Post Office Loans Review

Editor, Consumer Finance: Michelle Blackmore

Last Updated: February 5, 2026

In This Article

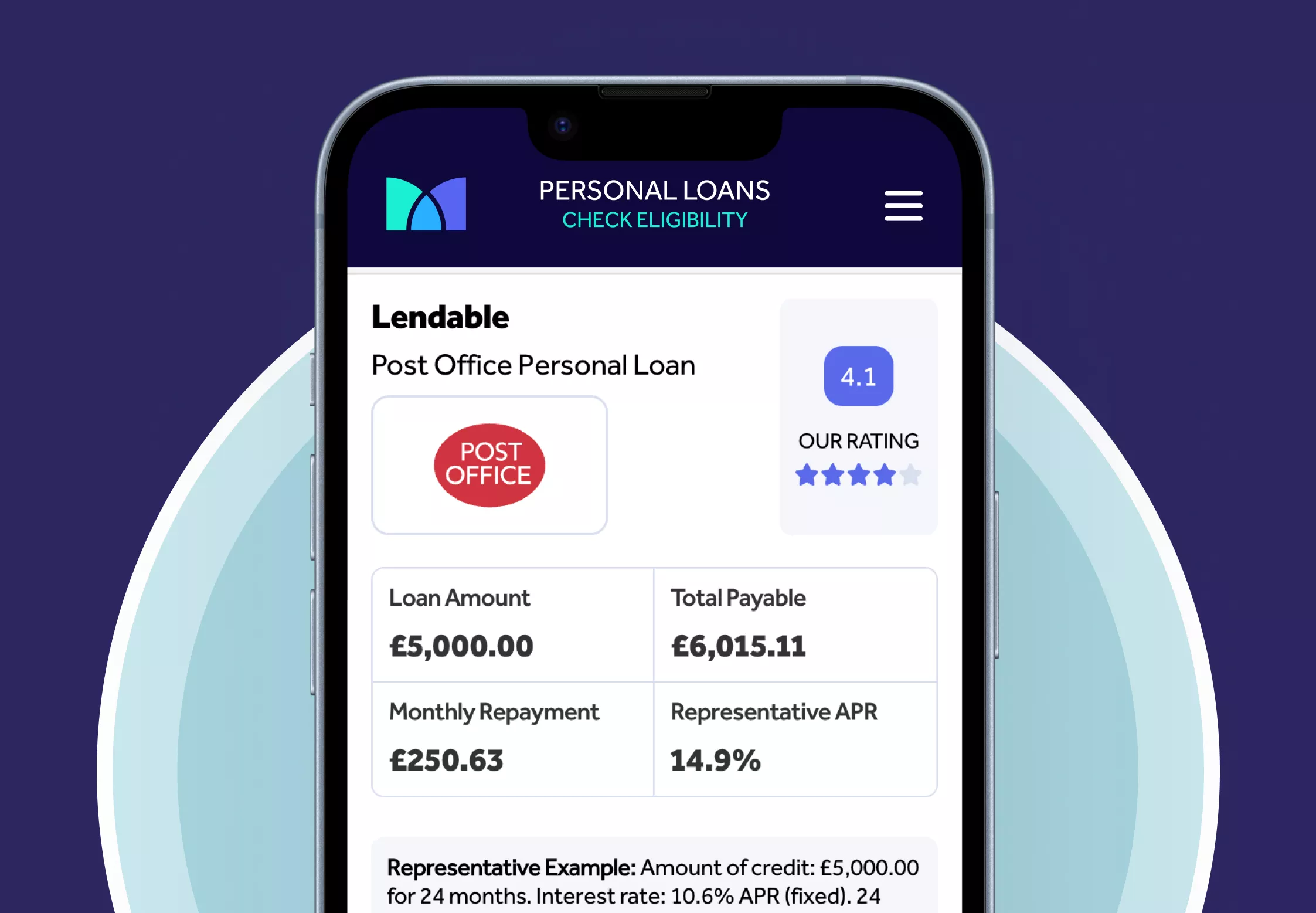

Post Office loans are fixed-rate unsecured personal loans delivered through the Post Office Money brand, with Lendable acting as the lender behind the product. This review sets out how the loans are structured, what you can expect during the eligibility check and the key features to be aware of before comparing your options.

