Oakbrook Loans Review

Editor, Consumer Finance: Michelle Blackmore

Last Updated: February 6, 2026

In This Article

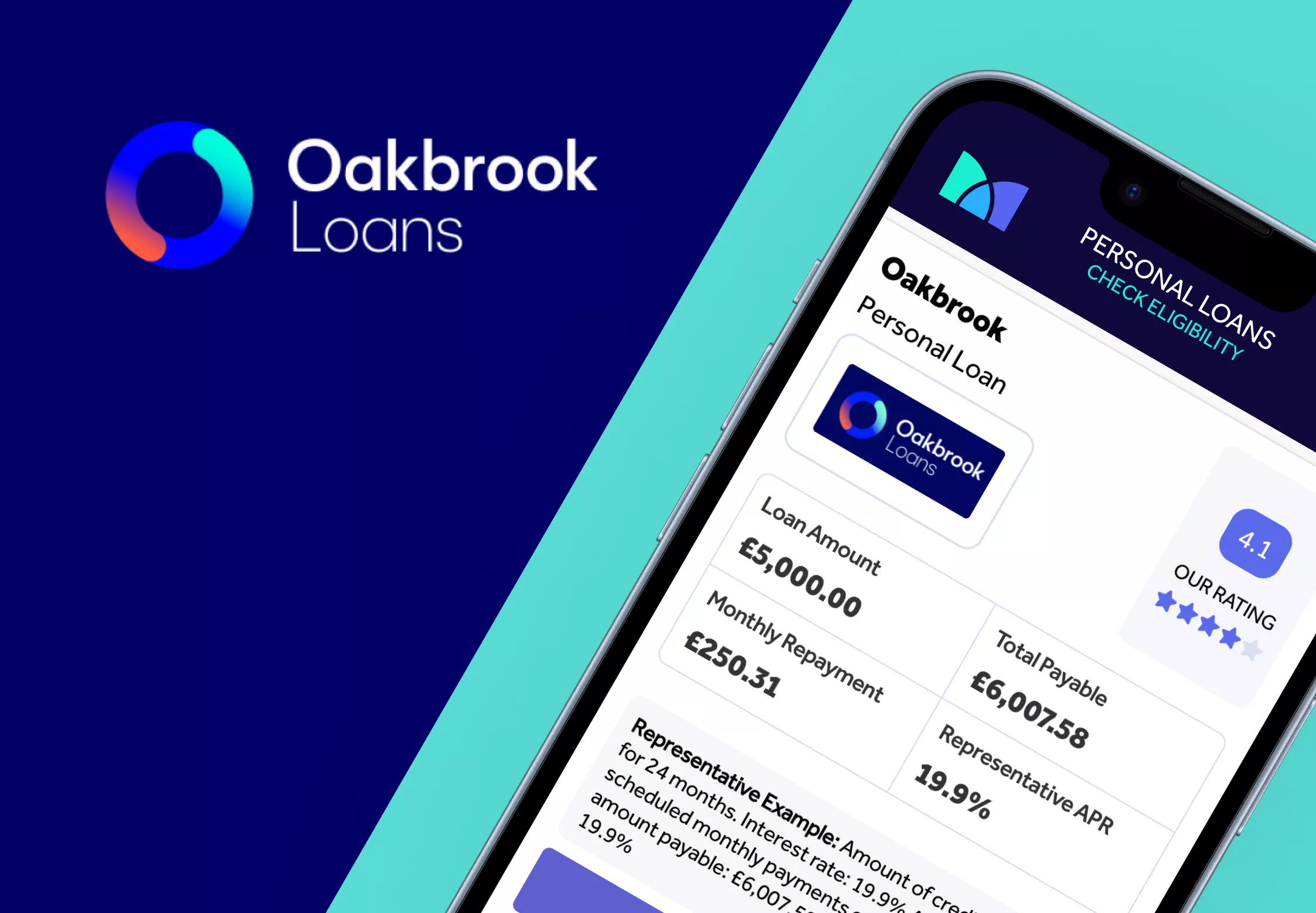

Oakbrook Loans provides unsecured personal loans in the UK through a straightforward online eligibility check with a soft credit check to view personalised terms before you decide whether to proceed. This allows you to understand potential costs and whether the loan may fit your budget without affecting your credit score at the initial stage.

In this review, we explain how Oakbrook loans works, the rates you may be offered, eligibility factors, pros and cons, and what to consider if you are thinking about debt consolidation. We also look at alternatives so you can compare different optionsand make a more informed decision.

