Wedding loans UK guide: costs, options and considerations

Editor, Consumer Finance: Michelle Blackmore

Last Updated: February 7, 2026

In This Article

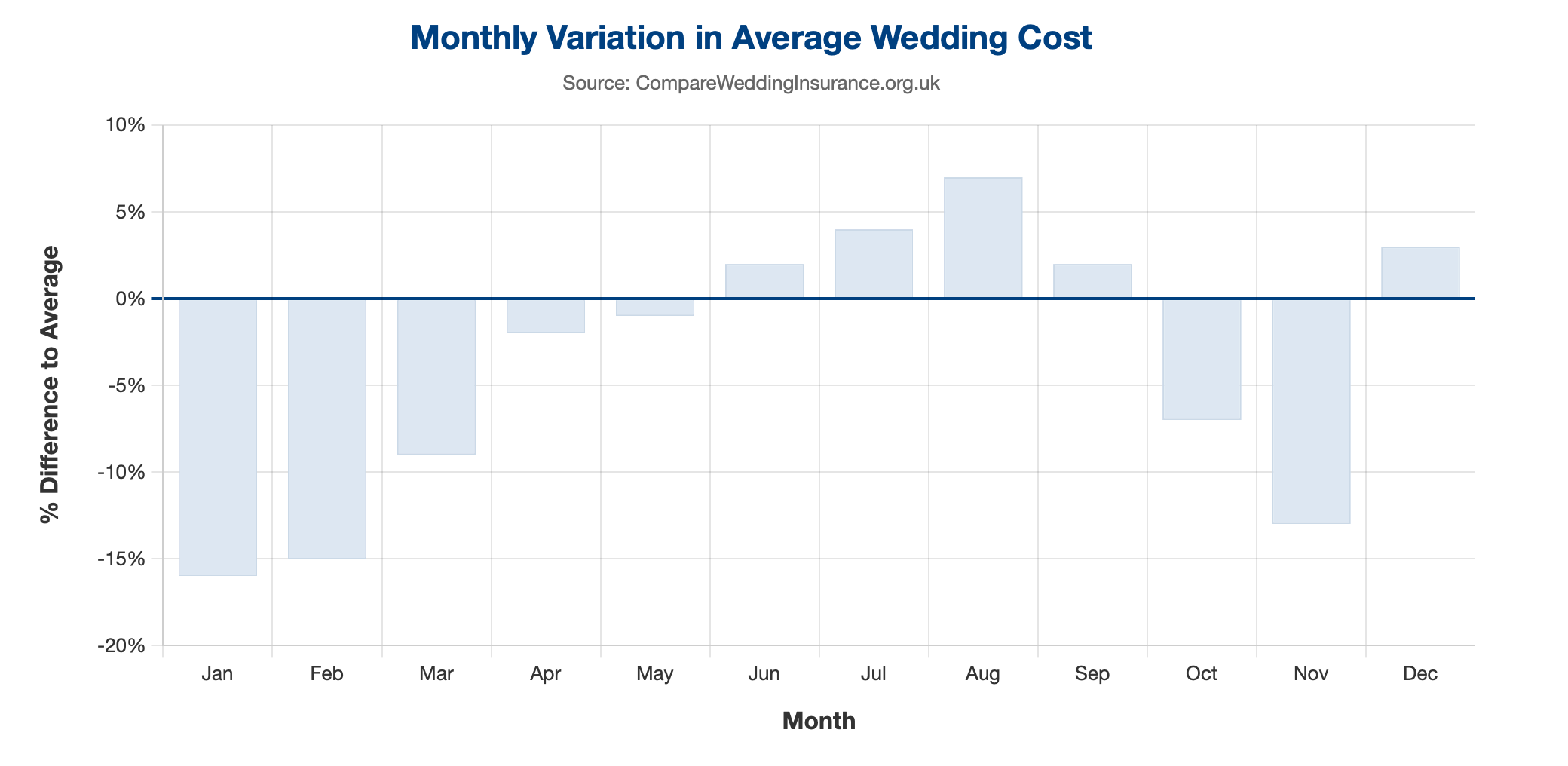

Weddings and honeymoons are exciting milestones, but they also come with one of life’s bigger bills. In 2025, according to compareweddinginsurance.org.uk 1 the average UK wedding cost around £25,625, up from £24,710 in 2024, although there are signs spending may be levelling off in 2026. Costs vary widely depending on the season, with winter weddings sometimes 16% cheaper and summer celebrations often costing much more.

