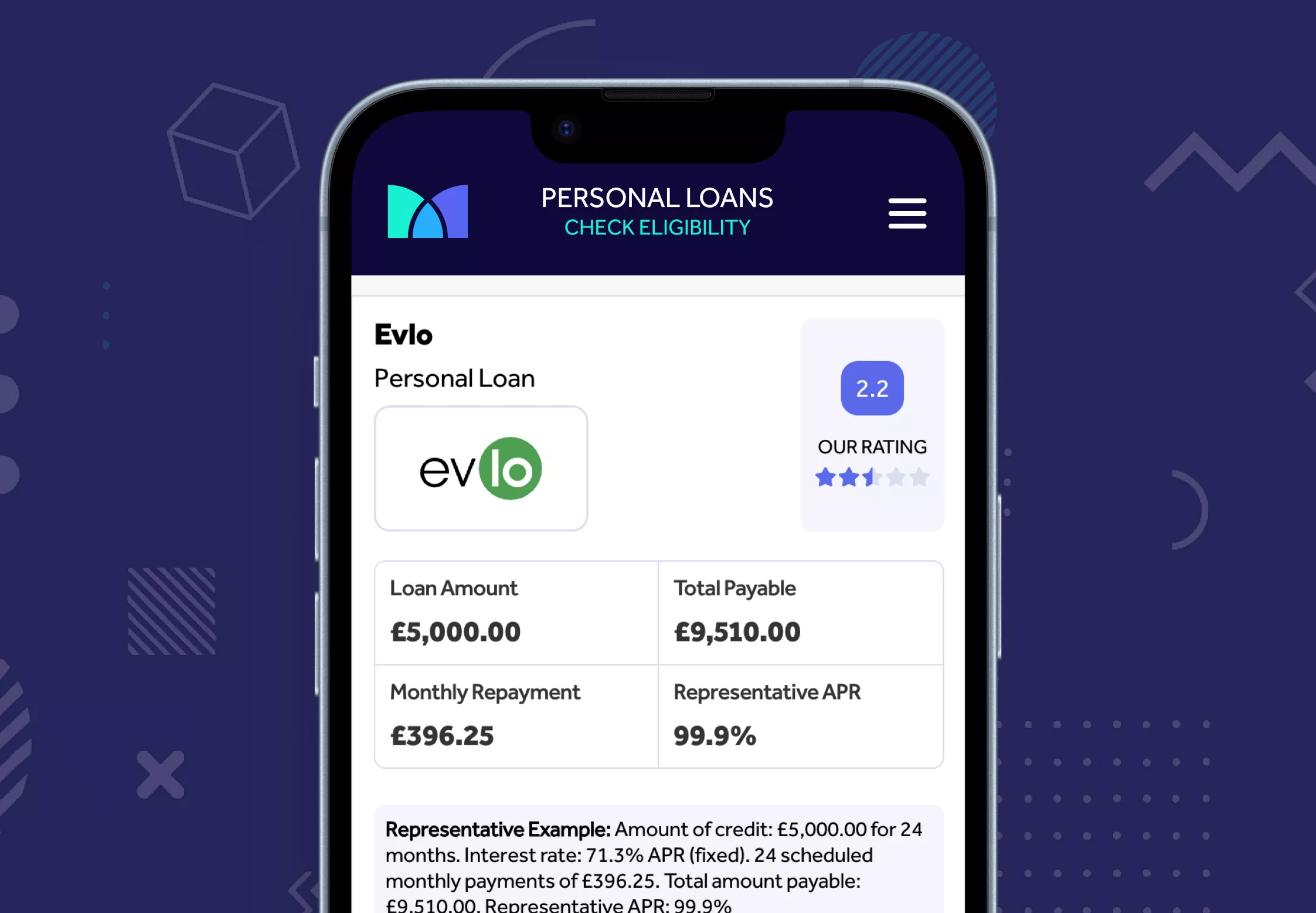

Evlo Loans review: Is Evlo legit, safe and worth It?

Editor, Credit Cards: Michelle Blackmore

Last Updated: February 5, 2026

In This Article

Evlo provides unsecured personal loans and usually consider applicants who have found it harder to qualify with mainstream lenders. It’s designed for borrowers with fair or limited credit histories who want to consolidate debts or cover essential costs.