Every application is assessed individually, and approval depends on the lender’s criteria. You should only take out a loan if you are confident the repayments will remain affordable both now and in the future.

Who are Oakbrook

Oakbrook loans is part of Oakbrook Finance Limited, a UK based financial services provider focused on personal loans through digital platforms. The business uses technology and data tools to assess applications and provide personalised loan terms online. Oakbrook Finance also operates other lending brands, including Finio loans, which serves a similar personal loan market with its own rates, terms and eligibility criteria.

- UK based lender: Oakbrook Finance Limited is registered in the United Kingdom and provides consumer credit services.

- Digital lending model: Applications and account management are completed online with decisions based on credit history and affordability.

- Operates multiple brands: Oakbrook Loans and Finio Loans are both part of the Oakbrook Finance group.

Oakbrook states that its aim is to use technology to support faster decisions and clearer borrowing experiences for customers who meet its eligibility and affordability criteria.

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Oakbrook loan features

Oakbrook Loans offers unsecured personal loans online as a direct lender. Key features include:

| Issuer | Oakbrook Finance Ltd |

| Loan type | Unsecured personal loan |

| Rate type | Fixed |

| Interest calculation | Interest calculated as a fixed rate over the agreed loan term |

| Loan amounts | Typically available from £1,000 up to higher limits depending on eligibility and lender criteria |

| Loan terms | 12 – 60 months (1–5 years) |

| Representative APR | Rates vary depending on credit profile and affordability assessment |

| Funding time | Same-day funding is possible; but timing depends on loan completion time and bank processes |

| Application fee | No application fee stated |

The information above reflects details available during Mintify’s research and follows our strict editorial guidelines.

