Joint personal loans: everything you need to know

Editor, Consumer Finance: Michelle Blackmore

Last Updated: February 5, 2026

In This Article

Quick Summary: A joint personal loan lets two people borrow together and share responsibility for the repayments. Both are liable for the whole amount, and missed payments affect each credit record. It can help with affordability when both incomes are considered, but it increases the commitment for each person.

Applying for a loan with a partner can sometimes make it easier to borrow the amount you need, as two incomes may strengthen the overall application. But joint borrowing also comes with important risks, including the impact on your credit file and the fact that both people become financially linked for the duration of the loan.

Key takeaways

- Joint loans can be secured (using an asset as security) or unsecured (no asset required).

- Both applicants undergo credit checks based on their income, spending and credit history.

- Each person is fully liable for the repayments, so if one cannot pay, the other must cover the shortfall.

- Combining two credit histories may improve eligibility for some applicants, but does not guarantee approval.

- A joint loan simply means more than one person is responsible for repaying the full amount.

This guide explains how joint personal loans work, how lenders assess two people and the key points to consider before applying.

What is a joint personal loan?

Joint loans work in a similar way to individual personal loans, but both applicants are equally responsible for repaying the entire balance. The loan appears on each person’s credit file for the full term, and any missed or late payments will affect both credit score and credit files. Lenders can ask either borrower to repay the full amount if payments fall behind, and the financial link remains in place for as long as the account is active.

- Two people borrow together under joint and several liability.

- The account appears on both credit files for the full loan term.

- Missed payments affect each person’s credit record.

- The financial link remains until the loan is fully repaid.

How do joint personal loans work?

When you apply for a joint personal loan, both applicants complete the application together and provide their individual details. Some lenders require both parties to live at the same address; other lenders are more flexible. The lender then assesses each person separately and as a pair to understand whether the repayments are affordable for the household as a whole.

During the assessment, lenders look at income, regular spending, existing borrowing and each applicant’s credit history. They also consider how your finances interact, including any shared bills or commitments, to build a picture of overall stability and affordability. Two incomes may strengthen an application, but approval is never guaranteed and each person still needs to meet the lender’s criteria.

Loan amounts, interest rates and terms are set based on the combined affordability outcome. The lender will only offer a loan if the repayments appear manageable for both applicants over the full term, taking into account current borrowing and any financial pressures already in place.

- Both applicants complete the application together.

- Lenders assess income, spending, debts and credit history for each person.

- Affordability is calculated on both individual and joint finances.

- Loan amounts and rates depend on the combined assessment.

What should you consider before applying?

Before applying for a joint personal loan, it is important to understand how the decision affects both people. A joint application links your finances and means each person is responsible for repaying the full amount, not just their share. This can be helpful for some households, but it also increases the level of commitment for each borrower.

Some applicants choose a joint loan because two incomes may support affordability, especially if one person might not qualify for the same amount on their own. Others use joint borrowing to manage shared expenses in a single monthly payment. However, both people will be credit checked, and both credit files will show the loan for the full term.

If one person cannot or chooses not to pay their part, the other person must cover the shortfall. Missed payments will appear on both credit records and may affect future borrowing options for each applicant.

- Both people become responsible for repaying the full loan.

- Each applicant undergoes a credit check and affordability assessment.

- The loan appears on both credit files for the entire term.

- If one person cannot pay, the other must cover the repayments.

Mintip: Before applying for a joint loan, make sure both people are clear on how the repayments will be managed. You should agree how much each person will contribute, how changes in income will be handled and what will happen if one person cannot pay. Clear expectations can help avoid missed payments later.

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Key things to know about joint loans

Joint loans can be both secured or unsecured

Joint loans may be secured against an asset or unsecured, depending on the lender. Most personal loans in the UK are unsecured and do not require assets as security.

Both people take part in the application

A joint loan requires both applicants to complete the application together. Each person provides their income, spending and credit history, and the lender assesses both applicants separately and as a pair.

Both applicants are credit checked

Lenders carry out credit checks on each person. If the loan is approved, it will appear on both credit files for the full term. Any missed payments will affect each applicant’s credit record.

Some lenders charge early repayment fees

Depending on the lender, there may be charges for repaying the loan early. The details are set out in the Summary Box and the credit agreement, so it is important to check these before applying.