But is Evlo legit? How does it actually work? And is it worth considering?

Here’s everything you need to know.

What is Evlo?

Evlo is a UK lender offering unsecured personal loans, typically for people with limited or less-than-perfect credit histories. The brand was formerly known as Everyday Loans, rebranded to Evlo in 2025.

Evlo provides loans between £1,000 and £15,000, repayable over 18 to 60 months. Interest rates are personalised and depend on the borrower’s income, credit history, and affordability checks. Unlike most online-only lenders, Evlo maintains a branch-based model, meaning applicants can receive their loan decision online but complete the agreement in person at one of its UK branches.

Evlo say that this allows them to explain the details of the loan clearly, answer any questions, and assess whether the product is suitable for the customer’s circumstances. The approach is designed to promote transparency and responsible lending, particularly for borrowers who may have been declined by other providers.

How does Evlo loans work?

You can start by completing a free eligibility check to see if you could qualify for a loan with Evlo or another lender. This uses a soft credit search, meaning it won’t affect your credit score.

If you’re matched with Evlo, the next step is to confirm your details and arrange a branch appointment. During the appointment, you’ll discuss your financial situation, provide documents such as proof of income and address, and complete affordability checks before a lending decision is made.

Loan rates are personalised, based on your credit profile and income. Monthly repayments are made by direct debit, and you can repay early without penalty fees, although interest will still apply up to the date of settlement.

Key points:

- Check your eligibility first; it’s free and won’t affect your credit score.

- Loan agreements are typically finalised in person at a local branch before funds are released.

- Rates and terms depend on your circumstances and affordability.

- You can repay early with no penalty fees yet interest will still be charged.

Who owns Evlo?

Evlo was previously known as Everyday Loans Limited, part of the Non-Standard Finance (NSF) Group, a company that specialised in credit products for customers who may not meet mainstream lending criteria. Evlo is authorised and regulated by the Financial Conduct Authority under firm reference number 724445 and is registered in England and Wales. Its head office is located in Bourne End, Buckinghamshire.

Following a period of restructuring and rebranding, the business changed its name to Evlo Loans Limited in 2025. It continues to operate as a UK-based lender offering unsecured personal loans under full regulatory oversight.

What do Evlo say about their rebrand?

“Evlo marks the beginning of a new era in our mission to tackle financial exclusion. This rebrand reflects our ambition to provide credit and lead the industry in responsible lending and accessibility. We are strengthening our commitment to customers who need us most.”

Jono Gillespie, Chief Executive Officer

This statement reflects Evlo’s description of its own product. Consumers should always compare APRs, fees and eligibility across providers before applying.

