Personal Loans for Bad Credit UK: Eligibility, Costs & Risks

Editor, Credit Cards: Michelle Blackmore

Last Updated: February 12, 2026

In This Article

Struggling with bad credit and need a personal loan? You’re not alone. According to research published by PWC:

“20.2 million adults in the UK are now defined as financially under-served. At least 1 in 3 adults may have difficulty accessing credit from mainstream lenders – a 50% increase since 2016.”

These numbers highlight how widespread the challenge is. If you’re one of these individuals, this guide will help you understand how personal loans for bad credit work, alternatives and the potential impact on your financial journey.

At Mintify, we stand for the responsible use of credit. There can be a number of different reasons why someone has a bad credit score. However, understanding the factors affecting your score and how to improve it can empower you to make better financial decisions.

Before you apply for a personal loan: key checks

Taking on credit can help in specific situations, but it also increases your monthly commitments. Make sure it’s affordable and right for you. If you’ve had past payment issues or a thin credit file, you might be unsure if there are any options available for your situation. This guide explains how bad credit personal loans work, the key risks to watch, and how to compare options without harming your credit score.

Before you apply, use this list to sense check your next step.

- Confirm you can afford the payment after essentials and a small buffer.

- Use a soft search eligibility check first; it won’t affect your credit score.

- Compare the total amount payable, not just the APR or the monthly figure.

- Be wary of “guaranteed approval” claims; lenders always run full checks.

- If you’re struggling with existing debts, seek free help from StepChange, National Debtline, Citizens Advice or MoneyHelper.

If any point above doesn’t stack up, pause the application and get impartial advice before you proceed.

What are personal loans for bad credit?

Personal loans for bad credit are usually unsecured fixed-term loans aimed at people with lower or limited credit scores. You borrow a set amount, repay in monthly instalments, and pay interest. Some lenders are more open to applicants with missed payments, defaults or CCJs, as long as the new loan is affordable.

Under the right circumstances, these loans can help you regain financial stability. For example, a debt consolidation loan allows you to combine multiple debts into one, making it easier to manage your finances.

There are specific lenders that recognise that financial challenges can happen to anyone. Although these loans may have stricter eligibility criteria or higher interest rates, they still can be an option when you need urgent financial support.

Mintip: Only proceed with a loan if the monthly payment is comfortably affordable and the total cost is reasonable for your goal.

Will applying affect my credit score?

How you check your eligibility and apply matters for your credit file.

- Soft search eligibility checks don’t affect your score and aren’t visible to other lenders.

- A full application uses a hard search, which can cause a small, short-term dip.

- Multiple hard searches in a short time may reduce approval odds.

- On-time repayments can help rebuild your profile over time.

Use soft-search checks first to understand the likely approval and pricing without any impact on your score.