Some couples dip into savings, others reach for a credit card, and many consider a wedding loan to spread the cost. But what if your wedding coincides with another major financial decision like a remortgage?

In this guide, we use a real life scenario to explore how to approach wedding borrowing, how lenders will view your finances, and what alternatives you should weigh before committing.

What we will explore in this post

- Do people take out loans for weddings in the UK?

Yes. Many couples use personal loans to cover wedding costs. It is one of the most common reasons for taking out an unsecured loan.

- How much can I borrow for a wedding?

Most lenders offer between £1,000 and £25,000. The amount depends on your credit profile and affordability.

- Can I get a personal loan for a wedding?

Yes. A wedding loan is simply a personal loan marketed for wedding use.

- Which loan is best for a wedding?

It depends on your circumstances. Fixed term personal loans are usually better for larger expenses. Credit cards can suit smaller purchases if repaid quickly.

Wedding costs and mortgage changes: an illustrative UK example

Here’s a simplified scenario based on a real-life discussion:

- A homeowner’s 1.29% mortgage deal was ending, with £145,000 left to repay over 20 years

- Monthly repayments were projected to rise by around £200

- They were planning a wedding and a honeymoon later in the year

- They considered using a credit card for honeymoon expenses because of Section 75 buyer protection, but were concerned about affordability

- They had £8,000 in cash savings, £92,000 in investments, and one partner currently out of work

This example illustrates how competing financial pressures can come into conflict; short-term life events against longer-term commitments like mortgage repayments.

Important: This scenario is for illustration only and does not represent advice. Using credit cards can provide benefits such as buyer protection, but may also lead to interest costs and debt if not managed carefully. Whether remortgaging, saving, or borrowing is suitable will depend on individual circumstances, and you may wish to seek independent financial advice.

Paying for a wedding or honeymoon on a credit card

Risks include:

- Carrying a large balance can hurt your credit score

- Standard APRs are often 20% or higher, which adds up quickly if the balance is not cleared

- Missing a payment could impact the promotional 0% offer

Should you use savings, a loan, or a credit card for your wedding?

The best choice depends on your circumstances. Some couples prefer to use savings, while others take a loan to spread the cost, especially if the interest rate is competitive. A few may qualify for a 0% purchase credit card and clear the balance within the promotional period. In practice, the loan that works best for a wedding is usually one that offers predictable repayments you can manage comfortably, whether that is a fixed term personal loan or a short term credit card option. Here are some points to consider:

- Using savings: Quick and avoids interest costs, but may leave you without an emergency buffer

- Selling investments: Could free up cash but may not be ideal if markets are down or if capital gains tax applies

- Wedding loan: Provides a fixed monthly repayment and a clear end date without draining savings

If savings do not cover everything, here is how the cost of borrowing £15,000 could compare:

- On a credit card at 24% APR repaid over 5 years could mean paying over £10,000 in interest

- On a Personal loan at 9% APR over 5 years could mean paying around £3,600 in interest

Weddings are a special milestone, but borrowing should always be affordable. Any loan or credit should fit comfortably within your budget both before and after the wedding. Responsible lending means thinking beyond the big day and making sure repayments do not create long term financial strain. If in doubt, explore all your options and seek impartial support before committing.

How a remortgage affects wedding loan decisions

Taking out a wedding loan can affect a mortgage application because it reduces affordability on paper. If you borrow just before remortgaging, lenders may see higher monthly commitments and offer fewer options or less competitive rates.

When assessing a remortgage, lenders will review:

- Your debt to income ratio

- Recent credit behaviour such as new loans or card balances

- Employment stability

For example, taking out a £15,000 wedding loan or running up a large card balance could weaken your affordability profile and limit the deals available.

Mintip: If you are remortgaging within six months, think carefully about taking on new credit unless you are confident it will not impact /or be cleared before your lender runs affordability checks.

Get Personalised Wedding Loan Rates

Find lenders that can approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Thinking carefully about wedding costs before borrowing

Before looking at loans or credit cards to cover your wedding costs, it can be worth stepping back and considering the overall cost of your wedding. For many couples, a wedding is one of the most important days of their lives, but it does not have to mean years of debt.

Some couples choose a smaller ceremony and celebration now, with a larger party or gathering later when finances are stronger. Others scale back non-essential extras and prioritise the moments that matter most.

