Home Improvement Loans UK – Calculator and Eligibility

Editor, Consumer Finance: Michelle Blackmore

Last Updated: February 5, 2026

In This Article

Key takeaways on how home improvement loans work:

Home improvement loans in the UK allow you to spread the cost of renovations, extensions and essential repairs. If you want to upgrade your kitchen, add a loft conversion or make your home more energy efficient, a loan for home improvement can help you get started sooner.

This guide explains how home improvement loans work, the pros and cons of borrowing, what to consider before applying and the alternatives available.

- Understand the total loan repayable, loan term, fees, and early repayment charges. Use a calculator to check affordability.

- Check eligibility with a soft search. This does not impact your credit score.

- Alternatives include savings, applicable grants for energy efficiency, or a 0% purchase credit card for short term costs.

- Representative APR: This shows the typical interest rate most applicants are offered, but your exact rate will depend on your personal circumstances and credit history.

- Read about a real-life scenario which could be similar to yours.

Before you start your home improvement project

Renovations can be exciting and stressful at the same time. You may be excited for upgrades that are a necessity or a nice to have, yet have an underlying feeling of anxiety about the cost and whether the finished work will meet expectations. Plans can change mid project, contractors run late or even not show up, and living around dust and noise can really be a pain.

Having a clear plan helps. Set a realistic budget, get more than one quote, and allow a contingency budget for unexpected costs. Where possible, agree the scope in writing, think about how you will live around the works, and allow time for a final inspection before making the last payment. It can also help to decide in advance who will handle any difficult conversations if the work does not turn out as expected.

If you need finance, remember there is more than one route. Many people use an unsecured personal loan for mid sized projects, while secured homeowner loans are available for larger borrowing or longer terms. For smaller or short term costs a 0% purchase credit card be enough. Use a loan calculator to understand monthly repayments and the total repayable, and check your eligibility with a soft search before you apply.

What is a home improvement loan?

A home improvement loan (sometimes called a home renovation loan) is money borrowed to pay for upgrades, repairs or building work on a property. You repay the loan in fixed monthly instalments over an agreed term.

Types of home improvement loans in the UK:

- Unsecured personal loans: no collateral required, typically up to £25,000.

- Secured homeowner loans: larger borrowing limits, secured against a property.

Secured loans are generally an option available to property owners, while renters may only have access to unsecured options.

