My Community Finance

Editor, Consumer Finance: Michelle Blackmore

Last Updated: February 6, 2026

In This Article

What is My Community Finance?

My Community Finance offers loans to UK consumers, but the way they work is slightly different from traditional banks or many online loan providers. Rather than lending directly, My Community Finance helps borrowers access personal loans through UK credit unions for larger loan amounts and through a regulated small-loan provider for smaller borrowing.

This means the type of lending available through My Community Finance is typically referred to as a credit union loan. If you have only ever borrowed from high street banks or mainstream online lenders, the concept of a “credit union loan” may feel unfamiliar.

This review explains what My Community Finance does, how credit union loans differ from standard personal loans, and the main points to consider before applying. We also cover how safe this type of borrowing is, who it may suit, and when another option might be more appropriate.

What is a credit union loan?

A credit union loan is a type of personal loan offered by a member-owned financial organisation rather than a high street bank or investor-led lender. Credit unions operate on a not-for-profit basis, which means surplus funds are reinvested or used to benefit members rather than external shareholders.

Although the structure is different behind the scenes, a credit union loan still works in a similar way to other personal loans. You borrow a fixed amount, repay it over an agreed term, and the loan is subject to credit checks, affordability checks and interest charges.

- Credit unions are member-owned and community-focused organisations.

- Surplus funds are reinvested or used to benefit members.

- Loans work in a similar way to other personal loans with fixed repayments.

- Borrowing is still subject to credit and affordability checks.

Credit union lending appeals to some borrowers because it is built around a community-led model rather than a profit-driven one. However, it is still a form of regulated credit and the rate and terms you are offered depend on your individual circumstances and assessment.

How My Community Finance works

Applying for a loan through My Community Finance starts with a free online eligibility check. You choose how much you want to borrow and for how long, then share some basic personal and financial information. The eligibility check uses this information to run a soft credit check, with no impact on your credit score, to see whether you are likely to meet the criteria of a lender on its panel, which includes credit unions and other regulated lenders.

My Community Finance is a broker rather than a direct lender. They manage the online journey and, if your details match a lender they work with, they show you a personalised quote with an indicative interest rate. If you decide to continue and the lender approves your full application, the funds are issued by that lender and your repayments are made directly to them.

- Start with an online eligibility check that uses a soft credit search to indicate whether you are likely to be approved and what rate you might be offered.

- Continue with a full online application if you wish to proceed, providing any extra information or documents the lender needs.

- If you are approved and accept the offer, the lender releases the funds and sets the repayment schedule.

- Your loan agreement is with the lender you are matched with, and you make your repayments to them, using My Community Finance’s portal to track your application where available.

For borrowers, this model means you make one online application rather than approaching each credit union or lender separately. This approach allows you to check your eligibility with multiple lenders through one journey, although approval is not guaranteed and each lender will complete its own assessment.

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Are credit union loans safe?

Credit union loans in the UK operate within a regulated framework, similar to other personal loan providers. Credit unions are authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority, which means they must meet standards around lending responsibly, assessing affordability and treating customers fairly.

Taking out a credit union loan is still a regulated credit agreement, and you are required to repay the loan in full and on time, just as you would with any other personal loan. The fact that a loan comes through a credit union does not remove the commitment to repay or the impact on your credit file if payments are missed.

- Credit unions are regulated in the UK.

- Loans are treated as regulated credit agreements.

- You are responsible for making repayments in full and on time.

- Missing payments can affect your credit profile.

The community-based structure can be reassuring for some borrowers, but it is important to view a credit union loan in the same way you would any other loan: consider the rate, the term, and whether the repayments fit comfortably within your budget.

My Community Finance loan amounts and terms

Credit unions and lenders available through My Community Finance offer unsecured personal loans with different loan amounts, repayment lengths and processing times depending on your circumstances and the lender’s criteria.

How much can I borrow?

