Autolend Personal Loan

OUR RATING

Loan Amount

Total Payable

Monthly Repayment

Representative APR

Representative example will update based on your input.

Get My Personalised Quote

Use our calculator to see illustrative rates. After that, check your eligibility to get a customised rate from this provider and a panel of others without any impact on your credit score. Representative 18.6% APR.

Mintify Limited, trading as Mintify, is an Appointed Representative of Creditec Limited who is acting as a credit broker, not a lender.

Our Verdict

Autolend provides personal car loans. Once approved, funds are typically received within two hours, making this a quick option for those ready to buy a car. It’s important to note that an application fee of £375 is added to the loan, which impacts the total cost of borrowing.

Important: The information contained in this table summarises key product features and is not intended to replace any terms and conditions from the card issuer.

| Issuer | Autolend |

|---|---|

| Loan Type | Unsecured Personal Loan |

| Rate Type | Fixed |

| Interest Calculation Method | Effective |

| Minimum Loan Amount | £1,000.00 |

| Maximum Loan Amount | £35,000.00 |

| Minimum Loan Term (months) | 12 |

| Maximum Loan Term (months) | 60 |

| Customer Type | New or Existing Customers |

| Relationship | New or Existing Customers |

| Acceptance Criteria | Minimum applicant income of £800 per month. UK Resident for at least 3 years. |

| Minimum Age | 18 |

| Maximum Age | 70 |

| Application Fee | £375.00 |

Important: When consolidating your existing borrowing, you may extend the term of your debt and increase the total amount you repay.

Get Personalised Loan Rates

Find lenders that may be able to approve you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

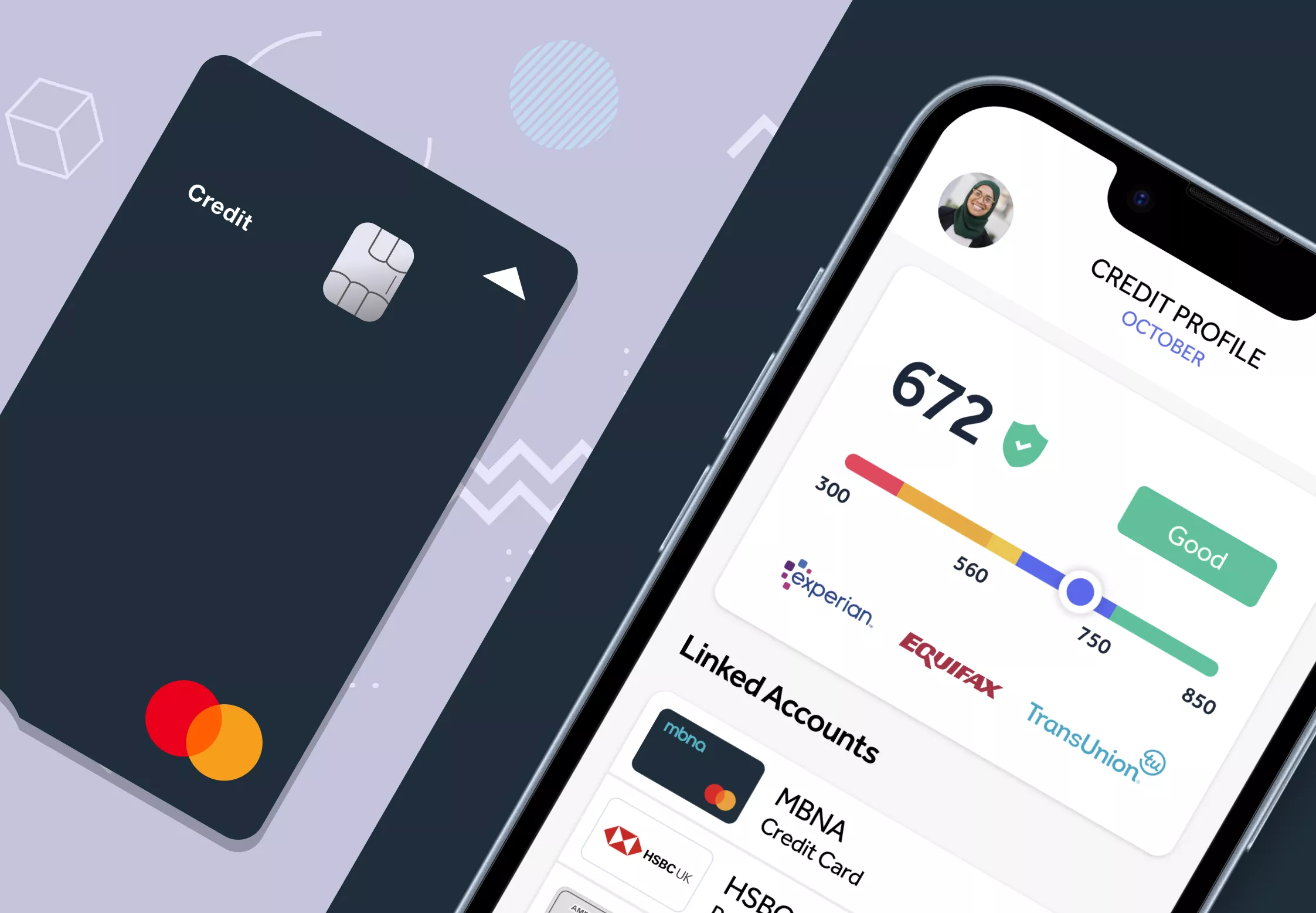

Check your credit card eligibility in the UK

Checking your credit card eligibility helps you understand which cards may be suitable before you apply, using a soft search ...

Balance transfer cards for credit builders

Your credit profile affects whether you may qualify for a balance transfer card. This guide explains how lenders assess applications ...

How much can you balance transfer?

Your balance transfer limit is usually a percentage of the credit limit you are offered on a new card. This ...