Taking on long term debt for one day may feel heavy once the honeymoon is over. Balancing your financial future with the type of wedding you want can help avoid stress later.

Mintip: A wedding loan should make your plans more manageable, not unmanageable. If repayments stretch your budget too far, consider adjusting the scale of the event instead.

Average wedding costs in the UK (2025 data)

Recent figures help show what couples are actually spending:

- The average UK wedding cost in 2025 was £25,625, up from £24,710 in 2024, though growth may level off in 2026

- Weddings in winter months such as January, February, and November can be up to 16% cheaper than the yearly average.

- Summer weddings, especially in peak months, tend to be more expensive due to higher demand for venues and suppliers

- Many published “average budgets” reflect early hopes rather than what couples actually end up paying once the day arrives.

When planning, add a buffer for hidden or unexpected costs. Venue extras, photography packages, and guest list increases are common areas where spending goes above the original plan.

According to compareweddinginsurance.org.uk 1Weddings held in the popular summer months of June to September are typically more expensive, with August averaging about 7% above the yearly cost.

In contrast, the quieter winter months of November, January, and February (with the exception of December and presumably Christmas weddings) can be up to 16% cheaper, offering potential savings of around £4,000 compared with the average.

Alternatives to wedding loans in the UK

- Offset mortgages: If you have large savings, linking them to your mortgage can reduce interest while keeping liquidity.

- Wedding loans from mainstream lenders: Fixed terms, usually £1,000 to £25,000, repayable over 1 to 7 years.

- No interest credit card promotions: Only suitable if you are certain you can repay before the promo ends.

- Family contributions: Gift allowances can sometimes be tax efficient.

Quick answers about wedding loans

- Do people take out loans for weddings in the UK?

Yes. Thousands of couples each year use personal loans to cover wedding and honeymoon costs. Lenders treat it like any other unsecured borrowing, but marketing often labels them as wedding loans.

- How much can I borrow for a wedding?

Most UK lenders allow between £1,000 and £25,000. The exact amount depends on your credit history, income, and what a lender considers affordable for you to repay.

- Can I get a personal loan for a wedding?

Yes. A wedding loan is just a standard personal loan. You apply in the same way and receive the money upfront to pay suppliers, venues, or travel costs.

- Which loan is best for a wedding?

That depends on how much you need and how quickly you can repay. A personal loan with a fixed interest rate and term may suit larger costs. A credit card with a 0% promotional period could be useful for smaller, one-off expenses if you clear the balance on time.

Practical steps before choosing a wedding loan

- Work out the true wedding cost including honeymoon, dress, catering, photography, and extras

- Compare personal loan rates as many lenders offer soft eligibility checks

- Check your mortgage timing and avoid major new borrowing within months of renewal

- Preserve your emergency fund so you are not left without a buffer

- Plan repayments to ensure the loan fits comfortably within your post wedding budge

Mintip: If you are worried about debt, free and impartial help is available. You can contact StepChange or MoneyHelper for guidance before taking on new borrowing.

Get Personalised Wedding Loan Rates

Find lenders that can approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Frequently asked questions about Wedding Loans

Are wedding loans different from other personal loans?

No. A wedding loan is just a standard unsecured personal loan marketed for wedding use.

How much can I borrow for a wedding?

Most lenders offer between £1,000 and £25,000. The rate you get depends on your credit profile.

Can I get a wedding loan with bad credit?

Some lenders specialise in loans for people with less than perfect credit, but expect higher APRs. Always consider whether repayments are affordable.

Will a wedding loan affect my mortgage application?

Usually, yes. Any new borrowing is usually factored into affordability checks. If your remortgage is due soon, weigh carefully before applying.

Key takeaways

- A wedding loan can provide certainty and structured repayments

- Credit cards give buyer protection but may impact your credit profile

- Remortgage timing is crucial because new borrowing can reduce your mortgage options

- Balancing short term celebration with long term stability is the goal

- Knowing the real costs of UK weddings helps set realistic budgets before borrowing

1. Average cost of a UK wedding

https://www.compareweddinginsurance.org.uk/blog/average-cost-uk-wedding.php

Related Articles

Oakbrook Loans Review

Lendable Loans Review

How to Apply for a Car Loan in the UK

My Community Finance

Asda Loans Review

Post Office Loans Review

The content presented here has been impartially gathered by the Mintify team and is offered on a non-advised basis for informational purposes only. We adhere to strict editorial integrity

Get Personalised Loan Rates

Find lenders that can approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.