Loans available through My Community Finance typically range from £1,500 to £25,000. The amount you are offered depends on your credit profile, affordability checks and the lender’s assessment. Not everyone will be offered the full range, and higher loan amounts may require stronger affordability evidence.

How long can I borrow for?

Repayment terms normally range from 12 to 60 months. Choosing a longer term can reduce monthly payments, but you may pay more interest overall. Shorter terms mean higher monthly payments but may reduce the total cost of borrowing.

How quickly can I receive a loan?

My Community Finance aims to provide a decision within two working days, although applications may take longer if additional information is required. If approved and you choose to proceed, funds are normally released within 2 to 5 working days. These timeframes are not guaranteed and depend on your circumstances and the lender’s processes.

Do I need to be a homeowner?

No. The loans available through My Community Finance are unsecured, which means you do not need to own a property to apply and you do not need to provide an asset to secure the loan. With an unsecured loan, you agree to repay the loan through set monthly repayments rather than securing it against your home or another asset.

My Community Finance loan rates: how APR is decided

The interest rate you are offered through My Community Finance is personalised and depends on your individual circumstances. Lenders on its panel assess the amount you want to borrow, the time period you want to repay it over and your credit history to decide an appropriate APR for your situation.

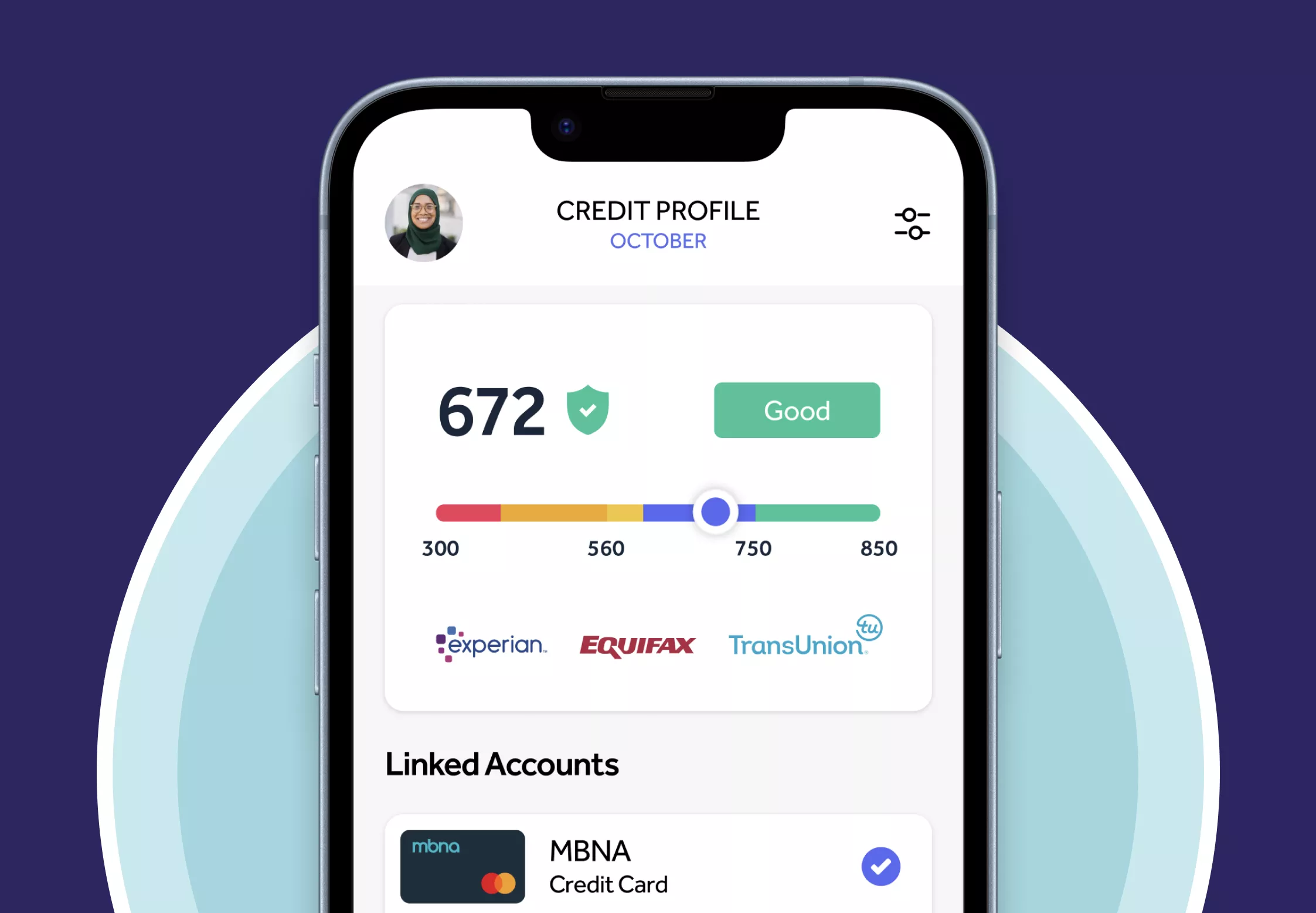

The information you provide during the application process, combined with data from UK credit reference agencies, helps lenders understand your affordability and recent financial behaviour. This means the rate you are offered can be higher or lower depending on how lenders assess the level of risk.

- Your APR is personalised to your financial circumstances.

- The loan amount and repayment term can influence the cost.

- Your credit history and recent repayment behaviour are considered.

- Rates may be competitive for some applicants, but this varies by profile.

Understanding your credit profile before applying can help you set realistic expectations around the APR you may be offered. Some borrowers may receive a competitive rate, while others may find alternatives more suitable depending on their situation and financial goals.

Who can apply for a My Community Finance loan?