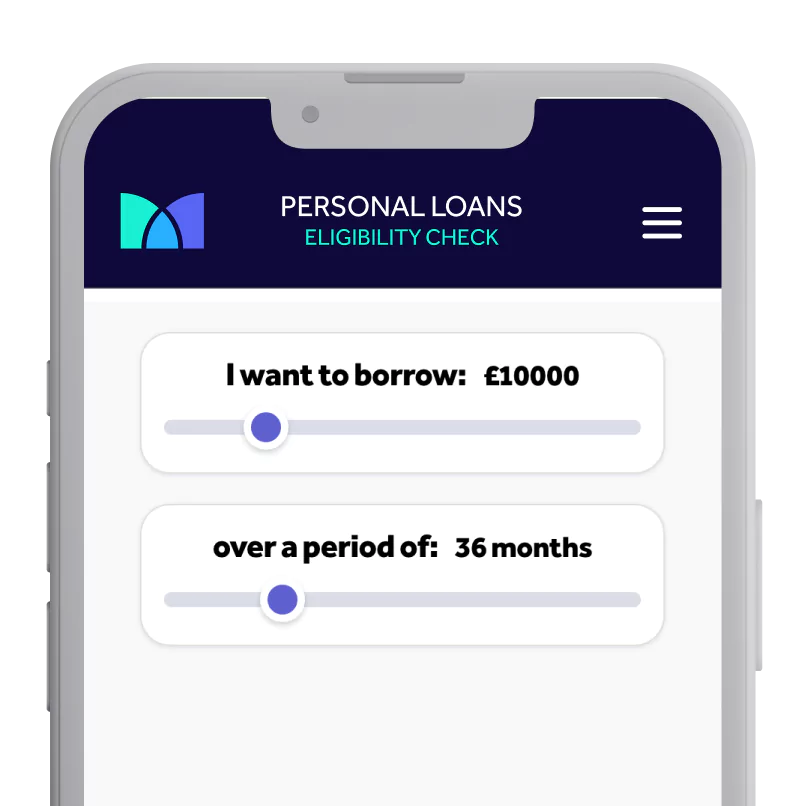

Plan Your Home Loan

Use our Personal Loan Calculator to find the right loan for you.

If you’re planning renovations or essential repairs, a home improvement loan can help you spread the cost with fixed monthly repayments. Using a home improvement loan calculator lets you estimate monthly repayments and the total repayable across different amounts and terms, so you can budget with confidence.

What can I use a home improvement loan for?

Most lenders allow you to use funds for a wide range of projects:

- Kitchen and bathroom refurbishments

- Loft, garage or garden room conversions

- Extensions and new rooms

- Roofing, damp proofing, plumbing or rewiring

- Landscaping, driveways or garden design

- Energy efficiency upgrades such as solar panels or insulation

While home improvements can sometimes add value, the increase in value may not always match the amount you spend.

What is the best way to borrow money for home improvements?

The best option depends on project size, urgency and financial circumstances:

- Personal loan: good for medium projects where predictable repayments matter.

- Secured loan: often chosen for larger projects with higher borrowing limits.

- 0% purchase credit card: useful for smaller projects if the balance is repaid in time.

- Personal Savings: cheapest if you can wait until you have the funds.

- Government grants:sometimes available for energy efficiency projects.

Mintip: Borrowing can make projects possible sooner, but savings or grants may be cheaper where available.

How do home renovation loans work?

Home renovation loans generally follow a straightforward process.

First, you compare deals by checking your eligibility and looking at APRs, monthly repayments and fees. Many lenders and brokers provide a free home improvement loan calculator, which helps you estimate the cost before applying online. Once you are ready, you submit your application.

If approved, the funds are usually released within a few days, and in some cases within 24 hours. The money is provided as a lump sum that you can use to pay for your renovations, with most lenders placing no restrictions on how it is spent, provided it is for legal purposes.

Finally, you repay the loan in fixed monthly instalments. Early repayment is sometimes allowed, although some lenders may charge a fee for settling the balance ahead of schedule.

Remember: Results from calculators and eligibility checks are indicative only; your final offer may change after a full assessment by the lender.

Pros and cons of a home improvement loan

Pros

- Start projects sooner without waiting to save

- Quick access to funds, sometimes within 24 hours

- Fixed monthly repayments make budgeting easier

- Repayment terms from 1 to 10 years (longer if secured)

- Flexibility in loan size and use of funds

- Useful in an emergency situation when you don’t have the time to save

Cons

- Interest adds to overall project cost

- Missed payments may harm your credit score

- Secured loans could put property at risk if repayments are missed

- Higher rates for borrowers with poor credit history

- Improvements may not always increase value by as much as they cost

Mintip: Borrowing can make projects possible sooner, but savings or grants may be cheaper where available.

Are there interest-free home improvement loans?

Interest-free options are rare, but there are situations where they may be available. Some local authorities occasionally provide energy-efficiency loans at zero interest, typically for improvements such as insulation or heating upgrades. Another possibility is a 0% APR credit card, which can be useful for smaller, short-term projects, provided the balance is fully repaid within the promotional period.

Can I get a home improvement loan with bad credit?

Yes, it is possible to get a home improvement loan with bad credit, though your options may be more limited and the interest rates are often higher. Lenders assess applications based on credit history and affordability, so approval can be more difficult if your score is low. That said, there are specialist lenders who focus on borrowers with weaker credit profiles, and unsecured loans remain an option in some cases, especially where lenders specifically cater to credit rebuilding. Using an eligibility checker before applying can help you see which loans you are more likely to be accepted for without affecting your credit score.