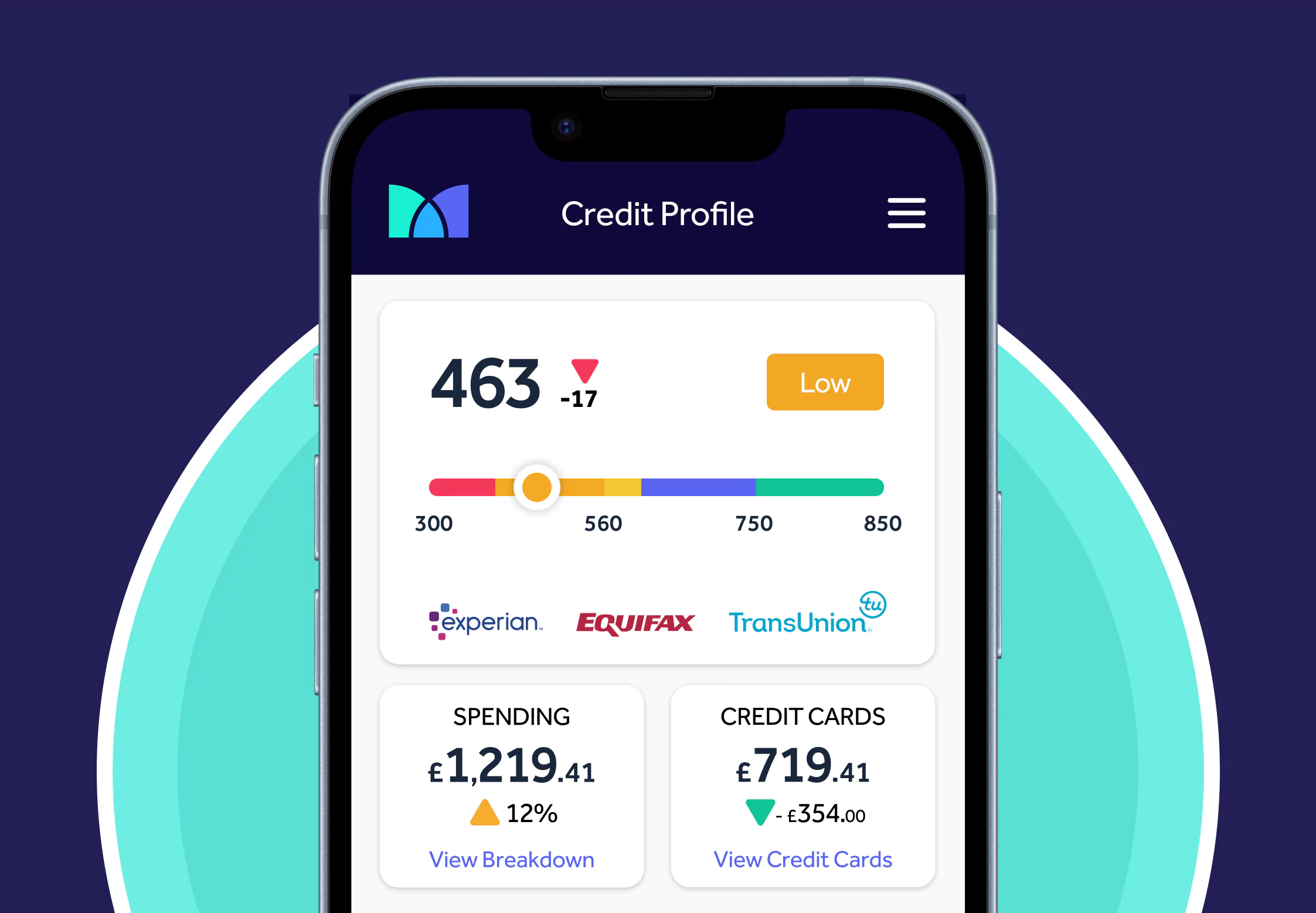

What credit score do I need for loans for bad credit?

There’s no universal credit score requirement for loans targeting bad credit. Credit reference agencies have different scoring systems, but generally a score in the lower bands is treated as ‘bad credit’. If your score is considered low, you may still qualify for a loan, but expect higher interest rates and stricter terms. Improving your credit score can help unlock better options over time.

What banks offer personal loans for bad credit?

Several UK-based banks and alternative lenders provide loans for borrowers with bad credit. While high street banks like Santander and Lloyds may cater to individuals with fair credit, specialized lenders focus on those with lower scores. Check your eligibility to see which lenders might have options that match your financial circumstances. Final approval will depend on the lender’s full assessment.

Get Personalised Loan Rates

Find lenders that can approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

How do lenders assess applications?

Lenders focus on whether the loan is affordable now and sustainable if things change.

- Income and expenditure (often via Open Banking) are used to stress-test affordability.

- Credit history: missed payments, defaults, CCJs, insolvency events, and how recent they are.

- Stability factors: electoral roll, address history, and employment history.

- Existing borrowing and credit utilisation relative to income.

If affordability is tight, approval is less likely and borrowing may harm outcomes.

Costs and small print to check

Small differences in terms can add up. Look beyond the headline APR.

- Representative APR: at least 51% of accepted applicants get this rate or lower. Your rate may be higher.

- Total amount payable: monthly payment times the loan term; this is your true cost.

- Fees and flexibility: arrangement fees, overpayment rules, and early-settlement charges.

- Term length: longer terms reduce monthly cost but usually increase total interest.

Consider choosing the shortest term you can comfortably afford and confirm early repayment options before you sign.

Should I take out a personal loan to pay off my debt?

Taking a loan to pay off debt is what is actually called a debt consolidation loan; this means replacing several existing balances with a single fixed-term loan. This can reduce the number of payments and may lower costs where the new rate and term are favourable. It depends on keeping spending under control and not reusing cleared credit lines.

Consolidation may be unsuitable if the new loan extends the term so that the total amount payable increases, or if it converts unsecured borrowing into a secured or homeowner loan. Secured borrowing carries additional risk: your home may be repossessed if you do not keep up repayments.

