What loans can you apply for when you’re self-employed?

Editor, Consumer Finance: Michelle Blackmore

Last Updated: February 6, 2026

In This Article

Quick answer: Many UK lenders offer personal loans to self-employed applicants who can show steady income and affordability through recent accounts, tax returns or bank statements. Loan types include: unsecured, secured, guarantor and even business loans.

It’s often said that getting a loan is harder when you’re self-employed, but that doesn’t have to be true. Many UK lenders are open to self-employed applicants, including freelancers, sole traders and company directors, as long as you can show consistent income and meet standard affordability checks. The process can take slightly longer than for employed applicants, but the main difference lies in how lenders verify your income and assess stability.

Can you get a loan if you’re self-employed?

Yes. You can apply for a personal loans even if you work for yourself. Lenders mainly focus on whether you can make repayments reliably rather than how you earn your income. You may be asked to share tax returns, SA302 summaries or business bank statements to show your recent earnings and affordability.

- Self-employed borrowers are eligible for most personal loans with the right documentation.

- Lenders assess income stability, credit history and affordability before approval.

- Proof of income can include tax returns, SA302 forms or recent bank statements.

- Eligibility checkers help you see your likelihood of approval before applying.

It’s worth checking your eligibility before submitting a full application. This avoids unnecessary hard credit searches and helps you find lenders most likely to approve you based on your self-employed income profile.

What lenders look for when you’re self-employed

When assessing a self-employed loan application, lenders are focused on how reliably you can meet repayments. They review your income, credit record and business stability to build a full picture of affordability. The process is designed to make sure the loan is sustainable under FCA rules and Consumer Duty expectations.

- Income consistency: Lenders prefer steady earnings over time, usually supported by one to two years of accounts.

- Credit history: A record of responsible borrowing strengthens your application.

- Length of trading: Longer trading histories provide reassurance of income stability.

- Existing commitments: Any personal or business debts will be factored into affordability checks.

- Affordability: Your disposable income after essential spending must be sufficient for repayments.

Lenders balance all of these factors rather than judging a single metric. Even if your income fluctuates month to month, showing reliable average earnings and a positive repayment history can make a strong case for approval.

Mintip: If your income varies seasonally, use your bank statements to highlight consistent average earnings instead of focusing on the highs and lows. Lenders value predictability more than peak months, so showing steady patterns across six to twelve months can strengthen your application.

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Documents you may need to apply

When you apply for a personal loans as a self-employed borrower, lenders need to verify your identity, address and income. Having your paperwork ready can make the process faster and improve your chances of approval. Each lender’s requirements vary slightly, but most ask for similar documents to confirm affordability and stability.

- Proof of ID: Passport or full UK driving licence.

- Proof of address: Recent utility bill, Council Tax bill or bank statement.

- Income evidence: SA302 forms, HMRC tax calculations or full accounts signed by an accountant.

- Bank statements: Personal or business statements showing income patterns and outgoings.

- Accountant’s letter: Confirmation of trading history or projected income if requested.

Lenders usually prefer at least one full year of financial records, though two years of accounts gives a stronger foundation. Keeping documents organised and up to date can help you move through the approval process smoothly.

Types of loans available for self-employed borrowers

Self-employed applicants can access most of the same loan types as employed borrowers. The main difference is how income is verified and which products are most suitable based on your credit profile and trading history.

- Unsecured personal loans: Fixed loans that have set monthly repayments and are suited to applicants with a stable income and good credit history.

- Secured loans: Require an asset such as a home or vehicle as collateral, often used when you have limited income proof or a shorter trading history.

- Guarantor loans: Involve a family member or friend agreeing to cover repayments if you cannot, useful if your income fluctuates or your credit record is thin.

- Business loans: Designed for borrowing linked to business activity rather than personal use. These may offer higher limits but often require detailed financial records.

The right choice depends on how you plan to use the funds. If the borrowing is for home improvements or personal expenses, an unsecured loan is usually more appropriate. If it relates to your business, a dedicated business loan may offer better flexibility and rates.

Mintip: Keep business and personal borrowing separate. Mixing the two can make it harder to track spending, prove affordability or manage repayments.

How lenders assess income and affordability

Lenders assess self-employed applicants using the same affordability principles that apply to all borrowers. The focus is on whether repayments are manageable and sustainable over the full loan term. They review both your income patterns and your regular outgoings to confirm that the loan fits within your financial capacity.