The aim of this review is to give a clear, factual summary so you can understand how the product works and whether it may be suitable to explore further.

What are Post Office loans?

Post Office loans are fixed-rate unsecured personal loans offered under the Post Office Money brand, with Lendable providing the underlying credit. The product is designed for borrowers who want a clear repayment structure over a set term, with predictable monthly instalments and a straightforward online application process.

Although the loan is presented under the Post Office name, the credit agreement, assessment and account servicing are carried out by Lendable Loans. This means certain processes may be similar to other branded loans they support, although the exact terms you receive will depend on your circumstances and the criteria applied when you check your options.

- Loan type: unsecured personal loan with fixed monthly repayments

- Brand relationship: Post Office Money branding with Lendable as the lender

- Typical uses: home improvements, car costs or consolidating existing credit, subject to eligibility

Who is Lendable?

Lendable is a UK-based lender that provides unsecured personal loans and also powers a number of branded credit products. For Post Office loans, Lendable issues the credit agreement, carries out the assessments and manages the account once the loan is active. The Post Office provides the branding, while the lending decisions and ongoing servicing come from Lendable.

Because Lendable supports several partner brands, some features or processes may feel similar across the products they provide. However, each branded loan can differ in pricing, terms or eligibility depending on the agreement between the partner and the lender, as well as your own financial circumstances.

- Brand partnerships: includes Post Office loans and ASDA Money Loans

- Lending focus: fixed-rate unsecured personal loans

- Connected credit brands: includes associated products such as Zable and thimbl credit cards

How do Post Office loans work?

