How to get the best rate on a £10,000 personal loan

Editor, Consumer Finance: Michelle Blackmore

Last Updated: March 2, 2026

In This Article

Quick Answer: Typical rates for well-qualified applicants range between 6% and 9% APR for a £10,000 loan over five years. Your actual rate depends on your credit profile, income, and the lender’s assessment. To strengthen your position, keep your credit score up to date and avoid multiple loan applications close together.

Borrowing £10,000 can be a practical way to fund a major purchase such as a car, wedding loan or a home improvement project. It could also be used to consolidate existing credit, or cover planned expenses without relying on credit cards.

For borrowers with good credit, lenders often reserve their lowest advertised rates, but the rate you receive still depends on how your profile matches their criteria.

Lenders will also assess your income stability, existing credit commitments and overall financial profile to determine whether the loan is suitable. Using an online eligibility checker can help you understand which lenders may consider your application, without affecting your credit score. This allows you to compare potential options, check representative examples, and make a more informed decision before you apply.

This guide explains how personal loan rates are set, what affects your eligibility, and how to find competitive offers through online eligibility checkers.

How lenders decide your personal loan rate

When you apply for a personal loans, lenders assess how risky it is to lend to you before deciding the rate. The interest rate you are offered is linked to your credit profile, income, and how affordable the repayments are over time.

Even if a lender advertises a low representative APR, it only has to offer that rate to at least 51% of accepted applicants. The rest may receive a higher rate depending on their credit score, borrowing history, and application details.

- Representative APR reflects the rate most, but not all, successful applicants receive.

- Affordability checks include income, spending, and existing credit commitments.

- Soft-search eligibility checks show likely rates without affecting your credit score.

Lenders use information from credit reference agencies, your declared income, and your recent borrowing behaviour to predict the chance of missed payments. Applicants with stable income, low utilisation of existing credit, and a strong repayment record are more likely to be offered the lowest available rates.

What affects your eligibility for the lowest APR

Lenders offer their most competitive rates to applicants who meet their ideal profile. Even if you have good credit, small differences in your financial situation can change the rate offered. Understanding what lenders look for can help you strengthen your position before applying.

- Credit score. A strong repayment history, low credit utilisation, and no recent missed payments can make you appear lower risk to lenders.

- Income and stability. Regular income from stable employment or self-employment reassures lenders that repayments are affordable.

- Existing borrowing. High levels of debt or multiple active credit accounts can reduce your chances of getting the best rate.

- Application behaviour. Submitting several credit applications close together may temporarily lower your score and suggest financial pressure.

- Loan term and amount. Shorter terms often have lower total interest costs, while higher borrowing amounts may qualify for slightly lower APRs depending on lender criteria.

Improving even one of these areas before applying can increase your likelihood of being offered a more competitive rate. For more detail on what lenders look for, read our full guide on personal loan eligibility.

Mintip: Making small improvements, like lowering card balances or updating your address details, can make a difference to the rate you are offered. Checking your eligibility first through a soft search can help you find lenders most likely to approve you without leaving a mark on your credit score.

LOAN APPROVAL CHECKER

See your chances of getting a loan approved

Applying for loans isn’t always straightforward, and rejections are frustrating. We give you access to a lender panel that runs a personalised pre-approval check, showing the loans you’re more likely to be accepted for. Pre-approval does not guarantee acceptance and is subject to further lender checks.

Find lenders that are more likely to accept you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender. UK residents only. Terms of Use apply.

How to compare £10,000 loan offers

Comparing personal loans is one of the most effective ways to find a better rate, but it is important to do so without damaging your credit profile. Many UK lenders now use soft-search technology, which allows you to check your eligibility and likely APR before submitting a full application.

- Use regulated comparison tools. Use platforms that work only with FCA-authorised partners, giving you transparency on how your data is used.

- Check the representative APR carefully. It shows the rate offered to at least 51 percent of successful applicants, but the actual rate depends on your personal circumstances.

- Compare total cost, not just APR. Fees, repayment term, and flexibility can make a big difference to what you pay overall.

- Read the key information before applying. Understanding any early repayment fees or conditions helps avoid surprises later.

By using a soft search eligibility checker, you can view potential loan options side by side and make an informed decision without affecting your credit score. This gives you confidence that the rate and term you accept are affordable and suited to your financial plans.

Example of how APR changes total cost

Here is a simple illustration for a £10,000 loan repaid over five years. The figures are estimates to show how the APR affects monthly payments and total cost. Your actual rate and repayments will depend on your profile and the lender’s assessment.