- Guarantor loans: require a co-signer, often a family member, who promises to cover repayments if you cannot.

- Secured loans: may be easier to obtain if collateral such as your property is available, though this carries the risk of repossession if repayments are missed.

- Unsecured loans: some lenders offer personal loans designed for borrowers with bad credit, though the interest rates are usually higher.

Mintip: Borrowers with bad credit may face higher costs overall, so improving your credit score before applying could give you access to cheaper rates and broader options.

What home improvement grants are available in the UK?

In some cases, UK homeowners or tenants may be eligible for grants or interest-free loans to help with essential improvements. These schemes are usually aimed at improving safety, accessibility or energy efficiency, and are most often available to low-income households, older residents or people with specific health needs.

Examples of upgrades that may be supported include:

- Loft and cavity wall insulation

- Boiler replacement or central heating upgrades

- Solar panels and renewable heating systems

- Urgent repairs such as unsafe wiring, roofing or damp treatment

Eligibility can depend on several factors such as income level, whether you receive certain benefits, the age or vulnerability of household members, and the condition of your property. Most schemes require documentation such as proof of income, ownership or tenancy, and in some cases evidence of disrepair.

How to apply: Most applications are handled through your local council or directly via GOV.UK. You may need to arrange an inspection before funding is approved. Grant amounts vary significantly from a few hundred pounds for minor works up to much higher amounts for urgent health and safety repairs but availability is limited and can change depending on funding rounds.

It is important to check the latest options with your council or government website, as many schemes are time-limited and only open in specific regions. If no grant is available or if the funding only covers part of your project, a home improvement loan could be an alternative way to spread the cost. Always compare the total repayable cost and ensure repayments are affordable before committing.

Case study: borrowing for renovations on a fixer-upper

A couple in their mid 20s moved into a fixer-upper and want to accelerate the renovation process. Their combined income is £4,000 a month, with a £900 mortgage and no other debts. After bills, they usually have £500–£800 available each month to put toward improvements. They have been doing some DIY but progress feels slow, and they want the house in better shape so they can run a business from home.

They have looked at a £15,000 home improvement loan. At around 6% APR, this would mean repayments of about £290 a month over 5 years, with total interest just over £2,400. On paper the repayments fit within their budget, but it raises the question: is this good borrowing or unnecessary debt?

Factors in favour of borrowing

- Affordability: £290 is within their disposable income, leaving room for other costs.

- Purpose: the money would be used to improve the property and create space for a business that could increase their income.

- Track record: they already use credit responsibly, clearing a 0% credit card in full each month and avoiding lifestyle debt.

Risks to consider

- Increased commitments: fixed repayments over 5 years would reduce flexibility in their monthly budget.

- Uncertainty: if income fell or unexpected expenses came up, the loan could become harder to manage.

- Value gap: not all home improvements add as much value to a property as they cost, so the financial return may not fully offset the borrowing.

What to consider before deciding to take out a home improvement loan

- Monthly repayments: think carefully about whether you can afford the repayments comfortably alongside your other commitments.

- Total repayment: look at the overall amount you will repay over the full loan term, not just the monthly figure.

- Early repayment charges: some lenders apply fees if you want to clear your loan before the agreed term.

- Alternatives to borrowing: consider whether saving first or using a 0% purchase credit card could be cheaper for your project.

- Secured loan risks: if you choose a secured loan, remember your property is at risk if you do not keep up repayments.

Mintip: Always review the total amount repayable, not just the monthly repayment, to understand the full cost of borrowing.

*Pre-approved is not guaranteed acceptance.

Get Pre-Approved for a Home Improvement Loan

Find lenders that can approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Frequently asked questions about Home Improvement Loans

What is the difference between a home improvement loan and a home renovation loan?