Joint loans may allow a higher borrowing amount, but not always

Two incomes can sometimes support a higher loan amount if the combined affordability is stronger, but this is not guaranteed. Lenders still need to see that repayments fit comfortably within each person’s budget.

A joint loan creates a financial link between both people

Once the loan is opened, both applicants become financially associated. Future lenders may consider this link when assessing other credit applications.

What happens if your circumstances change?

A joint loan continues to exist even if the two people named on the agreement no longer live together or no longer share the same financial situation. The lender still treats both applicants as responsible for the full balance, and this does not change unless the loan is repaid or refinanced into a new agreement.

If circumstances change, such as one person moving out or no longer contributing to the repayments, the other person is still required to make the full payment. Missed or late repayments will affect both credit files, regardless of who was meant to pay each month.

Some borrowers ask whether one person can be removed from a joint loan. In most cases, lenders do not remove someone from an existing agreement. The usual options are to repay the loan early or to apply for a new loan in one person’s name to replace the joint loan, but this depends on eligibility and affordability at the time.

- Joint liability continues even if living arrangements change.

- If one person stops paying, the other must cover the full repayment.

- Missed payments affect both credit records.

- Removing a person from a joint loan is rare and usually requires refinancing.

Once a joint loan is fully settled, it may be possible to ask credit reference agencies to remove the financial association. This process is known as financial disassociation. Each agency has its own steps for reviewing these requests, and they may ask for evidence that there is no longer any joint credit in place.

It may help to check your credit reports with Experian, Equifax and TransUnion after the loan has been cleared to confirm whether any financial links remain. These reports can also show if the joint account has been updated to reflect the settlement.

Mintip: If managing the payments becomes difficult or either person is unsure how to proceed, it may help to speak with the lender as early as possible. Free, impartial support is also available through services like StepChange or MoneyHelper.

How joint loans appear on your credit file

A joint loan is recorded on both applicants’ credit files for the full length of the agreement. Future lenders can see the account when either person applies for credit in their own name, as the repayment history is shared between both applicants.

Late or missed payments will be recorded on both credit files. These records could make it harder for either person to borrow in the future. Once the loan is settled, it usually remains on each report for six years from the date it is closed.

- Joint loans are recorded on both applicants’ credit files.

- Opening a joint loan creates a financial association.

- Missed payments appear on both credit records.

- The account usually stays on each file for up to six years after settlement.

Types of joint loans

Unsecured joint personal loans

Most joint personal loans in the UK are unsecured, meaning no asset is required. Both applicants borrow together and share full responsibility for the repayments. The lender reviews each person’s income, spending and credit history to check whether the loan is affordable for the household.

Secured joint loans

Some lenders offer secured joint loans, which use an asset, such as a property, as security. Because the loan is secured against an asset, there is a risk of repossession if repayments are missed. Both applicants must meet the lender’s criteria and remain jointly liable for the full balance.

Joint mortgages

Mortgages are one of the most common types of joint borrowing in the UK. Both applicants are named on the mortgage agreement and are responsible for the full monthly payment. Missed payments will affect each person’s credit file, and the financial link remains for the full mortgage term.

Joint overdrafts

Although not a typical loan, some banks allow a joint overdraft on a joint current account. Both people are responsible for repaying any overdraft balance, and missed payments or unauthorised overdraft use can affect each applicant’s credit record. Availability varies by bank.

Credit cards cannot be held jointly

In the UK, credit cards cannot be opened as a joint account. However, one person can take out a card in their own name and add another individual as an additional cardholder. The main cardholder is responsible for all spending on the account, including purchases made by the additional cardholder.

Is it a good idea to take out a joint loan?

A joint personal loan can help two people borrow together and manage a shared financial commitment. Combining incomes may strengthen an application or increase the amount you can borrow, but the decision must still meet the lender’s affordability checks.

Both applicants are responsible for the full balance, and the loan will appear on each credit file for the entire term. This makes it important that the repayments fit comfortably within both budgets and that each person understands their responsibilities before applying.

Pros of joint personal loans

- Two incomes may improve overall affordability.

- Can help one applicant qualify when applying alone may not be possible.

- Provides one shared repayment instead of managing separate borrowing.

- Positive repayment history can benefit both credit files.