Loan Amount: £5,000 with a loan term of 5 years.

- At 6% APR: monthly payments of about £193 per month, total repay around £11,600, interest about £1,600.

- At 9% APR: monthly payments of about £208 per month, total repay around £12,455, interest about £2,455.

Even small differences in APR can add hundreds of pounds to the total you repay. Compare offers using soft-search tools and check the term, fees, and flexibility as well as the rate.

These figures are for guidance only and do not represent any specific lender or offer. Even small differences in APR can add hundreds of pounds to the total you repay. Always check the terms offered to you by your lender and understand them thoroughly before making a commitment.

What can I use my £10,000 loan for?

People often use a £10,000 personal loan for planned, one-off costs such as a car purchase, home improvements, debt consolidation or a major life event. Borrowing should always fit your budget and a clear repayment plan. You’ll be asked to state the purpose on your application. Lenders may not accept some uses, such as gambling or certain types of investment.

I'm looking for a car loan

A car loan can help you buy a new or used car outright, giving you flexibility beyond dealership finance. Make sure the repayments fit your budget and the term suits how long you plan to keep the car. Checking affordability in advance helps avoid taking on more than you can manage.

I want to borrow for my wedding

Weddings often involve one-off costs such as venues, catering and travel. A wedding loan can help spread these expenses into regular repayments, easing short-term pressure. Only borrow what you can comfortably repay after the event so your celebration remains memorable for the right reasons, not financial stress.

I want to consolidate existing debt

A £10,000 loan can also be used to combine existing debts into one structured repayment. This may simplify budgeting and reduce stress, but ensure the new loan is affordable and does not extend your debt longer than necessary. Always check that consolidation genuinely lowers your total interest and repayment cost.

I want to borrow for home improvements

Many homeowners use a £10,000 loan to fund upgrades like a new kitchen, bathroom or energy-efficient changes. Borrowing for home improvement can make sense if it adds comfort or value, but always check the total cost, including interest and fees, to be sure the work remains within your planned budget.

Checklist: What you need to apply and get approved for a £10,000 loan

Before applying for a £10,000 personal loan, it helps to make sure you have the right information and documents ready. Being prepared can speed up the process and improve your chances of approval.

- Proof of identity and address. Most lenders will ask for official documents such as a passport, driving licence, or recent utility bill to confirm who you are and where you live.

- Bank and income details. Have recent payslips or bank statements available to show a stable income and consistent cash flow.

- Employment information. Lenders may ask for your job title, employer, and length of employment to assess stability.

- Monthly outgoings. Be ready to share details of rent, mortgage, bills, and other regular payments to help lenders complete affordability checks.

- Accurate credit information. A strong credit history, low credit utilisation, and up-to-date personal details can all support approval for a competitive rate.

- Eligibility check. Using a soft-search tool before you apply helps you see which lenders are most likely to approve you without affecting your credit score.

Taking time to prepare this information in advance can make your loan application smoother and more successful. It also helps you compare offers confidently and choose a loan that fits your financial situation.

Before you apply

Taking time to compare lenders, review your eligibility, and prepare the right information will help your loan application go smoothly. It also ensures you only borrow what fits comfortably within your monthly budget.

Before applying anywhere, double-check the representative APR, total repayable amount, and any early repayment terms. Using a soft search eligibility checker. first lets you see your likely rate and approval chances without affecting your credit score. A little preparation now can help you make a confident, informed choice later.

Need extra support? If you’re worried about meeting repayments or managing existing credit, free and confidential help is available. You can contact StepChange or MoneyHelper for independent advice and guidance on debt and budgeting.

Frequently asked questions

What credit score do I need for a £10,000 loan?

There is no single score that guarantees approval. Lenders assess your whole financial picture, including repayment history, income stability, and existing borrowing. People with strong credit and steady income are more likely to be offered lower interest rates.

How long can I borrow for?

Most personal loans run for one to seven years. Shorter terms mean higher monthly payments but usually a lower total cost overall, while longer terms reduce your monthly amount but increase the total interest paid.

Does checking eligibility affect my credit score?

No. Soft-search eligibility checks let you see your likelihood of approval and the rate you might be offered without affecting your credit score. A full application uses a hard credit search, which is recorded on your file.

Can I repay a £10,000 loan early?

Yes, many lenders allow early repayment. You may be charged an early settlement fee or interest up to a settlement date in your agreement, so it’s best to review the key information before you apply.

Can I get a £10,000 loan if I’m self-employed?