Checking eligibility and credit impact

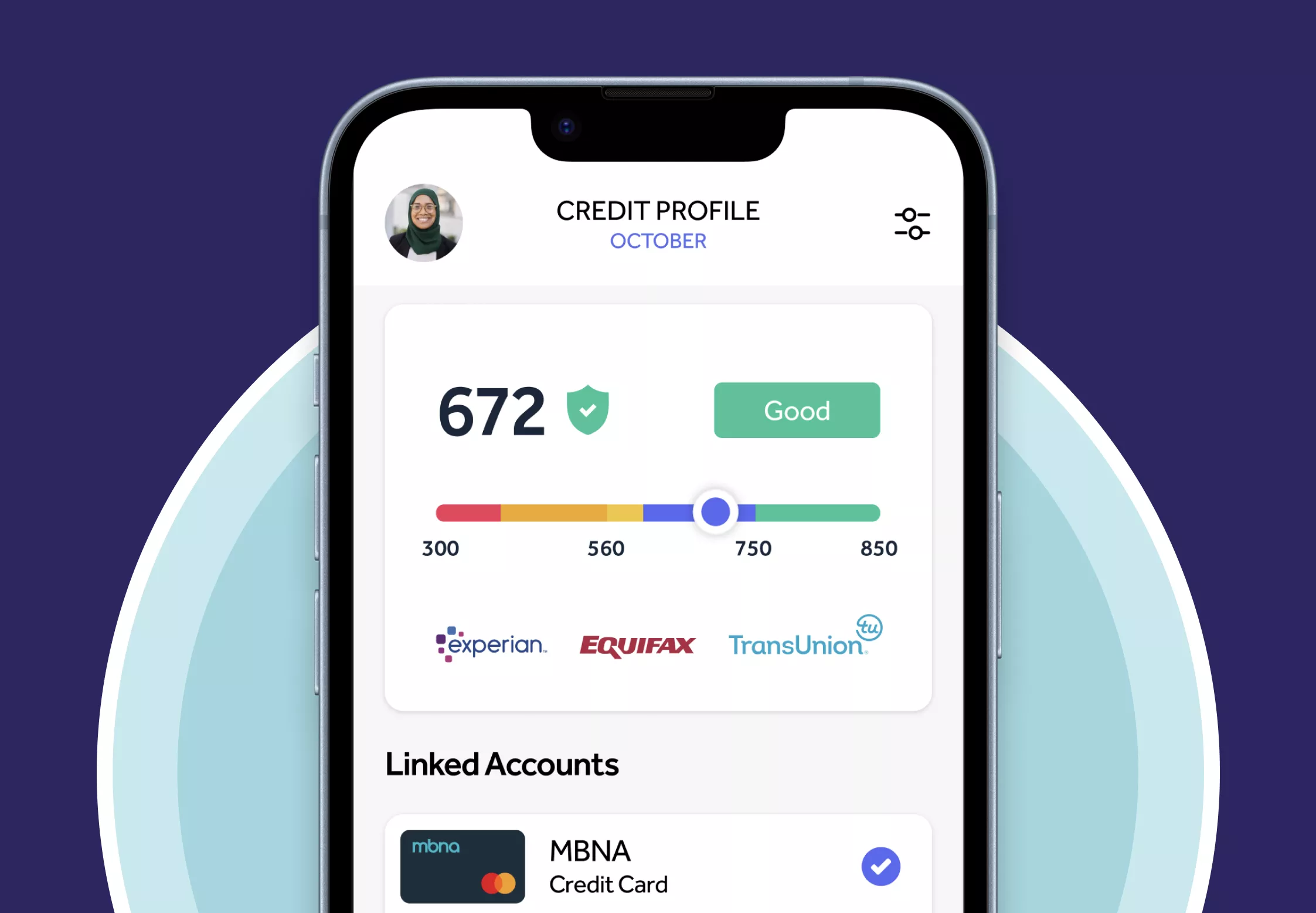

- Can I check my eligibility without affecting my credit score? When you first check your eligibility, a soft credit check takes place which allows you to see potential terms without affecting your credit score. A hard credit search is only carried out if you proceed with the full application.

- Do I need a high credit score? You do not need a perfect credit score to apply, but your credit history and financial situation will influence whether you are approved and the rate you are offered.

- Does an eligibility result mean I will be approved? No. Eligibility is an indication only. Final approval may require further affordability or identity checks.

Approval and funding timeframes

- How quickly could I receive the funds? Oakbrook aims to transfer funds promptly once the loan is approved and checks are completed. In some cases this may be the same day, depending on banking times.

- What could delay the payout? Delays may occur if further information is required, if the application needs clarification, or if the approval completes outside standard banking hours.

Application and required information

- What information do I need to provide? You will usually provide personal details such as name, address history, employment and income. Oakbrook may request documents if they need to verify your details.

- Will bank statements or digital verification be required? In some cases Oakbrook may ask you to share bank data or upload documents to support affordability checks. This depends on your individual circumstances.

- How long does the application take? Most applications take only a few minutes to complete online. Decisions are often quick, though additional checks can extend the process.

Repayments, overpayments and managing the loan

- Can I make overpayments? Yes. Overpayments are allowed and may reduce your total interest and shorten the loan term, as long as doing so remains affordable.

- How are repayments collected? Monthly repayments are usually taken by Direct Debit, supporting consistent budgeting.

- What if I miss a repayment? If a payment is missed, contacting the lender early is important. Missed payments can affect your credit file and may result in additional charges.

Important: Only take out credit if you’re confident you can keep up with the repayments. If your repayments ever become difficult to manage, free and impartial support is available from organisations such as StepChange, National Debtline and MoneyHelper.

LOAN APPROVAL CHECKER

See your chances of getting a loan approved

Applying for loans isn’t always straightforward, and rejections are frustrating. We give you access to a lender panel that runs a personalised pre-approval check, showing the loans you’re more likely to be accepted for. Pre-approval does not guarantee acceptance and is subject to further lender checks.

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender. UK residents only. Terms of Use apply.

Pros and cons of Oakbrook Loans

| Pros | Cons |

| Soft credit check allows you to view personalised loan terms without affecting your credit score at the initial stage. | Interest rates can vary significantly depending on credit profile and may be higher for some applicants. |

| Fixed rate repayments provide predictability for budgeting. | Longer loan terms can reduce monthly repayments but increase the total amount paid overall. |

| Potential for same-day funding once approved and checks are completed. | Approval and funding speed may not always be same day as it depends on verification checks and banking times. |

| Fully online application and account management without branch visits. | May not suit borrowers whose financial circumstances are likely to change in the near future. |

Who an Oakbrook loan may suit and who it may not suit

Who an Oakbrook personal loan may suit

- Borrowers who want fixed monthly repayments to help with predictable budgeting.

- People who prefer to check eligibility first using a soft credit search before deciding whether to proceed.

- Applicants who value the ability to make overpayments when affordable to reduce the total interest and shorten the loan term.

- Those comfortable managing their application and account online without branch support.

Who an Oakbrook loan may not suit

- Anyone unsure about future income or likely changes to financial commitments.

