LOAN APPROVAL CHECKER

See your chances of getting a loan approved

Applying for loans isn’t always straightforward, and rejections are frustrating. We give you access to a lender panel that runs a personalised pre-approval check, showing the loans you’re more likely to be accepted for. Pre-approval does not guarantee acceptance and is subject to further lender checks.

Find lenders that are more likely to accept you

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender. UK residents only. Terms of Use apply.

Compare personal loan options from a range of trusted UK lenders:

No more guesswork

Get access to personalised results from a panel of lenders powered by our partners.

Using a soft search, you can see your likelihood of approval before you apply, all without affecting your credit score.

Check your eligibility across multiple lenders in one place.

Quickly focus on lenders that are more likely to accept you.

See indicative loan amounts, terms and representative APRs.

Avoid wasted applications to protect your credit file.

Check if you could receive a pre-approved personal loan offer based on your details from a soft search. Compare potential offers side by side and make an informed choice without affecting your credit score. Final approval, amount and rate will depend on the lender’s full assessment.

Get clarity before you apply

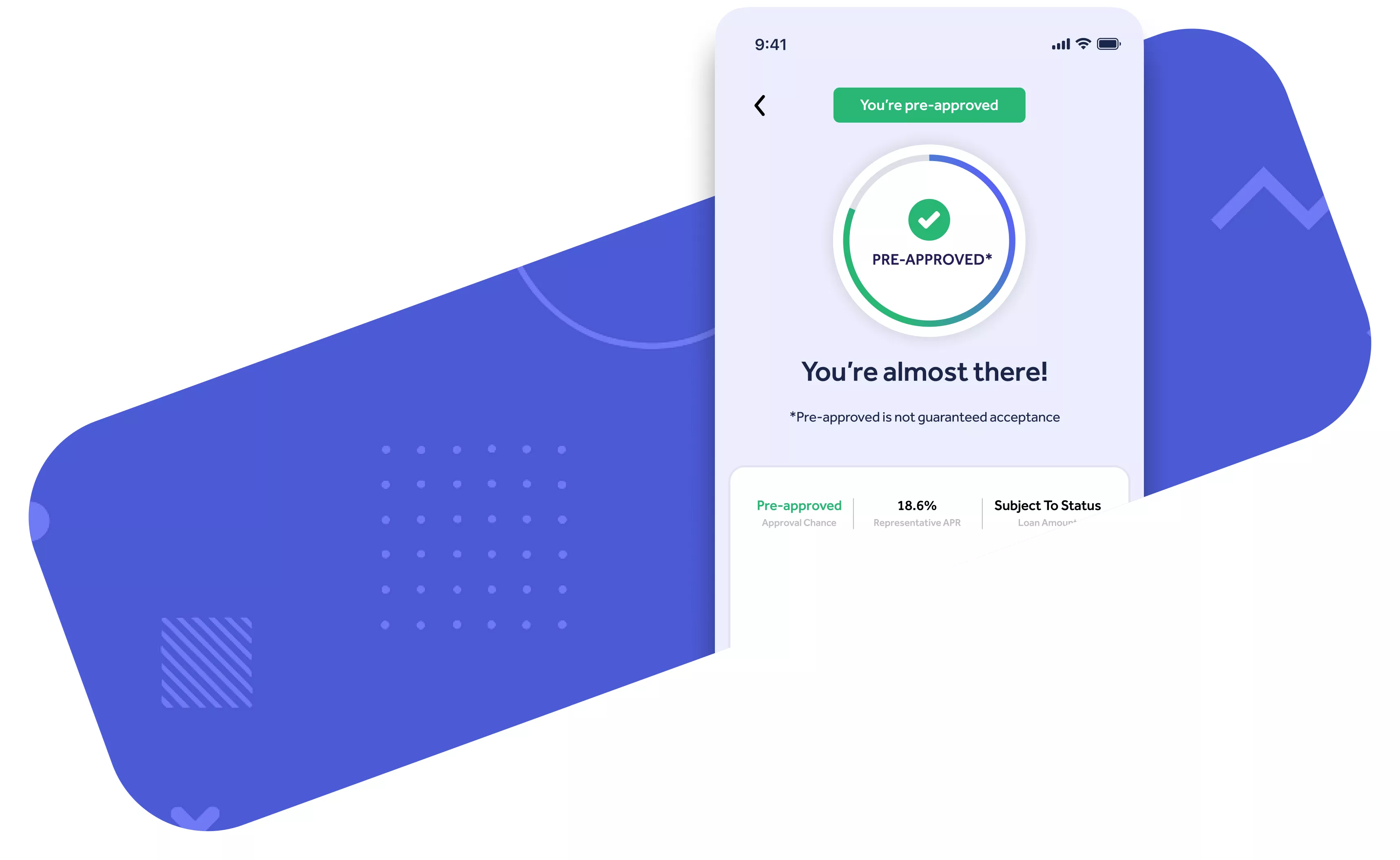

With a pre-approved offer, you’ll see what you’re likely to get

Using an eligibility checker gives you more clarity before you apply. In some cases, lenders may show you a pre-approved offer based on a soft search of your credit file. This can give you an indication of the loan amount, term and representative APR you’re likely to be offered, all without affecting your credit score.