Yes, it’s possible to get a £10,000 personal loan if you work for yourself, though lenders may ask for extra evidence of income. Recent bank statements, tax returns or SA302 forms can help prove affordability. A strong credit record and stable trading history will improve your chances of approval.

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Related Articles

Oakbrook Loans Review

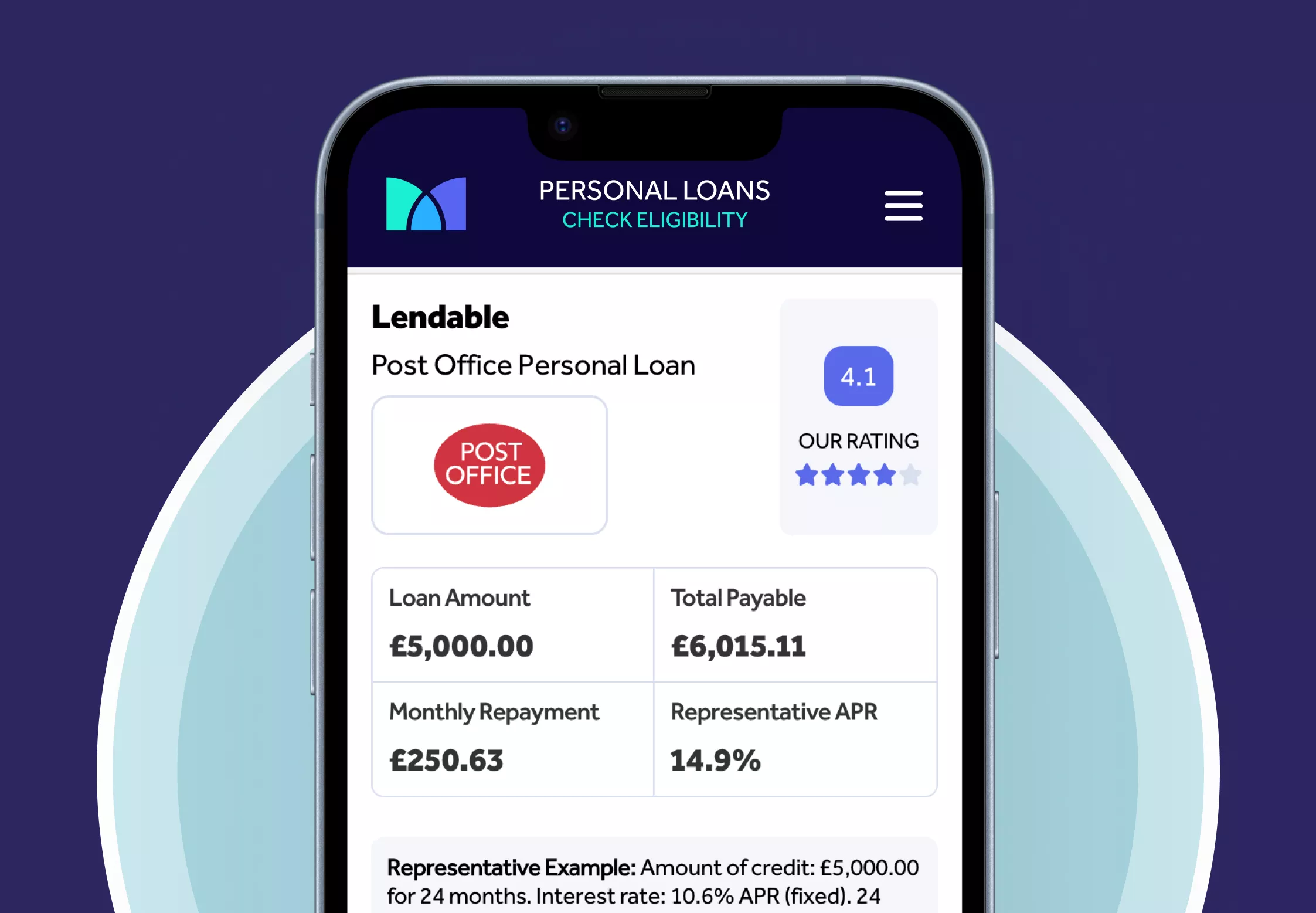

Lendable Loans Review

How to Apply for a Car Loan in the UK

My Community Finance

Asda Loans Review

Post Office Loans Review

The content presented here has been impartially gathered by the Mintify team and is offered on a non-advised basis for informational purposes only. We adhere to strict editorial integrity