- Borrowers looking for the lowest possible APR, as rates can vary by credit profile and may be higher for some applicants.

- People who prefer face-to-face banking or require in-person support throughout the loan.

- Those exploring short-term borrowing for smaller purchases where other credit options may be more appropriate.

Using an Oakbrook loan for debt consolidation

An Oakbrook personal loan can be used to consolidate existing debts into a single monthly repayment. This may help with managing your budget if you currently have several lenders or payment dates to track. Consolidation carries benefits and risks, so it is important to consider the full cost of borrowing and your financial circumstances before proceeding.

- Simplifying multiple repayments: Combining debt can make it easier to keep track of what you owe.

- Overall cost may increase: A longer loan term or higher interest rate can mean paying more in total.

- Check for early repayment charges: Some lenders apply fees if you settle borrowing before the agreed term.

- Consider the reason for the debt: Consolidation does not resolve the cause of the debt and may not prevent borrowing again.

- Affordability remains essential: A single payment still needs to fit comfortably within your budget.

For a more detailed explanation of how consolidation works, including risks, cost examples and alternatives, you can read our debt consolidation loans guide.

Cost and total repayable considerations

The total cost of an Oakbrook loan depends on the interest rate you are offered and the length of the loan term you choose. Even with fixed repayments, the amount you pay back overall may be higher with a longer term because interest is charged over a longer period. It is important to check the total repayable figure shown in your personalised loan terms before you decide to proceed.

- APR varies by applicant: Your credit history, income and financial circumstances may influence the rate offered.

- Longer terms reduce monthly payments: Smaller repayments can help with budgeting but may cost more in total.

- Total repayable is key: Focus on the total amount you will repay rather than only the monthly figure.

- Consider future plans: Changes to income or expenses may affect your ability to maintain repayments.

- Overpayments can reduce interest: Paying more when affordable may shorten the term and lower the total cost.

Important: Don’t forget to review the total amount repayable and ensure the repayments fit comfortably within your budget before applying. Make sure you understand the total cost of the loan, not just the monthly repayment.

Alternatives to Oakbrook loans

Taking out a personal loan is one way to borrow money, but it is not the only option. Depending on the amount you need and how long you plan to repay it, alternatives may be more suitable or more cost effective. It can help to compare different approaches before deciding to apply.

- Using savings: If you have savings available, using them may avoid interest costs altogether.

- 0% purchase credit cards: These can offer a period with no interest on spending if the balance is cleared within the promotional timeframe. This may suit planned, short term purchases where repayment is achievable before the offer ends.

- Balance transfer cards: If you are consolidating existing credit card balances, a balance transfer card may reduce interest costs for a set period. You can check how much you might save using our Balance Transfer Calculator.

- Speaking to existing lenders: If you are struggling with current borrowing, your lender may be able to offer support or payment arrangements.

- Debt consolidation loans: A personal loan can combine several debts into one repayment, but the total cost may increase depending on the rate and term. You can read our debt consolidation guide to understand this in more detail.

- Delaying non essential spending: If the purchase is not urgent, waiting may remove the need to borrow at all.

Plan Before You Switch

Use our Balance Transfer Calculator to find the right card for you.

If you’re carrying credit card debt, a balance transfer credit card can help you pay it down faster by moving your balance to a new card with 0% interest for a set period. Using a balance transfer calculator helps you understand how much interest you could potentially save by transferring debt from your existing cards to a balance transfer card.

Oakbrook loans reviews

Oakbrook Loans reviews on Trustpilot show that many borrowers highlight the quick application process, clear communication and fast access to funds. However, not all feedback is positive and some reviewers mention delays, declined top-up requests or outcomes that differed from their expectations.

- Fast decisions and funding: Several reviewers mention receiving a decision and payment on the same day after approval.

- Simple online experience: Many find the application easy to complete with clear steps and minimal paperwork.

- Outcomes can vary: A number of reviewers share mixed experiences, such as longer waiting times or not being offered a top-up later on.

Customer reviews reflect individual circumstances, so experiences differ.

Conclusion: Is Oakbrook right for you?

Oakbrook loans may be worth considering if you want fixed monthly repayments, a fully online application and the option to check personalised terms through a soft online eligibility check before deciding whether to proceed. The ability to make overpayments can also help reduce the overall cost if this remains affordable alongside other commitments.