- Verified income: Lenders rely on SA302s, HMRC summaries, or bank statements to confirm your recent earnings.

- Average monthly income: Regularity and consistency of payments often matter more than individual highs or lows.

- Business expenses: Deductions for tax and operating costs are taken into account when calculating disposable income.

- Existing borrowing: Current loans and credit commitments influence affordability calculations.

- Open banking: Some lenders use it to verify income automatically and speed up decisions, though it’s optional.

The aim is to ensure that repayments will not cause financial strain. Showing predictable income over time, even if earnings vary month to month, gives lenders the confidence that your repayments will remain affordable.

How to improve your chances of approval

Preparation can make a big difference when applying for a personal loan as a self-employed borrower. Lenders want to see that your finances are well-organised and that you can handle repayments even when income fluctuates. A few practical steps before applying can strengthen your profile and improve eligibility outcomes.

- Keep accounts current: File your tax returns and update financial statements promptly each year.

- Separate business and personal finances: Maintain different bank accounts to make income and expenses easier to verify.

- Reduce existing debts: Paying down credit cards or overdrafts can improve affordability ratios.

- Check your credit report: Correcting errors or outdated information can prevent avoidable declines.

- Use open banking wisely: It can speed up applications and give lenders confidence in your income consistency.

If you want to build a stronger credit profile overall, our guide on 9 habits to improve credit card eligibility covers practical habits that apply equally to loans. Steps like keeping utilisation low, paying on time and managing credit sensibly can all support your chances of approval.

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Can you get a self-employed loan with bad credit?

It is possible to get a loan when you are self-employed and have a lower credit score, but your options may be more limited. Some lenders will state that they offer loans for bad credit but they still check your ability to make repayments and may charge higher interest rates to offset the additional risk.

- Eligibility: You may qualify with a fair or low score if your recent payment history is positive.

- Loan amount: Lenders may offer smaller amounts until you build a stronger repayment record.

- APR: Interest rates are usually higher for applicants with impaired credit files.

- Documentation: Full income proof and up-to-date accounts help offset weaker credit data.

- Specialist lenders: Some providers focus on near-prime or self-employed borrowers.

If you have struggled with repayments in the past, take time to rebuild your credit before applying again. Showing consistent income, keeping balances low and maintaining a positive payment record can all improve your chances of approval in future.

Mintip: If you’re struggling with repayments or your credit record has been affected by missed payments, free and impartial support is available. Organisations like MoneyHelper and StepChange can help you review your budget, explore repayment options and understand how to rebuild your credit over time.

What can you use a self-employed loan for?

Personal loans for self-employed people can be used for a wide range of purposes, as long as the borrowing is affordable and clearly separated from business activity. Lenders will ask what you plan to use the money for to make sure it aligns with their lending policy and responsible lending rules.

- House renovations: Home improvement loan for upgrades or repairs to your main residence.

- Car purchase or repairs: Financing a car or repairing your current car.

- Debt consolidation: Consolidating debt into one manageable payment.

- Family or personal events: Weddings, education or other life milestones.

- Unexpected costs: Covering one-off expenses such as medical or relocation.

Always be clear about whether your borrowing is for personal or business use. Using a personal loan for business activity can breach lender terms and create problems if your business cannot meet repayments. If the funds are primarily for business purposes, a business loan may be more appropriate and tax-efficient.

Comparing personal loans: what to know before applying

Before applying, it’s worth comparing a range of lenders that accept self-employed applicants. Each lender uses different criteria to assess affordability and credit risk, so rates and loan amounts can vary even for similar profiles. Using an eligibility checker helps you narrow down options without affecting your credit score.

- Representative APR: Compare headline rates but remember that the rate you’re offered may differ based on your own circumstances.

- Loan terms: Review repayment periods carefully to balance affordability and total cost.

- Early repayment fees: Some lenders charge for paying off loans early, while others do not.

- Eligibility checkers: Use tools that run a soft search so your credit file isn’t impacted.

- Lender flexibility: Some providers allow payment holidays or top-ups once you’ve built a positive record.

Will a loan cost me more because I’m self-employed?

If your credit record and affordability evidence meet the lender’s criteria, you could be offered similar rates to standard personal loans.