If you proceed, plan how you will manage or close the cleared accounts, confirm any fees and early repayment rights, and check that the monthly payment remains sustainably affordable after essential costs. If you are in difficulty, consider free, impartial debt advice before taking on new credit.

For worked examples, alternatives and detailed considerations, see our debt consolidation guide.

Alternative to a debt consolidation loan: balance transfer credit cards

A balance transfer moves existing credit card debt onto a new card, usually with a promotional interest rate for a set period. For applicants with lower credit scores, options can be more limited and the 0% period is often shorter than mainstream offers, but it can still reduce interest if used carefully.

Choosing this option is mainly useful when you can qualify for a promotional rate, the transfer fee is reasonable, and you have a clear plan to clear the balance within the offer period. Always factor in the transfer fee, your likely credit limit (which may not cover the full balance), and the APR that will apply when the promotion ends. Missing a payment might end the promotional rate and increase costs so check these terms carefully.

Before applying, use a soft-search eligibility checker to check your chances without affecting your credit score. Some things to keep in mind are:

- Check the transfer fee

- 0 % promotional duration

- The APR after the 0 period

- Set up a direct debit for at least the minimum

For product details, comparisons and step-by-step checks, see our balance transfer credit cards guide and our latest Top 10 balance transfer cards. Eligibility indicators are not offers; lenders confirm final terms after full checks.

Mintip: Balance transfer cards are for moving debt; purchases and cash withdrawals usually incur higher, non-promotional rates so check the terms offered. You will also be increasing the overall debt you owe..

Car finance with bad credit, are there options?

It is possible to get car finance with a low or limited credit score, but options and pricing vary by lender. Start with a soft-search eligibility check so you can see likely outcomes without affecting your credit score. Focus on being able to comfortable keep up with the monthly repayments and understand the total amount payable, not just the monthly figure.

Most motor finance is secured on the vehicle (e.g., HP or PCP). If repayments are missed, the car could be at risk. Always read the pre-contract information and the lender’s terms in full before you apply.

Autolend (overview)

Autolend provides car finance via brokers with quotes generated from a soft credit search (no impact on your score). Their published basic criteria include regular income of at least £800 per month and UK residency for at least three years. Final decisions, rates and terms are confirmed by the lender after full checks.

For details on how Autolend works, fees and eligibility, see our Autolend car finance review.

Compare options and next steps

Compare HP, PCP and unsecured loans side by side, checking APRs, total amount payable, term length, fees, and early-repayment rights. If you’re unsure or affordability is tight, consider free, impartial help from StepChange, National Debtline, Citizens Advice or MoneyHelper before borrowing.

Mintip: Taking on a car loan is a big commitment. Read our full guide for a broader understanding of options, costs and eligibility checks: Best car loans & car finance (UK).

Guarantor loans for very low credit scores

A guarantor loan is a fixed-term credit agreement where a second person promises to make repayments if you do not. Lenders assess both the borrower and the guarantor. This route is sometimes considered when your score is very low or you have limited history but a trusted person has a stronger profile and stable income.

Taking on a guarantee is a serious legal commitment. If a payment is missed, the lender can request it from the guarantor and this may affect the guarantor’s credit file. Both parties should expect affordability checks (often using bank data) and should only proceed if repayments are sustainably affordable for each of you. Guarantees are not easily withdrawn once the loan is active; relationships can be put under strain if things go wrong.

Rates on guarantor loans can still be high and vary by lender. Compare the total amount payable, confirm any fees and early-repayment rights, and ensure you both understand the terms. If either party is unsure, seek independent advice before signing. If you are currently in financial difficulty, consider free help from StepChange, National Debtline, Citizens Advice or MoneyHelper before taking on new credit.

Where available, use a soft search eligibility check first to understand potential outcomes without affecting credit scores.

Unsecured personal loans (no secured asset needed)

An unsecured personal loan lets you borrow a set amount and repay it in fixed monthly instalments over an agreed term, without using your home, car or other asset as security. Pricing depends on your circumstances and credit history; a Representative APR is a guide only and not a promise. The key figure to compare is the total amount payable over the term.

Check the term length, any fees, and your early-repayment rights. A longer term can lower the monthly payment but usually increases the overall cost. Missed payments can lead to extra charges and may affect your credit file. Choose the shortest term you can comfortably afford after essential spending.