To apply for a loan through My Community Finance, you must meet certain criteria to ensure the loan is suitable and affordable for your circumstances.

- Be aged between 21 and 65.

- Live in the UK (excluding Northern Ireland, the Channel Islands and the Isle of Man).

- Be employed and earning £18,000 or more per year.

- Applications from self‑employed applicants are not currently accepted.

During the application, My Community Finance may ask you to verify your income and spending. Open Banking is one way this can be done. Open Banking allows you to share your banking information securely and electronically to help confirm your income and affordability. It provides read-only access and you stay in control of whether you agree to share this information. For many applicants, this can be faster than manually gathering bank statements and uploading documents.

Mintip: If you are self-employed, there are other loan providers that offer products for self-employed borrowers. You can take an eligibility check to compare options and read our guide on personal loans for self-employed applicants to understand what to expect.

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

How repayments work

Repayments for a loan arranged through My Community Finance are made directly to the lender you are matched with, not to My Community Finance itself. Repayments are usually collected monthly by direct debit on an agreed date as set out in your loan agreement.

- Your repayment amount is fixed unless you make changes such as early repayment.

- Payments are normally taken by direct debit on a set monthly date.

- The repayment schedule is agreed when you accept the loan offer.

- You may be able to repay the loan early. If you request an early settlement figure, it will set out the outstanding balance along with any interest due up to the date of repayment.

What happens if I miss a payment

If you miss a repayment, the lender will usually contact you to let you know and to discuss the reason for the missed payment. Missing payments can lead to additional interest or charges depending on the terms of your agreement. It may also be reported on your credit file and could affect your ability to borrow in the future.

- Your credit file may show a missed or late payment.

- You may be charged extra interest or fees.

- Your ability to borrow in the future may be affected.

- Informing the lender early about your situation can help you understand available options.

If you think you may miss a payment, speaking to the lender in advance is usually better than waiting until the payment is overdue. They may be able to explain the steps involved or outline any support available based on your situation.