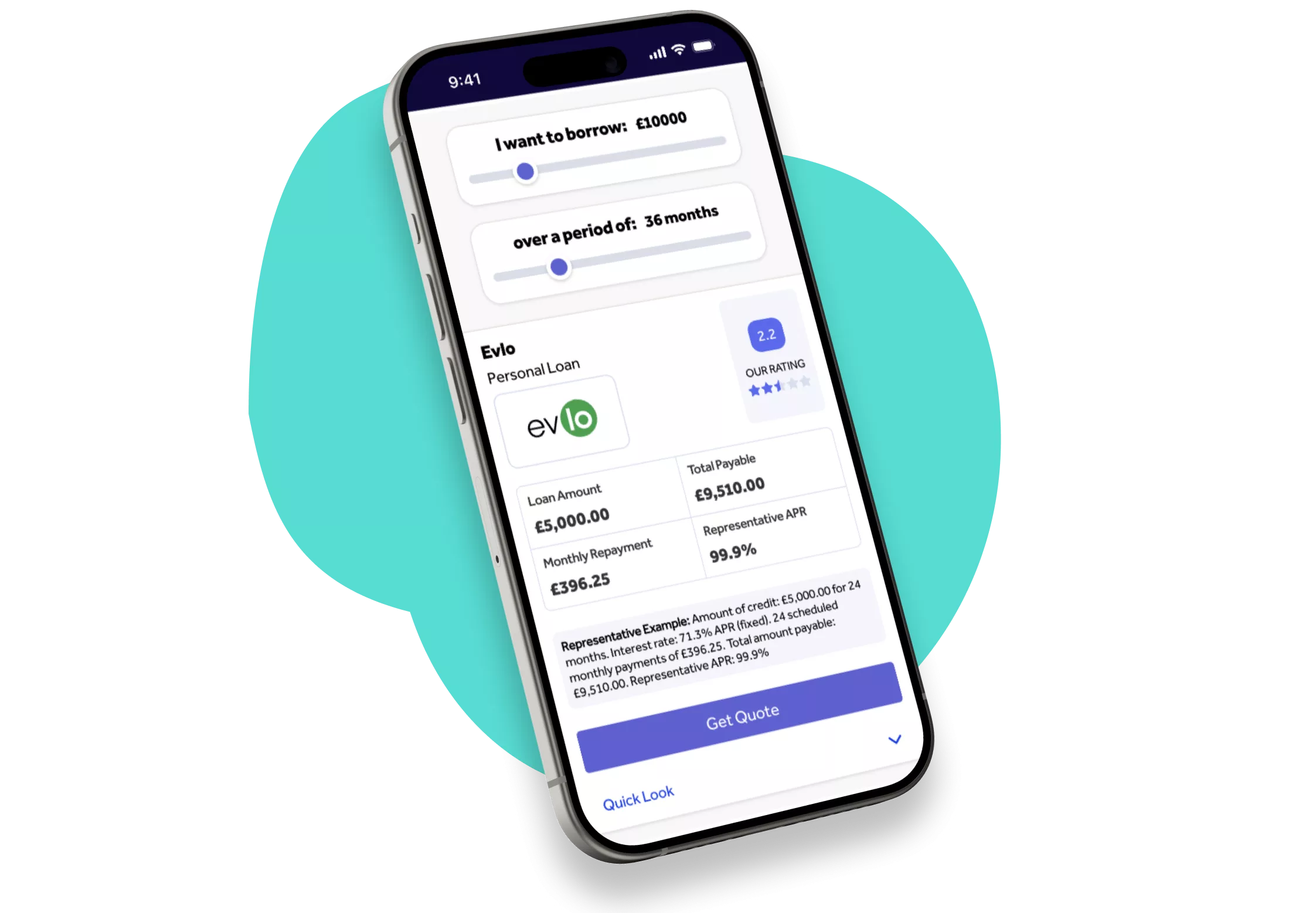

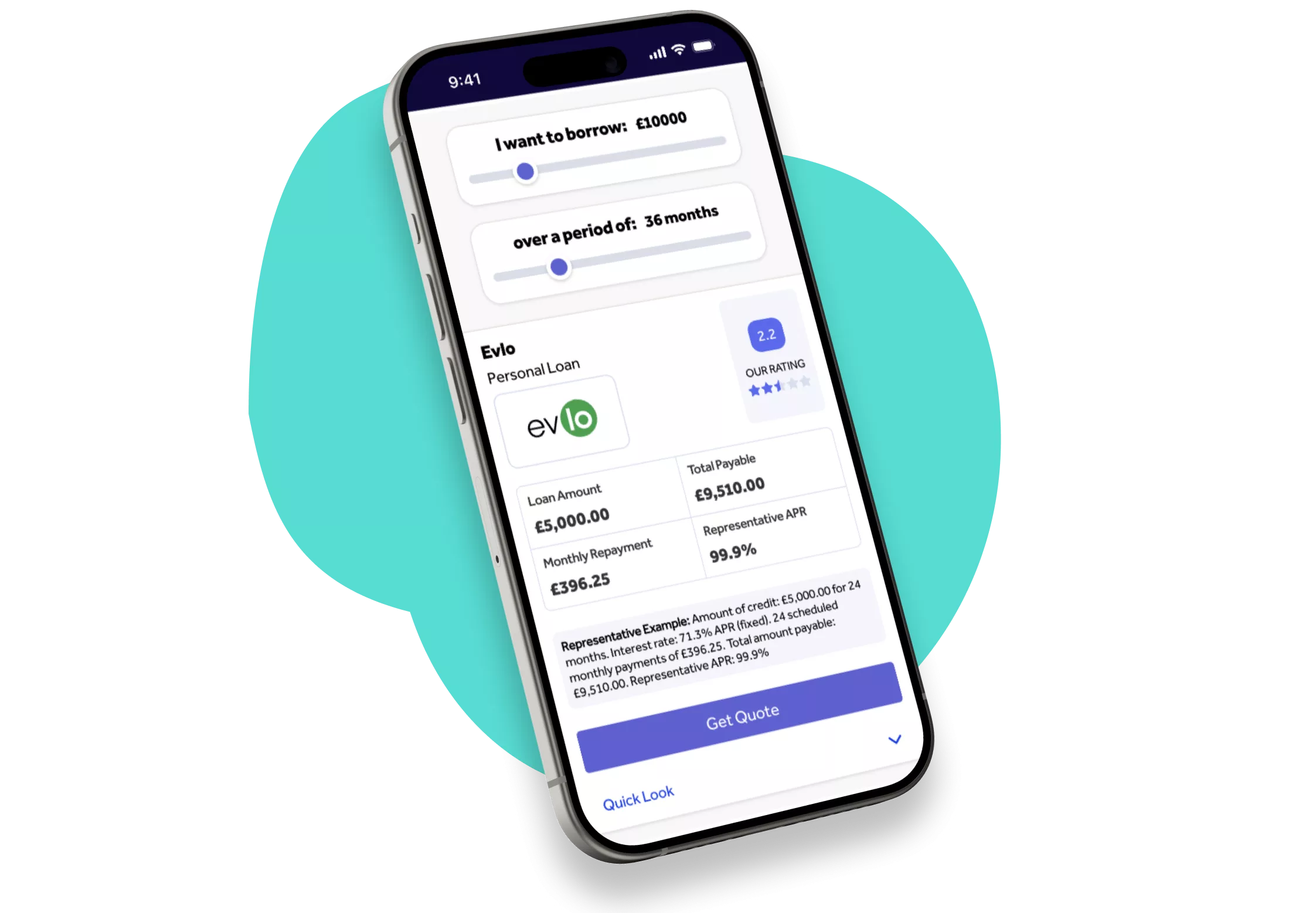

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Who can apply for a loan with Evlo?

Evlo offers personal loans to a wide range of UK borrowers, including those with fair, limited, or less than perfect credit histories. Applications are assessed individually, and lending decisions depend on a mix of credit history, income, and affordability checks.

You may be eligible if you meet the following criteria:

- You’re aged 18 or over

- You’re a UK resident

- You have a regular income from employment, self-employment, or benefits

- You can provide proof of ID, address, and income

- You have a UK bank account

Evlo loans can be used for debt consolidation, home improvement, car finance, or other essential expenses. Because interest rates can be higher than mainstream loans, it’s worth considering whether borrowing is the right option for your situation. Make sure the reason for the loan makes financial sense and that the repayments are comfortably affordable.

Important to know:

- All lending is subject to status and affordability checks.

- Approval is not guaranteed and will depend on your personal circumstances.

- Interest rates and loan amounts vary based on credit history and income.

Always check the total cost of credit and not just what you’ll pay each month.

How do I apply for an Evlo loan?

The easiest way to begin is by checking your eligibility. This allows you to see whether you may qualify for a loan from Evlo or other lenders, using a soft credit search that will not affect your credit score.

If Evlo appears among your matched options and you decide to go ahead and apply, you’ll then likely be invited to confirm your details and arrange a branch appointment. During this appointment, Evlo will review your identification, address and income documents, and assess affordability before making a lending decision.

Once your application has been approved and the loan agreement signed, funds are normally transferred to your account soon after, depending on your bank and individual circumstances.

Recap of application process:

- Check your eligibility.

- Bring proof of income, address, and ID to your branch appointment.

- Funds are released once all checks and the agreement are complete.

Mintip: If you’re thinking about taking out a loan to pay off other debt, make sure it genuinely helps you move forward and not just delay repayments. If you’re unsure, speak to a free and impartial service like StepChange or MoneyHelper before committing.

How long do Evlo loans take?

Because Evlo loans involve an in branch appointment, the full process can take slightly longer than purely online lenders. The initial eligibility check gives you an instant view of whether you may qualify, but final approval happens once your documents and affordability are confirmed in person.