Lenders focus on whether repayments are affordable and sustainable, not on how you earn your income. However, if your credit rating is less than perfect or your income varies a lot, it’s possible you’ll be offered a higher interest rate or smaller loan amount. Building a consistent income record, paying bills on time and keeping your credit use low can help improve the rates available to you over time.

Frequently asked questions

How many years of accounts do I need for a self-employed loan?

Most lenders prefer at least one full year of accounts, though two years gives you a stronger application.

Can I get a loan if I only recently became self-employed?

It depends. You might be able to but you may have fewer options. Some lenders will ask for extra income proof such as bank statements or a guarantor.

Do I have to use open banking?

No. It’s optional, but it can make the process faster and show lenders your income more clearly.

Is it easier to get a loan if I apply jointly?

Usually yes. A joint applicant with steady income and good credit can improve your chances of approval.

Does being self-employed affect my credit score?

No. Your employment type isn’t listed on your credit file. What matters most is how well you manage credit and repayments.

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Related Articles

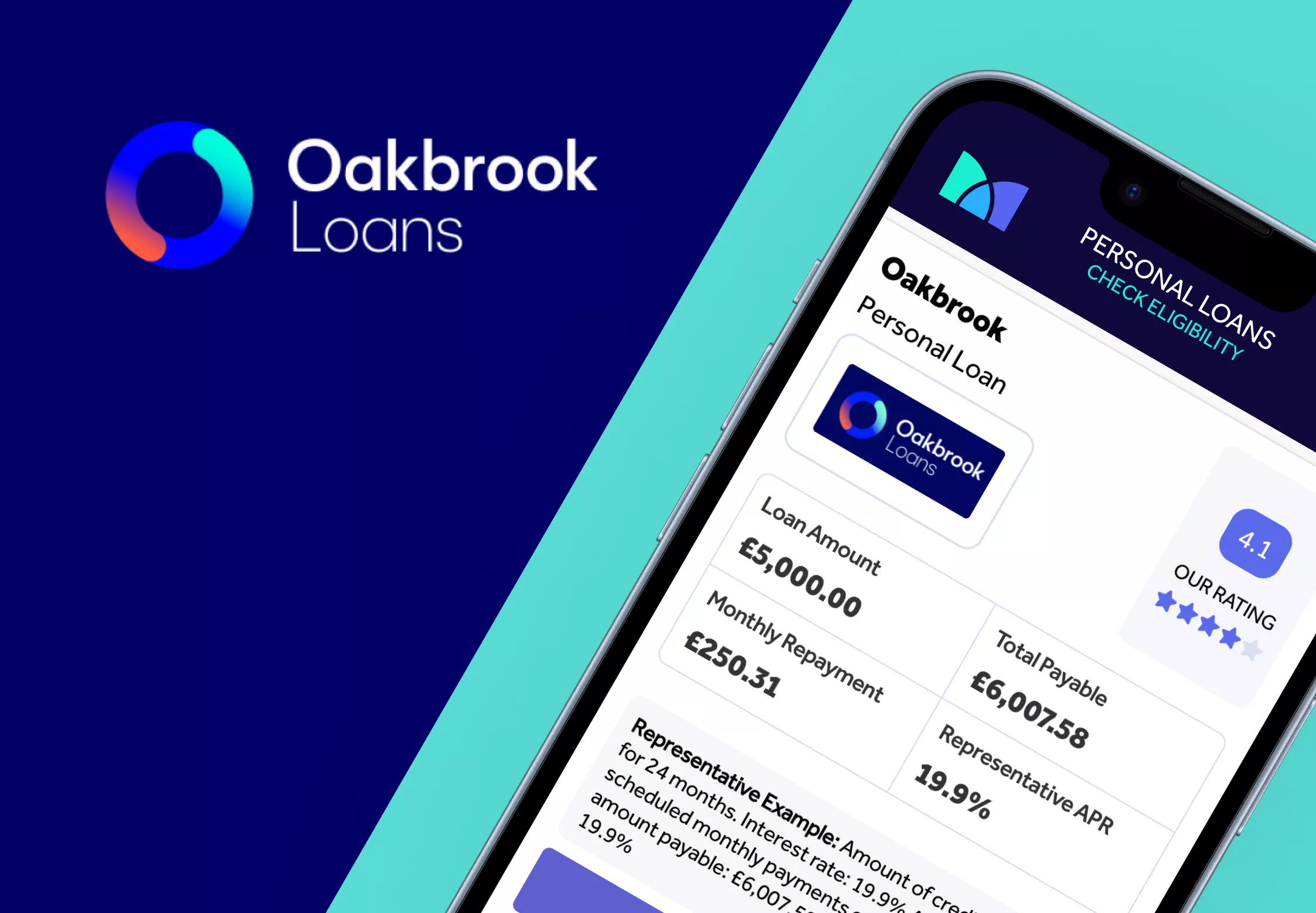

Oakbrook Loans Review

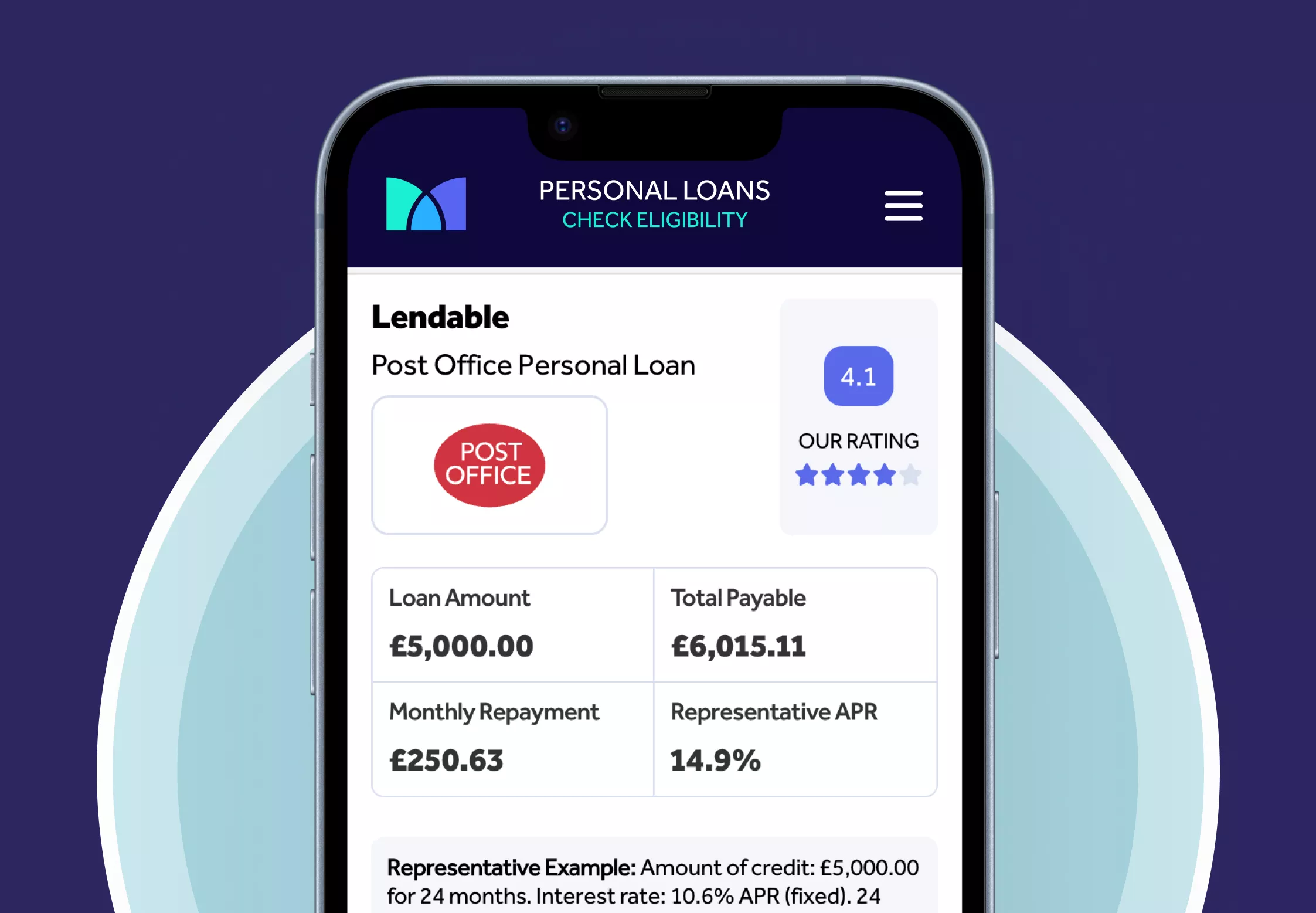

Lendable Loans Review

How to Apply for a Car Loan in the UK

My Community Finance

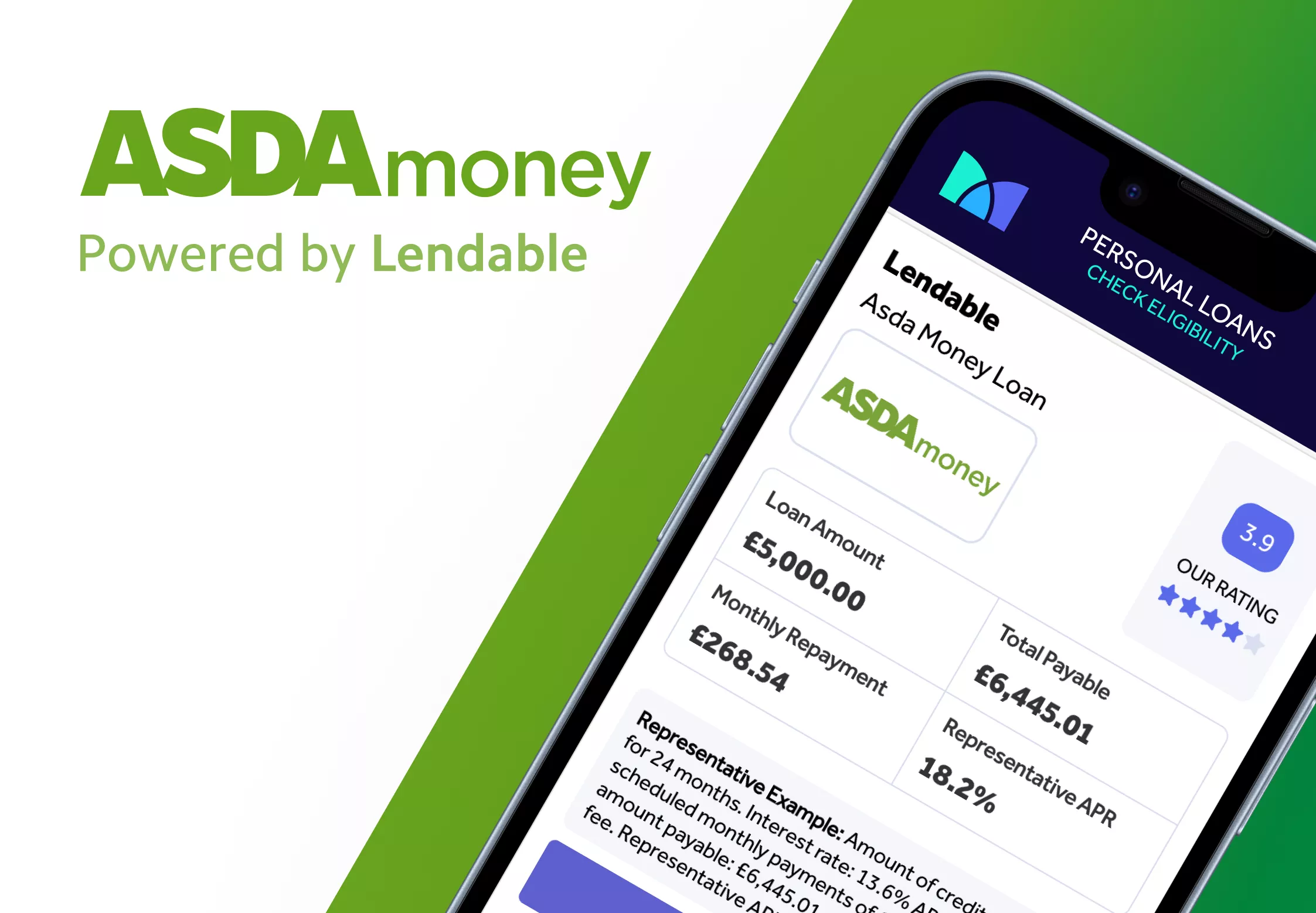

Asda Loans Review

Post Office Loans Review

The content presented here has been impartially gathered by the Mintify team and is offered on a non-advised basis for informational purposes only. We adhere to strict editorial integrity