However, a personal loan is a significant financial decision. Total costs can increase with longer terms, interest rates vary based on credit history and affordability checks, and consolidation does not guarantee lower costs or reduced financial pressure. It is important to think about how the repayments fit both your current budget and any changes that may occur in the future.

If you want to explore your options and see which lenders may be more likely to accept you, you can check your eligibility with no impact on your credit score. This does not guarantee approval, but it can help you compare potential loan offers before making a decision.

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Related Articles

Lendable Loans Review

How to Apply for a Car Loan in the UK

My Community Finance

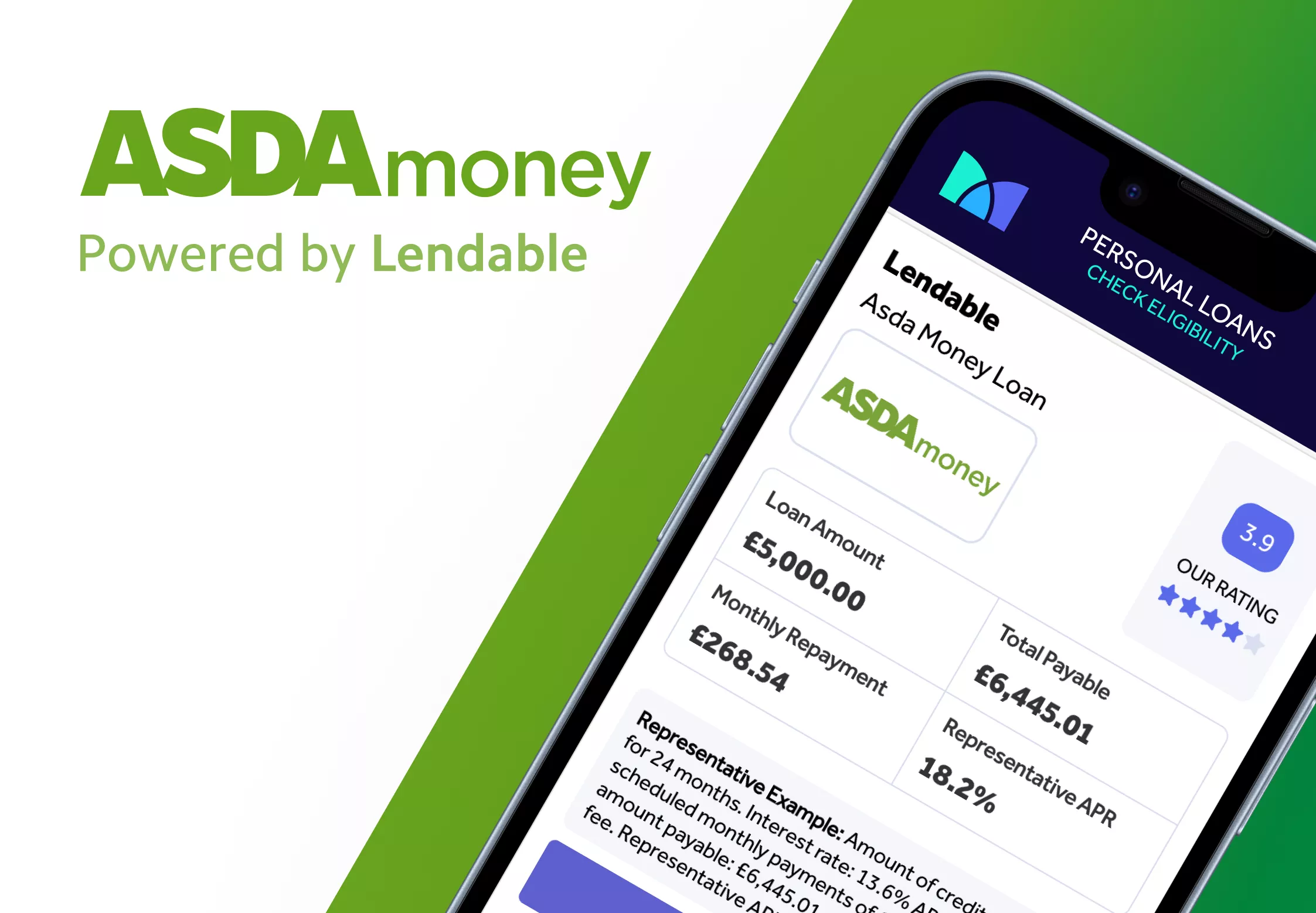

Asda Loans Review

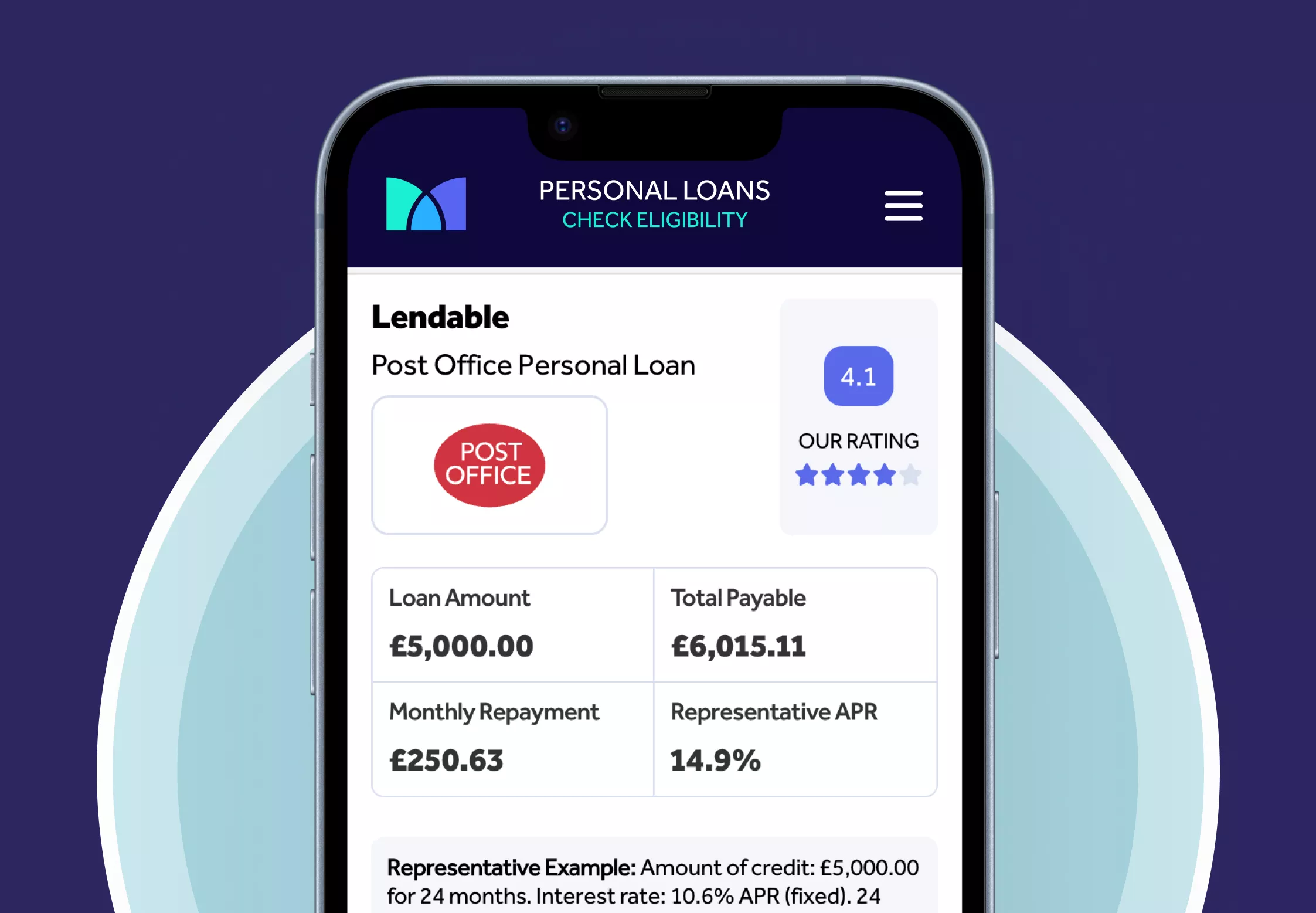

Post Office Loans Review

What credit score is needed for car finance in the UK?

The content presented here has been impartially gathered by the Mintify team and is offered on a non-advised basis for informational purposes only. We adhere to strict editorial integrity. Mintify is an Introducer Appointed Representative of Creditec Limited. We provide editorial reviews of the whole market, but we only provide links to apply for products available through Creditec’s panel of lenders. We may earn a commission if you click these links. This does not affect our editorial independence, but it limits the products you can apply for directly on this site.

Editor, Credit Cards: Michelle Blackmore

Last Updated: February 6, 2026