Pre-approval can save you time by highlighting lenders more likely to accept you, and can help you compare potential costs more confidently. If you choose to go ahead, the lender will still carry out their final checks, and the offer, including the rate, amount or terms, may change before approval is confirmed.

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Apply with confidence

Get an indication of the amount, duration and rate you may be offered.

*Pre-approved is not guaranteed acceptance

Tailored to you

See what you could borrow and the estimated total cost before applying.

Apply with confidence

A soft search has no impact on your rating and reduces the risk of applying where you’re unlikely to be accepted.

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Who is eligible for a personal loan?

Eligibility for a personal loan depends on various factors, including your credit history, income, and financial stability. Most lenders require you to:

- Be at least 18 years old.

- Be a UK resident with a permanent address.

- Have a steady source of income, whether from employment or self-employment.

- Have a bank account with a UK bank.

Eligibility criteria can vary between lenders, so it’s essential to review the specific requirements of each provider.

What are the basic requirements for a personal loan?

While eligibility varies, there are some common requirements most lenders look for:

- Proof of identity (passport or driver’s license).

- Proof of address (utility bill or bank statement).

- Proof of income, such as payslips or tax returns if you’re self-employed.

- A bank account for depositing the loan amount.

Meeting these criteria doesn’t guarantee approval, but it could strengthen your application and make the process smoother.

Check your eligibility with bad credit

Having a poor credit history can make it difficult to know which lenders might accept your application. A loan eligibility checker uses a soft search to review your credit profile and highlight lenders that may be more willing to consider applicants with missed payments, defaults, or limited credit history, all without affecting your credit score.

In just a few minutes, you can see personalised loan options tailored to your circumstances. The checker takes into account key factors such as income, affordability and your overall credit profile to match you with lenders who are more likely to approve your application.

If you’re wondering, “how can a loan eligibility checker help borrowers with bad credit?” here are the main benefits:

- Uses a soft search that won’t harm your credit rating

- Shows personalised results from lenders open to bad credit

- No obligation to apply; compare costs before deciding

- Fast results based on your real financial situation

Get Your Personalised Loan Rate

Find lenders that are more likely to accept you.

Options for all credit backgrounds

Representative 32.9% APR

No impact to your credit score

Mintify Limited, trading as Mintify, is an Introducer Appointed Representative of Creditec Limited who acts as a credit broker, not a lender.

Mintip: The results from an eligibility checker are a guide only and lenders will still carry out their own checks before making a final decision.

Loan eligibility and approval checker FAQs

What is a loan approval checker and how does it work?

A loan approval checker is a free online tool that helps you estimate your chances of getting approved for a personal loan. It uses a soft credit search, which doesn’t affect your credit score, and compares your details against lender criteria to show personalised results. The results are a guide only and lenders will still carry out their own checks before making a final decision.

How can I check my personal loan eligibility in the UK?

You can check your personal loan eligibility using an online checker that assesses your financial information and matches you with suitable lenders. It’s quick, doesn’t impact your credit file, and gives you an idea of the rates and terms you may qualify for.

Can I use a loan eligibility checker if I have bad credit?

Yes. A bad credit loan eligibility checker helps you find lenders that may still approve you, even with a poor credit history. It uses a soft credit search to show you real loan offers without affecting your score.

Will checking loan eligibility affect my credit score?

No. Eligibility checkers use a soft credit check, which is not visible to other lenders and does not impact your credit score.

What personal information do I need to use a loan approval checker?

You’ll typically need to provide your name, address, income details, employment status, and estimated expenses. This information is used to match you with lenders that fit your financial profile, and it is kept secure and confidential.

How do I improve my chances of personal loan approval?

To improve your chances, build a strong credit history by paying bills on time, reducing debt, and avoiding high credit utilisation. Checking your credit report regularly for errors also helps.

What is the difference between a soft search and a hard credit check?

A soft search is used for eligibility checks and doesn’t affect your credit score. A hard credit check occurs when you formally apply for credit and will be recorded on your credit file.

What does pre-approval for a personal loan mean?

Pre-approval for a personal loan means a lender has reviewed some of your details, usually through a soft credit check, and believes you are likely to be approved if you apply. It typically includes an indication of the loan amount, term, and representative APR you could receive. Pre-approval is not a guarantee, and the lender will confirm your information and run a full credit check before making a final decision.

What should I do if my loan application is declined?

Start by reviewing the reasons for the decline. Improve your credit score where possible, check for errors on your credit report, and use a loan approval checker to compare other lenders who may be more likely to accept your application.