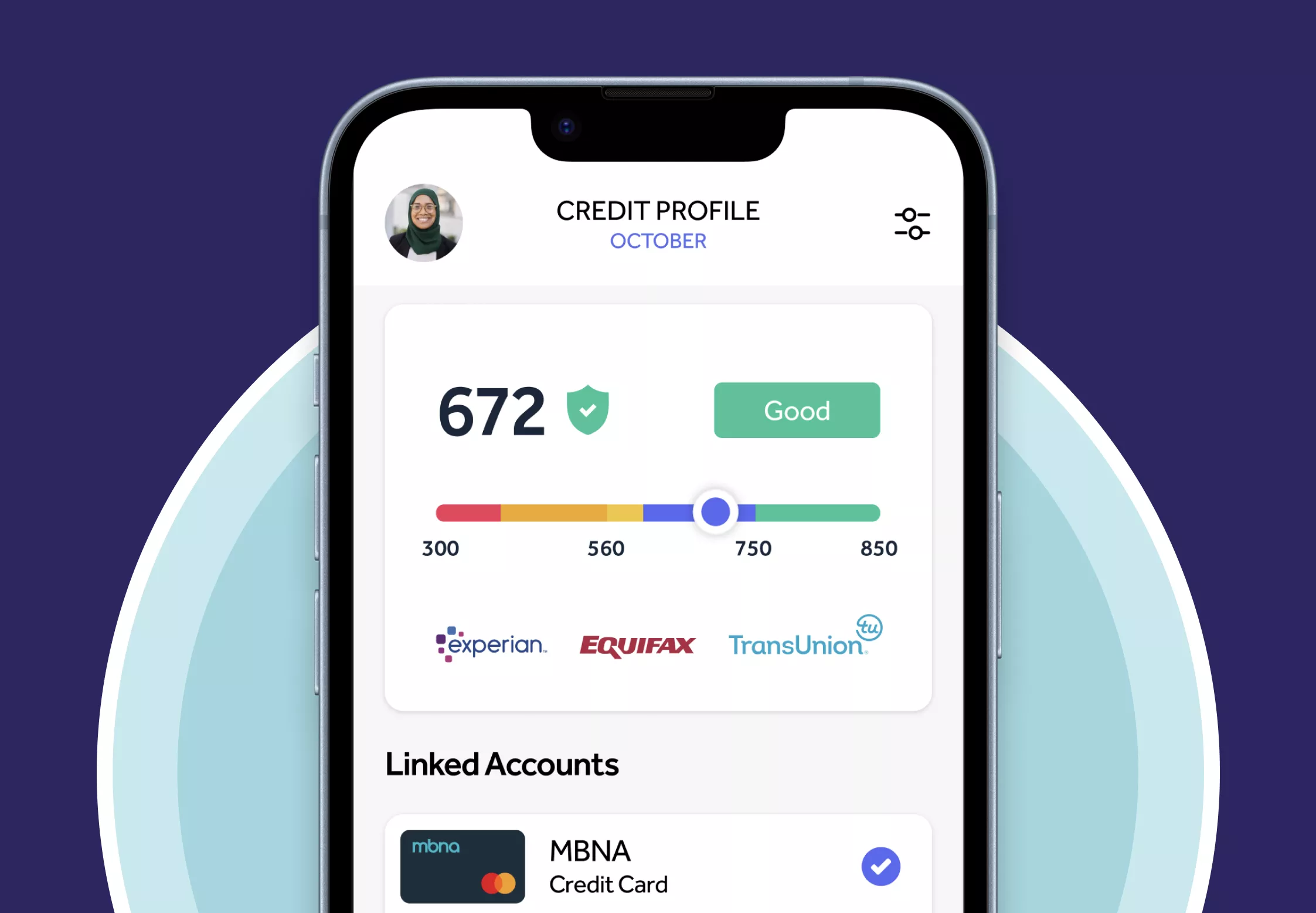

Post Office loans work as fixed-rate unsecured personal loans with a set repayment schedule agreed at the start of the term. The first step is a soft-search eligibility check, which gives an indication of whether you may qualify and what rates you could be offered, without affecting your credit score.

If you continue to a full application, the lender carries out affordability and credit checks to confirm whether the loan can be approved. Your rate, loan amount and term will depend on your credit profile, income, recent repayment behaviour and the lender’s assessment at that time. Monthly repayments stay the same throughout the term, and you can usually repay early by requesting a settlement figure from the lender.

- Soft search: initial eligibility check with no impact on your credit score

- Fixed repayments: equal monthly instalments over the agreed term

- Personalised offer: rate and loan amount based on your financial circumstances

- Affordability checks: full assessment carried out before a loan can be approved

- Early repayment: generally available, with a settlement figure provided by the lender

What loan amounts and terms do Post Office Loans offer?

Post Office loans are available in set loan amounts and repayment terms, with the specific offer you receive depending on your credit profile, affordability and the lender’s criteria at the time you check your options. The details below summarise the key product features based on Mintify’s latest research. Actual terms may vary by applicant and may change if the lender updates its product specifications.

| Issuer | Lendable |

| Loan type | Unsecured personal loan |

| Rate type | Fixed |

| Interest calculation | Effective rate |

| Loan amounts | £1,000 to £25,000 |

| Loan terms | 12 to 60 months |

| Application fee | £425 |

| Debt consolidation limit | Up to £25,000 |

The information above reflects details available during Mintify’s research and follows our strict editorial guidelines. This information does not replace any terms and conditions from the lender. Product features may change, and the rate, amount or term you are offered will depend on your individual credit profile and the lender’s assessment.

Who can apply for a Post Office loan?

Eligibility for a Post Office loan is based on meeting the lender’s basic requirements and passing affordability checks. The assessment looks at your income, credit profile and overall financial position to understand whether the loan is suitable for you. Meeting the criteria does not guarantee approval, but it helps indicate whether you may be considered when you check your options.

| Minimum age | 18 |

| Maximum age | 70 |

| Residency requirement | UK resident for at least 3 years |

| Minimum income | £800 per month |

| Customer type | New or existing customers |

Mintip: Lender application requirements can change at any time. By checking your eligibility through a soft search, you can see whether you may qualify for loan options from other lenders without affecting your credit score.

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

What fees or charges apply to Post Office loans?

Post Office loans include a one-off loan fee that is added to the amount you borrow and repaid through your monthly repayments. This fee forms part of the overall cost of borrowing and is taken into account in the APR. Other charges may apply depending on how you manage your account and the terms set out in your credit agreement.

How much is the application fee for a Post Office Loan?

The application fee for a post office loan is £425 and is added to the loan amount and repaid in monthly repayments.

