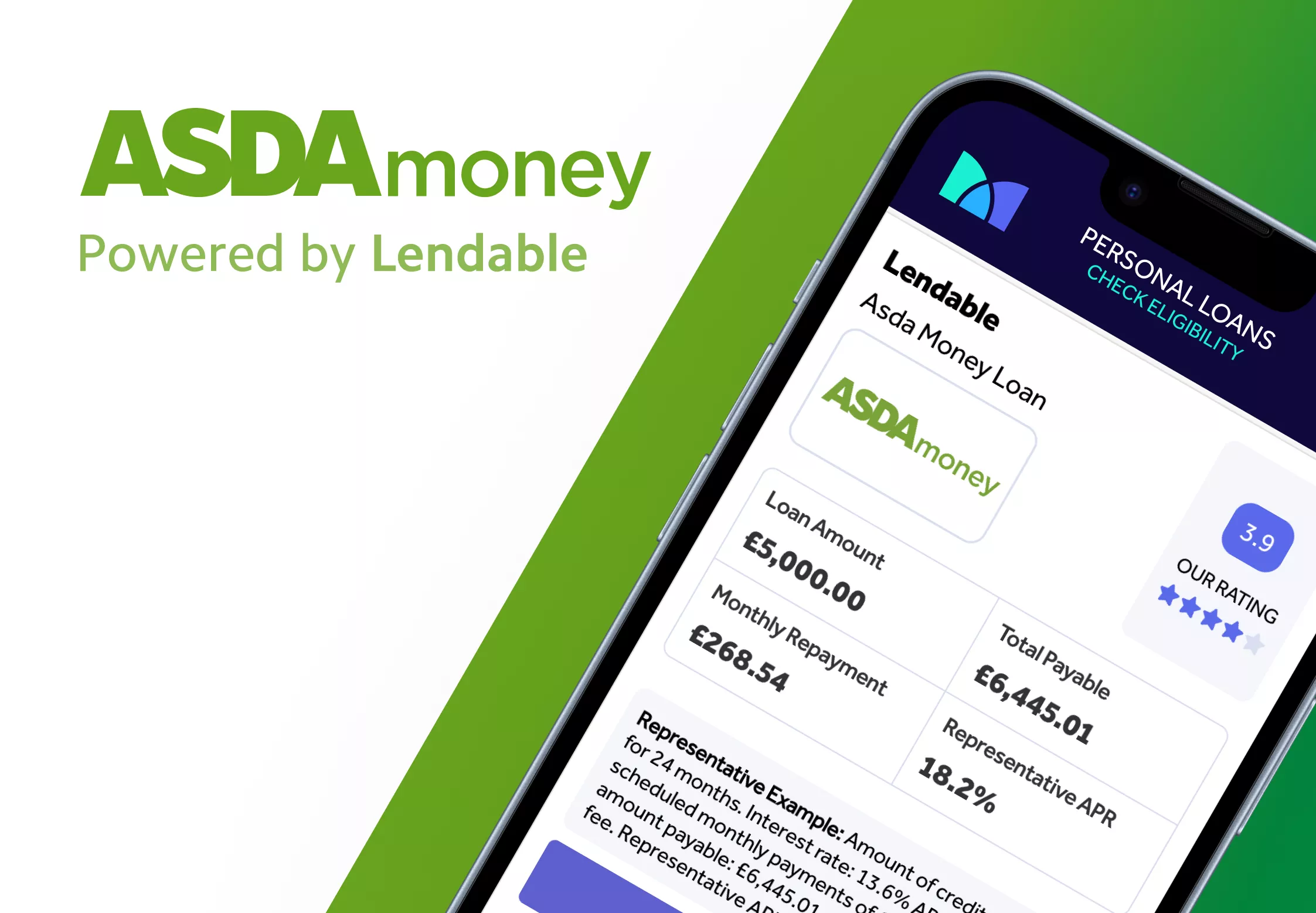

Asda Loans Review

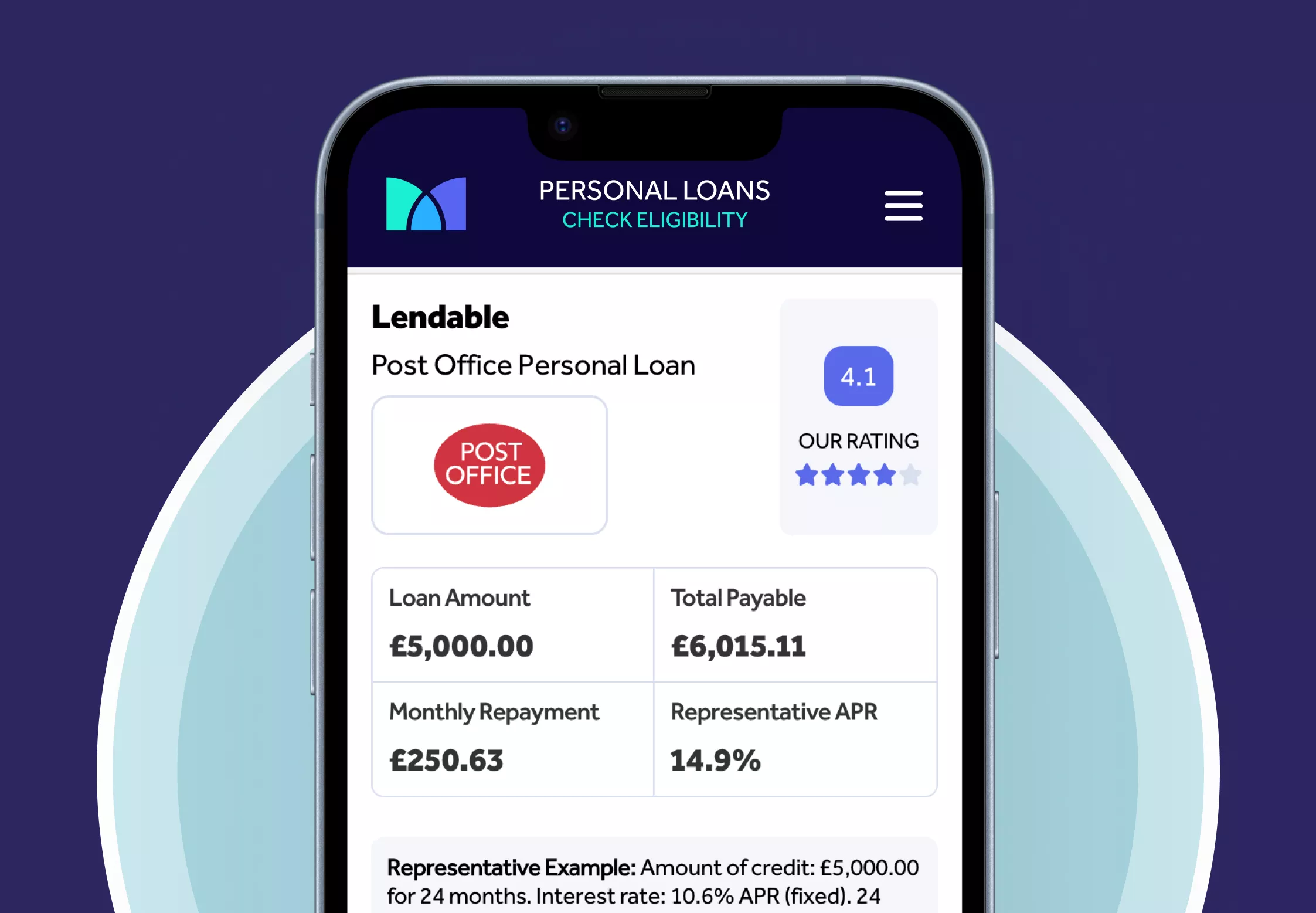

Post Office Loans Review

The content presented here has been impartially gathered by the Mintify team and is offered on a non-advised basis for informational purposes only. We adhere to strict editorial integrity. Mintify is an Introducer Appointed Representative of Creditec Limited. We provide editorial reviews of the whole market, but we only provide links to apply for products available through Creditec’s panel of lenders. We may earn a commission if you click these links. This does not affect our editorial independence, but it limits the products you can apply for directly on this site.

Editor, Credit Cards: Michelle Blackmore

Last Updated: February 5, 2026

How this calculator works

This tool provides an illustrative example of the costs of a personal loan based on the loan amount and term selected by the user. It is designed to reflect, as closely as possible, the actual calculation methods used by the lender.

What we show

For each loan product:

- We calculate monthly repayments, total amount repayable, and the representative APR.

- These calculations are based on publicly available product data and are representative, not personalised.

- We display the representative example required under FCA rules, which includes loan amount, duration, total repayable, interest rate, and representative APR.

How we calculate

The calculator uses the method aligned with how the lender presents its product:

- For lenders that use flat interest rates, we calculate using simple interest across the term.

- For those that use amortised or reducing balance interest, we apply appropriate formulas to reflect declining capital balances.

- Some lenders charge interest on a daily or monthly basis; we replicate those structures where applicable.

- If there are any fees (e.g. arrangement or completion fees), we incorporate these into the total amount repayable if the lender discloses them.

- We aim to reproduce the effective cost of credit as the lender would disclose it, using their advertised or representative data.

Important disclaimer

This calculator does not provide a personalised quote or credit offer. The figures shown are for illustrative purposes only and may differ from the rate or repayment terms you are offered. The actual cost of credit will depend on your personal circumstances and creditworthiness, and will be provided by the lender during the application process.

We regularly update our product data to ensure accuracy, but cannot guarantee that all lender changes are reflected in real time.