If you want detailed pros, cons and worked examples, see our unsecured personal loans guide. Start with an eligibility check where it’s possible to view likely outcomes without any impact on your credit score.

Comparing personal loans for bad credit – check your eligibility first

A careful, structured comparison reduces the risk of choosing an unsuitable or overly expensive loan. The aim is to understand likely outcomes without affecting your credit file, then compare costs and terms in a way that fits your budget and goals.

How to start

Begin with a soft search eligibility check with FCA-regulated lenders. This does not affect your credit score and is only visible to you. Treat results as indications, not offers; lenders make final decisions after full checks.

What to review

You may see loans you’re likely to be eligible for and, in some cases, a ‘pre-approved’ indicator. These are indications only and not offers of credit. Final decisions, rates and terms are set by the lender after full checks (subject to status and affordability, including a hard search) and may change or be withdrawn.

- Total amount payable over the full term (not just the monthly payment or APR).

- Representative APR as a guide only; at least 51% of accepted applicants receive that rate or lower.

- Term length and impact on cost: longer terms lower the monthly figure but usually increase the overall interest paid.

- Fees and flexibility: arrangement fees, late payment charges, overpayment rules and early-settlement terms.

- Funding speed when time matters, while keeping affordability as the priority.

- Product type: unsecured vs secured/homeowner loans and the risks attached to using your home as security.

Keep these in mind:

- Eligibility is not approval. Final pricing and acceptance depend on the lender’s full assessment.

- Check the pre-contract credit information and the lender’s terms in full before you apply.

- If you are in financial difficulty, consider free, impartial help from StepChange, National Debtline, Citizens Advice or MoneyHelper before taking on new credit.

Mintip: Pick the loan option that remains sustainably affordable after your essential costs and has the lowest total amount payable for your needs. If anything is unclear, pause and seek independent guidance before applying.

Get Personalised Loan Rates

Find lenders that can approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Frequently asked questions: personal loans for bad credit

Can I borrow money with a 500 credit score?

Possibly. Some lenders specialise in applicants with low or limited credit scores, but availability may be limited and rates may be higher. Start with a soft-search eligibility check (no impact on your score) and make sure the repayment fits comfortably within your budget. Final decisions and pricing are confirmed by the lender after full checks (subject to status and affordability).

Is taking out a personal loan a good idea?

It depends on purpose and affordability. A loan may reduce costs and simplify repayments where the rate and term are favourable and not excessively extended. If you’re struggling with existing debt, consider free, impartial advice before borrowing more.

What is the interest rate on a loan for bad credit?

Rates vary by lender and your circumstances. Treat the Representative APR as a guide, not a quote; at least 51% of accepted applicants receive that rate or lower, and others may be offered higher rates. Use a soft-search estimate to understand likely pricing and compare the total amount payable, not just APR.

Are there personal loans with no guarantor?

Yes. Many products are unsecured and do not require a guarantor. Some lenders may still request one depending on your situation. A guarantor becomes legally responsible if payments are missed, so both parties should review the risks and affordability.

Are there low APR car loans if I have bad credit?

Some providers offer relatively lower APRs, but availability may be limited. Compare personal loans and car-finance options (e.g., HP, PCP) and focus on sustainable affordability and the total amount payable. Most car finance is secured on the vehicle, so the car may be at risk if repayments are missed. Eligibility indicators are not offers; lenders confirm final terms after full checks.

Conclusion

Personal loans for bad credit provide a valuable solution for those facing financial challenges. They can help consolidate debt, cover unexpected costs, or finance major expenses. However, it’s crucial to approach these loans responsibly. Focus on improving your credit score, compare options to find the best rates, and avoid borrowing more than you can repay. By making informed decisions, you can take control of your finances and move toward a more stable financial future.

This article aims to provides a clear and ethical overview of understanding personal loans for bad credit, helping you make informed financial decisions. At Mintify, we encourage you to compare different offers and read the terms carefully before taking on any credit. View our unbiased database of personal loans to find one that could match your needs.

Related Articles

Oakbrook Loans Review

Lendable Loans Review

How to Apply for a Car Loan in the UK

My Community Finance

Asda Loans Review

Post Office Loans Review

The content presented here has been impartially gathered by the Mintify team and is offered on a non-advised basis for informational purposes only. We adhere to strict editorial integrity

Get Personalised Loan Rates

Find lenders that can approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.