Can I repay my loan early?

You can usually repay early by requesting a settlement amount directly from the lender.

Are there any late payment fees?

Your contract will outline any late payment fees so check the terms and conditions regarding such fees.

How do repayments work on a Post Office loan?

Repayments on a Post Office loan are made through fixed monthly instalments, agreed at the start of the term. Your credit agreement will set out the payment dates, the amount due each month and how the balance reduces over time. These repayments continue until the loan is fully cleared.

The lender explains the repayment structure before you decide to proceed, and you can review the details at any point through your account. If your circumstances change during the loan, the lender may discuss available options depending on your situation and the terms of your agreement.

- Monthly payments: fixed instalments for the full duration of the loan

- Collection method: payments normally taken by Direct Debit

- Managing your account: some changes, such as adjusting the payment date, may be possible

- Paying off early: you can request a settlement figure if you want to clear the loan ahead of schedule

What can a Post Office loan be used for?

A Post Office loan can be used for a variety of common borrowing needs, provided the purpose meets the lender’s criteria and fits within your overall affordability. When you check your options, the lender may ask about how you plan to use the loan to ensure it is appropriate for your circumstances.

The examples below reflect typical uses, but the suitability of the loan will depend on your financial situation and the assessment carried out during the application process.

- Home improvement loans: for projects such as repairs, maintenance or refurbishment

- Car loans buying a car or covering necessary repairs

- Debt consolidation loans: combining existing borrowing into a single structured repayment

- Large planned purchases: significant one-off costs such as a wedding loan or a travel adventure

Customer reviews on Post Office loans

As Post Office loans are issued and managed by Lendable, customer feedback is generally based on reviews of Lendable Loans rather than the Post Office brand itself. These reviews give an indication of how applicants experience the application process, communication and overall service. As with any financial product, individual outcomes vary depending on a person’s circumstances and how the account is managed.

On Trustpilot, Lendable is often described as straightforward to use, with many reviewers mentioning the speed of the eligibility process and the clarity of the information provided. Some customers say they appreciated the quick release of funds once approved, while others note that the rate they were offered differed from what they expected based on their credit profile.

Customer experiences vary, and the way a loan works for you will depend on the personalised assessment carried out by the lender and how you manage your repayments.

Pros and cons of Post Office loans

Post Office loans have features that may work well for some borrowers, while other aspects may be less suitable depending on your circumstances. The points below give a balanced overview to help you understand how the product operates.

Pros

- Fixed monthly payments: instalments remain the same for the full term, which can help with planning your budget

- Soft-search eligibility check: allows you to see whether you may qualify without affecting your credit score

- Clear terms from the outset: you are shown the repayment plan and key figures before deciding whether to proceed

- Straightforward application steps: many reviewers say the process feels simple to follow, although experiences vary

Cons

- Personalised pricing: the rate offered may differ from the representative APR based on your credit profile and financial situation

- Application fee: a £425.00 fee is added to your loan and repaid through your instalments

- No guaranteed approval: all applications are subject to affordability and credit checks

- Limited flexibility: changes to payment dates or account settings depend on the lender’s policies

Important: Before taking out a loan, make sure the monthly repayments fit comfortably within your budget. If you ever find it difficult to keep up with payments, free and impartial support is available from organisations such as StepChange, National Debtline and MoneyHelper.

Post office loans vs other loans

A Post Office loan is one option within the personal loans market. The right choice depends on your financial situation, the rate you are offered and how comfortably the repayments fit into your budget. Looking at a few alternatives can help you understand where this product sits compared with others.

Using a soft-search eligibility checker can show you personalised options from different lenders in one place, without affecting your credit score. This gives a clearer view of the rates and terms you may qualify for before deciding whether to go ahead.

- Compare multiple lenders: different providers may offer alternative rates, terms or eligibility criteria

- Check personalised offers: soft-search tools can help you see potential options without impacting your credit score

- Review repayment structures: some lenders may offer different terms that suit your circumstances better

- Consider car finance options: if you are looking to finance a car, check whether car brokers provide terms that fit your situation

Your final choice should be based on what is affordable for you and how the loan fits your overall financial position.