In most cases, the process from application to receiving funds takes a few working days once all checks are complete, depending on branch availability and how quickly documents are provided.

Timeline:

- Use an online eligibility checker.

- Branch appointment required before the loan is finalised.

- Once all signing is completed, check directly with Evlo on when they will release the funds.

Is Evlo a secured loan?

No. Evlo loans are unsecured personal loans. This means you do not need to use your home, car, or any other asset as security to borrow. Your application is assessed based on your credit history, income, and ability to make repayments.

Because the loan is unsecured, interest rates can be higher than for secured or homeowner loans. However, borrowers do not risk losing property or assets if payments are missed, although missed or late payments can still negatively affect your credit score.

Key loan details:

- Evlo loans are unsecured, no collateral or assets are required.

- Approval depends on income, credit history, and affordability.

- Missed payments can affect your credit profile.

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Is Evlo a good option?

Evlo can be a suitable option for people who want a more personal approach to borrowing and may not meet the criteria of mainstream lenders. Its in branch model provides the opportunity to discuss your situation face to face before agreeing to a loan, which some borrowers may find reassuring.

However, Evlo’s personalised service comes with trade offs. Rates can be higher than those offered by online only or prime lenders, and completing the process in person takes more time than a fully digital application. As with any credit product, the right choice depends on your financial circumstances and what you can comfortably afford to repay.

Evlo loans:

- may suit borrowers with fair or limited credit history.

- offers in-branch support and personal affordability review.

- has rates that can be higher than mainstream or online lenders.

- are subject to status and affordability checks.

Mintip: Be aware of the total cost of credit, not just the interest rate. Always check how much you will repay in total, including interest, before signing a credit agreement. Make sure the loan fits comfortably within your budget and avoid borrowing more than you need.

Is Evlo legit and safe?

Yes. Evlo is a legitimate and fully regulated UK lender. The company is authorised and regulated by the Financial Conduct Authority under firm reference number 724445 and operates in accordance with the Consumer Credit Act and FCA Consumer Duty standards.

Evlo Loans Limited is registered in England and Wales and continues to trade from its head office in Bourne End, Buckinghamshire. It follows strict policies around affordability, responsible lending, and customer transparency.

Your personal information is protected under UK GDPR and data protection laws. Evlo is also registered with the Information Commissioner’s Office (ICO), which regulates how financial firms handle customer data.

Key information about Evlo:

- FCA authorised and regulated (FRN 724445).

- Complies with Consumer Credit Act and Consumer Duty rules.

- Registered with the Information Commissioner’s Office (ICO).

- Subject to UK data protection and privacy regulations.

What do customers say about Evlo?

Reviews on Trustpilot highlight the professionalism and friendliness of Evlo’s staff, with many customers describing their experience as polite, considerate, and supportive. Borrowers often mention feeling welcomed throughout the application process and value the clear, patient guidance provided at every stage.

Consumers frequently comment on:

- The polite and helpful approach of branch staff

- Clear explanations and transparency during the loan process

- An efficient and straightforward application experience

- Personalised service and clear communication

While most feedback is positive, a few reviewers mention mixed experiences with payment handling and account management. As with any credit provider, individual experiences can vary depending on personal circumstances and expectations.

Frequently asked questions

Does Evlo offer loans for bad credit?

Yes. Evlo considers applicants with lower or limited credit histories, but all lending decisions depend on affordability and responsible lending checks.

Can I repay my Evlo loan early?

Yes. You can repay your loan early without any penalty fees, although you’ll still pay interest up to the date your loan is settled in full.

How long does it take to get a decision?

You’ll see an initial soft-search result when you do an eligibility check. Final approval happens once your documents and affordability are reviewed during your in-branch appointment.

Is Evlo a direct lender?

Yes. Evlo Loans Limited is a direct, FCA-regulated lender that provides personal loans directly to consumers rather than acting as a broker.

Do I have to pay any broker fees if I apply through an eligibility check?

No. Checking your eligibility is completely free and does not involve any broker or application fees. You’ll only see loan offers from lenders you’re matched with, and you’re under no obligation to proceed.