Mintip: Make sure the monthly repayment fits comfortably within your budget before you proceed. If your circumstances change at any time and you think you may struggle to make a payment, contact the lender as early as possible to discuss your options.

Who My Community Finance may suit

Credit union loans available through My Community Finance may appeal to borrowers who like the idea of a community-focused lender and prefer an online application journey. While suitability depends on your personal circumstances and the rate you are offered, there are some situations where this type of loan may be worth considering.

- Borrowers who want a straightforward online application with personalised rates.

- People who like the idea of borrowing through a member-focused or community-based organisation.

- Applicants who want to compare personal loan options in one place rather than applying to multiple lenders individually.

- Borrowers who meet the eligibility criteria and are comfortable sharing information to support affordability checks.

However, a credit union loan through My Community Finance will not be right for everyone. Eligibility requirements mean that some applicants, such as those who are self-employed or earning below £18,000 per year, may need to consider alternatives. It is also important to compare the APR and total cost of borrowing against other loan options to ensure it supports your financial goals.

My Community Finance reviews

Customer reviews can help build a picture of how borrowers found the application experience with My Community Finance. On Trustpilot, many reviewers mention a quick and straightforward online journey and clear communication throughout the application process.

- Positive comments often refer to an easy online application.

- Some reviewers highlight helpful communication and updates.

- Some reviewers mention receiving funds quickly after approval, although timeframes vary depending on the lender and the checks required.

- Experiences vary and outcomes depend on individual circumstances.

Not every review is positive and some customers mention that the rate offered did not meet their expectations or that extra information was requested during the process. This is a reminder to review any loan offer carefully, consider the total cost and make sure repayments are affordable before accepting. Your experience may differ from other customers, as rates, decisions and loan terms depend on your financial situation and the lender’s assessment at the time you apply.

Are credit union loans better if you have bad credit?

A credit union loan through My Community Finance is not automatically better for people with bad credit, and approval is not guaranteed. Credit unions still follow the same regulated checks as other lenders, including assessing your credit history, income and whether the repayments are affordable.

Some borrowers with limited or less established credit profiles consider credit unions because the lending model is member-focused rather than shareholder-driven. However, this does not mean lower rates or a higher chance of acceptance. The terms you are offered depend on your situation and the lender’s assessment at the time you apply.

If you are exploring borrowing with bad credit, it is important to compare the total cost, understand the eligibility criteria and think carefully about whether taking on new credit aligns with your current financial position. In some cases, alternative approaches such as reducing existing balances or improving your credit profile may be more beneficial before applying.

Alternatives to My Community Finance

A loan through My Community Finance is not the only option available. The right choice depends on your circumstances, credit profile and what you want the loan to achieve. Comparing loan options can help you find a loan that meets your needs and budget.

- Other personal loan providers that offer unsecured loans.

- Credit cards that may offer a lower cost for short term borrowing, such as 0% purchase cards, if the balance is repaid in full within the introductory period.

- Overdraft facilities arranged with your bank for smaller or short term needs.

- Lenders that offer options for self-employed applicants.

Before deciding, consider the total cost of borrowing, the repayment term and how confident you are that monthly payments will remain affordable. An eligibility check can help you understand your potential options without submitting multiple full applications that may impact your credit score.