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Related Articles

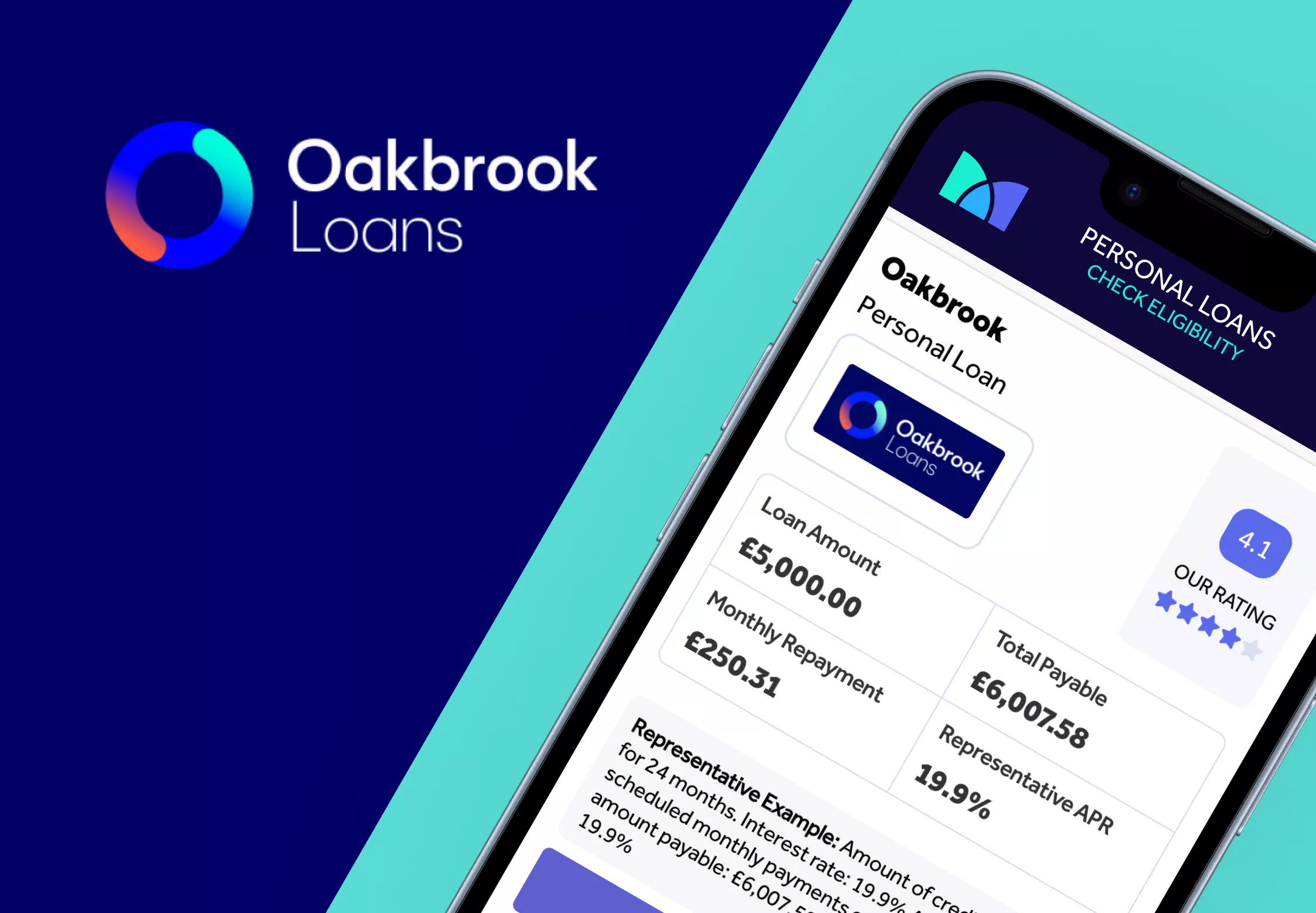

Oakbrook Loans Review

Lendable Loans Review

How to Apply for a Car Loan in the UK

My Community Finance

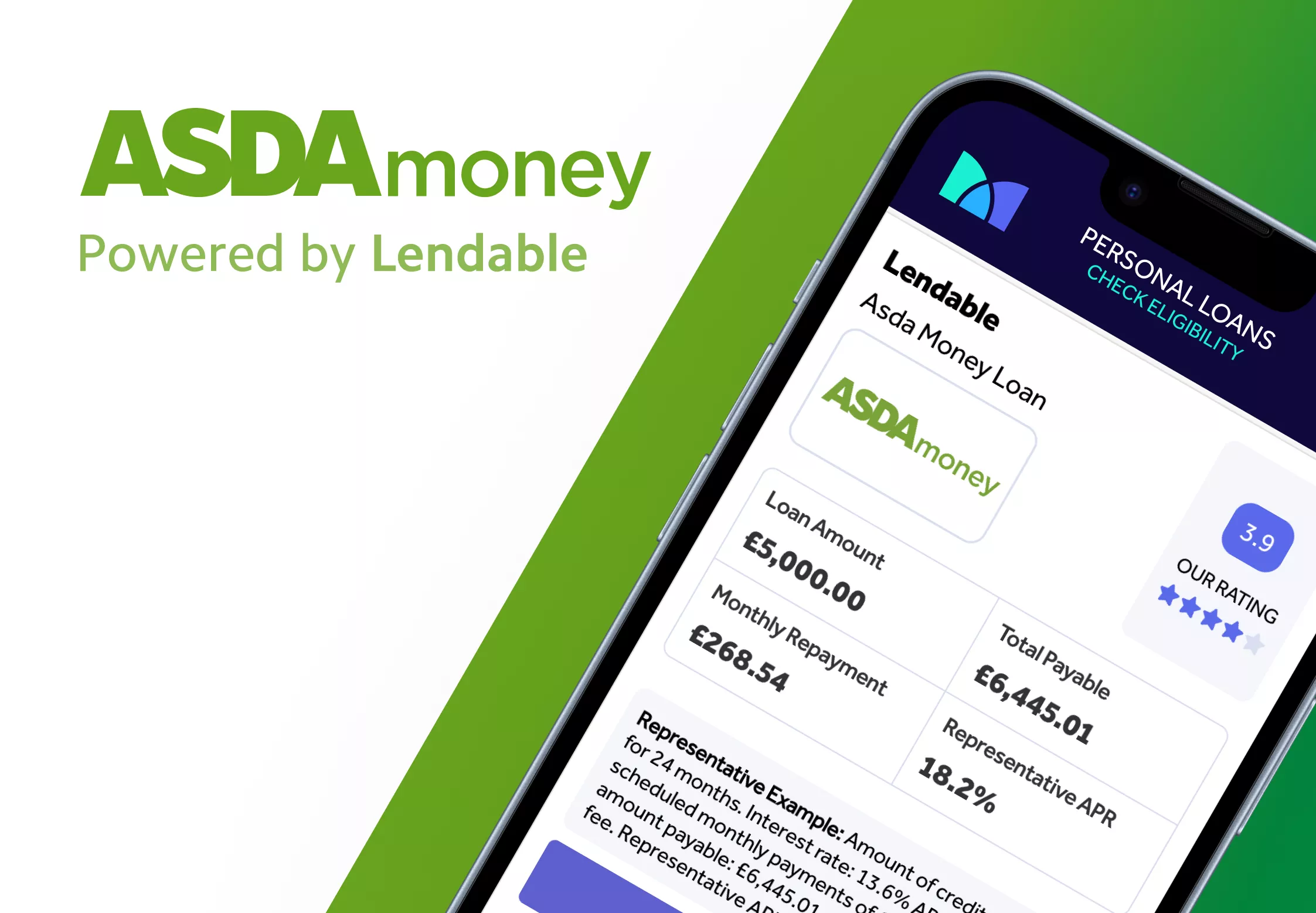

Asda Loans Review

What credit score is needed for car finance in the UK?

The content presented here has been impartially gathered by the Mintify team and is offered on a non-advised basis for informational purposes only. We adhere to strict editorial integrity. Mintify is an Introducer Appointed Representative of Creditec Limited. We provide editorial reviews of the whole market, but we only provide links to apply for products available through Creditec’s panel of lenders. We may earn a commission if you click these links. This does not affect our editorial independence, but it limits the products you can apply for directly on this site.