Cons of joint personal loans

- Both people are responsible for the full balance, not just their share.

- Missed or late payments affect both credit files.

- Creates a financial association until the loan is fully settled.

- Removing someone from a joint loan is difficult and may require refinancing.

- If circumstances change, one person may be left covering the full repayment.

It is important to think carefully about who you take out a joint loan with. Because both people become responsible for the full amount, the arrangement tends to work best when both applicants have a similar approach to money and are comfortable managing shared financial commitments. This can help reduce the risk of one person falling behind on repayments and protect both applicants’ credit records. It can also help to think about how stable each person’s income is, how the repayments will be shared and what would happen if circumstances change.

Mintip: Even if two incomes increase the amount you could be offered, it’s still important to choose a loan that’s affordable for both applicants over the full term..

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Related Articles

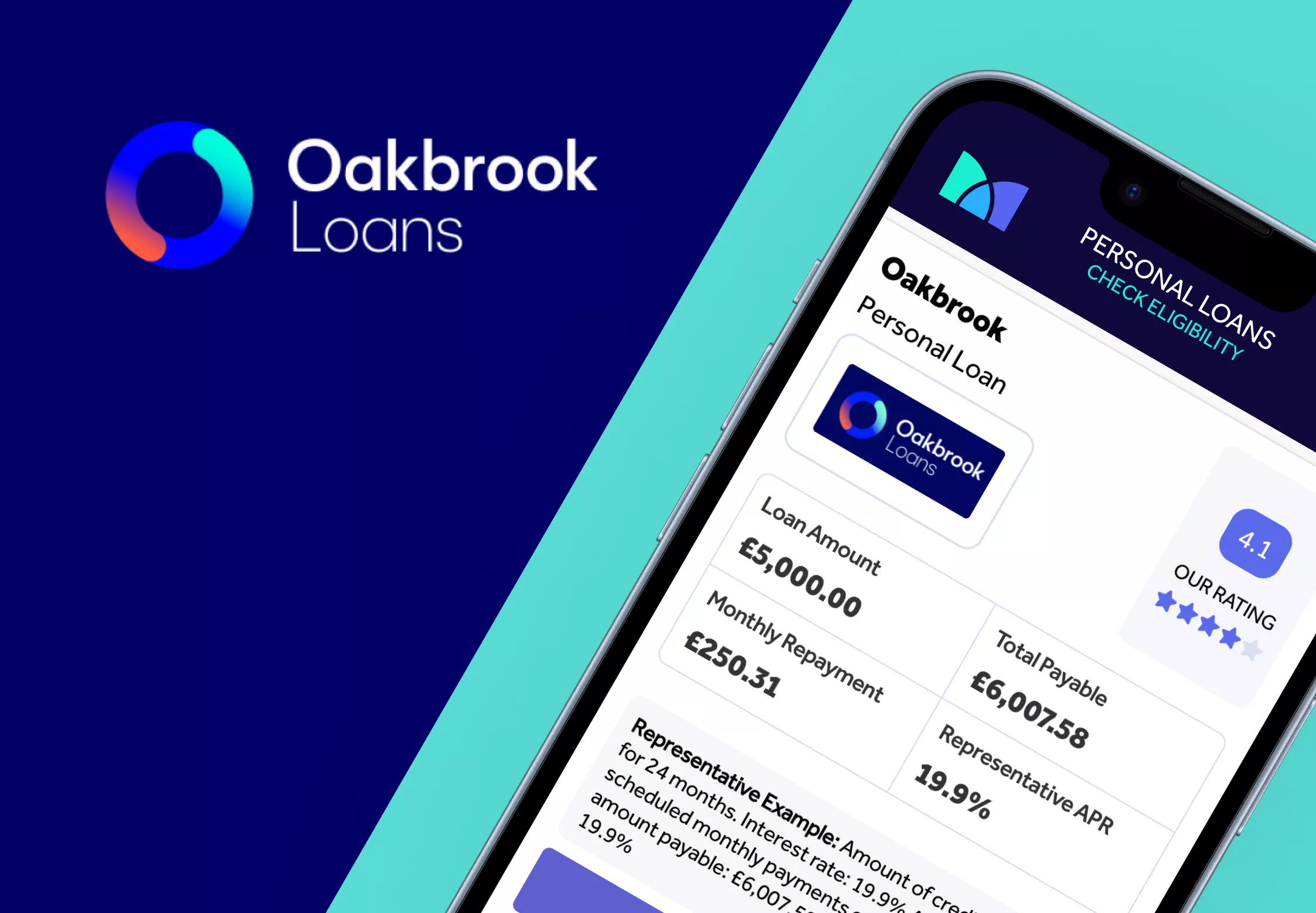

Oakbrook Loans Review

Lendable Loans Review

How to Apply for a Car Loan in the UK

My Community Finance

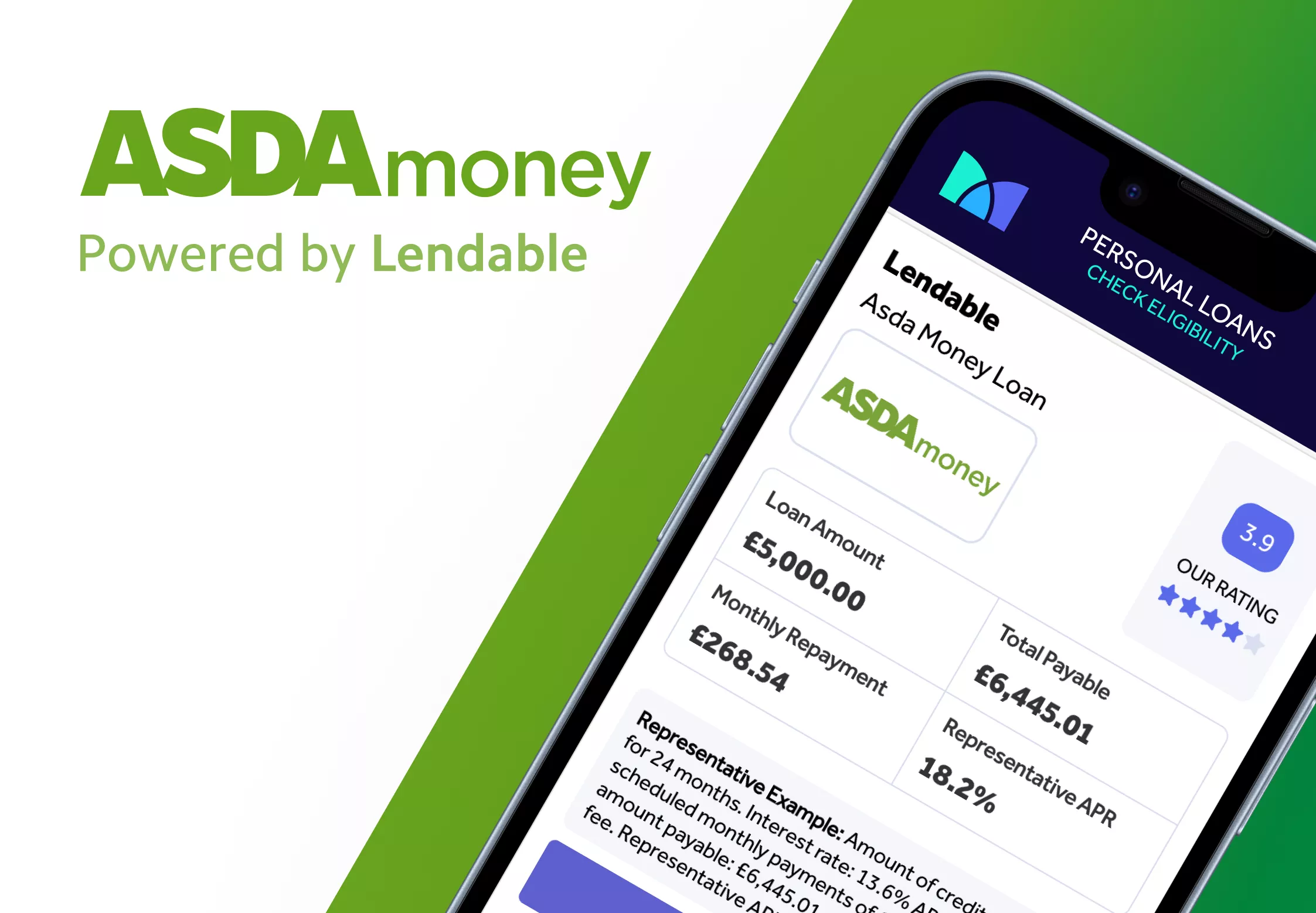

Asda Loans Review

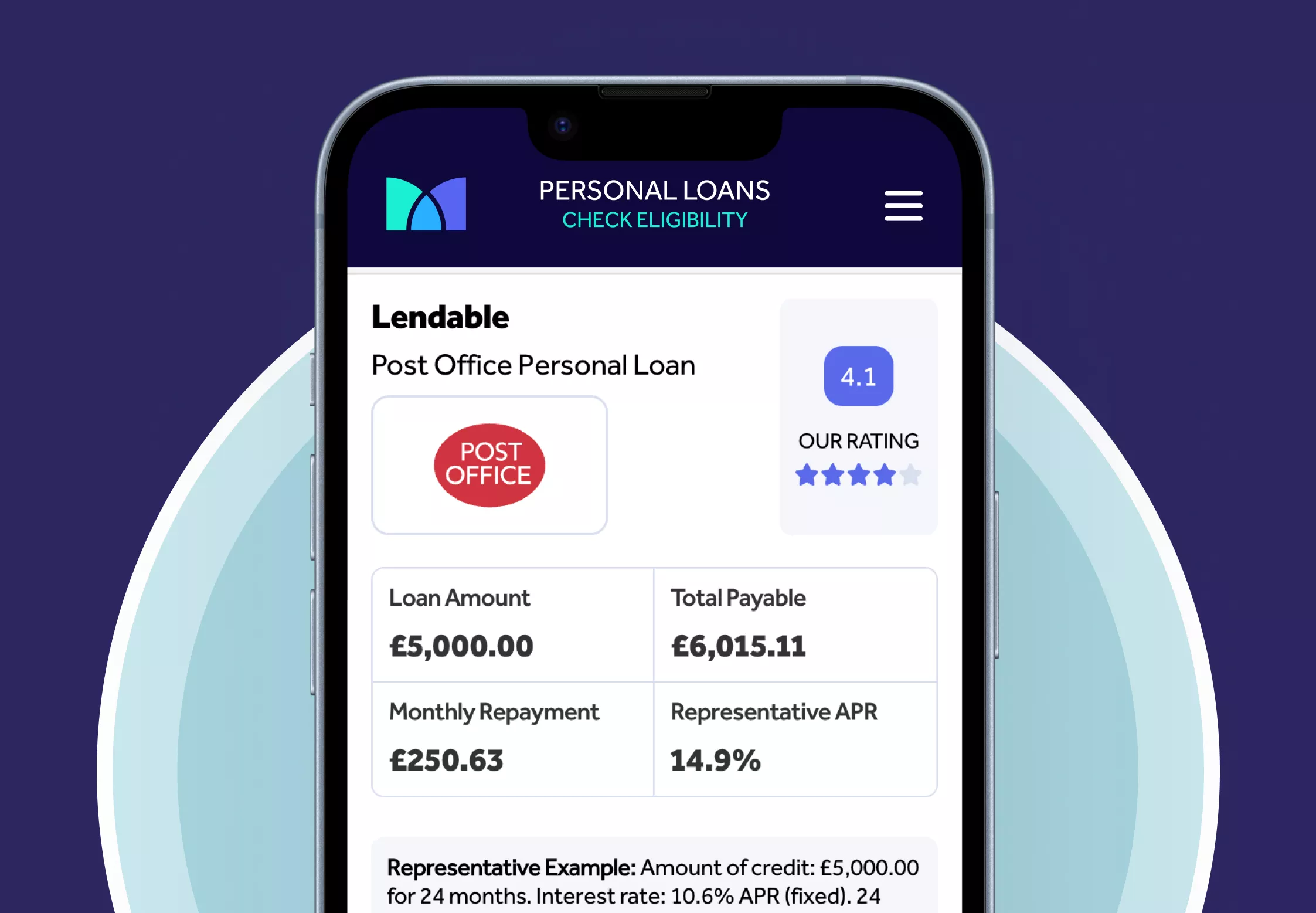

Post Office Loans Review

The content presented here has been impartially gathered by the Mintify team and is offered on a non-advised basis for informational purposes only. We adhere to strict editorial integrity