While the terms are often used interchangeably, a home renovation loan typically refers to loans used for upgrading existing structures, while a home improvement loan can cover broader projects, including extensions and energy efficiency upgrades.

Are there home improvement loans for renters in the UK?

Most home improvement loans are designed for homeowners, but renters can explore personal loans for smaller projects, provided they have the landlord’s permission.

What can I use a home improvement loan for?

Typical uses include kitchen and bathroom refits, loft or garage conversions, extensions, roofing and damp repairs, rewiring, landscaping, and energy efficiency upgrades such as insulation or solar panels.

Can I use a home improvement loan for landscaping?

Yes. Many lenders allow funds for gardens, driveways and outbuildings, but you should check the lender’s permitted uses first.

How long can I borrow for?

Personal loans usually run from 1 to 7 years. Secured homeowner loans often range from 5 to 25 years. Longer terms reduce monthly repayments but could increase the total interest paid. If you are nearing retirement, consider how future income changes may affect affordability.

Are there interest-free home improvement loans?

Interest-free options are rare. Some local authority schemes support energy efficiency works, and 0% APR credit cards can help with smaller, short-term costs if the balance is repaid within the promotional period.

How do home renovation loans work?

You compare deals and check eligibility, apply online, receive a lump sum if approved, and repay in fixed monthly instalments over an agreed term. Many lenders and brokers offer a loan calculator to estimate costs before applying.

Home improvement loans, what are my options?

Options include unsecured personal loans, secured homeowner loans for larger amounts or longer terms, specialist renovation loans, and for smaller purchases, a 0% purchase credit card if you can clear the balance in time. Secured borrowing is optional rather than standard.

How do most people manage to fund home improvement?

Common routes are savings, unsecured personal loans, secured homeowner loans, 0% purchase credit cards for smaller costs, and in some cases local grants for energy efficiency or essential repairs.

Should I save first and then do my home improvement or should I take out a loan?

Saving avoids interest and can be cheaper overall. A loan lets you start sooner and spread the cost. The right choice depends on urgency, affordability and project size.

What are the disadvantages of taking out a personal loan for home improvements?

Interest increases the total cost, missed payments may harm your credit score, and some lenders charge early repayment fees. Rates may be higher if you have a weaker credit history.

Can I get a home improvement loan with bad credit?

It is possible, but choices may be limited and costs higher. Some lenders offer specialist unsecured loans, and guarantor or secured options exist. Using an eligibility checker can help you see likely approvals without affecting your credit score. Improving your credit first may unlock better rates.

Making the right call for your home

Home projects are personal. The right finance depends on your timeline, budget and comfort with risk. Many people use unsecured personal loans for mid sized work, secured homeowner loans are an option for larger projects and longer terms, and grants or a 0% purchase credit card can help with smaller or energy focused upgrades. It is absolutely fine to wait and save if that keeps costs down.

Some practical tips would be to actually be pragmatic. Set a total budget, get at least two quotes and include a contingency budget just in case you need it. Use a loan calculator to see monthly repayments and the total repayable. Keep repayments comfortably within your household budget. If you choose a secured loan, remember your property is at risk if you miss repayments. If you are nearing retirement, check the term fits future income. If you rent, get the landlord’s permission before starting any works.

When you are ready, check your eligibility with a soft searchh, compare offers side by side and pick the option that fits your plans. Results from calculators and eligibility checks are indicative only; your final offer may change after a full assessment by the lender.

Related Articles

Oakbrook Loans Review

Lendable Loans Review

How to Apply for a Car Loan in the UK

My Community Finance

Asda Loans Review

Post Office Loans Review

The content presented here has been impartially gathered by the Mintify team and is offered on a non-advised basis for informational purposes only. We adhere to strict editorial integrity

Get Personalised Loan Rates

Find lenders that can approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.