Summary: Is Evlo right for you?

Evlo provides a more personal route to borrowing through in branch meetings and tailored affordability checks. It can be useful for people with limited or developing credit histories.

However, if you’re eligible for lower interest rate products from mainstream or digital lenders, those options may work out cheaper overall. Always compare the total cost of credit and check your eligibility across several lenders before applying.

Editorial disclaimer: Content presented here has been impartially gathered and is offered on a non-advised basis for informational purposes only. Always check full details with the lender before applying, and consider whether the product suits your circumstances.

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Related Articles

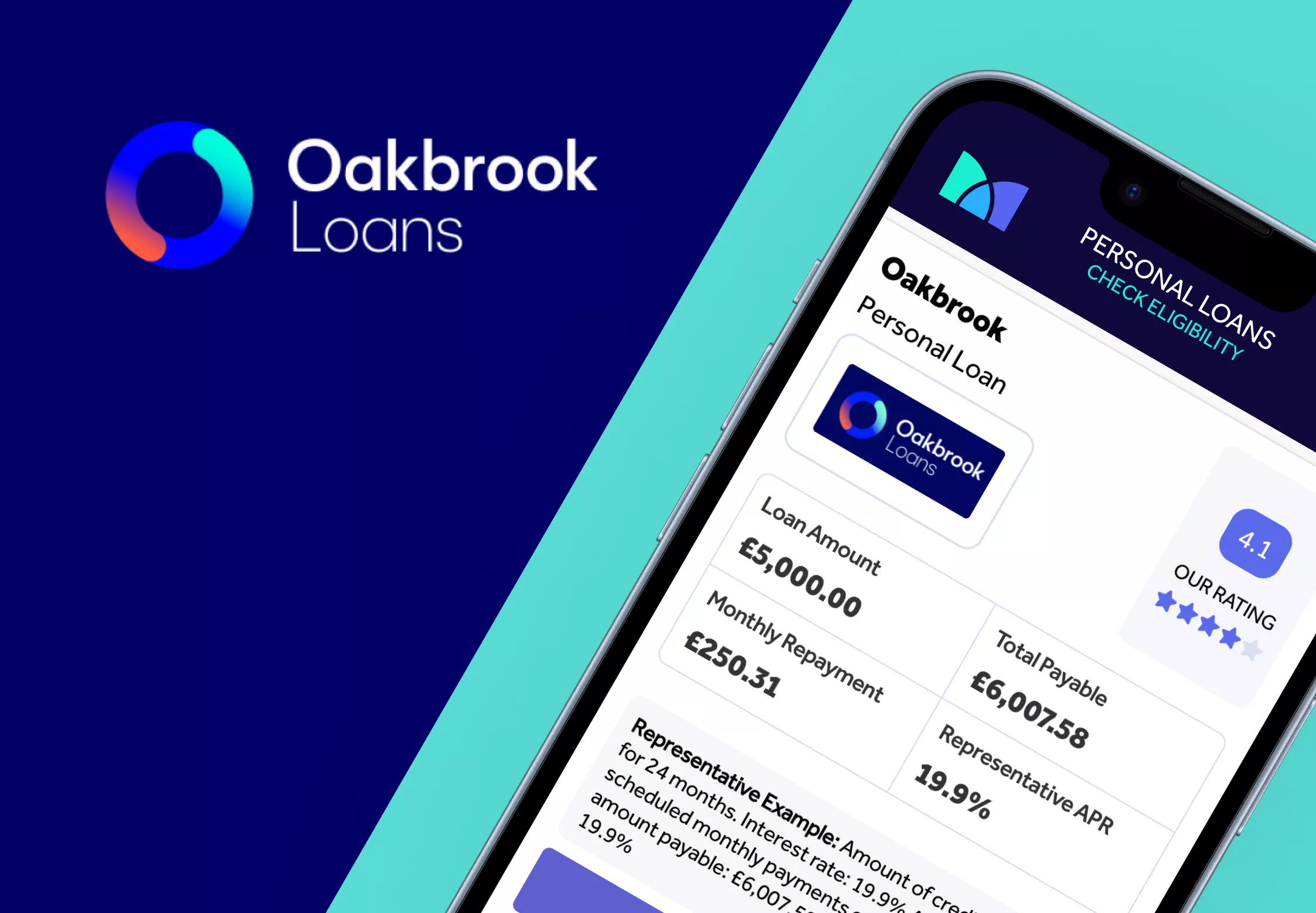