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Related Articles

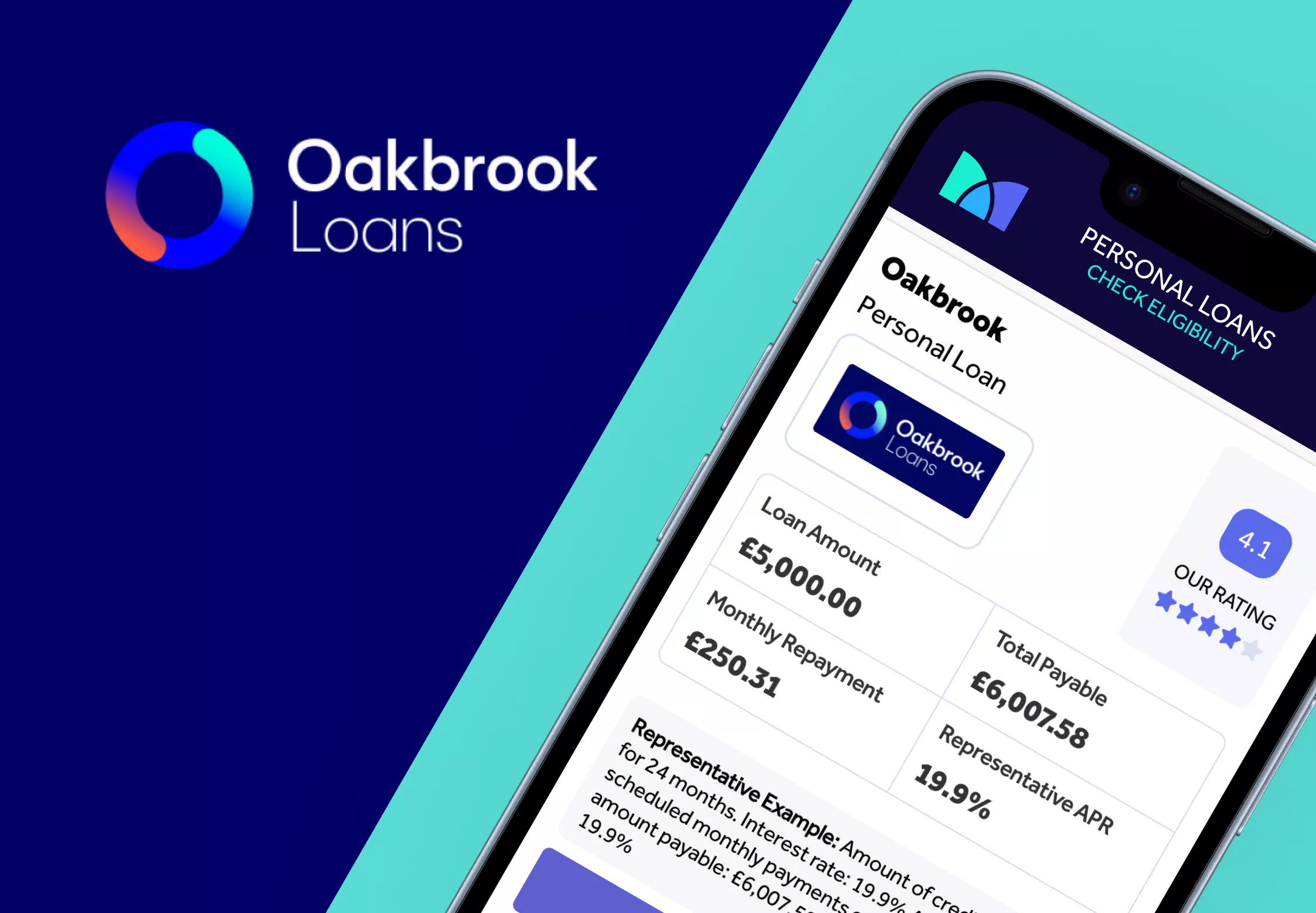

Oakbrook Loans Review

Lendable Loans Review

How to Apply for a Car Loan in the UK

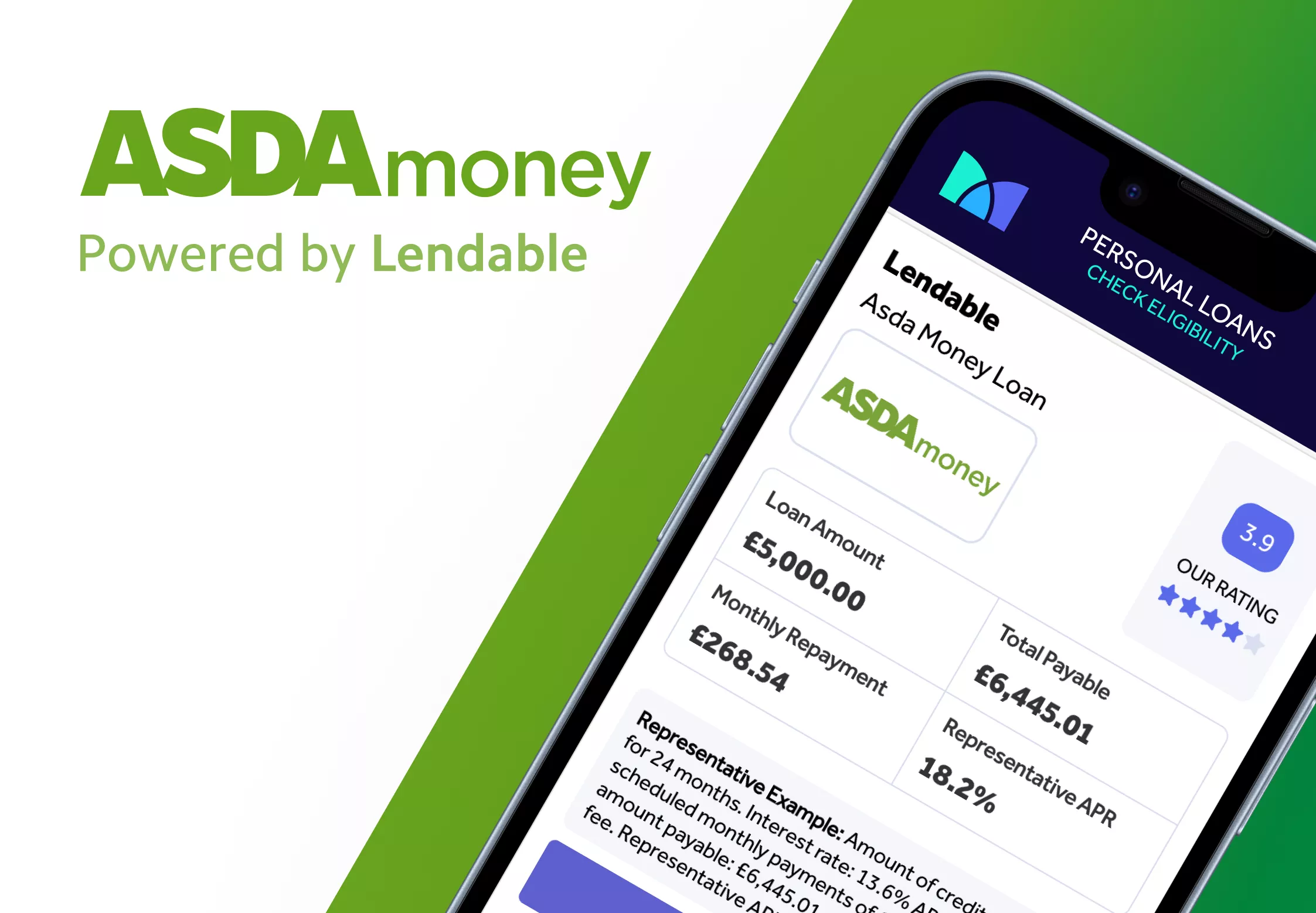

Asda Loans Review

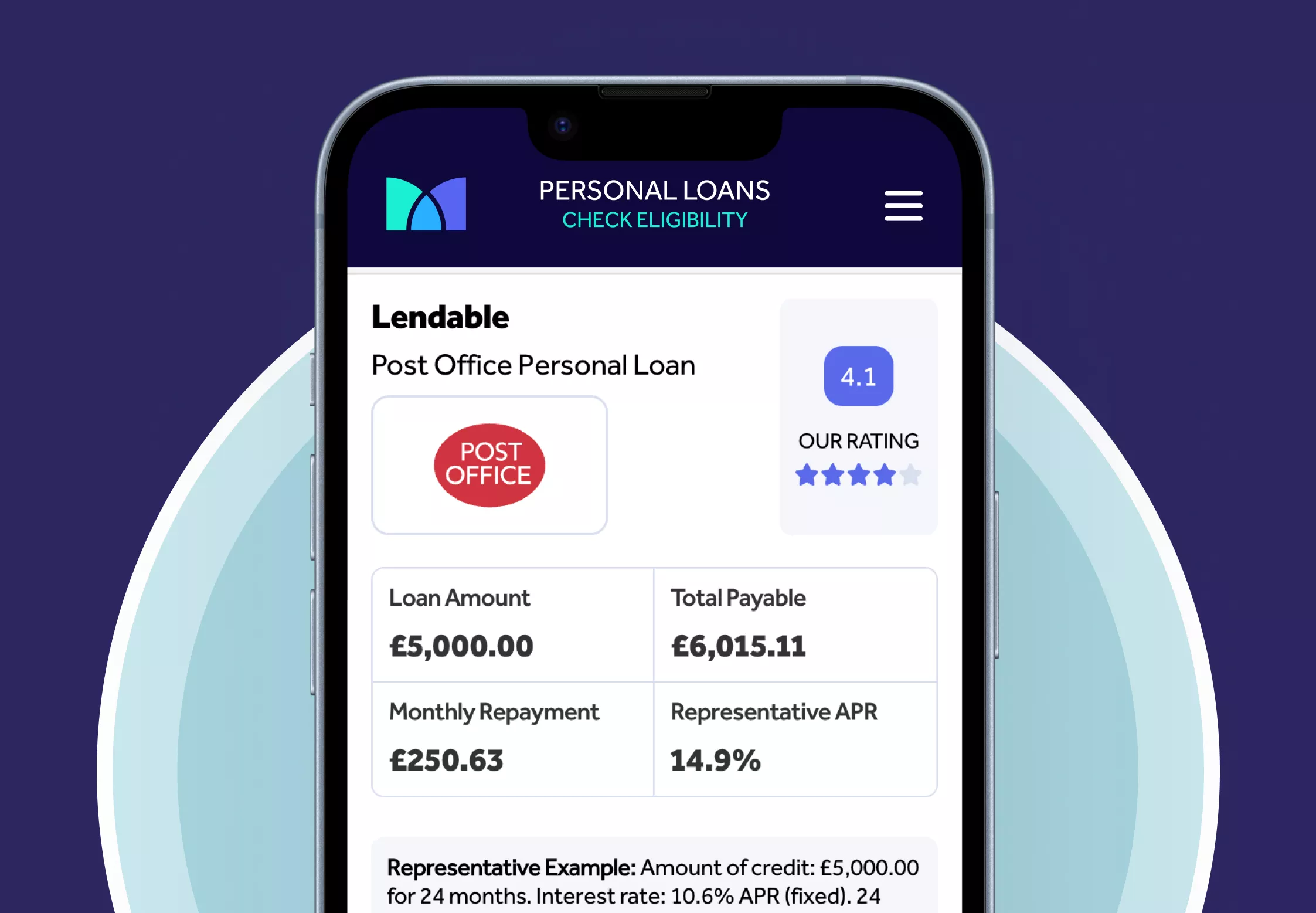

Post Office Loans Review

What credit score is needed for car finance in the UK?

The content presented here has been impartially gathered by the Mintify team and is offered on a non-advised basis for informational purposes only. We adhere to strict editorial integrity. Mintify is an Introducer Appointed Representative of Creditec Limited. We provide editorial reviews of the whole market, but we only provide links to apply for products available through Creditec’s panel of lenders. We may earn a commission if you click these links. This does not affect our editorial independence, but it limits the products you can apply for directly on this site.