Oakbrook Loans Review

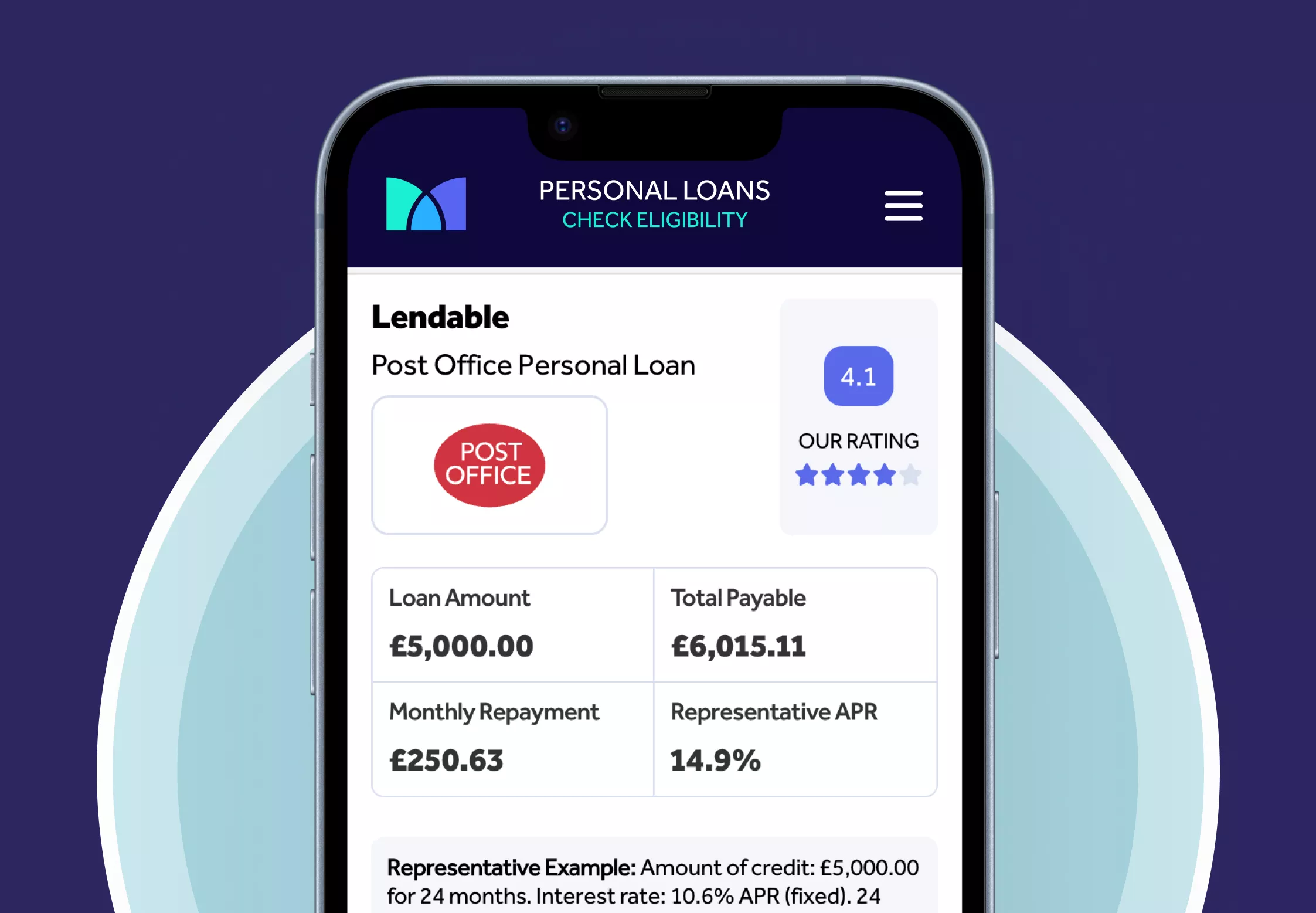

Lendable Loans Review

How to Apply for a Car Loan in the UK

My Community Finance

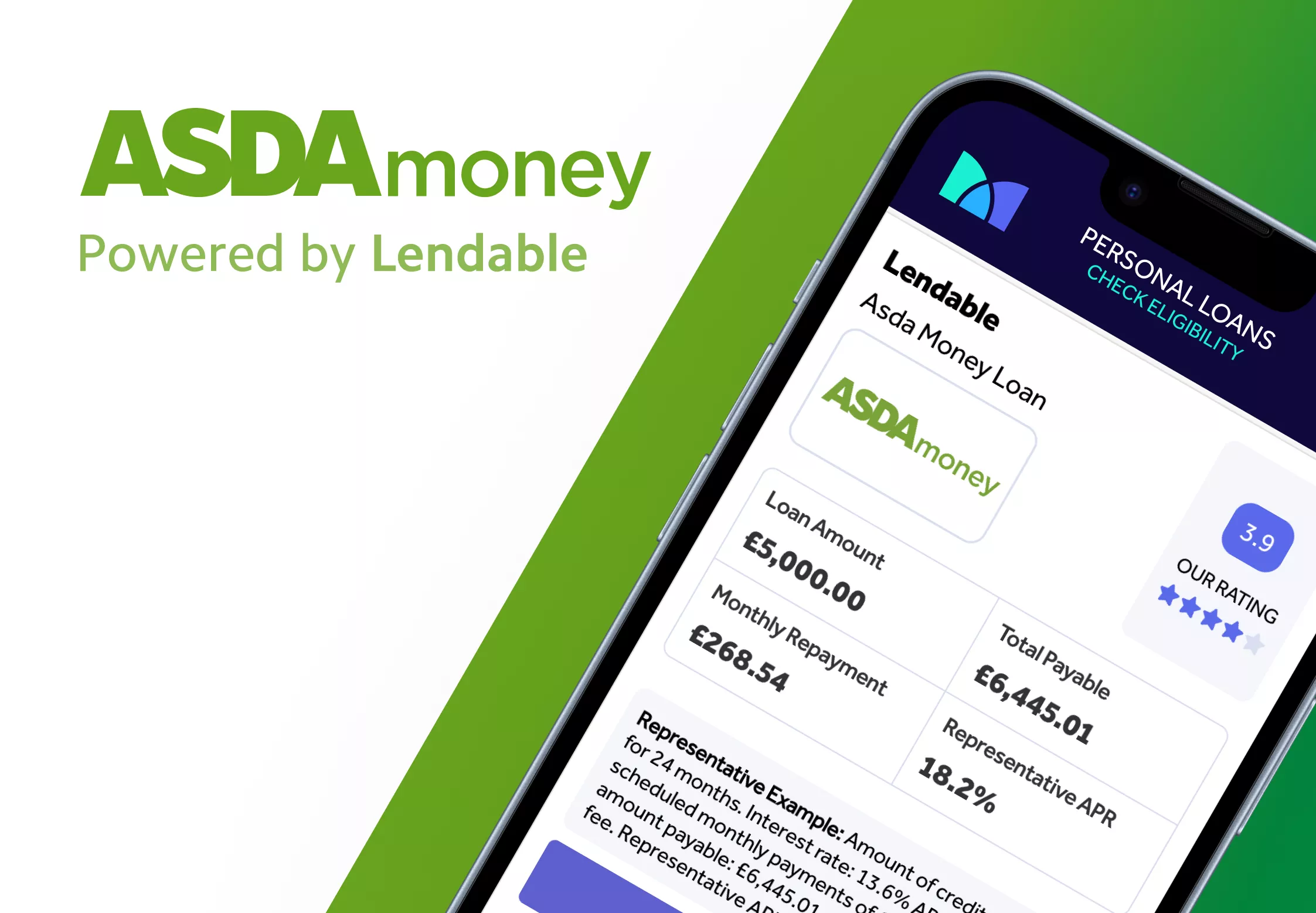

Asda Loans Review

Post Office Loans Review

The content presented here has been impartially gathered by the Mintify team and is offered on a non-advised basis for informational purposes only. We adhere to strict editorial integrity